May 5, 2023

Things I Learned This Week at OTC

May 5, 2023

The BIG Show? The Offshore Technology Conference used to be THE industry trade show. For years, if not decades, the first week of May was when the oil world descended on Houston for one of its biggest parties of the year. Restaurant reservations? Booked. Party spaces? Booked. Hotels? Long gone. And then, in 2014, the major oil companies decided to grow financial returns rather than growth in production at all costs, mainly because over 80% of major deepwater projects at that point, even with $120 oil, lost money. They had negative returns on the costs of putting the production online. By the end of the year, we were mothballing rigs, but the momentum kept OTC as a crown jewel event. Then, as offshore activity continued to wane over the next few years, the prestige of OTC waned as well. Companies were working hard to improve the economics of offshore activity based on technology rather than oil prices and continued to hone their skills and capability, but it wasn’t enough to stem the decline. The show was cancelled in 2020 due to Covid, and the 2021 meeting was held in August (in Houston!). Last year it returned to the first week of May but after being gone from the time slot for two years and seeing offshore continuing to decline, the 2022 show was missed by some. So now, 2023.

Transitioning. The largest annual oil and gas conference in the world is ADIPEC, which takes place annually in October in Abu Dhabi. The OTC comes in 2nd and is one of the 10 largest trade shows in the U.S. Whether this year qualifies is still a question. When you walk into the hall, which is enormous, it is amazing with every nook and cranny taken by some company. Some were back to huge displays, some in the 10x10 foot booths, but the exhibitor attendance was impressive. With my good friend David de Roode, we recorded podcasts, eyed the winning technologies and talked to a number of people. It seems the main thing missing this year was the attendees. The lack of oil company people was noticeable while the attendance from foreign national oil companies was impressive. But most of the salesmen were talking to other salesmen from other firms. Several people we talked to seem to see more value in company parties, where customers are invited but rival salesmen aren’t. There were a number of notable parties already. PPHB hosted a group at the Houston Country Club which was a great bash and I got to see a number of oil friends. More parties are never a bad thing.

Technology. Offshore and deepwater are now in comeback mode and a bit of optimism was in the air at the conference. What makes the comeback? Enough development of technology to bring the costs of offshore to a competitive level with the rest of the world. And who is doing this?

2023 Spotlight on New Technology Winners

Baker Hughes, producer of REACH™ wireline-retrievable safety valve

Framo AS, producer of Framo Submerged Turbine

Hägglunds, a brand of Bosch Rexroth and producer of Atom – The most powerful gearless direct drive

Oil States Active Seat Gate Valve

OSIRenewables™, an Oil States enterprise, FTLP™ Floating Wind Platform

Saipem, producer of FlatFish, a technology originated by Shell Brasil in cooperation with Senai Cimatec

SLB and Equinor, producer of Epilogue™ dual-string barrier evaluation

Teledyne Marine, producer of 3 Channel Vertical Optical Feedthrough System

Motivation. Nothing like the prospect of discounted energy to reorient one’s foreign policy stance! As we all know, the U.S. and the EU have put sanctions and price caps on Russia and Russian oil, with the U.S. ending its purchases of Russian oil and a ban on shipborne cargoes into the EU. The idea was to hurt Russia by reducing exports and the price received. But oil is a very fungible commodity, and we are starting to see very broad examples of why it isn’t succeeding in slowing Russian cash flow generation to fund the continuing Ukrainian war. India has long been a close ally of the U.S., but that country has over-taken China as the most populous country in the world and as the lead-in states, foreign policy is usually driven by fiscal policy and the ability to buy cheaper Russian oil was irresistible. We shrug and say that yes, India probably needs it. And they do. So that New York can take delivery of almost 90,000 barrels per day of gasoline and diesel refined in India. Who is to say whether it came from Russian oil, or Indian oil or even Iranian oil. 40% of the New York area’s imports of gasoline and diesel now come from India.

