March 31, 2023

Things I Learned This Week in Colorado

March 31, 2023

“Cutting Brent forecast (modestly) to reflect more economic uncertainty.” The headline appeared this week by one of the leading investment houses. I am reminded of an old axiom of mine, “no one ever lowers earnings just once”. The market is a discounting mechanism, by definition. The normal forward discount correlates best at 6 months. This would say that something bad might be in store for the next six months or so, around the end of September. Remember, we will start discounting the recovery about six months in advance as well. Most all of us believe in the rational supply/demand balance, but it is never a straight line. In stock technical terms, the gains of the last couple of years are consolidating before moving higher. There are 35 different patterns used in trading stocks. This is one. So, the question is WHEN??? It always is. After several decades in this business, and running operations in the U.S. and internationally, having confidence in ANYONE’S timeline forecast, is exceptionally naive. But the market is telling us that things may not get better quickly or soon.

That is No Surprise. We all know by now that lower than expected natural gas prices are expected to reduce the total U.S. rig count by 30-50 rigs. There are studies out recently that show natural gas is oversupplied and the rig count needs to drop by that much just to balance near-term supply/demand. If 50 rigs come down, at least 18 frac crews get idled. And of course, it is right when the industry has been adding capacity. Sure, it was E-fleets or high-line fleets and yes, those often, maybe even mostly, had contracts, but there is an industry wide reduction in the absolute number of assets being employed. Period. Who it hits? When it hits? How long it lasts? How bad will it be? That is a great amount on uncertainty in an industry that is starting to see forecast reductions, ergo earnings. And based on a commodity considered taboo by much of the world, as they embrace its products.

And Now? So, momentum is gone, a little weakness is expected. It could continue to be flat to down fundamentally (activity), for at least the next six months. On a supply/demand basis, it makes perfect sense. So, you remain cautious. No one is pulling in horns but there is very little interest in those horns getting bigger. Head down, plod ahead. It won’t last long, and we are better positioned today for a recovery than any cycle I have lived through. Discipline, professional management, understanding the goal is to make money, not grow production. And rationalizations don’t count.

Deals. On the M&A front, things have obviously stalled. Stock prices down 15%-30% just over the last four months or so. Forecasts drop as do EBITDA projections. And just like in the public markets, that causes valuations to drop. And being an industry of optimists, and fully believing that oil and gas prices are going higher soon, and they’ll be right on that previous EBITDA track. And that makes it very hard for a deal to get done. But as oil and gas prices move up…. See, I’m an optimist too.

Numbers. I was looking at a couple of stocks and found some interesting numbers in the pressure pumping space.

Halliburton’s stock is down 16% from its highs, earnings growth this year is estimated to be up 53% at the present time, currently trading at 10x 2023 earnings. The market’s multiple is 18.5x. It is either that estimates are too high or valuations are too low, though of course it’s always a combination of the two.

PUMP is down 30%+ since the end of last year.

Liberty was down 23% but seeing recent recovery.

RPC saw a correction of almost 30%.

NexTier went down 23%.

PUMP and LBRT are trading below 3x EV/ LTM EBITDA while Nextier and RPC are at ~3.3x and ~4.0x, respectively.

Market Share. Since the “Other” is turbomachinery, process solutions and digital solutions, this chart is a decent proxy for each companies’ OFS exposure. Baker overall is sitting on $8 billion worth of orders for equipment. They are a killer on all parts of LNG and that is a growth industry, but few real OFS companies are denominating their orders in the billions just yet. As a point of information, in Q4 net margins were 13% for SLB, almost 12% at HAL, and 3% at BKR, with much of its business being later cycle business with margins expected to expand well over the next couple of years. None of this is an endorsement or opinion on any of these companies. Across the spectrum, all three have significant strengths with optimistic expectations, in different areas, I think they all win.

