March 3, 2023

Things I Learned This Week

March 3, 2023

Launched! The Atlas Sand IPO road show has started. One of only a handful of energy IPOs in the last 3-4 years, this will test the market for proppant business which has gone from famine to feast to famine to feast. It seems to be a $400mm deal on a company value of $2 billion. The primary use of proceeds is to build the “Dune Express”, a 42-mile conveyor that will move sand from the mine to much closer to the wellsite. It has been in the planning stages and has the promise of lower emissions per ton from reduced driving, safer road traffic, and dramatically reduced delivery costs. Great ownership and management team, lowest cost production in the basin, and the promise of a gamechanger. We wish them all the best. Pricing is scheduled for mid-next week.

Oil. EIA Numbers.

U.S. crude production: indicated at 12,300 MBPD, unchanged from previous week, and up 700 MBPD from same period last year.

Refinery runs 14,979 MBPD, down 31 w/w and down 419 y/y. Utilization at 85.8%. A heavy spring turnaround season is expected, a headwind for domestic crude pricing. EIA projects refinery inputs <16 MBPD until April and utilization <90% until May.

Crude Imports (net): 579 MBPD, down 1,150 w/w and down 1,392 y/y. Brent-WTI spread at ~$6/bbl, slightly narrower w/w.

The EIA also noted crude exports of 5.6M bbl/day for the week, which appears to be a record high on a gross basis.

News. First Solar is currently in the pole position as the only real manufacturer of domestic solar panel capacity at scale, as the U.S. embarks on new monumental legislation driven subsidy push to increase domestic production of all manufactured solar components.

Well Said. While there are probably many more bullish projections out there than negative ones for WTI crude oil (many calling for a move to the $100/bbl range), there is little technical support indicating such a move any time soon.

The first two charts, on crude oil, show major support at the $66 level. It does not have to get there, but for the indefinite future, crude oil is caught in the $66-82 range. Not a bad place to be, but not in line with the consensus.

A weaker dollar would certainly help the bull case, but that is not happening, at least not yet. Again, there is a waiting game as to direction.

The third leg of our codependency is Emerging Markets (which would indicate the degree of demand for the marginal barrel). Looking at charts for the last year and two years, there is little to give incentive to an oil trader.

Hope is not a plan. – My good friend James Halloran in a very cogent moment!!

We Will Know in June. After getting a break from paying off student’s loans for a couple of years, they are set to resume in the next six months. $1.8 trillion. While knowing you have debt, and not having to pay it off for a couple of years, you would think people would save up a little money for when they resume, rather than shifting the budget item into another category. “More than 4 million Americans are expected to fall behind and millions more will struggle to pay” according to Bloomberg. The other worrisome thing for me has been the trend toward lower savings rates and higher credit card debts, making it increasingly difficult for the consumer to “bail out” the economy. “Experts predict more delinquencies on credit cards and auto loans as the impact cascades through the economy.” Again Bloomberg. President Biden, by executive order, is forgiving student debt up to $20,000 per student but a number of states have sued to block the effort. The U.S. Supreme Court, dominated by a 6-3 Republican-appointed supermajority, heard arguments in case. Early reports on justice’s questions did not appear favorable for the government but the Court won’t announce its findings until June.

Buckle Up! Market futures now see four rate hikes as the base case. There is currently a 40% chance rates rise to 5.75% by July. There is now a 13% chance of rates rising to 6% or higher. Just 1 month ago, odds of rates rising above 5.50% were at zero.

Hadn’t Heard. Oil and gas explorer Pioneer Natural Resources is said to be considering an acquisition of smaller U.S. rival Range Resources amid consolidation in the U.S. shale industry. Range rose as much as 18% on the news, giving it a market value of $6.8 billion. Before today, shares in Pioneer have fallen 11% over the last year, valuing it at about $47 billion. Of course, the rumor was garbled as the next day, Canadian E&P company Baytex Energy agreed to buy U.S. Ranger Oil Corporation for $2.5 billion. Anyone remember that game called “Telephone”?

