Energy Musings - September 20, 2022

Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

Doubling Down On Renewables In An Energy Crisis – Dumb?

Policymakers in Europe believe the solution to their growing energy crisis is that they should build more renewable generating capacity. They do not deliver power on windless and cloudy days.

Understanding Oil Price Volatility And Why It Will Stay High

Crude oil prices have been in a decline since peaking in June – down 30%. Economic recession fears have been the prime driver, but a lack of liquidity – less futures trading – is another issue.

Random Energy Topics And Our Thoughts

IMF Breaks Down Drivers Of Global Inflation

Increased Oil Efficiency In Today’s Economy

Worrisome Outlook For The Upcoming Winter In U.S. Northeast

Green Energy Impact On Families And Homes

The Growing Interest In Hybrid Vehicles

Doubling Down On Renewables In An Energy Crisis – Dumb?

The European energy crisis has exploded across the world as continental countries scour the planet seeking alternative natural gas supplies to relieve them of their dependency on Russian gas and other fossil fuels. Based on liquefied natural gas (LNG) carrier routes, European buyers are willing to pay well above the prices of long-term contracts elsewhere to secure cargos. Between accelerated buying of LNG cargos from around the world and reduced gas consumption, European Union (EU) member countries have rebuilt their gas storage volumes ahead of schedule. This spring, in anticipation of a possible catastrophic winter gas supply condition, if Russia cut off its shipments, the EU ordered member countries to prioritize gas storage. They were told to reach 80% of gas storage capacity by November 1 and 90% by that date in future years. If the target is not reached, EU countries will be ordered to ration gas use.

Exhibit 1. Frankfort, Germany Apartments With Lights Out - The Future? SOURCE: NY Times

To reach the mandated gas storage level, European LNG supplies came from everywhere – Australia, Qatar, Indonesia, Nigeria, Peru, Trinidad, Egypt, Libya, the Congo, the United States, and even China selling gas potentially transshipped from Russia. As the EU reached its supply target early, continental gas prices have slipped from record highs, although they remain four-times more expensive than a year ago. We would caution readers that storage traditionally supplies only 25%-30% of Europe’s winter consumption. That represents the seasonal gas demand, largely for winter home heating, while the rest of natural gas consumption (baseload demand) is for normal home and industrial use, and power generation. Traditionally, most of Europe’s gas supply comes from pipelines hauling cheap gas, primarily from Russia, although significant volumes come from the North Sea and North Africa, along with a small component from LNG cargos.

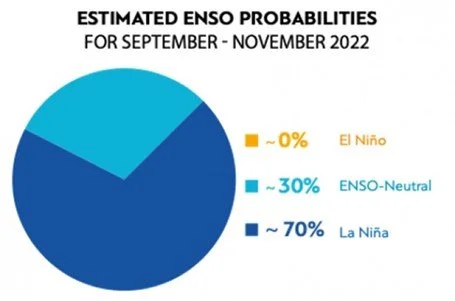

Based on data as of September 7, 2022, from GCI.com, the EU had 914.9 terawatt-hours (TWh) of gas in storage, or 82.23% of total continent capacity. The storage volume has risen by 624 TWh from its post-winter low on March 19. This is well above the pre-pandemic 5-year average storage build of 575 TWh. The rapid storage build is because the effort started earlier than normal and proceeded faster and was more persistent than in most years before the pandemic, spurred by the threat (now a reality) of a complete cutoff of Russian gas flows. An analysis based on historical inventory builds suggests storage volumes are on track to reach 1,008 TWh by the end of the summer injection season, falling within a range of 953-1,071 TWh. That would be the third-highest storage level since 2011, better positioning the region to withstand a colder than normal winter, which has become a possibility given that Europe is entering its third consecutive year of La Niña meteorological conditions. The last time the continent experienced a “triple-dip” La Niña was in 2010-2011, which brought one of the coldest and snowiest Decembers on record and an overall cold and harsh winter to the entire northern hemisphere.