But it’s not just India. Saudi Arabia is purchasing diesel from Russia, at least 2.5 million barrels in March alone, and then reselling it into Europe. Sanctions? Price caps? As we have noted several times, this is a temporary interruption of the markets as new supply routes take over. Sure, Russia said it cut 500,000 BOPD of production but that really hasn’t been seen yet other than in the production drop from formerly Exxon-operated Sakhalin Island, and OPEC has announced cuts but since some members weren’t producing their quotas, the real drop is much less. So, most of the pre-Ukraine conflict 100 million barrels per day of production remains in force. 98 to 102? That is considered a wide range. That oil still flows just in different directions, by different methods, and to different places than it did before but in a year or two, that will have become the logistical norm. But all that just means that the sanctions and bans on Russian oil won’t work. Such actions never have. And one cannot blame India or Saudi for taking advantage of a situation, that they didn’t cause, for the benefit of their people? So, we have spent a year now with a strategy that was doomed to fail in its primary objective. We need better strategic planning and a history book.

Reuters.

OPEC's share of India's oil imports fell at the fastest pace in 2022/23 to the lowest in at least 22 years.

Russia overtook Iraq for the first time as the top oil supplier to India, pushing Saudi Arabia down to No. 3.

India imported ~1.6 million barrels per day of Russian oil over the last year, about 23% of total imports.

EIA Weekly Data.

Crude Implications: Bearish – draw below expectations. 2.0 MMBBLs released from the SPR. Recall DOE offered to sell 26 MMBBLs (congressional mandate) from the SPR during April to June. WTI backwardation between 1M-12M is $3.8/bbl, down $1.5/bbl w/w. Gasoline and diesel demand weakened, persistent headwind for refining margins and crude oil prices.

U.S. crude production: indicated at 11,900 MBPD, up 100 MBPD from the previous week, and up 500 MBPD from same period last year.

Refinery runs 15,735 MBPD, down 98 MBPD w/w and up 269 MBPD y/y. Utilization at 90.7%.

Crude Imports (net): 1,659 MBPD, up 102 MBPD w/w and down 1,099 MBPD y/y. Brent-WTI spread at $3.8/bbl, flat w/w.

Cracks? The oil world’s widely held belief of a bull run in late 2023 is starting to show its first cracks. That was the lead-in for an article this week after oil prices continued their pullback. Brent is at a five-week low and down 8% in two days as of Wednesday. Everyone had expected China’s rebound would have been stronger and that sanctions on Russian crude would depress supply. Oops. China is coming back but tepid and it turns out they have as many supply chain problems post-Covid as we had. And India and China continue to buy as many barrels of Russian crude that they can. Morgan Stanley abandoned its bullish outlook for 2023 on Tuesday with a warning that the “prospects for second-half tightness have weakened.” And then there continues to be concerns over a potential recession. “Potential” is because it hasn’t happened yet, but many see it as increasingly inevitable and that we might devolve into a credit recession, whose impacts could be dramatic. The original reasons for optimism are still there, just farther out and not as strong. Uncertainty is never a good thing for prices. The valuation of many OFS stocks are reflecting this uncertainty. We continue the sage advice of - be nimble and careful. Oh, and continued capital discipline.

More Gas! By a 3-1 margin, FERC voted to reaffirm approvals initially issued in 2019 that will allow NextDecade’s new LNG export facility to move forward. NextDecade CEO Matt Schatzman - “We have publicly disclosed that we expect to make it (FID) by the end of Q2”. The initial three trains would be capable of processing 17.6 million tons/year of LNG, or 2.4Bcf/day, with plans for two more.

Snippets.

Argentina is moving closer to a breaking point as desperate government measures fail to halt a plunge in the peso. The risk of a currency devaluation President Alberto Fernandez pledged would never happen is rising.

