April 21, 2023

Party! This week, Innovex had a party in Midland which included a panel discussion moderated by Dan Pickering who quizzed Matt Wilks, the Executive Chairman of ProFrac, Kaes Van't Hof, the President and Chief Financial Officer of Diamondback, and Shad Frazier, the VP of Production at Endeavor. Then CEO Adam Anderson did a “fireside chat” with Alex Epstein, the well-known energy writer and advocate. This was followed by a really fun country band, BBQ and great people. Thanks Adam. Innovex designs, manufactures, and installs mission-critical drilling & deployment, well construction, completion, production, and fishing & intervention solutions to support upstream onshore and offshore activities worldwide. The event was called “#Fossilfueled the Concert”. The shirts below are still for sale!

Some panel observations.

If shale isn’t seen as a market share threat, OPEC’s price hike can be done with some impunity.

Endeavor - All of our frac is going all electric ASAP.

Some producers in the Permian are getting 30 cents/mcf

Too much money was chasing too much growth, but it went from growth and sow to now reap. The best thing we can do is continue making money.

FANG - Oil prices drop $40 and we didn’t change our effort or rig count. A steadier state of interest makes it better for everyone.

Make every barrel as clean as possible.

The U.S. barrel is going to be very critical for a long time.

Capital discipline is working and will continue. ROCE. How to make the most of it.

Honored. Alex Epstein is a very interesting person. David de Roode and I recorded an interview podcast while in route to Midland. A very smart and well-educated philosopher who went to Duke, Alex realized very early in his career that the acceptance, commentary and the push to ban oil and gas was not practical or positive, after having allowed mankind to flourish through access to cheap and abundant natural resources and energy. He is very positive on the future of fossil fuels and deals in facts and information rather than hopeful ideology. Check him out at https://energytalkingpoints.com/.

Law of Unintended Consequences. I read a very interesting piece this week in Forbes. It wasn’t really revolutionary to many of us, but it made some interesting points as well as being a story active today in the popular press. President Biden is pushing U.S. manufacturing hard, to reduce dependence on other countries, fixing the supply chain, and to create good jobs here. He has mentioned it in both State of the Union speeches. “Investing in America” was the reason for spending billions. But it isn’t really happening due to one major obstacle that seems to be putting almost everything on hold. The EPA. “It (the EPA) is hard at work proposing burdensome and costly regulations that could cause further permitting delays or halt projects in certain areas.” - Forbes. It was also noted that the EPA’s air rules make it harder to build, or provide regulatory relief needed for infrastructure of the energy transition and the return of domestic manufacturing.

Well Summed Up. “These rules make it seem like America has major air pollution problems, but the EPA’s own data as of 2020 shows that common pollutants, including PM2.5, have declined by 78% since 1970. The U.S. already has some of the strictest regulations in the world and we are outpacing our global competitors. Given the advertised overall objective of Biden energy policies, it seems illogical and counterproductive to crack down further now.” – Forbes.

Off the Front Page. It has occurred to me that I, and others, are no longer tearing down the EV/battery industry for the obvious consequences of the agenda being pushed. Lithium, cobalt, copper, disposal, real emissions etc. are all real issues but they are becoming so well known that continuing to repeat what has become obvious to many has faded. Now we only hope that understanding starts to spread to a broader audience.

Help Us. The agency recently finalized the “Good Neighbor” plan under the Clean Air Act, designed to force power plants and factories to sharply cut emissions that cross state lines involving 23 states, many of which are energy-producing and industrial centers. The rule has been criticized as “confusing and inconsistent” and is expected to be challenged in court. The EPA is also considering standards on fine particulate matter (PM2.5) which provides no way for some firms to comply, and ozone, which EPA’s own scientists and advisors can’t seem to agree on.

EIA Weekly Data.

1.6 MMBBLs released from the SPR. Recall DOE offered to sell 26 MMBBLs (congressional mandate) from the SPR during April to June.

WTI backwardation between 1M-12M is $5.8/bbl, down $1/bbl w/w. Refining margins under pressure as refinery runs increase and OPEC+ cuts support feedstock.

U.S. crude production: indicated at 12,300 MBPD, flat from previous week, and up 400 MBPD from same period last year.

Refinery runs 15,844 MBPD, up 259 w/w and up 127 y/y. Utilization at 91.0%.

Crude Imports (net): 1,723 MBPD, down 1,743 w/w and up 156 y/y. Brent-WTI spread at $4/bbl, flat w/w.

