August 11, 2023

Things I Learned This Week in the Heat

Oil Hits a 2023 High. Wow. The combination of stronger U.S. demand, production cuts from OPEC+, and no more releases of any scale from the SPR and boom! You almost have a balanced market.

Itching to Run? Oil prices are $84 yet the E&P world maintains its discipline. This time it comes as no surprise. I remember being told “sure they are disciplined with oil at $55 but when oil hits $85-$100, management teams will drop the gauntlet and run back to production growth” and that has kept many investors on the sideline.

Forced Discipline. What has happened has been interesting though. Boards of Directors, seeing the issues with sitting on boards of companies that go bankrupt, decided to take a stand. Now, almost all public E&P companies have incentives based on growing financial returns instead of production. That is an amazing distinction. Your compensation will always drive your behavior. If I pay you more for generating higher returns over growing production, that’s what you’ll do. You may have to stifle that old wildcatter inside of you, but money matters. And so, this discipline is not a phase that will pass by. It’s codified in the compensation structures by the Board of Directors for the senior management of the E&P operators. That matters. So now crude is at $84 or so, the highest level of the year, and everyone hopes, and partially expects, prices to go higher, but also expect to see the continued discipline by the E&P industry that will keep our boom and bust cycles at least more controlled than those in the past, while of course, staying a cyclical business.

Question. Elon Musk, who is the CEO of the new Twitter / X, is also CEO and owner of SpaceX. How many times has SpaceX launched a vehicle into space? What percentage of the supply chain dealing with people and materials for space does the company have? Read below for the answers.

The Cost of Underestimating, the Power of Momentum. A year ago, we and many others were predicting a U.S. recession. The Fed was raising rates and inflation was running wild, not just in the U.S. but globally. It looked like it was all falling apart. Earnings momentum was going to start to drop, which was going to drop the market. And for the last year we’ve all been wrong. The market has been much more stable than anyone had expected. The Fed continued to raise rates and we still talked about a soft landing. Now we know nothing ever landed. In skydiving, there’s a thing called ground rush. If you jump off the hood of a car to the ground, you’re accelerating all the way down, so you look down, close your eyes and jump - no problem. In skydiving you’re falling under a parachute at a constant rate of descent. The problem occurs when you look down and your brain thinks - OK I know when I’ll hit, so you wait and wait and wait and you don’t hit so you get out of position to look down and see when you’re going to hit and BAM! - that’s when you hit. That’s how you get hurt - underappreciating the power of momentum. So here we are today. The real estate boom is clearly over, with fire sales on shopping centers across America and defaults on hotel notes in cities like San Francisco. We’ve mentioned several times in the past the $1.25 trillion real estate refinancing that has to be done by the end of 2025, and most of that is with regional and community banks. That was one of our worries again. We were early. But it’s coming through now. Earnings have now dropped for three quarters in a row. We said they would, but it took almost a year before the market cared. Again, we were wrong and off by a year. Clearly, the oil and gas business has been in a recession through this year, most of which has been chalked up to high inventories and a slower than expected return from China. Russia has still been selling their oil, we’ve just shifted the supply lines around, keeping more oil on the market. The U.S. has been growing production as well, and as we usually do, we put too much to work too fast in the near term and over supplied the market, but we were going to get bailed out by China. Now China is having as much of an economic problem as we are. Their economy appears to be slowing or at least declining from expected levels recently. If so, what happens from here? I guess we finally get into the recession. We’re still talking about a soft landing but unfortunately, it really doesn’t matter whether you want a soft landing or not or if you’re happy that we haven’t had a landing at all in the last year. Now it just depends on how fast the wheels come off from here. Most of us agreed. We were all wrong. Or just early. As Boone Pickens told me once “I’ve come to realize that being not being right on oil prices for 15 years is almost the same as being wrong.”