Recently, the World Meteorological Organization (WMO) noted the possibility of a triple-dip La Niña. As WMO Secretary-General Petteri Taalas put it, “It is exceptional to have three consecutive years with a La Nina event.” Taalas quickly warned not to assume the triple-dip of cooling means that global warming is easing. “Its cooling influence is temporarily slowing the rise in global temperatures, but it will not halt or reverse the long-term warming trend.” The WMO’s probability for the triple-dip La Niña extending through November is at 70%. Other weather forecasters predict La Niña extending until spring of 2023. They also point to 2010-2011 as the third winter of the last triple-dip, although the WMO claims this would be the first time it has happened this century. We suspect the different conclusions come from reading different temperature databases plus the WMO’s official embrace of global warming. Nothing can alter that commitment.

Exhibit 2. Europe Should Fear Triple-Dip La Niña Winter SOURCE: World Meteorological Association

Although current gas storage volumes would appear to bolster the confidence of EU officials and those of its member country governments about surviving the upcoming winter, the cost of the gas supply and how it has elevated electricity prices are significant worries. Families and businesses are struggling to pay currently elevated power prices and trying to figure out how they will pay even higher costs this winter. Utilities are straining under the liquidity pressures of paying for these expensive fuel supplies. The latter concern has some wondering if we are heading into another massive financial crisis on top of the energy crisis.

European governments are moving quickly to socialize high energy costs, even though those prices are the result of poor energy policies. New British Prime Minister Liz Tress seems to recognize that relationship with her new £150 ($172) billion energy and financial plan for the country. But other continental government leaders appear more interested in doubling down on renewable energy as their future while only doing what is necessary for the near term to get their populations through the upcoming winter, counting on clean energy to solve the problems of the 2023-2024 winter and beyond.

Prime Minister Truss told Parliament that her government’s plans include capping the projected energy cost this fall at £2,500 ($2,870), up from the April cost of £1,971 ($2,263), but well below the projected 80% hike that would have put the cost at £3,549 ($4,075). More importantly, she announced that the price cap would extend for two years or through 2024, and family annual £400 ($459) payments will offset that energy price cap. While the earlier price cost projection from Ofgem, the British government’s Office of Gas and Electrical Markets, was based on current and contracted future energy prices, the reduced cost cap means the British government will be funding the cost difference that it plans to finance through additional borrowings adding more debt to the country’s balance sheet.

Those political leaders pushing for more renewables to solve their energy supply challenge were well supported by an opinion column in the Financial Times by International Energy Agency (IEA) Executive Director Fatih Birol. His column was titled “Three myths about the global energy crisis.” He began by stating “There are three narratives in particular that I hear about the current situation [energy crisis] that I think are wrong – in some cases dangerously so.” His second point was to confront the discourse over the cause of today’s crisis coming from the push for “clean energy.” Birol wrote:

The second fallacy is that today’s global energy crisis is a clean energy crisis. This is an absurd claim. I talk to energy policymakers all the time and none of them complains of relying too much on clean energy. On the contrary, they wish they had more. They regret not moving faster to build solar and wind plants, to improve the energy efficiency of buildings and vehicles or to extend the lifetime of nuclear plants. More low-carbon energy would have helped ease the crisis — and a faster transition from fossil fuels towards clean energy represents the best way out of it.

When people misleadingly blame clean energy and climate policies for today’s energy crisis they are, intentionally or not, moving the spotlight away from the real culprits — the gas supply crunch and Russia, he said.

We had several visceral reactions to Birol’s second fallacy critique. First, Birol is an institutionalist, having worked for 27 years for the IEA, so we would expect him to defend its policies, even if misguided. We also would expect nothing short of those policymakers who Birol talks to who are wedded to renewable energy to regret that they did not double down on it earlier. But why? Was it because they could not find enough money to entice renewable energy developers to build more capacity? For them, a lack of intermittent power capacity is the problem. However, with only 35%-40% utilization for wind turbines and 25% for solar, building sufficient capacity to power their economies means overbuilding capacity by 2-4-times their required power needs. Is that a proper use of capital?

