February 10, 2023

Things I Learned This Week in CABO

February 10, 2023

Themes. Earnings announcements continued this week. While we listened to most, we won’t write about all. I leave that to Chase, Kurt, David and the rest, but we do highlight a couple of points made. The slew of reports saying that oil and gas prices look to be flat at best for some time has been a damper on the market, even as companies announce record earnings. Or just positive earnings which is a huge step. Caution can be a good thing and investors are still skittish. Patterson said reactivation and the stock dropped 12% while Weatherford said $1 of earnings and jumped 14%. Different stocks make different moves, but performance sure seems to matter more than growth. We were discussing that very point yesterday with our anxieties eased by the ocean view and a margarita.

Opinions. Bloomberg asked three prominent investors what they thought were the next big risks possibilities:

Karen Karniol-Tambour, Co-chief Investment Officer, Bridgewater AssociatesLonger, Deeper Recessions. The next big risk is recessions that are deeper and longer than what we’ve been accustomed to.

Henry McVey, Chief Investment Officer of KKR

Where Are the Workers? The biggest risk, what’s changed, is around labor — and that’s a global statement.

Saira Malik, Chief Investment Officer, Nuveen

Climate Risks Fueling Inflation. I’m worried about climate change and the path we’re taking to lower emissions. It’s going to impact three key areas: Real assets, the economy and inflation.

Catch 22. The government announced that the economy created 517,000 jobs in January. Some estimates called for U.S. payrolls to decline by as much as 400,000. Fed Bank of Minneapolis President Neel Kashkari said Tuesday that January’s strong labor-market report shows the US central bank would need to keep raising rates to as much as 5.4% Last week, the Fed raised its benchmark to a range of 4.5% to 4.75%. Some officials had hoped for a less-robust figure since inflation continues to plague the economy, and Friday’s numbers mean Fed Chair Jerome Powell will have to blunt growth in order to curb prices, and that a strong jobs market will drive higher wages, further fueling inflation. Average hourly earnings have steadily strengthened over the past three months, exceeding all expectations. Another quirk in January’s report was revisions to reflect updated population estimates used in the household survey. Had it not been for those controls, the number of employed Americans would have dropped by 272,000, according to the Labor Department. There were 3.6 million employed Americans not at work in January due to illness, more than double that in December. At the same time, 6 million people were unable to work in the month because their employer closed or lost business due to the pandemic, roughly twice that in December. Whether it is good news or bad news will depend on the positioning of your portfolio and if your good friend is now employed.

Politics. The President’s State of the Union address was on Tuesday night. We wish everyone the best.

Two Sides of the Coin

"We have created more jobs in two years than any presidential term within two years. That's the strongest two years of job growth in history, by a long shot," said President Biden. Asked by a reporter whether he took responsibility for manufacturing the highest inflation in 40 years, he snapped "Do I take any blame for inflation? No. Because it was already there when I got here, man." "Remember what the economy was like when I got here? Jobs were hemorrhaging, inflation was rising, we weren't manufacturing a damn thing here ... that's why I don't."

The economy was in great shape in 2019 but then got hit hard by COVID-19 in early 2020, while Donald Trump was president. Trump's administration listened to the health experts and closed down the country to "stop the spread" of the virus. In April 2020, the nation lost 20.5 million jobs, and the economy plunged into recession. Congress passed $3.4 trillion in relief bills meant to keep employees on the payrolls and American families afloat. It worked, demand rebounded, and in the third quarter of 2020 GDP grew at an astonishing 38 percent clip. When President Biden assumed the presidency, jobs were coming back, and the economy was expanding at a 6% rate. Inflation was running at a low 1.4% when the President took office, and by the end of 2021, it had increased five-fold to 7%, on its way to 9% several months later.

Corner Turned. We followed Weatherford as an analyst for years, from before they bought Enterra, and at least 3-4 CEOs ago. After the restructuring, new management took over, but few investors looked at the stock because of its somewhat checkered past and the lack of good financial results for several years. We have long been a fan of the businesses, though many investors never took the time to really understand what their business silos were. There were other more interesting topics surrounding the company. That was then. This is now. Weatherford reported strong revenue and adjusted EBITDA, beating consensus. The revenues increased to $1,209 million, a 8% sequential and 25% annual increase. Operating income for the quarter was $169 million, versus $121 million in 3Q22 and $39 million in 4Q21. Adjusted EBITDA was $266 million, which increased by 24% from Q3 and 73% YoY. The puts the Q4 adjusted EBITDA margins at 22.0%, putting them in the top tier of the largest OFS companies. They generated $171 million of free cash flow of during Q4 and redeemed $175 million of 11% exit notes and $8 million of 6.5% senior secured notes in 2022, lowering its net leverage ratio to 1.4x. Earnings for Q4 was $0.99. Not EBITDA or cash flow. Earnings. The stock is up 260% in 6 months. Well done. Weatherford is back.