Chart - Thanks Jim Halloran

Opportunity. Under the rubric of, “it’s not just us”, there were some interesting stories out of Brazil this week. There’s a great effort to stop the deforestation of the Amazon. Very noble. The last statistic I saw was that we lose a couple of football fields every day. The fight comes from the government, realizing there could be up to twice as much oil in the Amazon as there is in their deepwater market, and today Brazil is the ninth largest producer in the world. Environmental activists don’t trust the government’s promises of respecting the forest and minimizing their operations. The industry today is well-versed in how this is done, but after seeing the Amazon rainforest mowed down over the last several years, I would think trust would be a hard thing to have. This is another one of those great opportunities. I remember when Parker Drilling was famous for its helicopter delivery in difficult environments and rigs that made drilling in places like the Amazon not only possible but as environmentally friendly as it could be. We are obviously a lot better now. We are much better stewards of the environment. If there is twice as much oil in the Amazon of Brazil as they have offshore, that sure strikes me as an opportunity for the best and brightest in our industry to prove environmental progressives wrong, and the geologists right. Everyone still wins.

A Real Loss. In what is some terrible news, the town of Lahaina in Hawaii has burned down. Lahaina was an old whaling town and basically the capital of Maui. An interesting and fun spot. I’ve had the pleasure of seeing it several times. It’s on the opposite side of the island From Hana. Before anyone starts blaming climate change for the fires that burned down the town, a cyclone 800 miles away created more wind and remember this is in an area of still active volcanoes, and contrary to what some environmental progressives might think volcanoes are not part of the human impact on climate change. Period.

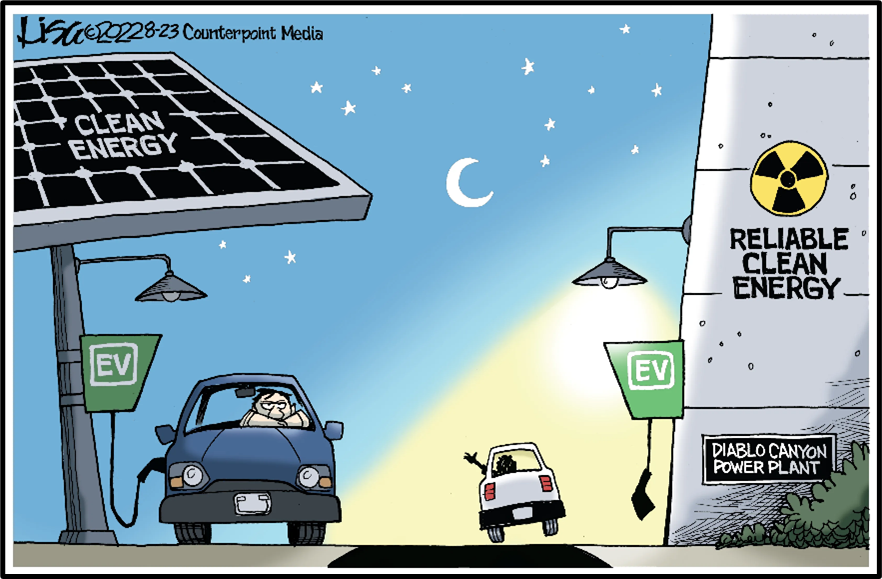

Sold Out. Uranium - first Hillary sells a chunk of our uranium reserves to the Russians, and now Biden has shut down the largest and most economic deposits in the country. I am a big fan of national monuments and I love the Grand Canyon. I love all state and national parks. I camp, hike, fish, ride, and in general love the outdoors. But I’m also a pragmatist and putting over 1,000,000 acres of land into a national monument to appease some who don’t want mining anywhere at all in this country strikes me as at least impractical. It is estimated that the world needs 300 new mines for copper, cobalt, lithium, and all the rare earth metals needed for our future electric world. So far, any attempt to open or re-open mines has been met with significant resistance from the same environmentalists that are pushing the electric agenda. And much like the environmentalists getting Biden to shut down the Keystone Pipeline as a way to end Canadian heavy oil production, establishing this monument to a very large extent is just intended to stop any oil & gas or uranium mining on another million acres of land that belongs to all of us.

Tough. Ten regional and community banks were downgraded by the rating agencies, including a few of the large banks as well, with the promise of more to come. This comes at a point in time when there is $1.25 trillion worth of real estate that has to be refinanced by the end of 2025. It also comes at a time when stories are getting more and more frequent about 50% to 70% write-downs in real estate values compared to just one year ago. That’s a crash. Real estate had been holding its own and even staging a great recovery post Covid. It was supposed to keep working, but the devaluations started with regional shopping centers and warehouses and have been spreading rapidly. Friends I know in both the brokerage and financial ends of the commercial real estate business tell me that business has slowed to a crawl. This is just one chink in the armor we mentioned. Rising oil prices, falling real estate values, slowing consumer spending and continued inflation. All of these things starting to happen at once is worrisome to say the least and as we note, whatever landing we are in for may not be as soft as we had grown to expect over the last six months.