Intermittent power requires backup power supplies that can be dispatched at a moment’s notice. This is an added and significant cost to ratepayers. Renewable energy promotors argue that battery backup is the best alternative, but batteries do not create energy only add supply for brief spans. Using batteries means that more power generation capacity is necessary because the batteries must be recharged at the same time renewable energy is powering the economy. The fallacy of battery backup emerges when wind is still for days on end as experienced in 2021 and more recently this summer, or when bad weather and night eliminate solar power.

When measured by Energy Return on Energy Invested (EROEI), an important evaluation feature, the fundamental weakness of renewable energy becomes clear. EROEI is a somewhat obscure concept but an important one. It measures how much energy is required to generate a usable unit of power. To demonstrate the concept, for each unit of energy invested in the natural gas eco-system (find a gas prospect, drill the well, process and transport the gas, build a combined cycle gas turbine power plant, and generate electricity) 30 units of usable power are released in the form of electricity. Thus, natural gas power generation is said to have one of the best EROEIs at 30:1.

An analysis by natural resource hedge fund managers Leigh Goehring and Adam Rozencwajg of their named firm (G&W) wrote about the history and significance of EROEI. They pointed out that for most of history energy systems were largely static. Most energy came from food and animal feed, while wood was used for heat and as a building material to provide the rest. Energy historians estimate this mix of biomasses produced an EROEI of 5:1 or one-sixth of the EROEI of natural gas. It means for every unit of energy consumed five units of energy were generated.

The G&W analysis concluded:

In AD 1, we estimate energy production averaged 17 gigajoules (GJ) per person annually. Assuming an EROEI of 5:1, 3 GJ were needed to supply this energy. Human food intake consumed 4 GJ of this energy, while other necessities like shelter and feeding your work animals consumed 10 GJ annually. Therefore, nearly all the 17 GJ of this energy produced per person was needed for daily sustenance. Less than 1 GJ in surplus energy was left after taking care of these needs.

Such a small amount of surplus energy limited the world’s economy and population growth. G&R pointed out that between AD 1 and 1650, the global population grew at only 0.02% per year, not even doubling over sixteen centuries. Why was growth so slow? As they explained, in AD 1, estimated annual energy production averaged 17 GJ per person. Assuming an EROEI of 5:1, 3 GJ were needed to produce the necessary energy. In their estimation, human food intake used 4 GJ, while providing shelter and feeding work animals consumed 10 GJ, using up almost all the energy produced.

Over those sixteen centuries, annual energy was estimated to have increased from 17 GJ per person to 20 GJ, a 0.04% growth rate. In various places, the denuding of forests around cities forced residents to expend greater energy to bring wood from further afield. Often, the energy expended was greater than the energy the wood provided, forcing people to consider alternatives. Coal was often abundant around those cities where forests were gone. Coal turned out to be a very effective source of energy when burned. G&R stated that “early coal-based steam power had an EROEI of 10:1, twice as productive as the biomass that had been used for thousands of years.” They went on to explain how this switch to a denser energy fuel impacted the economy and population. G&R wrote:

To meet the 20 GJ of annual demand went from requiring 4 GJ of energy to less than 2 GJ. Human food needs were unchanged at 4 GJ and other necessities remained at 10 GJ. Therefore, the surplus energy quadrupled from less than 1 GJ per year (unchanged for thousands of years) to 4 GJ per year.

The shift from biomass to coal and the resulting increase in surplus energy drove rapid growth. After having taken 1600 years to double, both population and total energy demand quadrupled over the next 250 years – a twenty-fold acceleration.

The next fuel transition from coal to oil and natural gas that occurred around 1900 benefitted from the latter’s extremely high EROEI of 30:1. G&R concluded that “to generate per capita of energy demand 25 GJ took less than 1 GJ. Human food needs and other necessities remained unchanged at 4 GJ and 10 GJ respectively, leaving a 10 GJ surplus. Once again, growth accelerated dramatically, with energy production and demand surging 13-fold in only 120 years and population going from two billion to eight billion people.” Welcome to the modern world.