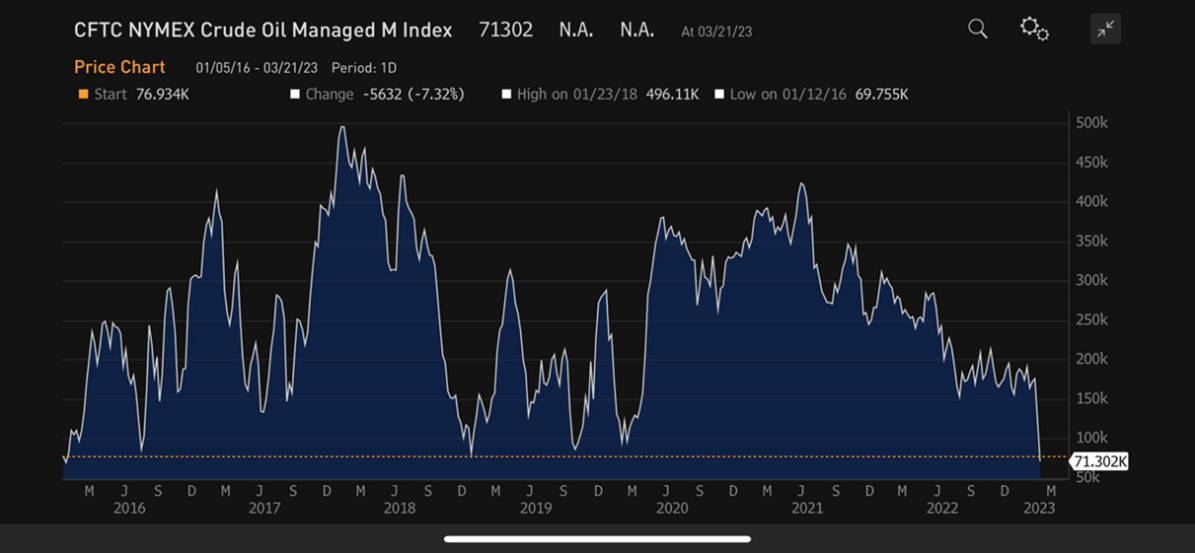

Bull and Bear. The Nasdaq is officially in bull market territory after a 20% move off its December low. So basically, stocks are rising because bank risk is falling and because investors think the Fed is going to have to cut rates. We have taken the argument from a 50 bps raise to a 25 bps raise and now a cut seems to be on the horizon. The Nasdaq is technology weighted. Oil speculation on the other hand is not going up. As the chart below shows, we are back to 2016 lows in terms of long interest in oil.

Headlines.

U.S. in recession in 2023? CEOs of Goldman Sachs and JPMorgan are convinced of this.

Top Democrat On J6 Committee: We Actually Didn’t Review Any Of The Surveillance Video.

New Stanford Study Calls EVs' Entire Business Model Into Question.

For U.S. natural gas producers, the LNG export bonanza can’t come quickly enough.

McKinsey is cutting 1,400 jobs.

The cost of attending an Ivy League school is pushing $90,000.

Doctors Report Startling Rise In Testicular Injuries Among Woman Athletes.

Oil price recovery depends on market confidence.

Elephant in the Room. A top tier analyst and firm published the following comment. We have written about it before. It seems to be “it must be the other guys” syndrome where it happens industry-wide, but every company refuses to admit it’s happening to them. The analyst published his “key takeaways from … our U.S. Shale Well Productivity Tracker note. U.S. shale well productivity remains a focus for investors as it is one of the key drivers of E&P capital efficiency. As we have flagged numerous times in prior research, our view remains that U.S. shale productivity has peaked and will continue to trend lower.”

Hopes and Dreams. The U.S. House of Representatives is considering a bill, HR 1 (which seems to denote the priority of the bill). The Lower Energy Costs Act. It does have a ring to it. It focuses on increasing the production and exportation of American energy, and reducing the regulatory burdens that make it harder to build American infrastructure and grow our economy. Democrats called it a giveaway to big oil companies. "While Democrats delivered historic wins for the American people by passing historic climate legislation, Republicans are actively working to undermine that progress and do the bidding of their polluter friends," said one Democrat. The industry was represented by the statement from NOIA’s President, Erik. “We need to look no further than the U.S. Gulf of Mexico and our offshore areas to achieve the policy goals critical to our nation’s sustained success.” The Gulf of Mexico is characterized by low carbon emissions and is consistently solving, scaling, and deploying new solutions to further improve emissions performance. Importantly, the offshore provisions in the Lower Energy Costs Act recognize the U.S. Gulf of Mexico region as a premier energy region. Senator Chuck Schumer said it was “dead on arrival” and President Biden said he would veto it. It must be a good idea.