One More. China’s exports are in a steep slide, regional banks getting downgraded, stocks edging down, corporate diversity is under siege and now an above normal hurricane season is predicted. It has been predicted to be above normal the last four years, but proved to be below normal. Where is the farmer’s almanac when you need it. As to the rest of it, fingers crossed.

Core Strength. CPI dropped to 3.2% last month which made everybody happy and gave the administration the opportunity to say it’s whipping inflation. In the financial markets, the hope is that the Fed will now cease raises since inflation is coming down. The part they don’t report as widely is core inflation, which excludes things like food and fuel. Now I don’t know about you, but in our house, food and fuel are real expenses. And with food and fuel, inflation is 4.7% and you’ve got oil prices on the rise. So, before you get lulled into the headlines about inflation, take that to heart if you no longer eat, drive or travel.

Water Everywhere. Not becoming public but gaining scale. WaterBridge, a portfolio company of Five Point Energy, announced the formation of NDB Midstream, a strategic partnership with WPX Energy Permian, a subsidiary of Devon. The partnership between “two technical leaders”, WaterBridge NDB within the produced water handling sector and Devon with 50-plus years of innovation in oil and gas, yields the largest private water infrastructure system in the prolific region of the Delaware Basin in Loving County, Texas and Lea and Eddy counties in New Mexico. In connection with the transaction, Devon and NDB Midstream entered into a long-term agreement where Devon has committed all of its produced water within a large area of mutual interest, including an initial dedication of ~52,000 acres, and contributed to NDB Midstream 18 SWDs with ~375,000 bpd of permitted capacity and ~210 miles of produced water pipelines for gathering, transportation, disposal and reuse. As part of the transaction, Devon received a 30% equity interest in NDB Midstream as well as a commitment by Five Point to fund a portion of the initial build of the system expansion.

Dropping Fast. And while we’re on the subject of falling real estate values, there’s China. China is going through a period of deflation. The definition of deflation is a process where prices of consumer goods and services fall and money increases in value. Longer periods of deflation can lead to higher unemployment, a decrease in demand, and a reduction in economic activity. The inflation in Chinese real estate over the last several years has driven much of the consumer economy, and now households are suffering a negative wealth affect (remember 2008). And while it sounds like prices falling would be a good thing, it’s actually not. Japan was trapped in a deflationary cycle for almost 20 years. It basically stalls out the economy. Only a large productivity boom can fix the economy after a collapse like this and under a communist regime, many don’t think that’s possible or likely. To have China be in a low growth mode for the next several years would not be good for the rest of the world. Over the last several years they have borrowed and spent very heavily to establish giant cities with no people or businesses. Low quality economic growth. The world has continued to focus on what happens to China in about every regard. Most people consider it a fait accompli that at some point in the near future they’re going to go after Taiwan. They may be right. Much like Russia has been speculated to possibly use a nuclear bomb on Ukraine. If it doesn’t look like it’ll win the war in question, there’s little chance that China would show restraint should they get to be in a desperate situation. And a deflationary spiral on what has been such a strong growth country is likely to lead to a desperate situation of some kind.

Make a Living. When I first saw this comment, I was dismayed. We are building huge amounts of physical infrastructure and spending billions of dollars on projects that are not economic without government subsidies. To a capitalist, that sounds at least horribly unfair. Subsidizing an industry to avoid losses during a period of early growth is understandable. Subsidizing companies’ profitability doesn’t seem right to me, especially when the underlying business is not economic in its own right even after 20+ years of subsidies. But then the practical side of me says if they are going to spend it, maybe I should get some. Field services, installation and manufacturing are all parts of our business that can be applied to all renewable efforts as well. Don’t let feelings of bad legislation and government spending get in the way of creating value for shareholders and providing a quality service/product. Government’s come and go. The pride in our industry and capability endures. “First Solar, an Arizona-based solar-panel manufacturer, expects to receive as much as $710 million this year—nearly 90 percent of its expected operating profit—from federal subsidies meant to encourage domestic renewable energy production. Those incentives could be worth more than $10 billion for the company over the next decade.”