Recapping the history of energy transitions and their impact, it took 1650 years to go from 17 GJ of annual energy supply per person to 20 GJ, 250 years to go from 20 GJ to 25 GJ, but only 120 years to go from 25 GJ to 75 GJ. G&R pointed out that “By 2019, OECD energy consumed was 175 GJ – seven times greater than in 1900.” This record in energy consumption is what supported the huge economic and societal gains in life span, living conditions, and ability to deal with changing climate conditions and carbon emissions.

Our modern world is the direct beneficiary of efficient and abundant sources of energy. The growth in carbon emissions has led to a movement to switch away from fossil fuels in favor of wind and solar. Because of more efficient fossil fuels, in many regions of the world, we have seen them transitioning away from the use of dirtier fossil fuels to cleaner ones leading to reduced carbon emissions. That has been clear in the U.S. where our switch from coal to natural gas has produced a meaningful decline in our carbon emissions. For the U.S., as well as most of the world, the current energy crisis has forced an increase in dirtier fuel use and a commensurate increase in carbon emissions. However, switching to wind and solar means embracing lower EROEIs. The EROEI of both wind and solar are approximately 3.5:1, after adjusting for intermittency and redundancy. That EROEI is more like what existed during our first sixteen centuries. What is the impact? G&R summed it up in the following chart.

Exhibit 3. The Global Impact By Embracing Low EROEI Renewables SOURCE: G&R

Low EROEIs translate into a lack of surplus energy, which means slower economic growth with a negative impact on living standards. It may also contribute to slower population growth, which, as we wrote about in our August 23, 2022, Energy Musings issue (“Current Economic Questions Force Look At Demographics”). We pointed to multiple recent demographic studies suggesting a near-term plateauing in global population growth in 25-35 years and an eventual decline to levels substantially below those projected by the United Nations. Such a scenario has profound implications for economies, living standards, energy use, and carbon emissions.

A position paper on the website of the World Nuclear Association (WNA), updated as of March 2020, contained the following:

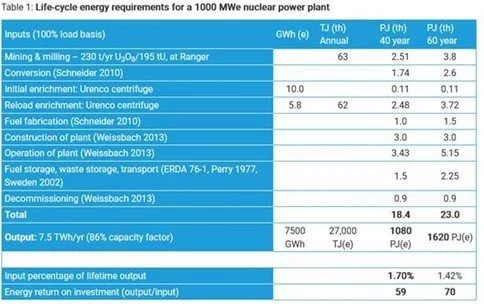

The economics of electricity generation is important. If the financial cost of building and operating the plant cannot profitably be recouped by selling the electricity, it is not economically viable. But as energy itself can be a more fundamental unit of accounting than money, it is also essential to know which generating systems produce the best return on the energy invested in them. This energy return on investment (EROI), the ratio of the energy delivered by a process to the energy used directly and indirectly in that process, is part of life-cycle analysis (LCA). Since any energy costs money to buy or harvest, EROI is not divorced from economics. An EROI of about 7 is considered break-even economically for developed countries, providing enough surplus energy output to sustain a complex socioeconomic system. The US average EROI across all generating technologies is about 40. The major published study on EROI, by Weissbach et al (2013, since the early editions of this paper) states: “The results show that nuclear, hydro, coal, and natural gas power systems (in this order) are one order of magnitude more effective than photovoltaics and wind power,” particularly when any energy storage is factored in for intermittent renewables.

The WNA is promoting the value and increased use of nuclear power, an energy source suddenly enjoying a revival in interest from energy and climate policymakers. The WNA produced the following chart on the life-cycle energy requirements for a 1,000 megawatts of electricity (MWe) nuclear power plant over two different lifetimes. We would point out how high the EROEI of the plant is over 40 years, but the incremental surplus energy produced when operating over an additional 20 years is huge. In some cases, in the U.S., nuclear plant production lives have been extended to 80 years, enabling them to generate even more surplus energy.

