September 1, 2023

Things I Learned This Week About the Dog Days of Summer. It’s Hot.

September 1, 2023

Opening Day Weekend for Dove in the North Zone! Just thought I would rub it in.

Limbo. Not the one where you get really low and go under the stick. The place between heaven and hell. It isn’t Purgatory. Business isn’t that bad. But it’s limbo. Spot pricing is down 30%, contracts will move on rolls but not much. Anecdotal stories of rigs going back to work. Hope, not despair. Optimism, not doom. We could be doing better but we aren’t doing that bad. Relative to activity rolls in the past, this is minor. We aren’t in a position of complete weakness and all sides know it. Dreams of 50% upcycles in activity are just that, but some sustained period of profitable growth sure sounds good to me. Consolidations need to continue, at every size level, including the biggest guys. More technical efficiencies will be brought to bear, making the entire enterprise more efficient. It has been worse before, with a less positive outlook. This is child’s play.

Oops. While the president declaring a “climate emergency” is still a possibility, some research which buries their position is likely to be ignored. It doesn’t fit the narrative. Fires all over the world have caught the attention of the media and policemen who say that all these fires are the result of global warming. Ignore the fact that the fires in Greece and Canada were arson. Now NASA steps in to note that the amount of area burned annually by fire globally has declined over the last quarter-century. The area burned declined by 25% between 2003 and 2019, according to the government agency that tracks such things from space, giving them a broader perspective than others. Last year, there was a record-low area burned. Emissions from wildfires have also declined globally since 2003. Roger Pielke Jr. is a climate change and disaster expert, and The Intergovernmental Panel on Climate Change (IPCC) “has not detected or attributed fire occurrence or area burned to human-caused climate change.” According to the IPCC, the most important factor in fire is not the weather but rather “human activities,” both land management and the starting of fires by humans.

Don’t Lose Perspective. Poor Americans are increasingly skipping meals and falling behind on their rent in a sign of worsening hardship. Among households using the Supplemental Nutrition Assistance Program’s boosted pandemic benefits, 42% skipped meals in August and 55% ate less because they couldn’t afford food, more than double last year’s share, according to a report today by Propel, a benefits software developer.

EIA Weekly Oil Data – Barclay’s Interpretations.

Crude Implications: Bullish – draw above expectations. WTI backwardation between 1M-12M @ $4/bbl, down $1/bbl w/w. SPR higher by 0.6 MMBBLs. Money managers’ net long positions in ICE Brent and NYMEX WTI are lower 7% w/w, and 16% below the recent peak in April suggesting market positioning more of a headwind.

U.S. Crude Production: Indicated at 12.8mm BOPD, flat w/w, and up 0.7mm BOPD y/y. Notable divergence with the recent DPR update.

Refinery Runs: 16.6mm BOPD, down 0.2mm BOPD w/w and up 0.4mm BOPD y/y. Utilization is at 93.3%. A peak of seasonal demand is within sight but hurricane and fall turnaround season are on the way, potentially reducing runs. Minimal impact expected from Hurricane Idalia.

Crude Imports (net): 2.1mm BOPD, down 0.6mm BOPD w/w and up 0.1mm BOPD y/y. Brent-WTI spread is at $3.4/bbl, down by $1/bbl w/w.

Gasoline: Neutral – draw below expectations. Demand up 1.8% w/w and up 5.6% y/y.

Distillate: Bearish – build vs expected draw. Demand down 3.5% w/w and up 3.8% y/y.

King’s X. We had congratulated President Biden for moving ahead with the Alaskan Willow project as well as the planned size of the upcoming lease sale. I was premature on the latter. The government took 6 million acres out of the lease sale and added some challenging terms. Companies are already filing suits.

Rice’s Whales.

Introduction. You didn’t even know Rice has whales! They don’t. A Rice whale is a limited population living in a limited area that just happens to be the Gulf of Mexico. The Sierra Club sued the National Marine Fisheries, and the settlement involved the government setting some restrictions on shipping in the Gulf. It of course dramatically impacts oil and gas since offshore activity requires ships and the restriction primarily impacts our industry.