Blown Away. Siemens is a global leader in renewable energy and is the largest player in offshore power generation. In Q4 2022, the company lost $1 billion. Just in Q4. The CEO said that in order for it and the overall wind industry to ever become “profitable,” that “further government action” would be needed. We aren’t subsidizing it enough? And how long has it been? "The negative development in our service business underscores that we have much work ahead of us to stabilize our business and return to profitability," said Siemens Gamesa CEO. He said the Inflation Reduction Act, the $739 billion climate and tax bill President Biden signed in August, and other European Union actions would help its business, but that those measures weren't enough and that governments would need to further assist the industry to ensure future positive growth. He said the headwinds were slow permitting, electric grid constraints and regulatory uncertainty. Welcome to our world and that the "sizeable gap between recent installation expectations and targets" is endangering the energy transition. Onshore turbine

Earnings. “Investors were disappointed that NOV is prioritizing capex and M&A over increasing payouts to shareholders as other OFS companies have done. Beyond the noise, we think street estimates are likely to go up, albeit modestly. The company’s 1Q23 Revenue and EBITDA guidance is 5% higher than street with Q1 expected to be lowest of the year. The relative underperformance provides an opportunity to get in the game. The thesis is simple: NOV is in a strong position to benefit from the need for the energy sector to upgrade, enhance and rebuild existing equipment as well as re-stock depleted inventories to meet future demand for oil, gas and renewables.” – Benchmark. “NOV still expects to be FCF positive for the full year, more than covering their $275mm capex guide to support organic growth opportunities. The company highlighted disciplined M&A as the next priority in terms of capital allocation. While the company remains committed to returning excess cash to shareholders over the long-term, they signaled that they are not yet ready to increase cash returns beyond their current dividend (0.9% yield).” – JP Morgan.

Headlines.

Carlyle plans to give new CEO Harvey Schwartz a five-year stock incentive package worth $180 million. The PE firm reported a sharp drop in quarterly profit.

In New York, it would take 13 years to save $61,074 for a down payment. The situation is almost as bad in Austin after a surge in prices driven by an influx of tech jobs.

OPEC “cautiously optimistic” about oil demand amidst reopening of China.

Spirit Energy to convert depleted North Sea gas fields into “world-leading” carbon capture and storage project.

Fed’s Cook Says More Rate Hikes Needed to Curb Inflation.

Surprise Used-Car Price Jump Adds to Fed’s Inflation Worries.

The slowest moving financial crisis of our time? Retirement.

Natural Gas. It has deflated. ~$2.50 this week and reports coming out predicting that prices could be flat through 2024. I was ready to make a natural gas-based investment but have been told to wait. Scotia Bank – “The sudden collapse of natural gas prices has shifted the near-term calculus for investing in the sector from pursuing positive rates of change and abundant shareholder returns toward seeking safety and sustainability from the most defensive names. While we remain bullish on the long-term outlook for the commodity and the equities, we believe the sector will face several challenging months as the North American natural gas supply and demand balance recalibrates. In light of this, we are highlighting what we see as the lowest break-even names in the sector and best near-term opportunities in a challenging natural gas market. In aggregate, the Canadian group (Scotia is a Canadian bank) screens as more sustainable than the U.S. group, with lower break-evens, higher growth and dividend yields, stronger balance sheets, and better asset level returns.” Freeport’s facility has increased domestic supply by a couple of B’s and both the US and Europe have seen very warm winter weather, saving Europe from burning furniture to stay warm and bringing global LNG prices down. Europe as a whole has depended on Russian natural gas for about 45% of demand with Germany above 50%. Refilling storage in the offseason will still represent a challenge but it seems not enough of one to convince analysts of any real tightening of price.

