June 30, 2023

Things I Learned This Week - Pick Your Team Well

June 30, 2023

First, I would like to thank David C. and Cris G. for their incredible hospitality last week. While it was blazing hot in Texas, and too hot to play golf in my book, the weather in Park City, Utah was fabulous, as was the company. We had bankers and former CEOs and Chairmen and me. 1 ½ days of good golf for me. We played three times, which was the problem. But like all of life, if you walk away with the money, you win. I picked my teammates well!!

The Quarter End is Here. The companies go quiet while they close their books and write scripts for the conference calls. It will be an interesting earnings season. We came into 2022 with almost record optimism as the world continued to recover from the Covid shutdown. It was common knowledge that oil prices would improve in the second half of the year. They still might, but they will be moving up from a much lower level than had been expected at mid-year. All of the positive indicators are still in place. China’s economic recovery, declining inventories, lack of U.S. production growth, and demand continuing far beyond what the Say No to Oil activists seem to understand. But OPEC+ has had to announce three different production cuts, nominally cutting 3 million barrels per day from supply. The real number may be closer to 1.5 million barrels but that is still oil that can come back on the market quickly as prices rise. We continue to focus on the inevitability of higher crude oil and natural gas prices but trying to forecast the near-term timing has proven to be a Fool’s Game. There is some silver lining. No one had time to go nuts and really ramp up more of everything. Instead, realizing that we are no longer a growth industry, but a more mature one where the focus is on cash flow generation, returns of capital and efficiency. The “merger of equals” combining PTEN and NEX demonstrates that shift. More of that should happen. And the creativity of this deal, combining drilling rigs and pressure pumping as a synergistic on-site combination, is something others in the industry should embrace.

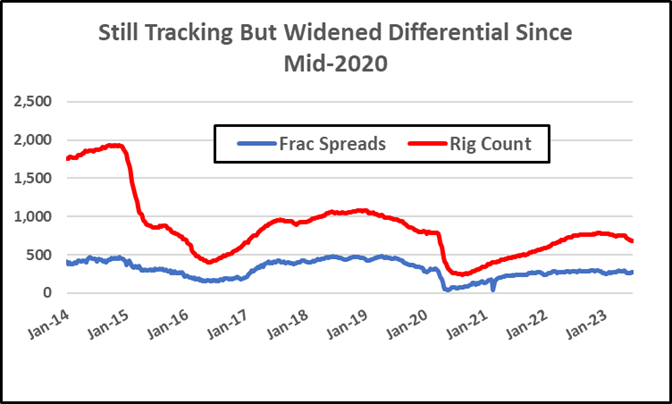

U.S. Totals. The U.S. rig count averaged 723 for the quarter, down 5% from Q1 but the exit rate of Q2 versus the exit rate of Q1 of 10% shows the momentum is still to the downside. The rig count is up a whopping 1.3% from Q2 2022. The frac spread count, as counted by Frac Focus, shows frac fleets very slightly up in the Q2 to Q1 comparison but down 4.5% in the exit rate for Q2 versus the exit of Q1. While the rig count is up slightly from Q2 last year, the frac spread count is actually down 1.6%. As utilization falls, so does price. As the drop in utilization accelerates, so does the pricing decline. Pricing always drops faster than activity and is slower to recover.

Overseas. International looks much better. The Q2 rig count is up 4.5% from Q1 and up 17% from Q2 last year, but the strength has been a bit of a surprise. The European rig count is up 38% and much of that is the North Sea, reflecting the continuing strength of offshore activity. Africa was up 24%, Latin America jumped 23% and Asia Pacific increased 21%. But the Middle East, with the largest number of active rigs, accounting for 36% of the international rig count, was up only 8%. This flies against the conventional wisdom of the Middle East being the main growth driver for international activity.

EIA Weekly Data

Bullish – draws above expectations. 1.4 MMBBLs released from the SPR and 23 MMBBLs have been released since March. Recall DOE offered to sell 26 MMBBLs from the SPR during April to June, and may buy back 12 MMBBLs barrels for the SPR this year.

Money managers’ net long positions in ICE Brent and NYMEX WTI remained low, 35% below the recent peak post OPEC+ announced voluntary cuts in April.

U.S. crude production: indicated at 12,200 MBPD, flat vs previous week, and up 100 MBPD from same period last year.

Refinery runs 16,254 MBPD, down 216 w/w and down 412 y/y reflecting lower runs in the Gulf Coast. Utilization at 92.2%.

Crude Imports (net): 1,242 MBPD, down 376 w/w and down 1,376 y/y. Brent-WTI spread at $5/bbl, flat w/w.

Offshore. In the Gulf of Mexico, there are 47 rigs of which 34 are marketed and 28 are contracted for utilization of 82%, down from 85% last year but that was only one more rig under contract. In South America, utilization of the 36 marketed rigs is 100%, and has been there all year thanks to Brazil and Guyana. Northwest Europe has 63 rigs marketed and 54 are contracted, putting utilization to 86%, down from almost 91% last year. The Windfall Profits Tax in the UK has not helped and the slow walking of London streets by No More Oil activists is causing further political pressure. West Africa has been the growth leader, pushing utilization from 79% this time last year to 90% today and with 30% more rigs contracted compared to last year. It is the offshore sector that is very active in the Middle East as opposed to the past dominance of land rig activity. The number of rigs contracted increased by 26% versus a year ago with 16% more rigs in the total supply category. That has pushed rig utilization in the Middle East offshore sector to 98% from 93% this time last year. Finally, southeast Asia has seen a decline of 10 available rigs and 6 contracted units, which has pushed utilization in the region from 90% most recently to 85% this time last year.

