April 11, 2025

Things I Learned This Week in Frisco Texas

Conference Week. This week was the annual meeting of the Energy Workforce and Technology Council, which is basically the trade association for the oilfield services industry. During the meeting, the Dow Jones rose almost 3,000 points and dropped 1,000 points the next day. Hello volatility. For those of us in the oil and gas industry, such volatility is not completely new. Overreact? Yesterday’s news. Keep pushing ahead with the discipline that has gotten us this far. The mood was positive, realizing that “Energy Dominance” is where we end up rather than where we start. The biggest issue was how the sector raises prices rather than throwing in the towel. We are going to be the near-term sacrificial lamb to control inflation, but longer term, we benefit. That was the message, and it was appropriately well received.

It's Relative. You're starting to see activity forecasts for the year come down. There's a great deal of hand ringing and moaning. Our fate once again. But keep in mind that 2025 was expected to be down anyway. It wasn't like we expected the market to be up 20% and now it's gonna be down 20%. We thought it was gonna be down 5% and now it's gonna be down 10%, maybe even 15%. I'm not really sure when the hand ringing is supposed to start, but we all know it can't last. Everybody's gonna start pulling up now. The numbers show that crude oil demand is inelastic, even in recession. And on the natural gas side, you can now try to argue that a recession or slowdown in the data center build out for AI could negatively impact natural gas prices. The worst-case scenario is that natural gas demand climbs by 20% to 25% over the next four years and that's kind of the base case. If we're gonna fall a little bit short of that, that's still spectacular. During one of my recent trips to Washington, a main point was stressed by several people we met. The reason Trump is moving so fast is to try and stay in front of a recession. That's practically a quote from several different people in DC. The question on the radio today was, will the tariffs be permanent? The U.S. tariffs on imported pickup trucks have been around for 60 years, and I don't see how it has negatively impacted F150 sales. It reminds me of the interruption of natural gas supplies to Europe, and the almost 2 years of dislocation while supply chains realigned. In the grand scheme of things, that's what's going on here, but in any of the scenarios, crude oil and natural gas demand is not going to plummet and we all know it will take increased activity just to stay flat. Our future is inevitable, but that doesn't make anybody feel better today, but don't get carried away with the mashing of teeth and the tearing of clothes. Looking at the world today, we have a longer term and better outlook than we have in the last couple of years. It's just gonna take a little pain to get there.

Brave Analyst. “History suggests more downside for Oil Services stocks. The OSX is down -46% from its cycle high made on 9/12/23. This is in line with the average 30%+ decline since ‘97. The average decline widens to -63% when aggregate Oil Services revenue declines y/y, which now looks to be the case this year. Moreover, the current uncertainty makes it increasingly likely that aggregate Oil Services revenue will decline again in ‘26. The OSX peak-to-trough decline was -73% during the pandemic and -70% during the financial crisis. The OSX is down -22% since the Apr 2nd close, underperforming the XLE, which is down -16% and front-month WTI, which is down more than -13%. Oil Services stock price performance is materially worse than the 2-day moves around 9/11 (-11%), Lehman bankruptcy (-4%) and start of COVID-19 (-12%).” This is from Doug Becker, a very good, thoughtful and well-trained analyst. No sugar-coating.

Razor’s Edge. “West Texas Intermediate crude dipped below $60 per barrel in early Asian trade on Monday as markets continue to react to U.S. President Donald Trump’s sweeping tariffs that have rattled global markets. This price level is well above the fundamental upstream break-even for most U.S. shale players, especially those in the Permian. However, Rystad Energy finds that full-cycle costs, including higher hurdle rates, dividend payments and debt service costs, means that the “all-in” full-cycle breakeven for many U.S. oil players is closer to $62.50. If the recent price downturn is sustained, these price levels could threaten U.S. oil production growth this year, as operators may be forced to cut back activity to maintain investor payouts.” - Rystad Energy.

Laying Off Risk. Woodside is developing the Louisiana LNG project, an under construction, pre-final investment decision (FID), LNG production and export terminal in Calcasieu Parish, Louisiana. It is a high-quality, scalable development opportunity, with a total permitted capacity of 27.6 million tons per annum or 3.6 Bcf/day. Front-end engineering design is complete, and site construction has commenced on the project, which contemplates the construction of 5 LNG Plants through 4 phases. Bechtel is the selected EPC contractor. Along comes Stonepeak, a $72 billion investment fund specializing in infrastructure and real assets “that underpins our daily lives”. Stonepeak invests in physical assets that power homes, connect communities to the internet, feed families, enable travel and deliver goods. According to their website, their “track record is founded on investing in essential infrastructure that delivers enduring social utility.” Stonepeak has bought a 40% interest in the project and will fund $5.7 billion in capex. They plan to contribute 75% of project capital expenditures in both 2025 and 2026. For Woodside, it derisks their exposure significantly and frees up capital for other opportunities. This brings new capital into an ongoing LNG project. Foreshadowing the future??