Joe Manchin. “The Biden administration is breaking its word to the American public by ignoring the text of the Inflation Reduction Act to pursue its radical climate agenda. Let me be clear: if this continues, I'll do everything in my power to stop them - including voting to repeal the IRA.”

An Israeli food-tech company says it has 3D printed the first ready-to-cook fish fillet using animal cells cultivated in a laboratory.

Russia had said it would reduce crude oil production by 500k BOPD due to sanctions, but data shows no reductions in Russian oil volumes.

Always loved Bill the Cat!

Headlines.

Ukraine is running out of ammo. So is the U.S.

There may be another Brexit coming for Europe.

Americans are buying more marijuana than chocolate.

College Debate Team Comes Out Against Debate.

The new controversy on the left: Is it okay to say Tucker Carlson had some good ideas?

Next: George Strait releases "All my exes have changed their sexes."

More Impediments. President Biden signed an executive order Friday aimed at ensuring federal decisions consider "environmental justice," which addresses higher pollution burdens often faced by communities of color and people living in poverty. Agencies will "consider measures to address and prevent disproportionate and adverse environmental and health impacts on communities," such as the cumulative effects of pollution and climate change, according to the White House. The order will create a new Office of Environmental Justice within the existing White House Council on Environmental Quality, with the administration calling on agencies across the government to conduct new assessments of their ongoing environmental justice efforts. Merry Christmas.

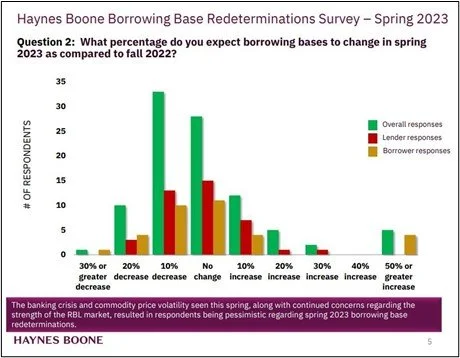

Borrowing Base. Our good friends at Haynes Boone, one of the country’s leading law firms, have put out some survey data which we find interesting. Banks are tight, oil prices are volatile, and the redetermination of the E&P industry’s borrowing capacity takes place again this spring. What will it bring? Good question. Here are Haynes Boone’s results from their survey. Nearly three-quarters of respondents said they expect oil and gas producers’ borrowing bases to stay flat or decrease by 10% or more. The survey questioned 96 executives of oil and gas lenders and borrowers, professional service firms, oilfield service companies and other firms in the industry. (42% were lenders and 36% were oil and gas producers.)

From Where?? “The latest survey reflects greater pessimism, which is a byproduct of the recent banking crisis and commodity price volatility, which offset the unexpected decision by several OPEC+ countries to voluntarily cut oil production,” said Kraig Grahmann, a Haynes Boone partner and head of the firm’s Energy Transactions Practice Group. Weak natural gas prices could negatively impact this spring’s borrowing base redeterminations for gas-heavy producers. Respondents in the new survey said nearly a quarter of producers’ capital in the next 12 months will be sourced from cash flow from operations. That is more than any other expected source.

Favorable? What is the temperature of banks in this market? There are about half as many banks that will lend to energy, specifically oil & gas, than just three years ago. So how do they feel this time??? Producers have been utilizing ABS (working interest securitization) transactions, in part, due to the lack of a robust RBL market. However, only a small percentage of respondents (12%) report that RBL lenders view these ABS transactions favorably.

Great Definition. “War is nothing more than the concentrated conveyance of destructive energy, and the history of war can best be understood through the lens of primary energy development, its efficient conversion into weapons, and its resulting targeted delivery against the enemy…. The history of propulsion technology at sea is marked by a completely sensible journey up the energy density ladder. Wind-powered sailing vessels were made obsolete by ships that burned coal, which were displaced by those that burned diesel, which ultimately gave way to those that leveraged nuclear technology. There is no room for platitudes in the great geopolitical chess match – you either wield real power or become ruled by others willing to do so – and energy density is a decisive metric.” - Doomberg.