Exhibit 4. Nuclear Power Plants Provide Very High EROEI SOURCE: WNA

Another important measure of energy efficiency and carbon emissions is comparing the material intensity per unit of power installed when compared to the electricity delivered. In effect, it is a measure of both the volume of materials (steel, cement, copper, etc.) needed for building each power source and the carbon emissions resulting from their use. The WNA presented the chart below, which is based on data from a 2015 U.S. Department of Energy review of energy technologies. Once again, fossil fuel power plants need fewer materials per unit of electricity (TWh) output and therefore fewer carbon emissions.

Exhibit 5. Renewable Energy Is Materially-Intensive With Energy And Emission Impacts SOURCE: WNA

Based on EROEI measures, dispatchable energy supplies offer much greater returns, which come in the form of surplus energy that contributes to our ability to grow our populations and economies, while raising living standards and extending lifespans. Moreover, we also see that the volume of materials needed for renewable energy sources creates much higher carbon emissions per unit of power output than from fossil fuel-powered plants. Even though renewable energy fuels are “free,” they come with significant legacy economic and emission costs that are generally ignored in the energy policy debates. Doubling down on low EROEI renewables is a dumb energy policy. Nuclear is the clear winner in this calculation and should get more support in our future energy system.

Understanding Oil Price Volatility And Why It Will Stay High

A week ago, last Monday, the front page of The Wall Street Journal’s Business & Finance section featured an article headlined: “Oil Slumps as Recession Fears Grow.” The headline described the then-current oil market conditions, ones that have existed since the summer when recession fears emerged following the release of a negative second quarter U.S. Gross Domestic Production (GDP) estimate. To illustrate the article’s focus, two charts were included that we are reprinting. The first chart (below) showed crude oil futures prices for the past year, which showed that they had fallen by 30% in the six months from the 2022 June high to September 9. As the chart clearly shows, the price correction was sharply down following the June peak, although marked periodically by violent upside price moves. Anyone actively monitoring crude oil futures prices would not be shocked by the trading pattern nor the magnitude of oil price moves, even by how much they often moved during a trading day and between trading days.

Exhibit 6. Dramatic Fall In Oil Futures Prices Since June SOURCE: WSJ

The second WSJ chart showed the daily open interest for contracts for 1,000 barrels of oil traded during the past five years. The overall image conveyed by the chart (below) is one of the trading volumes steadily declining beginning in late 2017. However, the trading volume fell markedly during 2022. Why the lack of interest in this market? Most likely it reflects traders withdrawing from active participation in the market because of how difficult it has become to predict the outcome of geopolitical issues that weigh significantly on oil industry fundamentals and therefore oil futures prices.

Exhibit 7. Drying Up Of Liquidity In Oil Trading Sparks Price Volatility SOURCE: WSJ

The article listed a series of complicated issues such as “calculating how much consumption will be reduced by China’s Covid-19 lockdowns to handicapping how many of Russia’s barrels will make it to market.” The article further stated: “Other examples of uncertainty looming over the market include how long the Biden administration will dip into the U.S. Strategic Petroleum Reserve to boost domestic supply, whether sky-high natural-gas prices in Europe will prompt utilities to burn oil instead, and to what degree the Organization of Petroleum Exporting Countries [OPEC] and its market allies are willing to cut output to support prices.”

Helima Croft, Managing Director and the Head of Global Commodity Strategy and Middle East and North Africa (MENA) Research at RBC Capital Markets, has been making the case that understanding where oil prices may go later this year and in 2023 depends on gauging the outcome of political issues such as those noted in the WSJ article. Her view is like that of BoA Securities analysts who wrote: “There is simply too much uncertainty around fundamentals going into the winter.” While these issues contribute to oil price volatility and reduced trading volumes, there are likely other considerations. We will only list a few besides the geopolitical ones mentioned above:

Terrible returns from oil trading for the prior five years.