Rules. First, it places speed restrictions on vessels and leaseholders starting next month. Year round, in the newly designated areas, vessels will be limited to 10 knots per hour, and all participants in the upcoming lease sale 261 will be required respect the 10 knots per hour across their leases. The agreement would also limit the location of lease sales, avoiding the sale of blocks in a long strip from the northeastern part of the Gulf all the way to the Mexican border, limited to areas with water depths of 100-400 meters, as delineated on isobath maps, plus an additional 10 km around the strip. That strip is where the speed restrictions would apply. One uncorroborated study of the whales is the basis behind the restrictions and after further study is done, one year plus possible extensions, so forever.

Outrage. The American Petroleum Institute, the National Ocean Industries Association, and the geophysical contractor’s group EnerGeo Alliance issued a joint statement deploring the deal. “This private settlement agreement between the federal government and environmental activists places unfounded restrictions on operations in the U.S. Gulf of Mexico that severely hamper America’s ability to produce energy,” the three trade groups said. They argued the deal amounts to “a far-reaching ban on operations.”

Misguided. While drilling, shooting seismic and running boats are all concerns in the Gulf of Mexico’s oil industry, these activists are not resting. Now we are slapping the wind industry too, and at a time where offshore wind is suffering some severe cost and profitability challenges. It seems that increased boat traffic and high-decibel sonar mapping of the ocean floor by the wind energy industry are behind the rising deaths of whales and other cetaceans off the East Coast over the last six years and could make the North Atlantic right whale extinct, according to researchers featured in a new documentary, “Thrown to The Wind.” One data analyst found that increased boat traffic from offshore wind construction strongly correlates with whale deaths. Another researcher discovered that the wind industry is engaging in high-decibel sonar mapping, which scientists say can split mothers from their calves, send them to poorer feeding grounds to escape the noise, and drive them into highly trafficked boat lanes where they face increased likelihood of being struck and killed. Shut it all down? I think not. As one writer noted, “the killing of whales by the wind industry and the role of the U.S. government is one of the greatest environmental scandals in the world.”

Headlines.

UBS Begins $10 Billion Cuts, Axing 3,000 Jobs After Credit Suisse Deal.

Germany’s Shrinking Economy Sparks a Struggle for Solutions.

BlackRock's Support for Climate and Social Resolutions Falls Sharply.

Protectionism That Fails. China again tried to boost markets, pledging to slow the pace of IPOs and halving the stamp duty on stock trades. But a rally in equities fizzled as overseas funds dumped mainland shares. Authorities have now asked some mutual funds to avoid selling equities on a net basis, people familiar said.

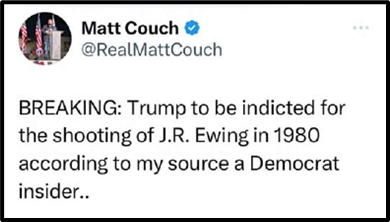

I have JR’s hat in my office.

BRICS. We have long written about the BRICS, the group of countries (Brazil, Russia, India, China, South Africa) that are trying to replace the U.S. dollar as the world’s reserve currency by only accepting currencies of countries that are members and working to become an alternative to groups like the G7. It is primarily focused on economic issues. Last week, the organization brought in new members. Argentina, Egypt, Ethiopia, UAE, Saudi Arabia and Iran. The organization is definitely expanding its reach.

No Clothes. Inventories as a tool to predict oil prices is spurious at best in my opinion. The following two charts are the same except for the timeline. From 1986 through today and it shows very little correlation. So, we shortened the time frame for the second chart and put it in more modern times, since 2000. A graphic explanation as to why reported inventories and crude oil prices have very little in common, real time or over time.

Conferences Upcoming.