Error Error. And I have a correction. Last week I wrote that the Defense Secretary’s comments about electrifying military vehicles applied only to the cars and trucks, and not tactical gear. I thought that was a much more reasonable approach. But alas, I was wrong. “We’re going to start the process for every vehicle in the United States military, every vehicle is going to be climate friendly. Every vehicle. I mean it. We’re spending billions of dollars to do it.” – President Biden. There was an excellent note I read that for a 60-ton Abrams 1 tank to be powered by electricity it would require a 40-ton battery. I won’t even go into the recharge questions in the middle of a battle or a tank pulling a power wagon. Eventually, they will figure it out.

Update – EVs. Following the enlightened news from our senior elected officials, who obviously took European civics in school rather than any science or math, comes some stark realities to the business. Currently, Rivian is spending $220,000 per unit while selling it for an average of $81,000 and taking a loss of (-$139,000) per truck. Every time Lucid Group sells an electric car, they lose hundreds of thousands of dollars due to staggering raw material and production costs, their latest statements showed. Ford lost $66,000 on every EV it sold in Q1, versus only $34,000 per vehicle last year but as noted, raw material prices continue to climb. Five GM assembly plants across North America are now building EVs. They may be profitable by 2025 but with lower margins than ICEs according to management. In what I think is an excellent statistic, Ford lost the equivalent of an E450 Mercedes for every EV sold in the first quarter.

Another Opinion, Same Topic. J.D. Power’s headline: “EV Divide Grows in U.S. as More New-Vehicle Shoppers Dig in Their Heels on Internal Combustion” refers to their report that shows the EV market share has grown “from 2.6% of all new-vehicle sales in February 2020 to 8.5% in February 2023, (but) sales hit a speed bump in March, with monthly market share falling to 7.3%.” It continued, saying that “many new vehicle shoppers are becoming more adamant about their decision to not consider an EV for their next purchase.” J.D. Power said the percentage of consumers who say they are “very unlikely” to consider an EV for their next vehicle “has been growing steadily for the past three months, reaching 21% in March.

Finally. There is currently only one EV recharging station on I45 between Houston and Dallas – at the Collin Street Bakery in Corsicana, home of the Deluxe Fruit Cake. Enjoy while you wait.

It Isn’t Just Us. Illegal entries into the EU, by land or sea, were up 64% in 2022 over the previous year, to the highest number since the refugee crisis of 2016. Formal asylum requests grew by 50%, with about one million applications filed. Not counted in those numbers are the millions of Ukrainians who fled the Russian invasion and now live in the EU under so-called temporary protection. The EU is at a loss. It doesn’t want so many people to come, but also doesn’t know how to stop them or what to do with them once they reach European shores. Hungarian Prime Minister Viktor Orban pretends the problem isn’t theirs and just keep migrants out completely. Formerly liberal Denmark has in effect closed its doors and focuses instead on deporting refugees back home, even to war-traumatized Syria. But sending migrants back against their will — and without the cooperation of their home countries — is hard. Only 21% of the roughly 300,000 migrants told to leave the EU every year actually go.

Fruit Salad. Vice President and re-election candidate Kamala Harris gave a speech at Howard University on Reproductive rights. It seems an altered version of her speech has been circulating that made her sound like she was rambling. To set the record straight, this is what Kamala actually said. “So I think it’s very important — as you have heard from so many incredible leaders — for us, at every moment in time, and certainly this one, to see the moment in time in which we exist and are present, and to be able to contextualize it, to understand where we exist in the history and in the moment as it relates not only to the past, but the future.” If this is reality, the faked viral video must have been a doozy. Oh, and as an aside, in addition to being tasked by the President to oversee border and immigration issues, which she has handled so well, Harris is now in charge of evaluating the issues around artificial intelligence-AI. There is a joke in there somewhere.

