October 4, 2024

Things I Learned This Week About Landscaping

It Was a Fun Week in Dallas. October is here. Fall is in the air. Well, in the morning it is in the air. By mid-afternoon, it’s hot. I celebrated the 1st of August by taking a picture of my car temperature gauge. 102 degrees. Granted, I was in the sunshine and temperatures are taken in the shade, but if you are out in that sunshine, with no shade, it is a lot hotter. No surprise. I am looking longingly at my sweaters, thinking one day, and maybe just for one day, I will get to wear one. Wow. The real treat this week was the Hart Energy Capital Conference in Dallas. The 400 attendees set a record for the conference. Karl Rove was the keynote so you can imagine how august a group it was. Sourcing capital is always the biggest challenge and everything having to do with capital was discussed. The real issue? How to gain significant scale while practicing capital discipline. That is the one thing that most vexes management across the energy spectrum. We now all realize that oil, natural gas, solar, wind, biomass, hydro, wave motion and nuclear will all be contributors to our energy future and scale can be accomplished in high growth areas, midstream or E&P. Oilfield Service has trouble building scale without just M&A, but the fits are never as seamless as E&P assets in a basin. But capital - access to, provision of and cost – will be the critical component to the future of energy, regardless of which source is king that day.

Total, Excuse Me. TotalEnergies is looking to grow its production by 3% this year. And for the next six years. Total is Europe’s 2nd largest integrated oil company and has plans to pay out $8 billion in share buybacks this year and do $2 billion a quarter going forward. And that is just one. So, growing production faster than demand growth and for the next six years. And you give shareholders back $2 billion per quarter? It should also be noted that Total’s ROIC has averaged only about 6% over most of the past ten years but is now bumping around 10%. Microsoft is 21%.

Wednesday. Oil prices climbed more than 3% on Wednesday on rising concerns that Middle East tensions could escalate, potentially disrupting crude output from the region, following Iran's biggest ever military blow against Israel. Benjamin Netanyahu vowed to retaliate against Iran after it fired about 200, 181 to be exact, missiles at Israel in an escalation of hostilities that world powers fear could spiral into a wider war - Bloomberg. So, what does Israel do? The U.S. government has turned a blind eye to Iranian sanctions. Does that change? Is there a U.S. response? Who is in charge of everything right now anyway?

Buy an EV and I’ll Throw in a Toaster and Charger. Seriously. Ford is now offering you a charging station and installation if you would just buy one of their EVs. I love being bribed.

Can’t Keep It Up. U.S. production growth has stalled. No great surprise since drilling activity has been trending steadily downward. No net growth in the last 10 months. Bullish for oil companies, negative for the service providers. The expectation is that, if oil prices stay where they are today, production will peak out later this year or early next. That will reduce the over-supply. Now that pesky question of “how quickly” and it is never quick enough.

Depth of Knowledge. The Chair of the FTC is Lina Khan, and you think to yourself, what was her real reasoning to deny John Hess a seat on Chevron’s board? Maybe a condition of her approving a $53 billion transaction? According to Lina, “increased U.S. oil production over the past decade should have driven down prices for consumers. But John Hess’s talks with OPEC instead risked advancing the cartel’s goals of propping up prices”, she and the commission’s two other Democrats said. The FTC alleged that John Hess discussed oil-price trends with OPEC officials over the years and sometimes praised the cartel’s management of prices at conferences and other venues. “Contacts between competitors about their commercial practices regarding output, prices or other competitive dimensions, whether made in public or in private, can undermine free and fair competition and violate the antitrust laws,” the FTC said. Adding John Hess to Chevron’s board would allow him to influence Chevron’s investments and policies to align more closely with OPEC’s mission and operations, the FTC said, heightening the risk of harming competition. OMG.

Possibility. “The potential impact of unfolding the voluntary cuts: If OPEC+ starts reversing its voluntary cuts from December 2024, oil prices could decline significantly, with an alternative scenario based of OPEC+ unwinding voluntary cuts from December 2024, predicting an average Brent price of $71 per barrel in 2025, dropping toward $50 by the end of that year.” Oil falling below $60 would completely crush earnings estimates for the oil sector. Similarly, the oil market may be giving us a timely warning about the global economy if we're willing to listen. This from a Rystad strategy piece.