Decarbonizing Global Maritime & Logistics Industries at Scale – by ADIPEC, Abu Dhabi

Hart Energy's Carbon & ESG Strategies Conference

2023 AWS Energy Symposium

Offshore Europe Aberdeen 2023

IADC & Sustainability Europe

Below. The ring nebula with 20,000 dense hydrogen clumps, each as big as the earth. A dying star. 2,000 light years away.

Brilliant Solution for Student Debt. Cut the interest rate on student loans from 6% to 3%. No debt is forgiven, and the debt is much more manageable. Interest rates fluctuate, and this is just going back to a reasonable longer-term average. Win, win.

Persistence. We have frequently written about the financial issues in several EU countries and the UK. Inflation was raging and energy costs rose dramatically, but as in the U.S., inflation started to ease. Until it doesn’t anymore. This comment caught my attention – “Euro-area inflation stopped slowing in August, defying expectations of a drop as energy costs stuck. The data underlines the quandary facing the ECB as officials weigh whether price pressures are too persistent to risk a pause in rate hikes.” Europe isn’t out of the woods, South America is having huge inflation issues, Africa is hugely in debt to the Chinese for their “roads and belts” program, and China, the world’s growth engine for the last couple of decades, is slowing down. We are the world’s best economy but that is a relative comment, not an absolute one. Stay nimble.

Less-Woke Shell. As everyone knows, Shell is leaving the Netherlands as one of its two co-headquartered locations to focus all operations on the UK. This was after a Dutch court said that Shell had to reduce its emissions by an amount that didn’t appear achievable at the time. It appears the new CEO agrees. The carbon offset program has been scrapped after the commitment to spend $100 million a year to work toward its zero emissions target by 2050. At the June analyst meeting, CEO Wael Sawan updated the corporate plan – relocation, doubling down on profitable oil and gas operations and very little about previous “green” plans. It is becoming increasingly obvious to all that the “transition” to a carbon free environment is much more complex and will take much more time and money than had been expected. While we will continue to move in that direction, as the industry has for decades, lowering emissions and increasing efficiencies, the need and demand for our products will remain strong. And hopefully, more will realize it is critical to our current way of life.

Fans Beware. No end in sight. Things are getting rocky over in Hollywood. Reports suggest that high-profile meetings between Amazon Studios, Disney, Netflix, Universal, and Warner Bros. Discovery are taking place amid divisions over how to proceed to end strikes by writers and actors, which are now in day 122 and 49, respectively. Failing to resolve the issues may lead to "devastating effects if it is not settled soon," and could potentially "produce an absolute collapse of an entire industry," according to Barry Diller, former CEO of Paramount Pictures and founder of the Fox Broadcasting Company.

Our Impact? More than 3 million workers would be newly eligible for overtime pay when they work more than 40 hours a week, under a new proposal from the U.S. Department of Labor. It would expand time-and-a-half pay protections to more workers by changing the exemptions to overtime eligibility under the Fair Labor Standards Act, a change that it says will boost workers’ economic security. Administrator Jessica Looman said in a press release on the rule: “For too long, many low-paid salaried workers have been denied overtime pay, even though they often work long hours and perform much of the same work as their hourly counterparts. This proposed rule would ensure that more workers receive extra pay when they work long hours.” Hold on to your wallets, here comes the government.

Perverse Economics. Last quarter’s GDP was revised down to 2.1% from 2.4%, and the ADP report showed the fewest job gains in five months. This is GOOD NEWS! Wow. Really. It means that the Fed may not raise rates again any time soon. I got that. But this is sacrificing a lot of lives, jobs and security to get us there. And the good part, it might just be getting better/worse!

Re-Run from April.