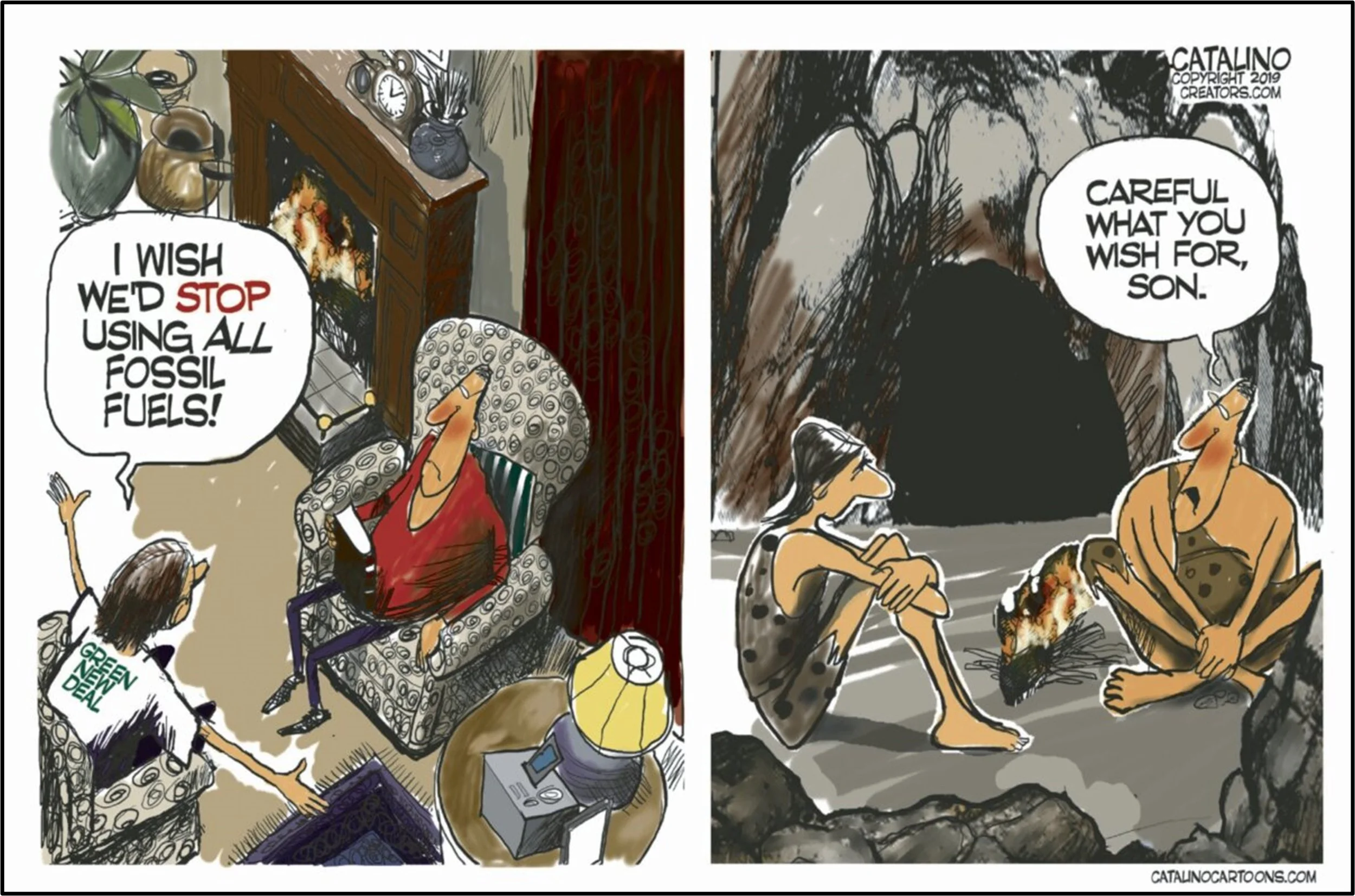

Advocate. Harold Hamm wrote an impassioned letter published in the WSJ this week. The Biden Administration Doesn’t Get It When It Comes to Energy Policy. (Okay, that is pretty basic). He makes excellent points about the benefits of U.S. shale production in both oil and gas as well as the significant increase in both U.S. products with all the money staying home. Billions have been spent on wind and solar and billions have been lost. He goes back to 1978 and the Fuel Use Act, which focused on coal production because oil and gas were so limited. He hits Carter in 1980 as well for his errors. All the points he makes are correct. None are new. And none are likely to get the people who are making policy more educated about our industry. But he is trying.