Just Saying.

1996: Nancy Pelosi encourages all of Congress to back reciprocal tariffs.

2008: Bernie Sanders wants tariffs, says jobs are going overseas.

2018: Barack Obama calls for reciprocal tariffs.

1988: Donald Trump says foreign countries must pay tariffs.

Too Easy. A subsea tie-back from a new well gets hooked up to the production hub and adds another 20,000 barrels a day to the company’s production. Subsea completion, subsea pipe to the production hub. How easy. In my day, one well rarely represented a “field.” This particular “field” is the Dover field by Shell in the Gulf of Mexico. First discovered in 2018, the play is 170 miles offshore and in 7,500 feet of water. The well itself was 29,000 feet. That is 5.5 miles to hit 800 feet of pay. The Dover field has two production wells hooked up by a 17-mile pipeline to the production hub. The FID was only made last year and now we’re on production. Exxon set the record in Guyana for one of the fastest large field first oil timetables. Production started just under five years after discovery. The old record was closer to seven. And 20,000 barrels a day seems inconsequential? Would you like to have it? It all adds up.

Small Stumble. The Merger between SLB, the company formerly known as Schlumberger, and ChampionX has been pending for some time. The U.S., usually considered the most aggressive anti-trust view, has already approved the deal. It was the UK that tossed the monkey wrench. The U.K.'s Competition and Markets Authority said planned acquisition may be expected to result in “a substantial lessening of competition” in the country's markets. As a result, the CMA will refer to the merger for an in-depth, phase 2 investigation. Unless the parties offer an acceptable undertaking to address competition concerns, adding that the companies have until the end of April to offer steps they are ready to take. The deal’s closing date was delayed last month, but we would not expect the deal to NOT close, with the timing now uncertain. Norway has yet to rule as well. Though, by the end of the week, the UK was sounding more positive. We shall see. All the best, Soma.

The Dallas Fed Energy Survey.

Activity and production rose slightly in the quarter, but the company outlook index decreased 12 points to -4.9, suggesting slight pessimism among firms. Meanwhile, the outlook uncertainty index jumped 21 points to 43.1.

Costs increased at a faster pace relative to the prior quarter. Among oilfield services firms, the input cost index advanced, from 23.9 to 30.9. Among E&P firms, the finding and development costs index increased, from 11.5 to 17.1, and the lease operating expenses index rose from 25.6 to 38.

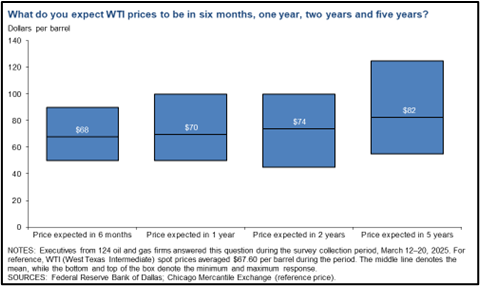

More Fed Price Queries. In the top two areas in which your firm is active: What West Texas Intermediate (WTI) oil price does your firm need to cover operating expenses for existing wells?

“The average price across the entire sample is approximately $41 per barrel, up from $39 last year. Across regions, the average price necessary to cover operating expenses ranges from $26 to $45 per barrel. Almost all respondents can cover operating expenses for existing wells at current prices.”

“Large firms (with crude oil production of 10,000 barrels per day or more as of fourth quarter 2024) require prices of $31 per barrel to cover operating expenses for existing wells, based on the average of company responses. That compares with $44 for small firms (fewer than 10,000 barrels per day).”

“For the entire sample, firms need $65 per barrel on average to profitably drill, higher than the $64-per-barrel price when this question was asked in last year’s first-quarter survey. Across regions, average breakeven prices to profitably drill range from $61 to $70 per barrel. Breakeven prices in the Permian Basin average $65 per barrel, unchanged from last year.”

Balance. When Energy Transfer tried to build the Dakota Access Pipeline, they ran into issues. Protestors showed up. Havoc ensued. Energy Transfer did not take this lying down and fought back. The environmental activist group, Greenpeace, led the efforts to shut it down. Greenpeace claimed the company’s “personnel deliberately desecrated documented burial grounds and other culturally important sites,” in order to scare financing away. So, they did it the American way. They went to court, sued Greenpeace saying it defamed the company and abetted vandals. Its organizers trained protesters and even brought lockboxes they used to chain themselves to construction equipment. Protesters lobbed human feces and burning logs at security officers and vandalized construction equipment. Bury the lead? The judge ruled against Greenpeace and fined them $667 million, bankrupting the organization. The defense? We didn’t order them to do it, we just played a “massive role” in training and motivating them. There is no First Amendment right to defame and destroy. Very true.

PPHB – U.S. Energy Market Update Highlights:

Commodity Prices: WTI crude oil is currently $59.63 per barrel (down ~3.8% week-over-week) and natural gas is $3.56 per MMBtu (down ~7.3% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.5 MM BOPD (up ~2.7% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories increased by ~2.6 million barrels week-over-week vs. an estimated increase of ~2.2 million barrels.