Yikes!! The headline read “Saudi minister sees oil falling to $50 if cartel curbs defied.” Merry Christmas he said sarcastically. A year and a half ago, the overwhelming consensus was that oil today would be $100 a barrel at the very least. Now we sit, hoping it will hold $70 and that’s with more than 2 million barrels currently off the market, to try and prop prices to this level. Then to have the Saudi minister talk about $50 oil? That’s not a good thing. I realize he was saying it to keep the cartel in line. $50 oil hurts them much worse than it hurts Saudi. Sure, it’s just a threat and doesn’t mean anything because conditions won’t be met. If everybody agrees, be careful. Remember last year’s price prediction? I’m either too smart or too stupid to try and predict oil prices. The old tagline was “in the LONGER TERM,” oil prices will trend up. Other than computer memory, has anything not trended higher in price? In the longer term, we are all dead. Make me MONEY!! What is oil going to do in the 12 to 18-month time frame? No one has any idea. The futures strip is 89% off, 3 years out, over the last few decades. I’ll take the over on $50. $20? I’m either not a gambler or I’m more hopeful than convinced. Good luck.

Succession Planning. He is not a public advocate. He is THE Public Advocate for the city of New York, and if the current Mayor Adams, who has been charged in Federal court for several felony offenses, steps down, Jumaane D. Williams steps in. He is the watchdog for the people of NYC. From his official city webpage: “As Public Advocate, Jumaane will continue to be an activist-elected official who brings the voices of everyday New Yorkers to City government and makes New York a truly progressive beacon for all.” Smart, engaging, committed. The world needs people like Jumaane. I am just not sure he is the person I would put in charge, who might try to implement an ideology, rather than efficiently operate a multi-billion-dollar enterprise. But then again, it is New York City.

PPHB – U.S. Energy Market Update Highlights.

Commodity Prices: WTI crude oil is currently $70.10 per barrel (up ~3.6% week-over-week) and natural gas is $2.89 per MMBtu (up ~5.1% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.3 MM BOPD (up ~3.1% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories increased by 3.9 million barrels week-over-week vs. an estimated decrease of ~1.5 million barrels.

Frac Spread Count: There are currently 238 frac spreads operating in the U.S. (an increase of 2 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 567 drilling rigs operating in the U.S. (no change in rigs week-over-week).

Badger. The Energy Weighting of the S&P 500 notes the relative size, in market capitalization, of the market. We are now down to 3.3%. Or should I say, “back down”? We have been between 2% and 7% for the last decade, averaging about 5%. Even if you include real estate and utilities, it only gets it to 8.5%. We are small but feisty.

It Feels Like I’m In a Ditch! The Energy Sector ETF, which tracks the S&P 500 energy sector, was the only S&P 500 sector that fell 3.7% in the third quarter of 2024 compared to Wall Street’s benchmark index, S&P 500, which hit record highs, closing the quarter up 6%. One key reason for the sector's underperformance has been a sharp downturn in oil prices, pressured by strong supplies, particularly in the United States and economic weakness, particularly in China.

Headlines.

Energy ETF hits 2-month high as oil prices surge.

Europe Set for Colder Winter Than Last Year as La Niña Arrives.

Citizens are being forced to risk their lives to rescue themselves!!!!

Is The Oil Market Foreshadowing A Global Recession?

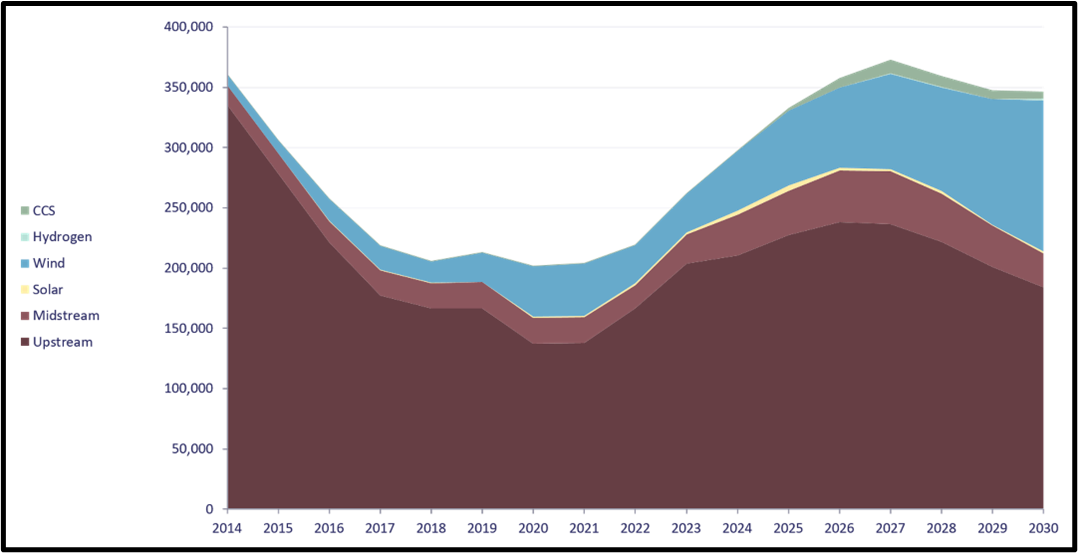

There's No Tellin' Where the Money Went. Offshore investments are expected to peak in 2027 with continued expansion for offshore wind. The below chart shows the Capital Spending by Sector.