Don’t Panic. In case you missed it, Jim Skea, the new chief of the UN’s Intergovernmental Panel on Climate Change, issued a plea to cancel out hysteria over the IPCC’s projections about global temperature rise earlier this week. Speaking to Der Spiegel, Skea warned against laying too much value on the international community's current nominal target of limiting global warming to 1.5 degrees Celsius compared to the pre-industrial era. "We should not despair and fall into a state of shock" if global temperatures were to increase by this amount, he said. Skea expanded “If you constantly communicate the message that we are all doomed to extinction, then that paralyzes people and prevents them from taking the necessary steps to get a grip on climate change… The world won't end if it warms by more than 1.5 degrees," Skea told Der Spiegel.

Boiled in Oil. His comments reflect the actual findings in IPPC’s latest report. But the UN goes into alarmist rhetoric mode when they release the reports, dooming any information that doesn’t fit the narrative. Mr. Skea’s boss at the UN is General Secretary Antonio Guterres. Just a couple of days before Skea’s comments were published by Der Spiegel, Guterres made the utterly ridiculous claim that “the era of global warming has ended; the era of global boiling has arrived.” What an idiot. It should be pointed out that neither the IPCC nor any other authoritative sources of climate information have ever forecast “global boiling.” But Mr. Guterres is utterly shameless with this kind of alarmist hype, and obviously feels compelled to try to top himself with every subsequent speech on the matter. Unfortunately for him, his rhetoric has become so absurd over time that most people have simply stopped paying attention.

Real Memory? I remember the number of times, through the last 50 years of oil and gas cycles, that we felt that we had finally hit Nirvana; this was as good as it gets and let’s PLAY for a while!!! Wait. There aren’t any I can think of. There were several where the only way oil and natural gas prices could go was up!! But those led to disappointment earlier and sooner than had been expected. How many times have we imagined the bumper sticker - “Lord, gimme one more boom and I promise not to screw it up!” How many times has it worked? My caveat is that expectations have come down in line with activity. But don’t think it can only go up from here, even if it does. Do not assume that oil prices next year will be higher than the strip. It’s a fool’s game. The business is shrinking, consolidating, becoming more digital - all in sync with one another. Understand that it is a different world, from the services you provide to how much you pay your people to the fear of technical obsolescence. Don’t lose sight of the prize now. Show investors how committed you are to success. Find things to do. You have cover for a couple more years. Make something of it.

The Press. “Crude is headed for its sixth weekly gain after Saudi Arabia extended its unilateral 1M bbl/day oil production cut by another month and said it could be prolonged or even deepened. The move adds to other voluntary reductions by some OPEC members, while Russia will continue to reduce its crude supply into September. An OPEC+ panel is also scheduled to meet amidst growing concerns about oil supplies, but no policy changes are expected. With crude prices expected to rise further, Investing Group Leader Avi Gilburt is expecting a "sizable rally" over the coming years, but is not convinced that all charts have bottomed out.

Blow Hard. Central Atlantic Wind Lease Sales: A Positive Boost for Coastal States and Beyond. Washington, D.C. - National Ocean Industries Association (NOIA) President Erik Milito spoke after the BOEM finalized three new offshore Wind Energy Areas in the Central Atlantic. “With offshore wind opportunities on the rise, the states along the Central Atlantic coast are positioned to become key players in the next wave of offshore wind hubs. The benefits of this development extend beyond the local level, with significant advantages rippling across our nation. But this also comes as a number of U.S. and EU planned offshore wind farms are seeing delays as higher costs have compromised returns and more subsidies are needed. It is good we are expanding areas, but it still needs to be economic at some level. NOIA has expanded from an offshore oil and gas focus to an offshore energy focus, which is very forward thinking in my opinion. But I am on the board.

Foresight?? Matador Resources is considering options to expand its cryogenic natural gas processing capacity in northern Lea County, NM, as part of the operator’s strategy to accommodate anticipated growth in regional gas production.