Frac Spread Count: There are currently 205 frac spreads operating in the U.S. (a decrease of 4 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 573 drilling rigs operating in the U.S. (a decrease of 2 rigs week-over-week).

Hot Buzzwords for 2025.

Uncertainty.

Reliable.

Permit Reform.

Deregulation.

Reliability. Commentary about the need for increased energy for the AI data center build out is everything we read today. It’s the reason we are all bullish on natural gas going forward. One of the points we have continually made is that there’s one word that is critical in this discussion and it falls right in the middle of a lot of arguments. Reliable. Data centers require reliable power sources. That means that most renewable energy sources, including solar and wind, are not the power source for AI data centers in the future. Coal is problematic, even if Mr. Trump continues to be a fan. China proves this by adding a couple of new coal fired power plants every week. Last year 2/3 of all new coal fired capacity was built in China. In the U.S., it will be natural gas. Originally, natural gas was intended to be a bridge fuel to the future, but now environmentalists and businesses are realizing that it is a base load fuel source for power. Not just a bridge. That doesn’t make the environmentalists like us anymore, but their voices seem to be fading a bit anyway. Most of today’s data centers are located in places like Virginia and Georgia for a host of historical reasons, but all are lacking energy sources to increase that concentration. Cheap, reliable power and a source of water to cool are the two most critical items needed for AI data centers. Stranded gas and produced water end up being some of the hottest terms in our business. President Trump talks about unleashing energy dominance. I’m a big fan of nukes but commercially, they’re 10 years away. Geothermal, while fabulous, is exceptionally geographically limited. Wind and solar prices just rose due to tariffs and while our industry uses renewable power whenever possible for data centers, it’s not an option. Occam’s razor. The only option left is natural gas and that combined with carbon capture and sequestration makes even the most diehard environmentalist recalculate their models. That isn’t to say that natural gas prices will streak ahead of the recent prices we’ve seen, but without any question, volumes will increase even if the economy does fall into recession. It’s so nice to talk about a product in our bailiwick that is so critical to the future. The future just needs to hurry up and get here.

Extremes at Both Ends. It was brought to my attention this week that Goldman Sachs has said that in an “extreme scenario” oil prices could drop below $40 due to OPEC opening the taps and U.S. tariff policies. I was asked my opinion. I remember when Goldman said oil was going to $150 and then I remember a couple years ago it was going to $20 and then it was going to $100 and now it could go to $40. Of course they’re right. All prices will be volatile. The idea that they’re actually right about the numbers, absurd. Goldman Sachs has been one of the trading houses that most actively trades for its own account. Their opinion on oil prices and other commodities swings around, and that volatility is positive for the trading desk, even if it means investors will be scrambling to figure out which price to forecast. They should pay attention to this week. I’m not saying oil won’t go to $40. I didn’t say oil wouldn’t go to $100. I’m either too smart or too stupid to predict all prices. The energy stocks are telling you we’re going into recession, but then every publication and news outlet says the same thing today. That can’t be a big surprise. The idea that we’re going to completely readjust global trade policy, and nobody will feel any impact is a terribly naive thought. The question now will be, how deep and how long the economic slowdown will last. Uncertainty. Never a good thing, but if it slows down investment in the near term, that just provides the opportunity for a rebound and prices in the longer term. In some ways, the oil industry is taking it in the shorts for everyone else. While the tariffs are likely to raise prices in the short term for consumers. Feeling some level of inflation or prices below $60 has the reverse effect. So, our loss is mitigating the loss for American consumers. They never really appreciate our effort, but it’s there anyway. Our industry is good at seeing light at the end of the tunnel. We get another chance to prove it.

No Slashed Wrists. The S&P 500 has seen strong returns in recent years, with a total return of 25.02% in 2024 and 26.29% in 2023. Over the last 10 years, the S&P 500 has had an average annual return of 13.8%, resulting in a total return of around 265.7%. The S&P 500 has also experienced periods of volatility, with the index declining by over 30% in several years, but it has posted annual increases 70% of the time.

Perspective. We all know it's broken in some ways. We know we need to fix it. We've been enabling China at our own expense with $36 trillion in debt now. But the arguments are that Trump's actions will take years. And that the American people want to see something done positive very quickly. The media is pushing the idea of immediate self-gratification and not fixing an underlying problem rather than putting up with some period of dislocation in order to fix our long-term situations. It is amazing to me, and it strikes me that this is the kind of thinking that God is where we are today. This isn't an Endorsement of Mr. Trump or anyone else. But the divisive points being constantly raised suggest that if Mr. Trump's efforts are successful, it will take several years to bear real fruit all while acknowledging that the system needs to be fixed but instead saying since it's not a quick fix, we don't want it. What a sad commentary and the commentary is being pushed by the media.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.