Skynet. We have said for some time that Artificial Intelligence, AI, would have a dramatic impact on our business and how it is done. We already have rig management programs that learn and perform the tasks that are highly repetitive and require less skill. For our industry, it is just adding one more technology feature to how we do our business, but we have said that it could be as transformational as the onset of the digital world. Division order checks are no longer the purview of a room full of accounting people and getting approval for work in digital devices instead of the big binder on the front seat saved Halliburton $800 million a year in working capital. The impact of AI is next. Microsoft has now said it would integrate artificial intelligence into its Bing search engine and Edge browser. "I think this technology is going to reshape pretty much every software category," CEO Satya Nadella declared. "I have not seen something like this since I would say 2007-2008 when the cloud was just first coming out." One analyst said the integration of ChatGPT into Microsoft's products would set off an "AI arms race”. Most applications are centered on four categories: reactive machines, limited memory, theory of mind, and self-aware AI. Microsoft is investing $10 billion in AI, Google has already spent $400 million. Pay attention.

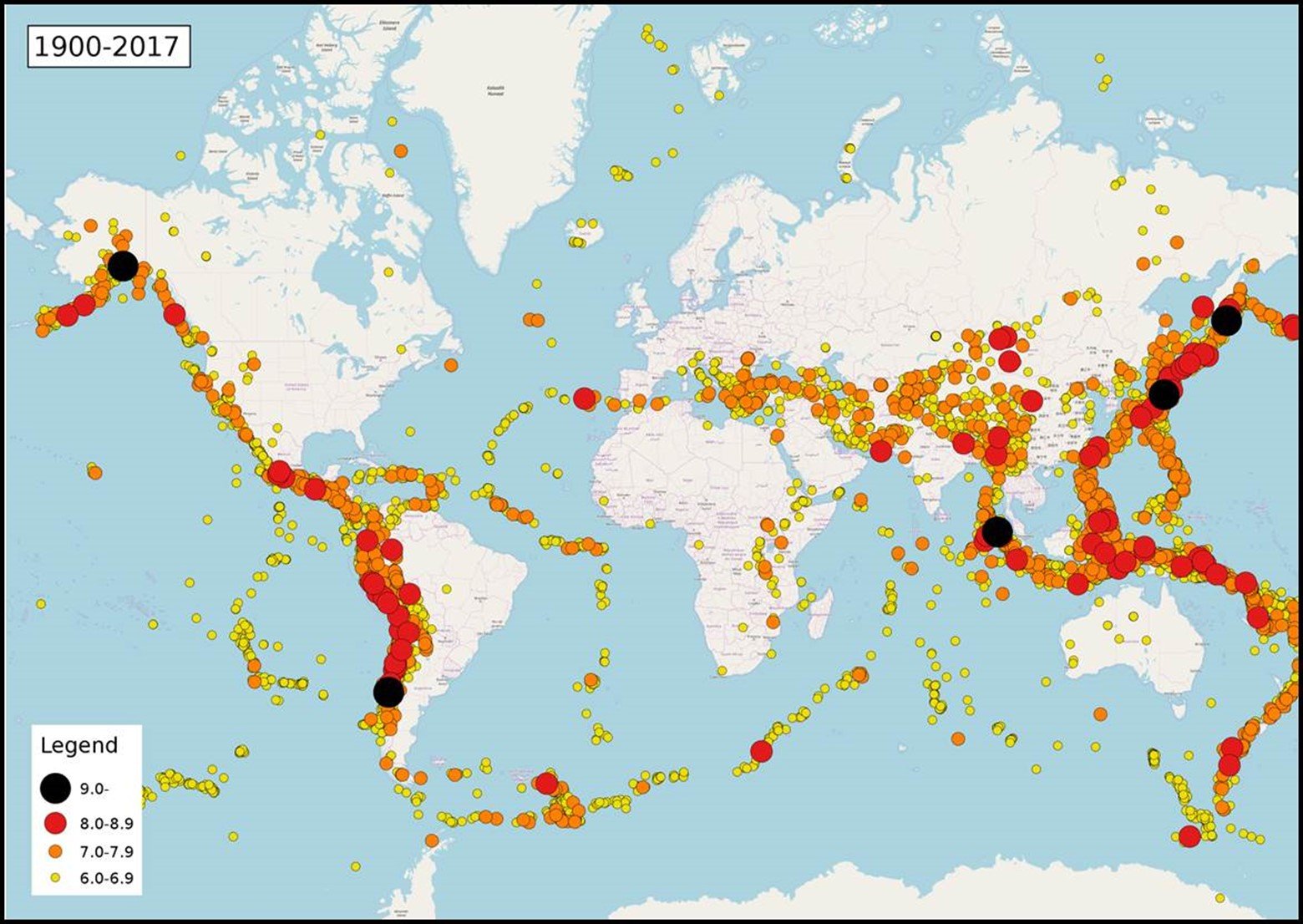

Shake & Rattle. A 7.8 magnitude earthquake in southern Turkey and norther Iraq, which was followed by a 7.5 aftershock has claimed the lives of 11,000 at this point and the expectation is above 20,000. No one has blamed climate change. Yet. The Richter Scale is used to measure the severity of earthquakes with each increase of one unit represents the release of about 31 times more energy than that represented by the previous whole number on the scale. So, an earthquake measuring 5.0 releases 31 times more energy than an earthquake measuring 4.0. A 7.0 quake releases 31.6 times more energy than a 6.0 quake, or 1,000 times more energy than a 5.0 quake. In theory, the Richter scale has no upper limit, but, in practice, no earthquake has ever been registered on the scale above magnitude 8.6. The Turkey earthquake doesn’t make the top 145 but it was the largest earthquake ever recorded in Turkey.

Yeah Yeah Yeah. LeBron James passed Kareem Abdul-Jabbar (changed from Ferdinand Lewis Alcindor, Jr when he was 24) as the player with the most career regular season points in NBA history. The Lakers star hit a 15-foot fadeaway jump shot last night to pass the record of 38,387 points. The killer part is that he has earned about $10,941 for every career point scored. I’ll save you hitting your calculator. $420 million. Other sources say $520 million which is $13,780 per point. That means he has averaged $375,000 for every game he has played. His endorsements add another $600 million to the total. And he still looks mad all the time. James Harden, who didn’t make the All-Star team this year has made over $300 million, or $13,700 per point. I’ll take Michael Jordan.