The rise of environmental, social, and governance (ESG) driven investing.

Politicians worldwide embraced climate change policies that favor green energy.

Promises by political leaders for a rapid transition away from fossil fuels.

Bans on the use of and even the sale of gasoline-powered vehicles.

A huge wave of energy company bankruptcies due to financial overleverage.

Investors demanding management invest less, repay debt, and return more cash.

Michael Tran of RBC Capital Markets, its Global Energy Strategist & Digital Intelligence Strategist, recently published a report “Oil Strategy: Wisdom of Crowds,” that contained the following chart that highlights the oil futures liquidity problem. Note that in 2022, the oil futures trading volume (solid black line) has been consistently below the 2021 volume (solid blue line), the 5-year average volume (dashed blue line), and often below the 5-year trading range (gray).

Exhibit 8. 2022 Oil Futures Liquidity Dramatically Down Versus History SOURCE: RBC Capital Markets

With sharply reduced trading liquidity, it is not surprising that oil prices can move erratically on any given day and move sharply up and down from day to day. It is unlikely that oil price volatility will moderate materially until more money becomes active in the oil trading pit. Tran made that case when he wrote:

We have highlighted that spot WTI contract liquidity has been off by more than 40% through the summer and investor positioning has fled to running multi-year low risk, resulting in volatile oil prices. A leading cause of the low market conviction and low liquidity is a function of the narrative shifting, over the past six weeks, away from true fundamentals toward policy driven catalysts. In fact, five of the biggest needle-moving oil market drivers currently are all policy based. OPEC’s commitment to swing both ways, the (minimal) potential for a nuclear deal with Iran, price caps and the upcoming EU embargo of Russian energy, to the wind down of US SPR, while the world awaits the resumption of Chinese imports. These factors have varying likelihoods of occurring over various timelines, but all are major market moving events dictated by government policy, which, of course, is always tricky for fundamentally based investors to navigate. Recent price discovery has been poor, but we believe that policy confusion has peaked and the derisking of such policies presents asymmetric upside price risk. (emphasis added)

The issue the geopolitical uncertainties revolve around is oil and energy demand and supply. Will there be enough supply if demand grows as much as some forecasters are projecting? If not, then oil prices will rise and possibly sharply. However, if there is sufficient or too much supply, then prices will remain flat or fall, again possibly sharply depending on the amount of oil oversupply.

If central banks raise interest rates to levels high enough to choke off consumer demand, raise unemployment, and ultimately weaken economic activity in a bid to dampen inflation, what will this mean for near-term energy demand? Does consumer spending fall significantly enough to force manufacturers to cut output (less energy needed) and fire workers (less consumer demand and energy use for commuting)? How much does demand get cut? How does lower economic activity filter through to energy needs? The Federal Reserve is hoping its policy actions will only snuff out inflation without causing a material increase in unemployment and financial pain for families.

To answer these questions, analysts are watching government energy data – some reported weekly, but much of that data comes from survey estimates and models. The more solid data takes longer to report, so forecasters are always looking backward for several months for information. Getting better insight into what drives the energy data often involves looking at alternative data sources that can then be inferred as a signal about the direction and possibly the magnitude of current energy demand changes. The field of data analytics is growing in importance in financial markets as it enables tapping alternative data sources. RBC’s Tran is actively capitalizing on tapping these alternative sources for insight into oil and gas demand, the most non-transparent aspect of energy markets, as well as in other commodity markets.

Early in September, RBC issued a report on its latest read of the outlook for commodity and business markets based on its tapping alternative data sources. The title page of the 21-page report is shown below. We were intrigued by the report’s title: “Quantifying The Previously Unquantifiable – Data Driven Conviction in Volatile Global Markets.” It certainly has captured the nature of financial and commodity markets today.