ROIC!!! We have long been proponents of ROIC, return on invested capital. Several years ago, we initiated coverage with a blended EBITDA/ROIC price target scenario. Generating lots of cash is great and needed, but what return on invested capital that does that cash flow represent? That is really the critical issue. As an industry, we have trusted in higher commodity prices to bail us out of low returns. We hit record levels of profitability last year and many OFS companies are still struggling to cover their cost of capital, and the ones with very high returns have very high equipment replacement rates. But the focus and attention by management teams is very positive and should continue.

Rig Count. In February, U.S. E&P companies cut the most rigs in a month since June 2020, with the gas rig count falling to the lowest since April. The rig count fell seven to 753 in the week of Feb. 24. Despite this week's rig decline, Baker Hughes said the total count was still up 103 rigs, or 15.8%, over this time last year. We continue to note that historically, with a very high statistical significance, the rig count declines into each new year before bottoming and reversing course around early May. This is followed by a rig count peak usually in early Q4 and decline into year-end due to holidays and spent budgets. We understand that the current natural gas price is likely to see 30+ rigs sidelined of the 150 gas rig count seen recently, but both commodities are expected to see a tighter market in the second half of the year.

The Oracle. The latest analysis from McKinsey and Company shows a new wave of M&A is expected in the upstream side, covering all of North America, not just the U.S. The report analyzes historical cash flows and projected operational and financial performance for the leading 25 North American E&P companies. Operating cash flows are projected to remain high, with levels between $70-$90 billion in 2023 and between $50-$70 billion to 2027 – even if oil prices drop to $65 to $70 per bbl.

Headlines.

Hong Kong Ends One of World’s Longest Mask Mandates After 945 Days.

Reality: we haven't even gotten to peak coal yet.

Oklahoma’s Latest Export. Hurricanes are moving farther north, putting millions of homes at risk in the U.S.

Oil markets may tighten in 2023 and 2024 on China.

Big Tech Layoffs Are Hitting Diversity and Inclusion Jobs Hard.

Hydrogen might be hiding underground.

Freak Accident Kills Man After MRI Machine Triggers Loaded Handgun.

Dept. of Interior Now Offering 'Eco-Grief Training to Employees.

Tesla has now produced 4M cars just seven months after passing the 3M vehicle mark for production (that is 20,000/day versus Rivian at 114).

Ilhan Omar: ‘We are not going to stop until every single person is freed from student debt.

Wind turbine seeds being planted on a wind farm.

Whew! Inflation in France is likely to reach its peak in the first half of the year and, barring a major world event, the risk of recession could be ruled out, French European Central Bank policymaker Francois Villeroy de Galhau said on Wednesday. It’s like calling the oil price. You aren’t good. You are lucky.

Big Plans. Banks that signed up for the Net-Zero Banking Alliance committed to align their lending and investment portfolios with the goal of achieving net-zero emissions by 2050. But the reality is that the biggest financiers of the world’s energy supply — many of which happen to be members of the NZBA — are a long way from meeting their commitments. Analysts at BloombergNEF reported Tuesday that the majority of banks in the NZBA have provided less financing for low-carbon energy companies and projects than they have for planet-warming fossil fuels. The goal is for a 4-to-1 ratio — with the 4 being the low-carbon part — to be reached by 2030. At the end of 2021, their average ratio was 0.92 to 1.

Getting the NZBA banks to deliver on their pledge is just “challenge number one,” said Adair Turner, the former City of London finance regulator who now chairs the Energy Transitions Commission. The second task is demanding lenders outside of the alliance, especially in developing countries, take action to cut emissions, he said.