High Finance. Two news items caught my eye this week. We all know of the bank failures over the past several weeks and then the largest money center banks reported earnings last week and all reported strong earnings and increased deposits. That all seemed to be positive but then we saw that $1.5 trillion in real estate loans must be refinanced by the end of 2025 and that most of that debt is at regional and community banks, not the big money center banks and the anecdotal stories abound of those banks cutting back significantly on additional lending and reluctance to refinance. Then this - “Deposit flight at U.S. regional banks blights interest income gains. A clutch of U.S. regional lenders saw deposits drop in the first quarter as clients, reeling from a crisis of confidence in the banking sector, moved to bigger institutions and sought refuge in money market funds.” That didn’t strike us as good news since our biggest concern has been that the economic slowdown would result in a credit recession rather than just an equity recession. And then this - “The biggest threat to the economic outlook is a credit squeeze that has not finished filtering through the financial system,” a senior official at Fidelity Investments told a European equities conference on Wednesday. And now the Federal Reserve Bank of New York president John Williams said credit conditions would likely deteriorate as a consequence of the banking sector debacle in March. We continue to watch and hope. It is driven a great deal by sentiment and these types of stories don’t help that. Fingers crossed.

Follow-up. While the Exxon for Pioneer rumors still swirl a bit, it really has been debunked. The WSJ writer contacted CEO Scott Sheffield for his comment before the story was published. The writer said that his sources were a high-ranking Exxon employee and an investment banker. The writer caught Scott as Scott and his wife were arriving in Mexico for a bit of R&R and asked the writer if he really thought the rumor was true if he was on vacation. He further said, and we agree with this significantly, that no high-ranking Exxon employee would ever leak such a story and would never have been a senior Exec at that company if he would do such things. The WSJ ran the story anyway. I own PXD so I care but reality wins out.

Depth of Inventory. The Exxon-Pioneer story has sparked an interesting narrative across the industry. Depth of inventory. The shale oil boom is now over 10 years old and much of the core has been drilled by those who had the acreage. But now? If you have 3-5 years of inventory, is the end in sight? If that is the inventory you have, you need more. Deeper prospect inventory. If you don’t have it, get it. Lease it? Not much left. Another company with a significantly deeper inventory? It is an obvious option. PXD and DVN are two E&P companies with a great deal of inventory so it is obvious these two companies would be at the top of the gossip list. We have seen in the past when barrels were cheaper to acquire on Wall Street rather than with the drill bit. Are we headed back to that now? Stay tuned.

OFS Earnings have started.

Baker Hughes beat expectations and while full year guidance didn’t change, it was encouraging. New orders were strong and could result in a beat of current guidance. The company booked ~$1.4 billion of LNG orders, including Port Arthur and Qatar and reiterated its expectations for 65-115mmtpa of industry LNG FIDs in 2023. The OFS segment continues to see strengthening spending trends in international and offshore markets, but does anticipate some headwinds in North America and lowered the Drilling & Completion guidance.

Liberty Energy beat EBITDA estimates by 10%. Buybacks continue with Liberty retiring 3% of shares. Guidance/outlook for Q2 shows no decline. At the end of the quarter, Liberty had cash on hand of $21 million, a decrease from fourth quarter levels, and total debt of $210 million.

Hope Springs Eternal. We were optimistic many months ago when Senator Manchin proposed permitting reform in exchange for his vote on the Inflation Reduction Act but alas, he was baited and switched, his bill was not supported and died. And with it died the near-term hope of a more rapid permitting process for pipelines and infrastructure. Now, House leader McCarthy is talking about adding language to the debt ceiling raise that would be supported on a bipartisan basis. “It doesn’t matter what type of energy you love. Maybe you love wind and solar, you still can’t build it … How are we going to compete with other countries? I think if we attach that [permitting reform] to a debt ceiling [vote], growing our economy, that’s going to save us money in the long run. Among other things, this bill restores American energy leadership, makes it easier to build things in America, makes us less dependent on China and brings jobs back to America. That will grow our economy,” he said. Senator Manchin said he would be re-introducing his permitting reform legislation and that he would take a serious look at the Republican package.

ESG. Companies sold about $6 billion of bonds last quarter to pay for projects that help the environment, achieve a social goal, or improve their governance, a type of debt known as ESG. That’s down more than 50% from the same time last year, according to data compiled by Bloomberg, which focused on companies outside the financial industry.

Okay, Okay. So, I didn’t learn this just this week. That observation was made a very long time ago. Mainly by wives but lots of other people too!

