August 25, 2023

Things I Learned This Week Hanging at Home

August 25, 2023

Homebody. Spent most of the week at home. I actually remembered where I lived! It has been a busy summer of travel and now that the summer is coming to an end, it is safe to spend more time in Houston! I am speaking this week at the Houston CPA meeting, which is about as far as I want to go right now. Except of course the road trip this weekend to move my daughter into her new place in Washington DC as she starts her new job. Let’s see if I can find something interesting there to discuss!

Good Press. Remember around six months ago when EVERY newspaper and news outlet had energy as one of the lead stories? Now, we hardly get a mention. So, I was pleasantly surprised when I saw a story about Dallas-based Merit Energy planning to invest $1 billion, targeting mature oil and gas fields that might fall out of the $24 billion in E&P consolidation so far this year. The blurb for the story was “Consolidation in the shale industry is driving recent deals”. Not an earthshaking revelation to those in the business but considering this was the mainstream press, you have to pay attention. It wasn’t a story about flaring or fracking but one of an industry that is looking to optimize the future, whether it be from being the big consolidator or one of the little guys looking for crumbs off the table. We have always been an opportunistic industry, and I am just happy to see stories about the ambitions of people and companies in this industry.

ESG. Again. The WSJ had an entire segment of the paper one day this week focused solely on ESG, noting that “it’s everywhere, it’s everywhere”. Except most of the stories are about the fact that the original idea for ESG got corrupted and it has become a mantra that many believe, but few fund performances say that it alone makes for good investment decisions. And it isn’t just die-hard capitalists bashing ESG. The lead story’s title was “A Progressive’s Case for Getting Rid of ESG”. The push to be cleaner has been going on for decades. Remember the smog over Los Angeles and Denver? The river catching fire in Cleveland? Several rivers and lakes that were once toxic are now clean and enjoyable. ESG will be around for some time. The SEC will require more emissions reporting later this year. But you knew when Larry Fink, the head of BlackRock, said two years ago he was no longer investing in energy and named the CEO of Aramco to his board, things are changing. It may not be a complete backlash, but the pendulum is clearly swinging away from the extremes and back to the middle where it belongs.

EIA Weekly Petroleum Report.

Crude Implications: Neutral – draw above expectations. Money managers’ net long positions in ICE Brent and NYMEX WTI are lower 3% w/w, and 10% below the recent peak in April, suggesting market positioning is less of a tailwind moving forward.

U.S. Crude Production: indicated at 12.8mm BOPD, a post-pandemic record high, up the last three weeks, up 0.1mm BOPD w/w, and 0.8mm BOPD y/y.

Refinery Runs: 16.8mm BOPD, up 0.03mm BOPD week on week and 0.5mm BOPD y/y. Utilization at 94.5%. The peak of seasonal demand is nearing, but hurricane and fall turnaround season could potentially reduce runs.

Crude Imports (net): 2.7mm BOPD, up 0.1mm BOPD w/w and up 0.7mm BOPD y/y. Brent-WTI spread at $4/bbl, flat w/w.

Gasoline: Demand up 0.7% w/w and up 5.6% y/y.

Distillate: Demand up 5.2% w/w and down 1.3% y/y.

Snippets.

Investors ditched Chinese blue-chip stocks to the tune of $11 billion in a 13-day run of foreign-fund withdrawals as confidence floundered

UK growth optimism is pierced by a surprise drop in business activity

China is banning all seafood from Japan in response to Tokyo's decision to begin releasing treated radioactive wastewater from the Fukushima nuclear plant

Government Employees Told to Work from Home due to Rampant Crime Outside the Nancy Pelosi Federal Building in SF

Coasting. The North Sea investment outlook is set for near-term growth. Investments in the Norwegian Continental Shelf and the UK Continental Shelf will remain stable through 2026, increasing marginally from $29.2 billion in 2023 to $29.4 billion by 2026.

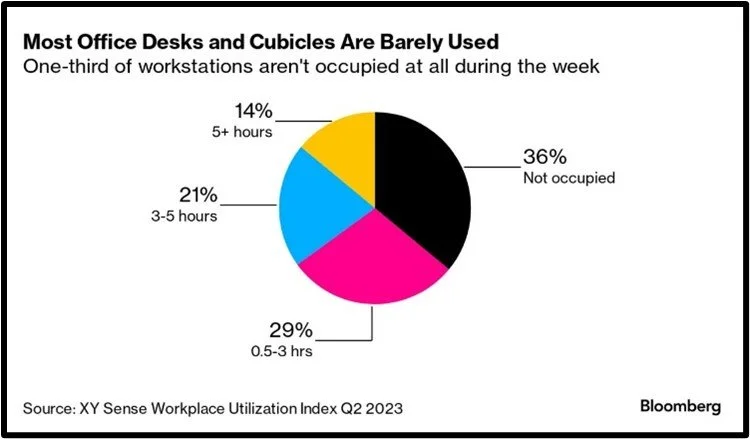

Hate Cubicles. More than one-third of desks in offices around the globe are unoccupied all week, according to a new report, raising questions about how well workplaces are currently designed as companies struggle to get employees back into the office. The report found that 36% of cubicles and desks are never occupied.