Banks. In 2021, JPMorgan Chase & Co., the biggest U.S. bank, had an energy-supply banking ratio of 0.7 to 1. That was slightly worse than Citigroup Inc. and Bank of America Corp., but better than Wells Fargo & Co.’s 0.4-to-1 ratio, according to BNEF. BNP Paribas SA did the best out of the 10 largest banks, coming in at 1.7 to 1. None of 10 largest financiers were anywhere near the 4-to-1 goal.

JPMorgan is the biggest financer of clean energy and fossil fuel projects.

But Then…. A report by the UK Industry and Regulators Committee concludes that the Government is likely to miss its target for reducing emissions to net zero by 2050 unless it puts in place credible plans which are needed to encourage essential investment by consumers and businesses. The report concludes that the target has not been matched by the policies and the clarity over financial incentives necessary to unlock the substantial private investment needed to fund new energy technologies for both industrial and domestic use. It is amazing how quickly plans are being revised in the light of reality.

2019. The UK today became the first major economy in the world to pass laws to end its contribution to global warming by 2050. The target will require the UK to bring all greenhouse gas emissions to net zero by 2050, compared with the previous target of at least 80% reduction from 1990 levels.

2023. The report concludes that the Government is likely to miss its target for reducing emissions to net zero by 2050.

Bank Warnings This Week.

JPMorgan warned that quants could be forced to unload about $50 billion of equities if the S&P drops below the key 200-day MA threshold, which it came within 1% of doing on Friday.

More gloom from JPMorgan: Last year’s outperformance in so-called value stocks over growth peers will likely reverse.

Credit Suisse added that there are a lot more negative tactical and technical indicators than positive ones for global stocks and recommended selling into rallies.

You Can’t Make This Up. Greta Thunberg, the teenage activist is now demanding that Norway shut down a wind farm that powers 100,000 homes because the reindeer herders say the machinery frightens their animals, calling it “green colonialism”, against the group recently and infamously called Europe's "only indigenous people".

Double Standard. A train derails and contaminated waste has to be dealt with. How? Pumping it into the ground. So pumping contaminated waste with some real toxins involved is a good thing, but ban fracking, done by experts and in an industry that has been making everything we do more environmentally friendly along the way. The solution? Send the contaminated waste to Texas to dispose of, pumped down into rock reservoirs well below the surface. Wait wait wait. We do it, it’s bad. You do it, it’s good, and it’s by making us do it. Wow. 1.8 million gallons of contaminated waste needs disposal. The first batch arrived in Texas unannounced.

Score!! Sotheby’s has put six individual Air Jordans worn by Michael Jordan during the winning game of each of his NBA championships up for a private sale. The sneakers—dubbed The Dynasty Collection—are on display in Dubai. It’s unclear how much they will go for, but a pair of shoes Jordan wore in his rookie season sold for a record-breaking $1.47 million in 2021. Experts say these could fetch much more.

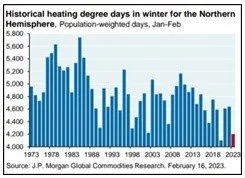

Saved. This chart shows why natural gas prices are so low and why Europe dodged a huge bullet this winter. What does next year look like?

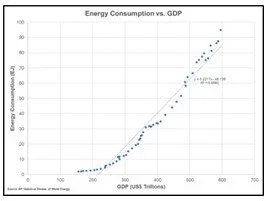

High R-Square. I have long liked this chart. Over the last several years, with Covid, E&P capital discipline, and some trying to shut down the energy that currently supplies 80%+ of global power, so many correlations just don’t work anymore. But some still do.

Not Oil. UAE turned on its 3rd nuclear reactor in 3 years. This 3rd reactor was delivered in record time, 40% more efficient than 1 and 2. The nuclear plant is the largest producer of electricity in Abu Dhabi, contributing ~22% of power in 2022. “3 units in 3 years! With each passing year, we achieve new successes, and we drive our nation forward towards a Net Zero future. In the #YearOfSustainability we are proud to announce the start of commercial operations of Unit 3 of the #BarakahPlant”

Snippets.

