February 24, 2023

Things I Learned This Week While Thriving

February 24, 2023

Headliner. Two years ago, the first Daniel Energy Conference took place, at Minute Maid Park in Houston. As one of the first meetings post-covid, it attracted a stunning 800 attendees. This year, the number was 2,300. The number of sponsors, displays, outdoor attractions and the quality of the presentations were unmatched in the industry. From batting practice on Tuesday to the end of the day Thursday, you would have thought it was baseball season. What follows are some observations made at the conference. If you didn’t attend, you missed out. The BBQ in Midland in September will be fabulous again, but this was a learning experience as well as a lot of fun. I want to shout out many of my friends I got to see and catch up with. Thanks John D and team.

Onshore Drilling. The CEOs of Helmerich & Payne and Precision were asked where they thought the natural gas rig count would go in light of lower prices and 40-50 rigs seemed to be the mark. Even with that drop, SuperSpec rig utilization will still be at 90%, high enough to support industry pricing. “We need 50% gross margins to make this work.” Daily cash costs have gone from $12.5k to $18k, and a new rig costs $35 million versus $24 million a couple of years ago. As a result, a $40k/d rig count generates about the same margin as $18k-$25k did a couple of years ago. HP said they prefer performance-based contracts, which wasn’t a surprise but the fact that 42% of their current contracts were performance-based was a surprise. Rigs today drill 55% faster than they did in 2014. No new builds are on the horizon.

E&P Panel. Endeavor Resources said they have their own power generation and will be installing additional turbines to make sure OFS companies have power. In 2020, the OFS margins were unsustainably low but now everyone is less efficient and wants to get paid more. Manufactured goods have struggled.

The Buyside Panel. Invesco, Nuveen and Wellington were represented on the panel, all heavy weights.

Natural gas will be sloppy for the new 12+ months, but the 3-5 year outlook is good.

Energy is no longer included in growth indices and must now show real value to be in a portfolio.

Oil will be stronger in the 2nd half of the year.

The sector remains a tough sell to generalist Portfolio Managers who remember years of under-performance.

A dividend discount model may be the most appropriate valuation method.

The longer the sector shows discipline, the more new investors will believe.

Scarcity is no longer a real issue and that reduces the valuation multiple of the stocks.

Until ROIC is positive, investors won’t come back.

Compensation was tied to growth but is now aligned with investors.

Clay Williams, the CEO of NOV, was interviewed by Leslie Beyer and me. Offshore activity is picking up, refurbishments more than anything but there is still a handful of rigs in Asia under construction. The Middle East will be the growth engine for some time and NOV had put significant manufacturing capacity there to be a “local supplier”. The M&A discipline of the last few years still holds, with most acquisitions being technology oriented that benefit existing product lines. NOV is focused on digital and the digital smart cloud. Digital can make all the different pieces of equipment, readings, and results, with the goal of providing the most efficient sets of equipment in the industry. Much less capital exposure is a goal. International growth is easier since investors are not as focused on short-term results whereas the U.S. market is dominated by Wall Street’s desires. The supply chain has been a problem, but NOV is so global in its manufacturing that its flexibility has shielded it from the worst. Clay is very knowledgeable and has built an impressive company and culture, and it was obvious as to how and why after talking with him.

Jeff Miller, the CEO of Halliburton had a “fireside” chat at the conference. He made some interesting observations.

International is longer cycle and well underway. Middle East and Latin America lead the way.

In the U.S., we will optimize cash flow.

50% of business is international and 40% of that is offshore.

At least 50% of free cash flow returned to shareholders.

Capex will continue at 5%-6% of revenues, in line with the last 5-6 years.

We are not adding frame capacity except fleets to customers who make a longer-term commitment. Most all incremental is electric.

A goal - to drive profitable growth internationally. Be very deliberate. Doing a lot more with NOCs than previous cycles.

Challenges - supply chain, hasn’t failed but has seen longer deliveries. Really no particular challenges.

Outlook for U.S. - Sold out for the foreseeable future, but is a capital-intensive market.

“We are returns driven.” The major point made in the presentation.