Another BRIC in the Wall. We talk about BRICS, group of counties compose the world's leading emerging market economies: Brazil, Russia, India, China and South Africa. The BRICS states it aims to promote peace, security, development and cooperation. That sounds very nice and noble. But it doesn’t include them setting their own rules, laws, political actions and economic deals that many other countries might not agree with. As expected. It underlies though a much more notable phenomenon underway. The fragmentation of the global economy into competing blocs. None of this kumbaya stuff. “Let’s all work together toward the same ideals” would not seem to fit in that scenario. If I have it and you don’t, I have power over you. If you owe me money, I have power over you. If you come down and I don’t, I now have power over you. And make no mistake, this is about power. Economic power, political power. The ability to shape the world as you please. Treaties? Amount some countries', we have them, and they work. BRICS? If it serves their purpose. An example? China burns more coal than every other country combined. China started up two coal fired plants every week of last year. The largest buyers of Pariah Putin’s oil? China and India. Sanctions? No thanks. But it won’t be everybody against the BRICS. The bankrupt developing countries like Zambia and Sri Lanka? The EU is more of an economic and political power than military or political outside of their realm. Guyana and Suriname are going from two of the poorest counties per capita to some of the richest.

From Here? This isn’t an indictment of any system, though of course I have my own prejudices, but from everything from future demographics to the evaporation of physical money to the potential level of AI applied to many parts of daily life. And where before it was most everyone working together to get there, now separate factions will pursue their own aims so, specialty will matter more than general, indigenous resources will matter and globally everything will cost more. When do we get there? As the saying goes, it’s not the destination, it’s the journey. The U.S. had 2.2 million immigrants cross the U.S. southern border, millions leave Ukraine for Poland, and desertification in Africa is forcing people to move. Those are all changes in demographics. We are well on our way to a cashless society. AI is either praised or condemned with few in the middle, but it will primarily be applied in the middle - in jobs and projects where a computer can do a more efficient job, which are typically terribly boring and repetitive jobs, and they learn how to do it better. When Detroit went robotic, it changed the industry for the better. Now imagine the robots getting better at their jobs by themselves.

BRICs and Blocs. And all those factors are already shifting countries into blocs, whether to accept or reject immigrants, build or dismantle nukes, allow drilling for oil, or managing different currencies to suit an objective. Military power will matter, and Ukraine surprised many who didn’t think a tank-based ground war would really ever be fought again in Europe. But that is minor. Who has nukes and who will have nukes. That will be the basis of military power and will help force the creation and durability of these emerging blocs. Cooperation has been the focus of global economies and politics for decades, almost from the end of WW2 and it has made gradual progress over that time. Think of the adage that everything is cyclical. Now think - is cooperation on the decline? The very obvious answer is yes. Now ask, how fast?

Headlines.

Every 24 hours, 27,000 trees are cut down for toilet paper.

The U.S. must change course and lead a resurrection of the liberal world order, Bloomberg’s editors write.

The U.S. government is tracking more than 650 potential UFO cases.

U.S. foreclosure filings jumped 22% in the first quarter compared to the same period a year ago.

India is now the most populous country in the world.

U.S. President Joe Biden, Barack Obama share common link; great-great grandfathers were shoemakers from Ireland. (true)

The S&P 500 is already up over 8%, while the NASDAQ is already up over 16%.

Pentagon warns Biden’s offshore wind plans conflict with military operations.

History. The Shale Revolution transformed the U.S. oil and gas industry in the late 2000s and early 2010s, but the most significant changes occurred years later. More recently, capital market constraints, the Covid pandemic, and a looming ESG narrative have propelled the industry into the next phase of its evolution, highlighted by fiscal discipline, which delivers improved shareholder returns through managed capital spending. RBN Energy.

California Again. Reparations aren’t enough. California Electric Bills Will Be Based on How Much You Make. From each according to his ability, to each according to his needs.