In 1948, when Al Gore was born, Earth had 130,000 glaciers. Today, just 75 years later, only 130,000 glaciers remain.

Adnoc Gas raises the size of its IPO — already set to be the world’s largest so far this year — to as much as $2.5 billion amid heavy demand.

A report just found that the U.S. has given Ukraine more financial aid than the entire cost of the Afghanistan War.

Germany faces a $1 trillion Challenge to Plug Massive Power Gap - About 250 gigawatts of new electricity I needed by 2030. Germany needs 43 soccer fields of solar power every day.

As of February 2023, over $144 billion-worth of upstream assets are on the market, out of which nearly $93 billion-worth were put up for sale in 2022 alone.

The World’s Best Disclaimer!! (Not mine!)

I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning in varying size. This is not a recommendation to buy or sell any stock or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in the piece at the time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. They are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple of beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Obscure. This was something l learned and should have known. There is a tanker, a super tanker really, sitting on the west coast entrance to the Red Sea that has 1 million barrels of oil in it. For almost 30 years, it was used to store Yemeni crude, but the Houthi rebels and Saudi Arabia’s clash in 2015 shut the operation down. But the crude remains. In a ship with no power, no maintenance for about seven years, so no venting of fumes or any other safety actions. For reference’s sake, it is 4x the volume of the Valdez spill. The UN has raised some money and the Houthi rebels have agreed to allow the ship to be reclaimed but it is estimated that the effort will cost at least $140 million, much more than the value of the oil. Stay tuned.

Multi-Variable Equation. Pakistan has fairly well-developed LNG infrastructure and has been transitioning to it for some time. In the last year, it has been harder for Pakistan to find LNG cargoes and even had contracted ones diverted to points in Europe. The cost and reliability of LNG as its power supply has changed dramatically. So, it is returning much of its power generating capacity to burning coal. The law of unintended consequences. Does it really matter? It’s just Pakistan? Norway has 5.4 million people. Italy has 60 million. Pakistan has 231 million. It matters.

Cheetos? The World Action on Salt, Sugar & Health has said that the bulk of food and drinks sold by four out of five global producers across three major markets are unhealthy. Kraft Heinz, Nestle, Unilever and Kellogg all sold a greater proportion of unhealthy food. Danone fared better. The worldwide economic impact of excess body weight will more than double to $4.27 trillion in 2035 from 2020 levels. So the deep fried bacon at the Texas State Fair is off limits??

Speaks Volumes. "American millennials in their 30s have racked up debt at a historic clip since the pandemic. Their total balances hit more than $3.8 trillion in the fourth quarter, a 27% jump from late 2019. That is the steepest increase of any age group." - WSJ, Federal Reserve Bank of NY

The Hot Topic.

ESG and woke are not at all the same but the media has mistakenly explained it wrong all along. First, ESG is something we mostly do already, under the mantle of HSE. Go look at pictures of an oilfield 50 years ago. Now 30. Now today. We have been driving an increasingly “cleaner” business since inception. Safety? It is every company’s most important issue, with a meeting of only 10 people still getting the safety talk! Governance? I think we have been weak here. I will note over 650 bankruptcies as some proxy. Some fiddled while Rome burned. But now? Boards have put compensation incentives in place to reward management teams toward more constructive behavior, focused on profitability.

Society? We were building schools and churches in remote locations, on five continents almost 50 years ago, under my watch. The “S” has been somewhat high jacked with DEI add-ons that were never part of ESG’s origins. Transparency. A key aspect of the “Societal”. And the oil and gas industry today, from technical to financial, is much more transparent today than ever before. Like it or not. It too has been a continuing trend over the years.

So now comes a bill that some think of as an anti-ESG bill.