Big Brother’s Big Brother. A statesman is one who is willing to take risks and do what is right, even if not everyone agrees with him. An idiot is one who makes a pronouncement having no clue of the issues, challenges and reality of the situation and just likes telling people what to do. Without putting anyone specifically in either category, the Biden administration, through the EPA, is making the automobile industry a “de facto state-directed utility”. The new emission standards proposed by the EPA will force automakers to make EVs, and almost nothing but, whether consumers want them or not, with no consideration of the issues involved in making that so. Copper used in EVs is 2.5x that of an ICE vehicle (internal combustion engine). China processes about half the world’s copper. Cobalt and lithium? The Democratic Republic of Congo has some of the largest deposits of both, but we ignore child labor to facilitate an all-EV industry. Battery disposal? Turn a blind eye. Those are minor issues compared to a government agency deciding what cars are made and sold by what is ostensibly an independent industry. What does that mean? That they are no longer independent. And the whole idea is an exceptionally regressive tax. EVs cost 30%-35% more than equivalent ICE models so the poorer areas will be powered by ICE’s and older ICE’s, with their attendant emissions, and the wealthier areas will have clean air and hopefully a couple of charging stations.

How?? The EPA is using its authority under the Clean Air Act to regulate tailpipe pollutants, which again forces auto makers to produce more EVs whether consumers want them or not. The EPA cannot mandate EVs, but it will set CO2 emission standards such that automakers will be required to have EV’s consist of two-thirds of vehicles made. Recently, government agencies have been reined in on some proposals that are really the purview of Congress, but this doesn’t seem to qualify. Yet. The EPA proposal is even more aggressive than President Biden’s August 2021 executive order, which set a goal of 50% EV sales in 2030. The EPA says at least 20 countries have announced plans to phase out internal combustion engine cars in the coming decades, so its proposal is no big deal. I beg to differ, as do others. In February 2023, the EU gave preliminary approval to phase out sales of ICE passenger vehicles in its 27 member countries by 2035, a situation cited by the EPA. However, it conveniently ignores that the EU walked back the ban last month amid concerns about its enormous costs.

Analyst Opinion. “Halliburton's second quarter results were solid, but it appears likely that activity levels are going to impact the company going forward. The drilling rig and frac spread count in the U.S. is falling sharply, which will have an outsized impact on Halliburton's financial performance at some point. While international activity may hold up going forward, there is a real possibility Halliburton's earnings have already peaked. The company continues to trade on an elevated multiple for this stage of the cycle, creating elevated downside risk.” I respectfully disagree with the fact that earnings have peaked. International and offshore remain strong with increasing momentum, and while the U..S market is taking a pause, the focus by Halliburton on ROIC almost ensures that forward results will improve. Good Luck.

The World Gravy Wrestling Championship was held last week in the UK. No comment.

Ouch. The steep jump in public debt loads over the past decade and a half, as governments borrowed large amounts of money to battle the Global Financial Crisis and the fallout from the COVID-19 pandemic, is probably irreversible. That's the conclusion of a research paper presented last week to some of the world's most influential economic policymakers at the Kansas City Federal Reserve's annual central banking symposium in Jackson Hole, Wyoming. Since 2007, worldwide public debt has ballooned from 40% to 60% of GDP, on average, with debt-to-GDP ratios even higher in the advanced countries. That includes the United States, the world's biggest economy, where government debt is now more than the nation's yearly economic output. U.S. debt was about 70% of GDP 15 years ago.

Tough. "Debt reduction, while desirable in principle, is unlikely in practice," Serkan Arslanalp, an economist at the IMF, and Barry Eichengreen, an economics professor at Berkeley, wrote in a paper. Many economies will not be able to outgrow their debt burdens because of population aging and will in fact require fresh public financing for needs like healthcare and pensions, the authors argued. A sharp rise in interest rates from historically low levels is adding to the cost of debt service, while political divisions are making budget surpluses difficult to achieve and more so to sustain. "High public debts are here to stay," they wrote. "Like it or not, governments are going to have to live with high inherited debts." Doing so will require limits on spending, consideration of tax hikes, and improved regulation of banks to avoid costly blow-ups, they wrote. "This modest medicine does not make for a happy diagnosis," they said. "But it makes for a realistic one."

And if any of you find yourself in Amsterdam, the first beer is on me.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.