Crude Oil. For Q2, WTI crude oil has averaged $73.82, down only 2.8% from the first quarter average, which doesn’t sound too bad but again, momentum is not our friend. The current price, the exit price for the quarter, is down 14% from where we started the quarter. The futures strip shows $69.50 oil prices for the next 12 months and goes to $64.36 by December 2025 and $63 by the end of 2025. We fully understand that the future strip is always wrong, but it is the order of magnitude of that error that really matters. An analyst I have worked with did a study and found that five years out, the variance on the oil price versus the futures strip can be as high as 80%+ but oil companies use the futures strip for planning purposes with the Majors rarely changing a budget during the year while Independents shift their spending very quickly with changes in oil prices. But for now, it is very difficult for someone in the planning meeting to say they don’t believe the strip and want a higher budget price.

Natural Gas. We live in a relative world rather than one of absolutes, though the absolute price received is of course critical. For Q2 this year, natural gas averaged $2.12, down 20% from the $2.66 average of Q1, though the current price is 13% higher than the beginning of the quarter, indicating some positive momentum. It is the comparison to last year that skews everything, and it isn’t like the industry expected prices to stay high or any building of new equipment to take place as a result but the June average this year of $2.06 compared to June 2022 of $7.96. Granted, it did inspire optimism across the board but with Europe and the U.S. having abnormally warm winters, the continued pressure on all things “fossil”, one big LNG plant down for months and no new capacity coming on just yet, natural gas prices may struggle for some time, with little optimism until we get closer to winter.

European LNG Progress. At the NAPE Global Business meeting in February, I moderated a panel on natural gas and LNG where one of the main points being made was the inability or unwillingness to provide long-term contracts for the supply of LNG. The German utilities were in no financial shape to make such a long-term commitment and the German government, or at least the politicians in charge, showed an unwillingness to commit the state since normalized relations with Russia, and the return of Russian gas, could happen somewhat soon. Chicken and the egg. But the blockage appears to have been breached. In the news - Venture Global LNG signed a 20-year purchase and sale agreement with Germany’s state-owned company SEFE Securing Energy for Europe GmbH, to supply LNG from its CP2 project. This almost doubles Venture’s imports into Germany which makes them the largest LNG supplier to the country. “Germany has acted decisively to diversify its energy portfolio, and LNG will be a vital part of that mix as it seeks to strengthen its energy security while at the same time advancing environmental progress,” said Venture Global LNG CEO Mike Sabel. That is very positive, but the facility has not yet been completed. It will be on a 546-acre site in Cameron Parish, Louisiana. Approximately 1/3 of the current offtake agreements are with German buyers. After pussyfooting around any willingness to commit longer term, it is viewed as clear positive in terms of moving ahead with the additional capacity needed.

Snippets.

Of 193 countries, the U.S. is number 3 in gun violence. Subtract out St. Louis, Detroit, Philly, Chicago, and LA, all with very tough gun control laws, we drop to 189 of 193.

U.S. reading and math scores drop to lowest level in decades.

Harvard’s leading expert on honesty research has been caught fabricating research data in as many as 135 studies.

Sweden Dumps Climate Agenda, Scraps Green Energy Targets (only the beginning).

Norway approves $18 billion in oil and gas development.

California’s first-in-the-nation law to stop oil companies from inflating gas prices takes effect TODAY.

The View's Ana Navarro is on the verge of tears as she says the big takeaway from the Hunter Biden laptop is the story of a 'father's love.'

JPMorgan Sees Oil at $380 on Worst-Case Cut by Russia.

Shares in Siemens Energy plunged by a third after it said wind turbine components are degrading faster than expected.

Really??? We always note the billionaires flying to environmental conferences in their private jets scolding the rest of us for our wasteful ways. Now we can take solace in our health professionals, who obviously demonstrate their focus on more healthy living.

Top of the Heap. The top five countries that emit the most CO2 in the world, along with their percentage of global CO2 emissions, are as follows:

China - 28% of global CO2 emissions

United States - 15% of global CO2 emissions

India - 7% of global CO2 emissions

Russia - 5% of global CO2 emissions

Japan - 3% of global CO2 emissions

Together, these five countries account for over half (58%) of global CO2 emissions. It is important to note, however, that per capita emissions vary widely between countries, with high-income countries typically having much higher per capita emissions than low-income countries.

Guilty Parties. We asked AI Chat about the events of the last 50 years that have put the most CO2 into the atmosphere:

Burning of fossil fuels - The burning of coal, oil, and gas for energy production is the largest contributor of CO2 emissions, accounting for around 74% of global greenhouse gas emissions since 1970.