Crank It Up. Norway’s biggest oil and gas companies are reviving exploration plans in Arctic waters as the government agitates for fresh discoveries in the Barents Sea to secure the country’s future as a key energy supplier to Europe. Estimated to hold more than 60% of Norway’s undiscovered hydrocarbon resources, the Barents Sea has long been seen as the future of the country’s oil and gas industry. Norway has become Europe’s largest supplier of natural gas and is under growing pressure to pump more of the fuel to its neighbors as the continent severs its remaining energy ties with Moscow. -Bloomberg

Headlines #2.

Baby undergoes groundbreaking surgery in mother's womb. Doctors successfully completed brain surgery on a baby before she was born. Geez.

It appears foldable smartphones are making a big comeback.

U.S. border cities prepare for massive influx of migrants as Title 42 ends.

The first casualties of the writer’s strike are late night talk shows including Jimmy Kimmel, Seth Meyers, Stephen Colbert and others. Darn.

H&P Sees Softening Rig Activity, Expects to Drop 24 Rigs.

Bank Issues Continue. Regional bank stocks are trading at their lowest level since 2020 as worries about bank failures continue. Remember that $1.5 trillion of real estate must be refinanced by the end of 2025 with most of that debt held by regional and community banks. Banks PacWest and Western Alliance dropped by 27% and 15%, respectively, on Tuesday. Both banks said their deposits had stabilized but this is a sentiment issue as well and if investors and depositors rush for the exit, it won’t matter.

Out of the Mouths of Idiots. The mayor of New York City said the city receives “close to 200 migrants” per day and that “the national government has turned its back on NYC”. Mayor Lori of Chicago wrote Texas Governor Abbott – “I am, yet again, appealing to your better nature and asking that you stop this inhumane and dangerous action." "We are completely tapped out. We have no more space, no more resources, and frankly, we are already in a surge. We've been seeing over the last two to three weeks, 200-plus people coming to Chicago every single day." Wow. 200 people per day. The Texas border is seeing 7,000 people per day cross into the state. 200 for NYC is too many but 7,000 for Texas is okay. If Washington has forgotten New York, was Texas ever a thought? The population of NYC is 8.5 million, Chicago is 2.7 million and Brownsville Texas has 187,000. “Tapped out”?…. Both NYC and Chicago are sanctuary cites. A sanctuary city has limited the extent to which it will volunteer resources in support of federal immigration enforcement agents’ responsibility to enforce federal immigration law and refers to cities that are committed to welcoming refugees and asylum seekers.

As of March 2021, the following states claim sanctuary status:

California

Colorado

Connecticut

Illinois

Massachusetts

New Jersey

New Mexico

New York

Oregon

Vermont

Washington

Infrastructure for Offshore. The West Coast is ground zero for offshore wind, with the Biden administration aiming for 30GW by 2030 and 10GW of floating turbines. We can anchor in shallow water, but Deepwater has posed problems. A miniscule amount of installed offshore wind is in deep water. It has been estimated that California will need more than 10 ports to meet the staging, manufacturing and O&M needs of offshore wind. Parallel development required includes tugs and barges, semisubmersible assets, vessels, alternative fuel power and a trained workforce.