Working Together. SLB reached an agreement with Patterson and Abu Dhabi-based Adnoc Drilling to create a joint venture to accelerate the United Arab Emirates' unconventional oil and gas program. The JV will help accelerate the innovations in the market today of artificial intelligence, smart drilling design, as well as completions engineering and production solutions and will accelerate the initial scope of 144 wells delivered to them by the end of next year, with additional wells in phase 2. SLB will provide integrated drilling, stimulation and completion services, as well as project management, digital capabilities and subsurface support as part of the venture. Adnoc will own a 55% majority equity stake in the JV, while SLB will hold a 30% equity stake and Patterson the remaining 15%. Congrats all.

The FTC Does It Again. I was going to head over to Saudi Arabia for Halloween, but I’m worried I might see someone who works for Aramco, and that could be a disaster. “Good morning, sir! It’s a beautiful day.” Whoa! Did you fail to mention that you were actively trying to convince Saudi on oil production limits?? Because if you did, you are guilty of collusion and aiding and abetting, and can never serve on a board again. Geez. FTC did it to Pioneer in the Exxon deal, not letting the Pioneer CEO serve on the Exxon board because “he had communicated with people in Saudi.” Now John Hess, for the same reason. I wish Pioneer or Hess had enough stroke to influence Saudi or global oil economics. That would be cool. But two sitting CEOs, because they “attempted to collude with OPEC” on oil prices. If only they could. The FTC is investigating Sheffield and referred the case to the Justice Department for possible prosecution. Do these people live real lives?

Some Specs. A recent report about the E&P industry, both potential deals and completed, included some benchmarks I found interesting…

Management noted the high-quality nature of the Double Eagle assets (including a deep inventory of undrilled locations) and acknowledged that the deal would make strategic sense.

We estimate that OVV paid ~$1.2MM per net undeveloped location and 2.8x NTM EBITDA for the deals announced in April ’23.

This represents a considerable discount to the estimated implied valuation markers for both the December 2023 OXY/CrownRock transaction (~$3.2MM per net location and 6.1x EBITDA), and the February ’24 FANG/Endeavor transaction (~$3.5MM per net location and 5.3x EBITDA).

The Shape of Things to Come. PJM Interconnection is a regional transmission organization (RTO) that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia, serving 65 million customers. So, PJM held a July capacity auction where prices were up dramatically from a year ago. The company said that it was sending a price signal to the market, indicating prices needed to add more capacity. And the Chairman made it clear what that additional capacity would be. “Given these trends, it has become very clear that our region will require the buildout of a significant quantity of new generation, including a material amount of natural-gas-fueled generation, in order to maintain the reliable electricity supply our customers expect.” Wham! Reality beats idealism every time. But why is all this happening? In the words of the company Chair – “As PJM has been warning for some time now, our region is experiencing a combination of trends that have served to rapidly tighten the supply-demand balance on our system. These trends include:

Electrification coupled with the proliferation of high-demand data centers in the region that will result in material load growth.

Retirement of thermal generators at a rapid pace due to policy pressure as well as economics.

Slow new entry of replacement generation resources due to a combination of industry forces, including siting, permitting and supply chain constraints.

The high proportion of our interconnection queue that is composed of intermittent and limited-duration resources, many of which are valuable energy resources but are much less effective providers of capacity than the thermal resources they are replacing.

Baby I’m Blue. We all know blue hydrogen, made when natural gas is mixed with hot steam and a catalyst to create hydrogen and carbon monoxide. And we know green hydrogen, also called renewable hydrogen, is obtained by electrolysis of water using only renewable energy. Now comes turquoise hydrogen, that's produced by breaking down natural gas into hydrogen and solid carbon through a process called methane pyrolysis. The last creates no CO2 and solid carbon, usually carbon black. Pick your poison. The most economic works best but full cycle economic analysis is rarely applied.

Valuable. Bank of America analysts published their “Value 10” list of stocks. These are the highest-ranking value stocks, according to BofA analysts. The criteria for a stock to be included in the list are: BofA vs. EPS surprise rating of 1; a buy-rated opinion; and the lowest trailing 12-month P/E. The annual performance for the Value 10 stocks so far this year is 19%, compared to 15% for the S&P 500 benchmark. The only energy stock?? Devon. Confession. I own it.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.