No Reparations?? A Democrat-backed bill making its way through the California Legislature would require judges in the state to consider a convicted criminal’s race when determining how long to sentence them to prison. The bill would add a section to the Penal Code of California, requiring courts, whenever they have the authority to determine a prison sentence, to “rectify” alleged racial bias in the criminal justice system by considering how historically persecuted minorities are affected differently than others.

Tonga-Hunga. Cool to say but it is actually a volcano near New Zealand. Haven’t heard about it? That is because it doesn’t toe the narrative line. According to NASA’s Jet Propulsion Laboratory, Hunga Tonga-Hunga’s eruption spewed 146 trillion grams of water vapor, one of the most efficient alleged greenhouse gases, into the upper atmosphere as detected by NASA’s Microwave Limb Sounder, an event that JPL scientists say, “could end up temporarily warming the earth’s surface.” Wait. A volcano? Caused by Maga Republicans no doubt. A new study conducted by scientists at the Climate Change Research Centre and Centre of Excellence for Climate Extremes, University of New South Wales, Sydney, Australia, reached the following conclusion. Volcanic eruptions typically cool the Earth's surface by releasing aerosols which reflect sunlight. However, a recent eruption released a significant amount of water vapor, a strong greenhouse gas, into the stratosphere with unknown consequences. This study examines the aftermath of the eruption and reveals that surface temperatures across large regions of the world increase by over 1.5°C for several years, although some areas experience cooling close to 1°C. Additionally, the research suggests a potential connection between the eruption and sea surface temperatures in the tropical Pacific. The report also finds that the warming effects will occur over a period of a decade or more, likely peaking “around years 3-7 after eruption, i.e., 2025-2029.” A single volcano spewing 146 trillion grams of water vapor into the upper atmosphere is likely to cause planetary warming for a decade. It must be a racist volcano.

And Again. “WFRD posted another solid quarter on the strength of international markets. Revenues of $1.27 billion came in ahead of both RJ/Street estimates and were up 7% sequentially. International activity led the way with sequential revenue growth of 12%. Consolidated EBITDA also beat estimates substantially as operating margins of 22.8% expanded 16 basis points sequentially and 536 basis points year-over-year. FCF of $172 million blew out the previous guidance of at least $50 million and the company raised its FY EBITDA margin and revenue guidance equating to FCF of >$400 million.” - Raymond James. What’s not to like?

Headlines.

“I wish I hadn’t called it (the Inflation Reduction Act) that. It has less to do with inflation than it does providing alternatives to economic growth.” - Joe Biden, August 10.

A Presidential candidate Fernando Villavicencio was assassinated in Ecuador.

More than $30 billion in spending is delayed as setbacks pile up for renewable-energy sector.

Very Well Put. “The Energy Transition Needs More Critical Minerals. Governments globally are implementing a wide array of climate policies and significantly increasing funding for renewable energy projects and decarbonization initiatives, driving a noticeable surge in the number of companies venturing into the realm of green energy projects. The transition to clean energy solutions is driving exponential demand for essential metals and minerals, as these resources play a pivotal role in manufacturing renewable energy equipment components, EVs, batteries, and other applications. The magnitude of growing demand for critical minerals is evident in the 30% increase in global investment experienced in 2022, which builds on the 20% growth in 2021. The critical minerals market for clean energy has already achieved a total addressable market of $320 billion and is expected to further expand over the next decade.” – Evercore

And Again. “Between 2017 and 2022, lithium demand experienced a staggering threefold increase, while cobalt and nickel saw surges of 70% and 40%, respectively. As demand continues to surge, investment in the critical minerals industry has witnessed substantial growth, with a significant funding increase of 50% in the lithium sector, alongside investments in copper and nickel.” – Evercore

Take a Shower. Hillary Clinton – “I still feel strongly that the Supreme Court needs to stand on the side of the American people, not on the side of corporations and the wealthy.” That is the most divisive, disgusting, prejudicial and untrue statement I have ever heard. Against the Supreme Court. Liberals lost the Supreme Court 53 years ago. Today’s court isn’t some novel make-up. But because some people don’t like the rulings, people who are rarely constitutional scholars politicize the court to further extremists who fall for their pitch. For 53 years, the Supreme Court has had a conservative bent. It’s only been a political football of the last couple of years as basic arguments run thin.

Published. Robert Bryce is one of my favorite people. Which reminds me. I owe him a call. He keeps what he calls the Renewable Rejection Database, citing rejections or restrictions. The number is now at 574. Stunning. I thought everyone wanted windmills in their front yards and solar panels in the back.