Ideology vs Reality. There is only one nuclear facility still in operation in California, the Diablo Canyon plant which provides 8% of the state’s electricity and since the state must import about one-quarter of its power needs from other states. It was slated to close in 2025. With a degrading electricity grid, the prospect of ongoing rolling blackouts, and the need to import significant electricity from other states. The government ignored environmental activists – a cornerstone of Newsom’s political coalition – and has agreed to keep it open. “Maintaining operations at Diablo Canyon will keep our power on while preventing millions of tons of carbon from being released into the atmosphere,’ according to Isabelle Boemeke of the Save Clean Energy group. Nuclear power has seen a resurgence in recent years as the climate crisis has worsened and governments increase efforts to cut climate-warming emissions. The Biden administration launched a $6 billion effort earlier this year aimed at keeping the country's aging nuclear plants running. The smaller modular reactors, fueled by thorium and other materials, are gaining traction outside the U.S. but the licensing procedures in this country has scared off potential investments. The problem still is with the U.S. Nuclear Regulatory Commission (NRC) which has denied a request from PG&E to renew an operating license application for the plant based on previous operations and must start from scratch.

Perspective.

This the only currently active lithium plant in the US. Demand is expected to rise by over 40 times by 2040 due to demand for electric vehicle batteries. This plant requires 132,000 gallons of water to produce on ton of lithium. Thank goodness it isn’t a pipeline right-of-way.

On Planet Earth?? "Unreliable natural gas". As opposed to what? The governor of Colorado used those words three different times, obviously trying to make his point clear, at the State of the State luncheon. He said the state needs to transition the electric grid to renewables. He pointed to the winter storm in Texas last year that saw the state in a deep freeze, but natural gas surged from an average of 33% of the generation mix in the weeks prior to the storm to 62% of power generation during the depths of the freeze. Wind went from 29% to 8% over those same time frame. In the 2021 annual risk assessment by North American Electric Reliability said, "Natural gas is the reliability fuel that keeps the lights on,” and natural gas policy must reflect this reality". I guess Governor Polis didn’t read the report.