Exhibit 9. New And Different Ways To Assess Commodity Market Conditions SOURCE: RBC Capital Markets

The data analytics team at RBC spelled out its strategy in building its various data models to help assess market strategy for broad economic sectors. They wrote:

We are market investment strategists, rather than economists, but our real time data driven approach can be used to help supplement more traditional methods of unpacking market blind spots. We utilize alternative data methods from geospatial intelligence, to Internet of Things data, to natural language processing and everything in between to quantify key market themes ranging from supply chains, to societal behavior in a rising energy price environment, to food inflation, and more. The goal is to increase the signal to noise ratio across the most critical markets to arm investors with the real time data to call inflection points with conviction.

In the report, RBC laid out the details of “a vertical in which we’ve built a market framework, with bespoke indicators to watch…” We have been following several of their verticals, especially those related to energy. Here is an example of how this works in the financial world. If you watch the television news showing crowded airports at holiday times, or even at non-holiday times, you have a flavor for the volume of air travel happening. How much is business- versus vacation-related flying? Assessing that mix enables you to estimate how much money the airlines might be earning – more from business-class tickets versus vacation travelers. But you need to then estimate how many of each category there are, which is where alternative data sources come into play. This is how analysts approach modeling demand, revenue, and profit measures.

The RBC report covered several economic sectors. It had a single-page summary, which was titled: “Cheat Sheet – Key Takeaways by Major Theme through the Lens of Alternative Data.” Since we are discussing energy demand, we show the conclusions of those activities most tied to energy demand.

Flight Activity (Constructive): Web searches for future travel are happening at a significantly higher rate and later this summer than over prior years. The late summer pickup in travel search interest is likely either pent up travel that was missed this summer due to soaring travel costs or logistical airport chaos. Either way, abnormally strong search interest for travel at this point in the year is indicative that the demand for discretionary travel remains elevated despite concerns of an eroding consumer balance sheet.

Hotels & Car Rentals (Bullish): Counting clicks across websites suggest that web traffic across high-end hotels and middle tier hotels is up +42% and +68% over the past three months versus the same period in 2019. Lower tier hotels and motels are also seeing strength (+13%), but at the softest clip of our tiered accommodation data. Vehicle rental website visits are seeing strength across the board. Web traffic across the three largest US rental car companies is up 58% so far this year, relative to 2019.

Geospatial Analytics across Retail Gas Stations (Neutral): Credit card spend data suggests that spend at gas stations has increased by some 30.1%. Our modeling suggests that demand for US gasoline has faltered by 4.4% so far this year. This figure widened out to 7.9% over the most recent four months as pump prices printed record highs. This amounts to 413 kb/d, and 740 kb/d of gasoline demand destruction, respectively. This real-time modeling is made possible by stacking various layers of alternative data, ranging from connected vehicle IoT data with geo-fenced retail gas stations, along with expenditure data.

Real Time Flight Tracker (Constructive): Our global flight tracker, which scrapes and amalgamates air traffic schedules and feeds into our ASK-focused regression model, aims to provide a weekly evolution of global jet fuel demand. We expect global domestic jet fuel demand to average 99% of pre-COVID levels throughout 2H’22. We foresee 2H’22 international travel on track to average 82% of 2019 levels. We model that jet fuel demand will remain a mere 700 kb/d short of 2019 levels by the end of 2022.

Global Supply Chains (Improving): Our bespoke congestion metric, Time of Turnaround, measures congestion at 22 of the world’s most influential ports in near-real time. The Ports of Los Angeles and Long Beach, have improved materially from peak congestion, but struggle to return to pre-COVID efficiency. Current ToT is 5.7 days, down from the 8.2 seen in Oct’21, but pre-COVID efficiency levels near 3.5 days remain elusive for now. We see global port congestion normalizing, in non-linear fashion, by early 2023.

When we consider the observations from the status of these measures, we are encouraged that oil demand destruction may not be as severe as some oil price forecasters are suggesting. We recognize that current market conditions are only part of the equation in predicting where future oil demand may go but having a more current starting point is important. Our reading of data suggesting that the current oil market demand situation may not be as dire as some forecasters and the media suggest may explain the frustration being voiced by key oil market players like OPEC and Saudi Arabian officials. In August, Saudi Energy Minister Prince Abdulaziz bin Salman described oil markets as “in a state of schizophrenia,” when questioned about oil price volatility and the sharp drop in oil prices that had occurred in prior weeks.