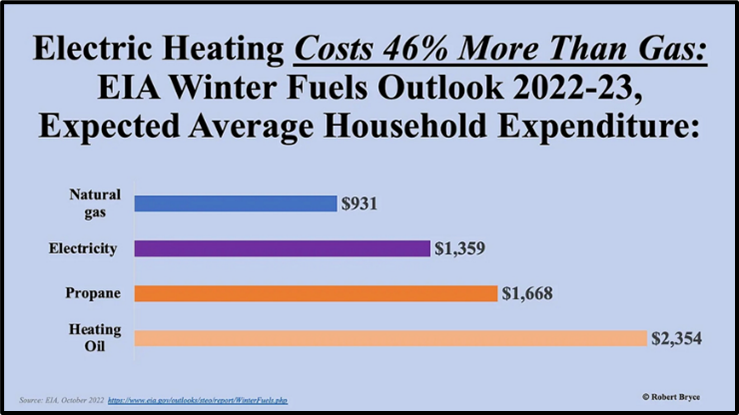

Unbelievable. In a unanimous opinion, the U.S. Court of Appeals for the Ninth Circuit, THE most liberal court in the land, ruled that the nation’s first ban on natural gas, put in place by the City of Berkeley in 2019, violates federal law. The three judges found that the city’s ordinance was preempted by the Energy Policy and Conservation Act of 1975, which prohibits the implementation of regulations that favor one type of fuel over another. About 47 million American homes have gas stoves including Energy Secretary Jennifer Granholm. The DOE’s own numbers show that heating homes with gas is far cheaper than heating with electricity.

Go Astros! In Houston, an employee only needs to gross about $125,000 to achieve the same purchasing power as someone making $312,000 in New York, per Bloomberg.

Greek Rules. I am not making any kind of judgement, just reporting news. A sorority at a university in Ohio has let a 37-year-old trans woman in. Now that person is requesting to live in the sorority house. Many girls are against it but afraid to speak up for fear of being labeled transphobic. And it isn’t an isolated incident. At the University of Wyoming, a lawsuit was filed by seven sorority members challenging the induction of a transgender woman into their local chapter. The woman made residents of the Kappa Kappa Gamma house uncomfortable in part by sitting on a common-area couch for hours and staring at them without talking. “One sorority member walked down the hall to take a shower, wearing only a towel. She felt an unsettling presence, turned, and saw Mr(s). Smith watching her silently,” the lawsuit alleges. The lawsuit claims national sorority officials pressured the local chapter to violate sorority rules, including those for voting to induct new members. And finally (?), a transgender college student has received an outpouring of support after she revealed that she was rejected from every sorority she attempted to join during the student recruitment process at the University of Alabama.

Re-Green. AOC – “Today we reintroduced the Green New Deal in the House! We’re also rolling out a new tool: an implementation guide to show communities and organizers how to get federal $$ for Green New Deal investments in your community. The passage of the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) provide a historic opportunity to deliver on the most significant climate and clean energy investments in our nation’s history, putting us on a path to take on the climate crisis, repair historic harms to low-income and disadvantaged communities, and create good, union jobs.” This guide lays out the goal of the Green New Deal and compiles resources from the White House and federal agencies to give cities, states, Tribes, nonprofits, and individuals the tools they need to take full advantage of these new programs and create on-the-ground progress toward a Green New Deal.

What’s Your Major? The Medical Field Will Provide Best Career 12 Years from Now, read the headline. Demographic trends may also be supporting the idea that becoming a doctor or a nurse will be a wiser choice for the youngest generation: Economists forecast massive demand for health-care workers as the population ages in the U.S. and around the world. Investors have a different recommendation for those graduating from high school. Those students will be best off pursuing a career in tech, despite recent layoffs at Meta Platforms Inc., Amazon.com Inc. and Alphabet Inc. Tech savvy is seen as ever more important in a world increasingly influenced by digital platforms, even as some worry AI may pose a threat to some entry level jobs. Source: Bloomberg MLIV Pulse survey on April 10-14 with 678 responses. “The highest paying jobs were so clearly in the finance sector for two or three decades, and now tech is really competitive with that — they’re kind of neck and neck,” said Andrew Challenger, senior vice president of human-resources consulting firm Challenger, Gray & Christmas Inc. The KBW Bank Index is down about 18% year-to-date compared to the S&P 500 up over 7%. The tech-heavy Nasdaq 100 is up about 20%.

More Headlines.

The Aliens Have Landed, and We Created Them.

The Taxman Will Eventually Come for AI, Too.

AI ‘Trustworthiness’ Is Focal Point of New U.S. Government Inquiry.

Google’s Rush to Win in AI Led to Ethical Lapses, Employees Say.

AI Weed-Killing Drones Are Coming for the Mega Farms.

TikTok’s Algorithm Keeps Pushing Suicide to Vulnerable Kids.

Party Pooper. Greenpeace accused the European Union of applying a “fake” green label to gas and nuclear power as part of the bloc’s plan to become climate neutral by 2050. The environmental group said it will file a case at the EU’s General Court today, challenging its decision to include some gas and nuclear power stations in its so-called taxonomy aimed at encouraging sustainable financing.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I service on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.