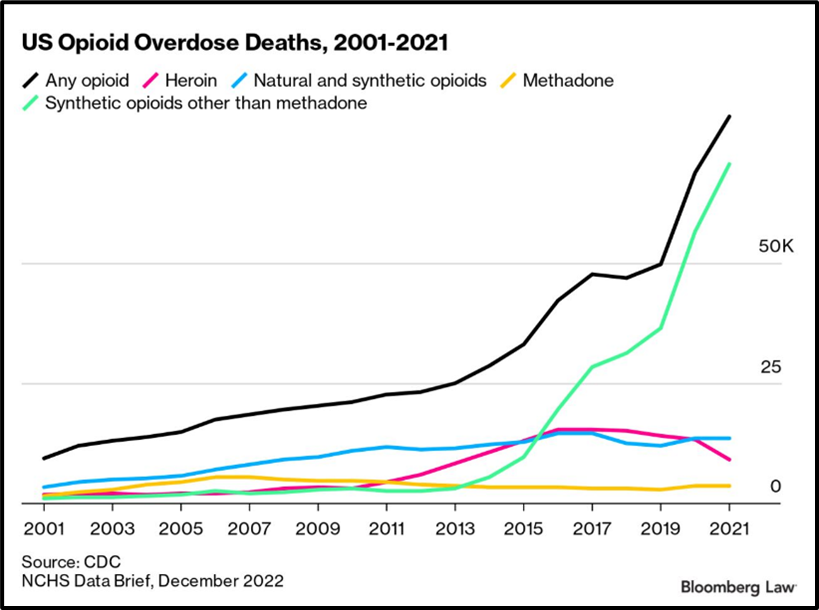

Insidious. Fentanyl overdose deaths in the U.S. more than tripled between 2016 and 2021, a grim marker in the escalation of the opioid epidemic. The abundant and cheap drug played a leading role in some 80,000 U.S. deaths in 2021 alone, the CDC said. Overdose death rates for meth and cocaine also soared. Death rates were highest among men, people aged 25 to 44, and Alaska Native, American Indian and Black people.

OFS Macro. Analyzing the end of the whip, where the greatest volatility resides, is a thankless task and a difficult one. Analyst comments this week focused on the U.S. land rig count, with one spelling out a very sophisticated model that said the natural gas rig count would decline 35%-40% on the Baker rig count. They are down 9%-20% already. The other shies away from an explicit number but notes the Haynesville and the Appalachian Basins have already seen declines of 13%-15%.

All Seeing. I don’t know how low it will I go but I can tell when it will start going up. When natural gas becomes economic again. And it isn’t just how high, but when. Unconventional shale gas wells produce 82% of their value in the first year. The price is in contango and after being ~$2.60 this week, and 2024 prices averaging $3.50. Timing is everything. Last year, drilling was led by privates, but due to the current and recent economics, they have slowed down. Last week, Permian gas was trading at $0.30-$0.50. Over 5% of the wells value every month. And how quickly can we put additional production online. It’s not like you’re gambling. Look at the futures strip! You will probably hear that a lot unfortunately, but the point is that at some price going forward, and I can call it by quarter if not month - why would I keep drilling now? Pipe commitments? Okay. Next?? We need to remember how quickly the oil company capex can move around these days.

Tandem?? Oil too is more of a matter of “when not if” as well. China has not staged as robust of a post Covid recovery as had been hoped. And forecast. So, forecasts change. Russian oil is still flowing into the markets. OPEC looks smarter rather than greedy now. Imagine another 2 MBOPD into the market. Yikes. But oil production declines on the basis of physics, not market forces, and it is relentless. I do not agree with the “we’ve under-invested for years” argument but future investment is still needed, and more investment even if production stays flat. And even if it eventually declines, the price will likely offset the economics of lower volume. When do oil prices begin to move up? When global supply/demand is in balance.

Hold Tight. There is the issue of oil companies not willing to ditch a super spec when utilization is 98%+ thinking they may not get it back. We have heard this argument several times over the years but this one actually works. Most operators would think it is easier to hire any of the several pressure pumping companies but giving up a rig that’s done a fabulous job? A super spec with fewer green hats? Utilization will decline for both for a bit, or at least stay near current levels. I won’t say “weaken” because oil prices and activity are higher than most of the last 3-4 years. Oil at $75 and the rig count is 755. Perspective. We would have killed for that 2-3 years ago. Okay, not killed. But I would have taken a beating to get those numbers.

We don’t really have owners of these stocks. We have renters, and as soon as they can do better, they will.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.