Education. There has been a great deal of discussion in the industry about ESG, DEI, and climate. It is now being taught in an institution that surprised me. A group called Judicial Watch, which is admittedly a conservative organization, got 167 pages of records from the DOD under the Freedom on Information Act. The records include recommendations that the U.S. Airforce Academy in Colorado Springs “consider Behavioral Science 362, ‘Class, Race, Gender, and Sexuality’ as a core class,” and that all curricula be reviewed for “D&I” (diversity and inclusion) topics, and that all cadets and staff be educated in “specific D&I concepts and skills in order to decrease incidents of microaggressions, unconscious bias, etc.” – Judicial Watch.

Snippets.

Switzerland's authorities revealed a loan for Credit Suisse and UBS of 250 billion Swiss franc ($273.31 billion) as an emergency lifeline. UBS paid just over $3 billion for Credit Suisse.

Russia: oil production fell by around 300,000 barrels per day (bpd) in the first three weeks of March.

Offshore driller Transocean on Tuesday announced contract awards for two of its harsh environment semisubmersibles worth $382 million from Equinor.

Kings X. Xi traveled to Moscow for three days where he held lengthy talks with Putin alongside toasts to their “no limits friendship.” They declared in a joint statement that “all nuclear weapons states should refrain from deploying nuclear weapons abroad.” Someone had their fingers crossed since only a couple of days later, Putin announced plans to ship tactical nuclear weapons to neighboring Belarus, which borders Ukraine. That would be the first time Russia has stored such weapons abroad since the collapse of the Soviet Union. In 1994 Ukraine sent all of their nukes back to Russia, with the U.S. and others promising to protect Ukraine if they did.

Money. Remember when the oil industry, which has been the core of the high-yield market since its inception, was paying 9%? 10%? Some as high at 13% and higher? This week, Pioneer Natural Resources priced a public debt deal of $1.1B of three-year 5.100% senior notes. Key words – “public” and “5.1%”. If you do it right and well, it still works.

Debt. It became very obvious several years ago that China was working on and succeeding in seducing countries in Africa, with most thinking China wanted friendly access to their natural resources. And of course, to gain political influence in one of the most resource rich continents on earth. How do you get influence in the world? Spend $240 billion. Make 22 counties indebted to you for helping when few others would, with a “Belt and Road” campaign of building infrastructure. As it turns out, these were loans, not gifts. And another and very real level of indebtedness solidifies that influence. But now many of these African countries are broke and can’t repay the debts, and whereas corporately you would seize their assets, you can’t “seize” the natural resources of another country. Influencing is not cheap.

Quick Flash. Interesting chart below. $70 works. $80 works better. But as the industry shows discipline, the price has to move to accommodate it. Just never as quickly as we would like.

Middle East. Israeli Prime Minister Benjamin Netanyahu has a very narrow coalition government and recently proposed changes to the influence and power of the judiciary, reducing their power and increasing the power of the Prime Minister. Mass riots have been going on for weeks. His defense secretary disagreed and was promptly sacked. But the outpouring of dissent has caused Netanyahu to

announce a hold on any legislation “to make sure the people’s interests are respected”. Now, BP and Abu Dhabi’s oil company have offered to buy NewEnergy, the Israeli energy company that owns Leviathan, the 22Bcf field that is the largest gas field yet discovered in the Mediterranean.

Why It Matters. Stability in the Middle East. With all due respect, different regions of the world have different cultures and cultural morals. There are still some societies that will not hesitate to capitalize on a rival, neighbor, or friend’s instability. Some of those societies are in the Middle East.

Ouch. The FDIC has “paid out” $23 billion. The recent bank failures come with a price: $23 billion for the FDIC. Who will pay for it? The FDIC is looking to put a larger than normal burden on the big banks and continue bending over backwards for the community banks. Who will really pay for it? Us. Never fails. $23 billion.

Different Drummer. This is amazing coming from a Canadian bank who seems to never lose any optimism in anything Canada. “In conjunction with our oil and gas commodity update, we are providing an update for our Canadian Energy Services coverage group. While we continue to believe the sector is very well positioned longer-term, particularly as global oil demand grows, we don't see many drilling/completion-related positive catalysts over the next several quarters. As such, we are now recommending investors take a more cautious approach over the short term, focusing on ancillary service names with company specific catalysts.”

A Shift in Players. In 2021 and 2022, activity was led by the private oil companies, at one point estimated to be more than 50% of the rig count. Now the tables have turned. Privates are headed to the sidelines and the largest players are playing harder. To be continued.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.