Olivier Le Peuch, the CEO of SLB, which still gets introduced as “the company formerly known as Schlumberger,” which is likely to continue for some time, was the first speaker of the conference. His predecessors were known for only attending one or two conferences a year so Olivier’s appearance both demonstrates the conference’s impact but also makes the company, and stock, better understood.

He is getting progressively more bullish on offshore.

He expects another 1-2 good years easily, and maybe more.

Exploration is on a comeback, though slowly.

SLB is working to only spend capex when the returns justify the investment. That means making an increasingly higher return.

It’s the first inning (he knows baseball) of a major oil and gas expansion.

The market gave a pretty clear message on capital discipline.

Carbon Capture and Sequestration are the most exciting and immediate in the clean energy push.

Oil sales and clean energy isn’t an “either/or’”. Hydrogen, cleaner operations, and significant opportunities are an option.

Wrong Protestors. We have not seen the “just say no to coal” demonstrators yet and considering it is

China, we might not. But there are a few interesting statistics I have seen.

China will consume 33% of global electricity by 2025.

Currently, 63% of its electricity comes from coal.

It built more new coal power plants in 2021 than the rest of the world combined.

Headlines.

Existing U.S. home sales fade for twelfth straight month.

Tesla now boasts the widest profit margins of any automaker.

The level of uncertainty about where things are headed is worse than usual - JPMorgan CEO.

Jeff Bezos hired an investment firm to evaluate a possible bid for the Washington Commanders.

Supreme Court Upholds Ruling That FLSA Overtime Exemption Does Not Cover Highly Paid Rig Worker.

New Cars Are Only for the Rich Now as Automakers Rake In Profits.

Uber Technologies will introduce 25,000 electric vehicles in India for ridesharing over three years.

Timing. Several months ago, we wrote about the Fed statement of “we will keep raising rates until the market quits going up”. That statement alone was enough to keep me out of the broad market for the last several months. But it was much more loss avoidance than actually making any money, and I am slightly overweight energy, which is not done as well this year, after convincing us for two years that it was the only place to be. We just become a long”er” term investor.

Ready?? So now one must think we are closer to the point of buying/adding to positions. That might apply to the energy sector as well. Every forecast out there is calling for a stronger second half of 2023 from an oil price perspective than the first half. The market is nothing but a discounting mechanism, typically discounting six months in advance. That would indicate it’s time to increase weighting in energy, but we may not be out of the woods.

Equity vs Credit. The Fed appears to have engineered a soft”er” landing. The UK has avoided a recession as well, so far, thanks to a very warm winter in Europe, and a warmer winter in the U.S. The strain on consumers and energy related utilities has lifted, and that has been a distinct positive for the European economies. We hope this is a trend that continues. An equity recession can be painful, wiping out investment value, but it this becomes a credit recession, people come and take stuff away.

Who Took the Spark?? As the below shows, China is expected to be generating one-third of the world’s electricity in a couple of years. A good steward?? A year after President Xi Jinping promised China would stop building coal power plants overseas, the country has completed 14 such facilities beyond its borders and will finish another 27 soon.

Everyone Agrees. The general consensus seems to be that oil prices will strengthen in the second half of the year, and the natural gas prices will stay where they are through 2024. When the consensus is in such agreement, I have to wonder. Every cycle I have lived through in the past, right before we went over the precipice, the statement was, “we can’t go down from here”. We are an industry of optimists. It drives what we do and how we operate. But the reality is as an industry, we are terrible at predicting commodity prices. I have a Christmas luncheon that’s in its 15th year and every year we will wager on the oil price over the coming year the results have been abysmal. The other one or two we were right, we were only lucky, not smart. We will leave the prediction of oil prices to those smarter, or not as smart as we are, but all indications are of up and to the right, even if it isn’t a straight line.

Stability Still Works. If prices stay where they are for some extended period of time, that’s not all bad. The E&P companies are already complaining about the significant rise in service costs. Clearly drilling rigs are now coming off in the natural gas market due the depressed pricing. It’s not a major concern to us since usually the rig count would be dropping now anyway. And losing several gas rigs after the count has more than doubled over the last 18 months seems to be a small concession. Pricing for the oilfield service sector may come under some challenge since the margins for E&P are no longer as high as they were or expanding. This week we heard one E&P company complain that service companies are asking for more money and providing lower quality and less efficient products and services. When statements like that are made, you know that belts are getting ready to be tightened.