Oil Outlook. Last week, I attended the NAPE dinner hosted by Raymond James featuring my very good friend Marshall Adkins. Marshall was bullish on oil prices, which is no surprise. He has long been an oil bull. He had any number of charts and tables supporting his thesis that the near-term, and longer-term, direction for oil prices is up. This week, Art Berman weighed in on oil prices but had a very different perspective. He said that analysts and journalists are obsessed with the possibility of much higher prices if demand from China rebounds. “The objective current state of oil markets do not support a significant increase in oil prices at least until fundamentals begin to move in a different direction” and suggests that the oil business is on a long path toward terminal decline. “What began in 2018 as investor disaffection with a decade of poor financial returns has become a headlong flight from the petroleum energy source that supports modern civilization. Short of some unlikely moment of reckoning, investors have crossed the Rubicon and are unlikely to go back except in short-lived moments of seller’s remorse.” He said that Goldman and most analysts are using an outdated paradigm for oil-market dynamics and price formation.” “IEA Executive Director Faith Birol said recently, “If demand goes up very strongly, if the Chinese economy rebounds, then there will be a need, in my view, for the OPEC+ countries to look at their policies.” Those are some pretty big “ifs.” Even the Saudi oil minister sounded skeptical who said in response to questions about the demand rebound from China, “I will believe it when I see it.”- –Abdulaziz bin Salman.

Gas Outlook. It too continues to struggle. We noted last week the Raymond James report that said natural gas was essentially stuck in the current rut until 2024. But remember – Commodity prices don’t need to rise very much from here for E&P companies and even OFS companies to improve earnings in 2023, but most forecasts hold them steady with 2022 levels, just like the commodity.

And It Begins. Headline: VAL – Reactivating Cold Stacked DS-8 for New 3-Year Contract with Petrobras. Petrobras has contracted a 6-gen floater for three years with a day rate expected to be similar to Transocean’s recent Dhirubhai award at $430k/d, with Valaris spending an expected $65-75mm for deactivation of the rig. The rig’s last contract, its first and last contract was at $618k/d. There is little question that the Deepwater market is improving. It has been for about a year. It’s the trajectory of the recovery that is the issue, which makes this announcement more meaningful for the industry. It is another step up, continuing a trend that is steepening, after 7 or so years of decline. Brazil is the largest Deepwater market with 12.7 billion barrels. The U.S. Gulf of Mexico has 4.65. Petrobras is following up a recent 8 rig tender with a need for another 3. After years of slumber, the beast awakens.

Go Deep. The deepwater drilling market is expected to grow significantly with CAGR more than 7.8% during the period of 2020-2025. Key growth markets will the Gulf of Mexico, Brazil, Guyana, Nigeria, and the North Sea. Just the fact that we can talk about multiple growth markets is a huge change and clearly portends a brighter future. We have been writing about how Transocean, the only offshore driller that didn’t go through a restructuring, has been stacking up contracts or extensions in Norway, the UK, India, Suriname, Brazil, and the Gulf of Mexico, expanding its backlog to $8.5 billion.

Guard Rails. Capital discipline has been the most prominent buzzword for a couple of years now. I have championed ROIC over just cash flow for some years and we have seen E&P adopt it in a big way and so far, the OFS sector has as well. But when Patterson announced it was going to reactivate rigs and add another frac crew, investors didn’t seem to care that the company had $100 million in positive net income in Q4 or that it’s pressure pumping business is outperforming rivals, or that leading edge rig day rates are hitting $40k per day. All they saw was increased capex to build more equipment. And they didn’t like it, dropping the share price by 12% on the news. Patterson has one of the most capable management teams in the industry, one of the cleanest balance sheets and has shown significant capital discipline through the recovery. I own the stock personally. This goes to show that investors immediate reaction to an OFS company raising capex to grow its capacity is not positive, regardless of anything else. We hope this works out for Patterson, but it should be a warning to all - going back to build-baby-build will not be supported by the financial markets.

Snippets.

Russia will cut oil production by 500,000 barrels per day, or around 5% of output, in March, Deputy Prime Minister Alexander Novak said, after the West slapped price caps on Russian oil and oil products.

Britain's economy showed zero growth in the final three months of 2022 - enough for it to avoid entering a recession for now.

Chick-fil-A I will debut a cauliflower sandwich on its menu next week.

Lyft shares plunged more than 30% in extended trading after the ride-hailing company said it would prioritize lower prices to attract more customers.

Mexico stunned markets Thursday by increasing interest rates by half a percentage point, in a move by the central bank that no top economist predicted.

Aggregate. On my NAPE panel last week, there was a discussion about how “aggregators” are being very beneficial to the supply of energy to Europe, when the utilities and governments can’t or won’t make the term commitments to enable the expansion of things like LNG liquefaction. She’ll and BP were mentioned as the two primary players in that effort. Now comes the headline: “Exxon is creating a trading unit that pulls together its crude, natural gas, power and petroleum-product desks, to better compete with the likes of BP and Shell in energy derivatives.” Looks like it’s catching on.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.