Texas First. In September 2021, the Texas governor signed Senate Bill 13 (SB 13) – widely referred to as the anti-ESG bill in Texas. The primary purpose of SB 13 is to protect the energy industry in Texas from decarbonization of investment portfolios by funds and asset managers. Under SB 13, Texas state investment entities, such as state pension funds and public-school endowments, are prohibited from investing in companies that boycott the fossil fuel industry. The law also prohibits governmental entities from entering into contracts valued over $100,000, unless the contracting company expressly represents that it does not and will not boycott energy companies during the term of the contract. Following the passage of SB 13, five of the largest municipal bond underwriters have exited from the state of Texas.

Veto. Then a federal bill that was vetoed by President Biden. There is a great argument about what it would have really meant. The verbiage says that money managers would be allowed, not forced, to consider ESG and any other impact in their investment decision. Having run a fund, I should be allowed to consider any variable I choose to help make an informed investment decision. There are already forces at work that are cooling the ESG fever associated with prioritizing climate over returns. The idea that money managers fulfilling their fiduciary responsibility would sacrifice returns for some nebulous idea of saving the planet will never get a great deal of traction and like poison ivy, given time, it basically goes away.

We Have the Basics Down. Governance & Accountability Institute (G&A) is a leading consulting firm on sustainability and ESG. G&A’s research found that 92% of the S&P 500 companies published a sustainability report in 2020, up from 90% in 2019. This research shows that corporate sustainability reporting has clearly been adopted as a best practice by the largest U.S. public companies.

Pervasive. “Net zero” was mentioned in more than 6,000 filings with the Securities and Exchange Commission in 2022 and countless other times by publicly traded corporations and investor groups in statements and on their websites. The SEC says its proposed climate disclosure rule will help investors “evaluate the progress in meeting net-zero commitments and assessing any associated risks.”

Reality. In September, the Electric Power Research Institute, the research arm of the U.S. electric utility industry, released a report titled “Net-Zero 2050: U.S. Economy-Wide Deep Decarbonization Scenario Analysis.” The EPRI report concludes that the utility industry can’t attain net zero. “This study shows that clean electricity plus direct electrification and efficiency . . . are not sufficient by themselves to achieve net-zero economy-wide emissions.”

And Again. The other recent report is “2022 Long-Term Reliability Assessment” from the North American Electric Reliability Corp., a government-certified grid-reliability and standard-setting group. NERC concluded that fossil-fuel plants are being removed from the grid too fast to meet continuing electricity demand, and that it is putting most of the country at risk of grid failure and blackouts during extreme weather.

Surprise Surprise. We have all been over the many issues with Electric Vehicles, especially the amount of mining and access to materials to make enough batteries to power the future. This is a very important point, and we all think we can see how it eventually plays out. But what about the more immediate needs of those who already own and EV or are looking to buy one. Battery smattery, I now have my EV!! The problem is that owners of EVs are admitting that recharging away from home is a total "logistical nightmare," between finding charging stations, and the fact that in the best case scenarios it takes 30 to 40 minutes, and up to two hours, to recharge. Sitting at a “gas station” for 30 minutes doesn’t sound appealing, much less 2 hours. Solution? The Biden administration announced that Tesla would open its Supercharger network to non-Tesla owners by the end of next year - a plan which includes 3,500 Tesla fast chargers and 4,000 of the slower, Level 2 chargers. Now, there are currently about 64,000 gas stations in the U.S. (you know, those selling gasoline and diesel). The infrastructure bill passed in 2021 has a goal of installing 500,000 new chargers across the country.

Sanctions Work. We just assume China and India will keep buying Russian crude, though at a discount, allowing Russia to continue to finance its invasion of Ukraine, even at revenue levels below market. It appears to be getting increasingly difficult, especially for India. Indian buyers of Russian oil, a crucial lifeline for the Kremlin in recent months, are struggling under the weight of increasingly onerous demands from financiers wary of breaching Western sanctions. It’s a headache that is slowing transactions and threatening to at least temporarily dent record flows to the Asian nation.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.