Sentiment Needs to Turn. So, what the market believes matters. That is sentiment and how right it is over time is the real question. As I say, when everyone agrees, I get nervous. A toe in the water never hurt. No one wants to wish for a cold winter and for people to be in any discomfort but an average winter around the world next year wouldn’t break my heart. And while the next several months may be a challenge, the 6-12 month outlook is clearly higher. For now.

Snippets.

Seattle became the first U.S. city to outlaw caste discrimination, after its local council voted to add caste to the city's anti-discrimination laws. The move addresses an issue important to the area's South Asian diaspora, particularly the Indian and Hindu communities.

Cheniere is guiding to $8 billion in 2023 EBITDA, the trailing twelve-month net income qualifies them for entry into the S&P500 with a $37 billion market cap. Wow.

Selena Gomez now has 382 million Instagram followers, dethroning Kylie Jenner to become the most followed woman on the platform. (More than the population of the U.S.)

The Supreme Court ruled Wednesday that a drilling rig worker who earned more than $200,000 a year still qualified for overtime pay under a New Deal-era federal law meant to protect blue-collar workers.

Head of Energy Aspects, Amrita Sen, is one of the top oil experts and was recently interviewed on CNBC. When asked for her forecast for WTI prices, she responded for 2023: “under $100 for first half and $110 WTI for second half 2023”. This is conventional thinking among several oil experts.

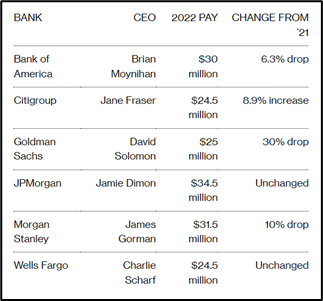

More Money! You think you are underpaid. You deserve a raise. You work your tail off every day. What does my CEO have that I don’t? I don’t know offhand but if you are the CEO of one of the major banks, you must be damn good at something.

Gas is King. Shell is now the largest LNG trader. We made reference to it being one of the largest natural gas “aggregators” in the business, helping to balance term and demand in the LNG world especially. The company released its annual LNG outlook. The global LNG business in 2022 was an estimated 20 trillion cubic feet of natural gas, which was up 4% from 2021. Europe was about 28% of that and up 60% over last year due to the interruption from the war. And we doubt this year is a one-time thing. Germany may not bring in Russian gas for a long time if ever. Russian gas can be diverted but there is little question, more natural gas, LNG, is needed. Shell estimates global gas demand of 34 trillion cubic feet by 2040, which is a compounded 3% over 18 years! China will continue to be the “swing buyer” in the market due to its electricity demands, and they have increased domestic gas production by 14%, pipeline gas imports by 33%, gas storage by 35% and regasification capacity by 19%. They are ready. Regardless of feelings of climate change, natural gas is here to stay for a very long time. Natural gas will continue to be produced by the oil and gas industry. And the more we can export, the more normalized global supply, demand and pricing will be.

Reality Sets In. There was a great deal of press this week about BP revising their pledge to reduce emissions by scaling back oil and gas production by 40% by 2030, relative to 2019 levels. Kings X! Okay, then 25%. Back-pedaling or facing reality? Remember Shell said a 28% reduction by 2030 but a Dutch court said it had to be 43%, resulting in U.S. refinery and production sales. The U.S. majors have made either much more moderate pledges or none at all. BP is increasing its spending on its transition businesses to 50% of total capex by 2030. Shell expects one-third of group spending, both capex and opex combined, to be spent on low-carbon projects this year. In comparison, about 14% of Exxon’s investments in the next five years will go to “lower emissions” and really focus half of that on cutting emissions from its own operations. The U.S. majors are up an average of 34% over the past twelve months while the European majors including BP, Shell and ENI are up an average of 9%, though BP has moved up 17% since it revised its pledge. The pendulum swings. It turns out that making a higher return is favored over diversification into lower return businesses. Notice – there was no mention of oil or fossil fuels in that statement. Diversifying into new and lower return businesses, even if these new businesses are more “sustainable”, has not been well received by investors, and has been broadly demonstrated by the market.