Pay Up for Change. The wage floor for American workers is rising and recently hit a record high, according to a Federal Reserve Bank of New York survey. The lowest annual pay that workers would accept to take a new job increased to $78,645 in July, according to the New York Fed’s most recent Survey of Consumer Expectations. That’s up from about $72,900 a year earlier and $69,000 in July 2021.

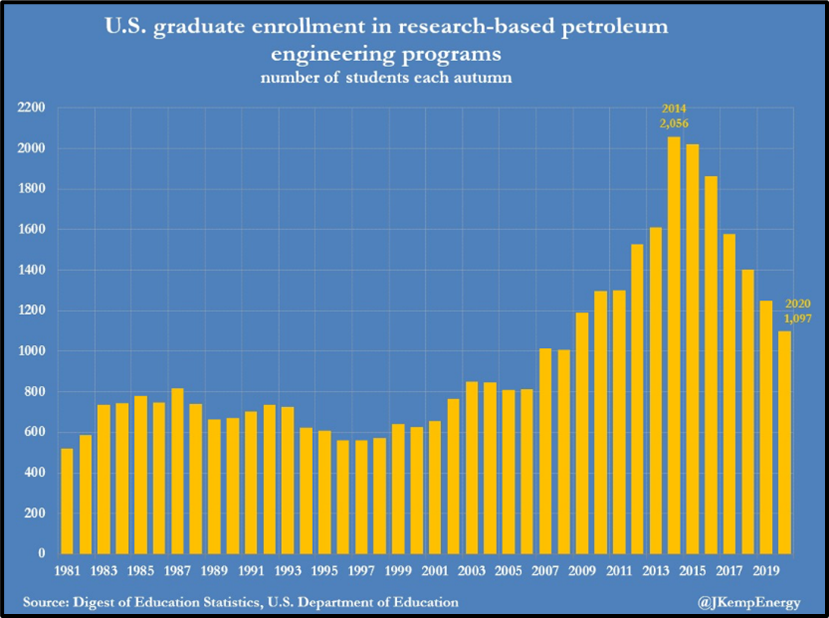

On the Other Hand. While the expected price to get someone to change jobs has gone up, a counter trend is emerging. Companies are cutting pay for new hires, with the worker shortage of the past few years easing. In 2022, salaries took a big jump after a good move in 2021. 2023 sees it starting to notch down. The investments business is similar. You can kill it one year and get unlucky the next but if you do it in the wrong order, you make zip. Welcome to my world. So, a generation will have to go from “quiet quitting” to having been “quitted”. It does confirm the slowing economy. And this is at a time where the headlines blare that after 40 years of growth, the party is over in China, the world’s second largest economy. We as an industry should use this as an opportunity to replenish the stocks of young people in our business. Hire, train and upgrade.

EVs. Electric Vehicles. I have friends who love their Teslas and I take nothing away from them. I rented one in Houston recently and since I didn’t have to charge it, it was great ($35 recharge fee). But the wheels are getting unsteady, though not coming off entirely… Yet. 60% of EVs sold in the world are sold in China. Not only is China’s long-term growth slowing, but there are also pictures throughout the press showing tens of thousands of electric vehicles sitting stranded in lots. The CEO of Ford recently took a road trip in an electric F-150. He said that there is a great deal of work to do. The head of Toyota said that the unspoken reality among his car manufacturing peers is that EVs might be interesting, but hybrids are the future. Environmental activists are shutting down every attempt to open a new mine for the rare earth minerals required in making EV batteries, and it is estimated that we need another 300 mines globally for copper, cobalt, lithium and other materials. If they don’t get built, batteries don’t work, and the car doesn’t move. One headline read “The EV Bubble Starts to Deflate”. We have written about this numerous times. EVs are priced 40%-60% higher than internal combustion engines (ICE), putting them out of reach for the average car buyer. The lack of charging stations continues to be a main issue, requiring a friend recently to spend 24 hours driving to Denver in his Tesla versus 16 hours in his truck. At any point in time, California has 25% of their EV charging stations down. Ford and GM both lost $4.5 billion each on EVs in Q2. Rivian loses $140,000 on every truck it sells. Over 200 Chinese EV manufacturers have gone bankrupt in the last three years. Inventories of EVs are now at 103 days, approximately double what it is for ICEs. Price cuts are becoming the norm. People who really wanted an EV have already bought one. Now comes the higher resistance buyers who aren’t yet fully convinced. And everything going on today seems to say they are right.