“The warnings about the landscape-destroying sprawl of wind and solar energy have been coming for nearly two decades. The warnings have come from some of the world’s most prominent scientists, government agencies, and energy analysts.”

“Unfortunately, those warnings were ignored. And now, all over the world, rural people are reacting with fury at the encroachment of large wind and solar projects on their homes and neighborhoods. The backlash has been ongoing for years and can be seen from the Golan Heights to Oahu. Of course, the backlash against the energy sprawl that frequently comes with large-scale renewable projects doesn’t fit the narrative being pushed by climate activists, anti-industry NGOs, and their myriad allies at legacy media outlets.”

“The backlash is irrefutable, it’s growing, and it’s happening on multiple continents. In the Golan Heights, Australia, Colombia and more. Meanwhile, here in the U.S., over the last 10 days, local governments in Illinois, Ohio, and Iowa have rejected or restricted wind and solar projects.”

Snippets.

A major increase in solar power generation in southern Europe played a leading role in averting energy shortages during the heatwaves of recent weeks when temperatures broke records and drove unprecedented demand for air conditioning.

Morgan Stanley bear Michael Wilson warned U.S. equity investors to “be ready for potential disappointment” on economic and earnings growth. JPMorgan strategists echoed the downbeat view. (How soft a landing??)

Aramco raised its payout to investors and Saudi Arabia’s government by more than half even as its profit slumped.

CEOs of the 10 companies we studied represent just 8-10% of total remuneration while annual performance bonuses range from 13% to 18% and long-term equity incentives range from 72% to 79% of compensation.

The range for CEOs is 12% to 17% base salary, 11% to 20% annual bonus, and 63% to 77% long-term incentives.

Return What? To me, the shift by the industry to a focus on growing financial returns over production growth has been a watershed moment and we have spoken and written a great deal about it. Over 4,000 former directors of bankrupt energy companies are still out there and on other boards now. And they don’t want to go through that again at all. So, compensation shifts from growth in production to growth in ROIC. And it’s codified by the compensation mandates of the board. Huge shift. We used ROIC for a research initiation 10 years ago and I have long championed the focus by our industry. Today, I read a very good and interesting piece by RBN Energy. That is very self-serving. They go into great detail about my own commentary. Validation at last!! https://rbnenergy.com/they-work-hard-for-the-money-the-latest-trends-in-setting-oil-and-gas-companies-executive-pay

EIA Weekly.

Crude Implications: Bearish – build above expectations. WTI backwardation between 1M-12M is $5.8/bbl. Money managers’ net long positions in Brent and WTI notably recovered over the past five weekly reports, up 82% from recent bottom at 6/30 suggesting market positioning less of a tailwind moving forward.

U.S. crude production: indicated at 12.6mm BOPD, a post-pandemic record high, up 0.4mm BOPD from the previous week, and up 0.4mm BOPD from same period last year.

Refinery runs 16.6mm BOPD, up 0.06 mm BOPD w/w and flat y/y. Utilization at 93.8%. Peak of seasonal demand within sight but hurricane season on the come, which may impact refinery runs.

Crude Imports (net): 4.3mm BOPD, up 2.9mm BOPD w/w and 0.3mm BOPD y/y. Brent-WTI spread at $2.5/bbl, down $1/bbl w/w.

Gasoline: draw above expectations. Demand up 5.3% w/w and up 2.0% y/y.

Distillate: draw above expectations. Demand down 1.7% w/w and up 1.0% y/y.

Answer. SpaceX is nearing its 250th trip into space and has well over 90% of the space logistics business.

Join Energy Workforce for the 2023 Safety & Technical Conference August 15-16 at the Grand Galvez Hotel & Spa in Galveston, TX. The annual Safety & Technical Conference spotlights industry experts who provide technical and operational content, discuss the challenges of today's market, and explore the opportunities in today's business climate. Recipients of the annual Safety Awards will be recognized at a special event.

Join me in Amsterdam for my Market Outlook Presentation at the @IADC HSE & Sustainability Europe 2023 Conference & Exhibition, which will take place on 25-26 September in Amsterdam. For complete program and registration please visit: https://www.iadc.org/event/iadc-hse-sustainability-europe-2023-conference-exhibition/#program

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.