Hot Potato. Chesapeake and Comstock announced they would be lowering their Haynesville rig counts with low natural gas prices and little growth in LNG demand expected for a year or two at best, following getting Freeport back online. JP Morgan thinks the current gas market is over-supplied, the reason natural gas prices are so low, and oversupplied by 2Bcf/d, after being 1.5Bcf/d undersupplied in 2021. According to their math, the Haynesville would need to drop ~16 rigs to see a 1 Bcf/d decline in production, while a 2 Bcf/d decline in exit rate production would require the Haynesville rig count to fall by ~31 to 54 rigs. That matters and matters to the Haynesville the most.

With Age Comes Wisdom. A Fraser Institute report released on Wednesday shows Canadians aged 18-to-34 had a more positive impression of socialism (46%) than capitalism (39%), communism (13%), and fascism (8%). The most common perspectives of socialism among the group were “government providing more services like healthcare, education and daycare” (67%), and “the government guaranteeing a certain level of income for all citizens” (59%). The least common perspective of socialism was “the government taking control of companies and industries to control the economy” (36%). According to most young Canadians, additional services and a guaranteed level of income should be financed by taxing wealthy citizens. Seven-in-ten (72%) said socialism should be funded by increasing taxes on the top 1% of high-income citizens, and six-in-ten (57%) said the system should be funded by taxing the top 10%. Support for socialism trended downwards with age, as 18-to-24-year-olds favored socialism the most, and those aged 55+ favored socialism the least.

Politics. The train derailment in East Palestine has dominated the headlines this week and got more fun toward the end when former President Trump visited the site before Transportation Secretary Buttigieg made his. The area voted 70%+ for Trump and he was welcomed by almost a parade. Buttigieg apologized for not coming sooner and blasted Trump for some of his comments. And so it begins. As an aside, a recent Washington poll showed the preferred democratic candidates for president in 2024 were Biden, Harris and Buttigieg.

OUCH. The average monthly payment for a new car has soared to a record $777, nearly doubling from late 2019, according to Kelley Blue Book owner Cox Automotive. That’s almost a sixth of the median after-tax income for U.S. households. Even used models have climbed to $544 a month on average.

Begging & Pleading? So a bevy of Republicans, on their way home from the Security Conference in Munich, drop by the United Arab Emirates (UAE), the #6 ranked country in terms of oil reserves. Coincidentally, OPEC+, which includes Russia, has recently stated that it will stick with existing production targets through 2023. But wait! Goldman Sachs, the IEA and others, cited as “prominent oil industry voices”, say that markets will skew significantly by the 2nd half of this year, unless someone ramps up production. First, there is the idea of Wall St. research analysts “schooling” the oil minister about oil prices. These are not uneducated Bedouins. Next is the idea that first President Biden came to the region to ask for help and now we assume the batch of Republicans are there for the same reason. “Please produce more oil or the price will skyrocket, and high gasoline prices will kill my election chances”.

More. There is no question that the Middle East, and particularly members of the Gulf Cooperation Council, are ramping up spending and activity in a big way. Listen to the conference calls of Halliburton, SLB, Weatherford, NOV and any that have operations in the region. The U.S. isn’t an afterthought, but everyone is growing internationally faster than in the U.S. and it is centered around the Arabian Peninsula. By July, Saudi is expected to have 79 jack up rigs under contract. Few think of Saudi as an offshore market. There are 3 in the U.S. Gulf. And it is just now starting to happen. Saudi Aramco has awarded 46 multi-year contracts through last November, or 70% of all Middle East and 45% of all global term jack up contracts. But it takes time to actually get production online, and that is even true in a country where the government owns and runs everything. The effort is starting, and it will have momentum. It just not in time to bridge a short-term spike is the concern.

Change of Business Model?? Meta Platforms announced that it is testing a monthly subscription service, called Meta Verified, which will let users verify their accounts using a government ID and get a blue badge. The subscription bundle for Instagram and Facebook will be priced starting at $11.99 per month on the web or $14.99 a month on Apple's iOS system and Android. Charging for something you are used to getting for free is a hard transition.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.