Hold My Beer. Interesting coverage of California and the rain. The headlines were in large font and emboldened. “Tropical Storm Hillary Pummeled the U.S. West Coast with flooding rains Monday, disrupting flights and knocking out electricity. Tens of thousands lost power and more than 300 flights were canceled in California, Nevada and Arizona.”

Severe thunderstorms left over 100k people without power in the Houston area. 300,000 homes were initially impacted. June 2023

Feb 2, 2023 — By 3 p.m. Thursday, more than 337,000 customers in Texas were still without electricity, according to PowerOutage.us

Heavy rains in Houston lead to closing of schools, power outages and rescues. 2019

It’s the city’s third “500-year” flood in the past three years. 2017

5 dead, thousands without power as Houston flooding continues. 2016

Putin Wins. Yevgeny Prigozhin, the chief of Russian mercenary group Wagner, was onboard the plane that crashed northwest of Moscow on Wednesday, the Russian Federal Air Transport Agency said. Russian state media said all 10 people on the aircraft died in the crash. Other victims included Utkin Dmitriy, a trusted lieutenant of Prigozhin’s since Wagner was formed, according to the list of passengers onboard shared by the Russian Federal Air Transport Agency.

Wisely Said. The 10-year treasury yield is at its highest level in 15 years. Boone Pickens told me once that being early by 15 years is almost the same as being wrong. A lot has happened in 15 years. That was the financial crash. And here we are.

Recession Reaction. While we’re all thrilled that inflation has come down to around 3%, consumer prices in the UK are up 6.8%. The headlines read “headwinds loom”. The UK is not out of the woods, and we may not be out of the woods, but we continue to be the best market in the world and that’s good for the oil and gas industry. The oil industry doesn’t need a recession, especially when we’ve got several million barrels already off the market. I think it is a real testament to our industry and the discipline that has been shown by the entire spectrum of energy companies through this price cycle, or rather the roller coaster, we’ve been on for the last several months. Here we have oil at $85 and the rig count seems to have stopped falling but it certainly isn’t going up yet. That’s discipline. Congratulations guys we’re getting it figured out.

Adios. Another political theater is ready to kick off with the pending September trial of Texas Attorney General Paxton. And people say we can’t be bipartisan. The Texas House voted 121 to 23 to impeach Paxton in May with 70% of the GOP representatives voting to impeach their fellow Republican, including all five GOP members from his home county. He seems to have been tainted from the very beginning, and the only thing protecting him from criminal indictments now is his position. It is an embarrassment to me that this guy was ever the attorney general, and I’m thrilled to realize after learning the numbers that he no longer will be.

Lost in the Shuffle. S&P downgraded and cut the outlook for several U.S. banks, following Moody’s revisions. KeyCorp, Comerica and others saw grades lowered amid a “tough” climate of higher rates, deposit declines squeezing liquidity, and the value of many lenders’ securities falling.

Interesting Story. Okay, so Tucker Carlson’s Trump interview went head-to-head with Fox’s Republican candidate debate. X, the company formerly known as Twitter, has been losing advertisers and a new CEO was brought in to fix that. But while Tucker is popular, he is polarizing, so how to woo advertisers? I had no idea that an entire set of multi-named tools being made more “robust” with more “control” was even an industry. It makes perfect sense, but they would think the same thing of a reservoir simulator. “CEO Yaccarino has been promising more robust brand-safety tools to give brands more control over the content near which their ads appear.” Asked about Carlson’s show, X said that “if advertisers want to avoid having their ads appear next to certain content, they are given options and tools to do that.” And while Mike Pence got the most airtime, many media outlets are praising the job done by Vivek Ramaswamy, a very interesting candidate.

Energy Snippets.

Nuclear accounts for nearly 10% of energy consumed in the European Union, with transport, industry, heating and cooling traditionally relying on coal, oil and natural gas

The rates of severe delinquency on auto loans are at a 17-year high

Historically, nuclear has provided about a quarter of EU electricity and 15% of British power

Path to Growth. The E&P consolidation wave continues, this time with Permian Resources spending $4.5 billion to acquire Earthstone Energy. This will make Permian one of the largest producers in the Delaware Basin, with 400,000 acres and 300,000 BOPD of production. That moves the 2023 M&A total to about $24 billion so far this year.

What “Green” Means to Some. The majors are continuing to invest in “green” but are being much more selective. Shell and BP mentioned earlier this year that some of their “green” goals are overly ambitious and not yet profitable. Chevron’s head of new energy technologies noted several interesting facts at a recent conference. “Renewable fuels [are] the most mature. We’ve invested the most money as a company in that space, and it’s the most profitable today,” he said. The company is investing $10 billion through 2028 to grow its low carbon business and about $4 billion has already been spent on a sustainable fuel acquisition and ramping up renewable diesel production. “It doesn't mean the returns always match other investment opportunities you have in the traditional space, but you need to be able to see a pathway to reasonable returns and eventually attractive returns.” 10%-12% of capex will be spent in the low carbon space by Chevron. Now you know what one major is doing.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.