Deforestation - Clearing of forests for agriculture, logging, and other purposes has released large amounts of CO2 into the atmosphere. Deforestation accounts for around 9% of global greenhouse gas emissions since 1970.

Industrial processes - Industrial processes such as cement production, steel production, and chemical manufacturing also release significant amounts of CO2 into the atmosphere. This accounts for around 6% of global greenhouse gas emissions since 1970.

Transportation - The burning of fossil fuels in cars, trucks, planes, and ships is a significant contributor to CO2 emissions. This accounts for around 11% of global greenhouse gas emissions since 1970.

No Caption Needed.

Perception. My friend Josh Young posted this. It was from an oil company that had done a roadshow for investors. “Oil & gas equities remain hated. I got the following note this morning about a recent energy roadshow: Unfortunately, our trip was met with little enthusiasm with the best words to describe the interest as lethargic, passive and apathetic. There remained a preference for oil over natural gas as the latter continues to be strongly detested.”

Floating Above It All. SLB presented to a group in NYC and made the following observations about the improving offshore rig market – “It is only the beginning of the offshore and deepwater boom. SLB shared its perspective on the ongoing oil and gas upcycle, showcasing its distinct features that are increasingly evident in the offshore oil and gas markets. The integration of technology and digital advancements has led to enhanced efficiency, thereby lowering costs and significantly reducing cycle times.” The offshore deepwater cycle started to fall apart in 2014 as the major oil companies shifted their focus from production growth to growth of financial returns, while some 80% of deepwater projects had negative returns, even with oil prices above $100. As SLB says, technology of all kinds has made it economical again. It’s about time.

And Then from World Oil. Integrating production expertise with digital capabilities drives next-generation autonomous well control solutions. State-of-the-art automation and optimization are being honed by continuous advancements in digital sensors, remote terminal units for wellsite control and physics-based diagnostics software. The next evolutionary step is fully autonomous well control, demonstrated by an initial pilot project on a group of 100 rod lift wells.

How Much?? The headline read - Tanzania to sign $42 billion deal for onshore LNG plant in July. Equinor, Shell and Exxon are pursuing an LNG project that the country could confirm any day now. New LNG facilities continue to be sanctioned around the world so Tanzania shouldn’t come as a surprise. But it does.

Keep It in the Ground. The biggest contributors to atmospheric emissions are volcanos. The worst ones are listed below:

Mount Pinatubo, Philippines (1991) - Eruption produced a 20-mile-high ash cloud and caused global temperatures to decrease by 0.5°C.

Mount St. Helens, United States (1980) - Eruption caused the biggest landslide in recorded history and sent a plume of ash over 80,000 feet high.

Mount Agung, Indonesia (1963) - Eruption lasted for almost a year and caused over 1,000 deaths.

Novarupta, Alaska (1912) - Eruption was the largest of the 20th century and produced 30 times more ash than the 1980 eruption of Mount St. Helens.

Mount Tambora, Indonesia (1815) - Eruption was the largest in recorded history and caused a global temperature drop of 0.4 to 0.7°C, leading to the "Year Without a Summer" in 1816.

EV’s. An Intelligent Discussion. AI Chat says it is a language app, so we asked it about the economics of electric vehicles.

The growing concern over climate change and the impacts of greenhouse gas emissions from traditional combustion engine vehicles has led to a surge in interest and demand for electric vehicles (EVs). The economics of EVs is multifaceted and involves several stakeholders, including manufacturers, consumers, and governments.

From the manufacturer's perspective, the economics of EVs has often been a challenge due to the high cost of production, especially for batteries. However, with advancements in technology and economies of scale, the cost of production has significantly reduced over the years. As battery costs continue to decline, EVs are becoming more affordable, and manufacturers are investing heavily in the production of these vehicles.

From the consumer's perspective, the economics of EVs is mainly influenced by the total cost of ownership, which includes purchase price, fuel costs, maintenance costs, and resale value. Although EVs generally have a higher purchase price than traditional cars, the cost of ownership over the vehicle's lifespan is lower. EVs are more energy-efficient, have lower operating costs, and require less maintenance than conventional vehicles. Thus, the total cost of ownership for an EV is usually lower despite a higher purchase price.

The government's role in the economics of EVs is critical in terms of incentives and regulations. Governments worldwide are implementing policies to encourage the adoption of EVs to reduce greenhouse gas emissions. These policies include tax incentives, rebates, and subsidies for EV purchases, funding for EV charging infrastructure, and emissions and fuel efficiency standards. The adoption of EVs would also significantly reduce the reliance on fossil fuels, thereby reducing the country's dependence on international oil markets.

In conclusion, the economics of EVs is a complex issue that involves several stakeholders and factors. However, with advancements in technology, declining battery costs, and favorable government policies, the adoption of EVs is likely to increase, leading to a greener and more sustainable future for the transportation sector.

Six Fast-Growing States in the South—Florida, Texas, Georgia, the Carolinas and Tennessee—are contributing more to U.S. GDP than the Northeast for the first time in data going back to the 1990s. Some 2.2 million people moved to the Southeast in just over two years, bringing $100 billion in new income to the region.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.