In OPEC’s most recent report issued last week, the cartel attributed the recent oil price sell-off to “erroneous signals” from the commentary about slowing economic growth and tightening monetary policy that will dampen global oil demand into 2023. OPEC officials wrote:

Hedge funds and other money managers further cut net long positions in the two major futures contracts. The paper and physical markets have become increasingly more disconnected. In a way, the market is in a state of schizophrenia, and this is creating a type of yo-yo market and sending erroneous signals at times when greater visibility and clarity and well-functioning markets are needed more than ever to allow market participants to efficiently hedge and manage the huge risks and uncertainties they face.

Based on its assessment of the global economy, especially due to the Covid-19 lockdowns in China, the IEA said in its recent monthly report that it expects worldwide oil demand to rise by only 2.0 million barrels per day (mmb/d), down slightly from its previous estimate of a 2.1 mmb/d increase. The agency expects demand to slow in the upcoming fourth quarter as the economy slows, although switching from natural gas to oil in Europe and elsewhere due to cheaper price differentials will add 700,000 barrels per day (b/d) to demand and continue that burn rate well into 2023’s first quarter. The IEA continues to predict a 2% demand increase next year, or an additional 2.1 mmb/d of oil consumption.

Although the world has added about 5.0 mmb/d of oil supply this year, growth next year will be slower reflecting the historical lack of industry investment and the supply chain hurdles of securing more drilling rigs and workers. The IEA expects global oil demand will exceed supply in the second half of 2023, which supports expectations for healthy oil prices, likely higher than now. Key to that view is that the IEA foresees global oil supply capacity falling to about 1.6 mmb/d, making it one of the tightest markets in years.

Every forecast, no matter how detailed, depends on assumptions about supply and demand growth, which means predicting both economic and geopolitical issues. This highlights why oil futures traders remain hesitant to place bets in the oil pits, which explains why oil prices remain volatile. This situation is unlikely to change in the next several months until we get into December, and we see both how the world’s economies are functioning and how the European ban on Russian oil imports impacts global energy markets. The next six months will be an interesting time for energy and commodity markets, as well as for global economies and financial markets.

Random Energy Topics And Our Thoughts

IMF Breaks Down Drivers Of Global Inflation

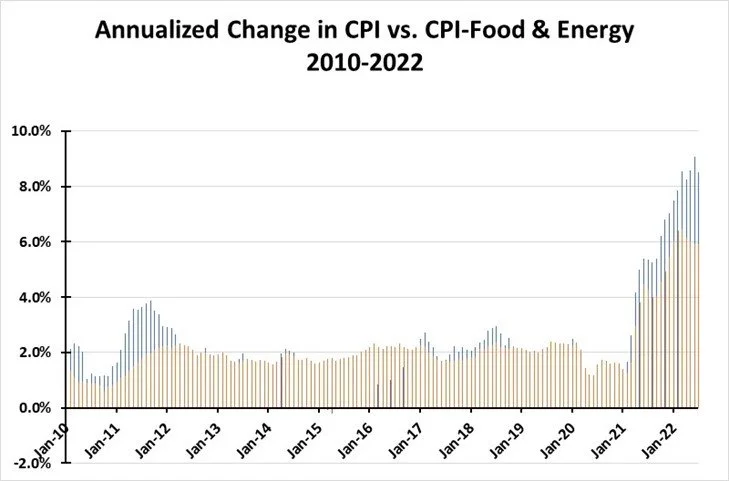

A blog from the International Monetary Fund (IMF) recently provided an analysis of global inflation drivers from 2010 to the middle of 2022, with an emphasis on what is currently happening. The organization’s research staff tapped the IMF’s Consumer Price Index database of nations to calculate the mean value for each expense (food, housing and energy, transportation, and other) category from 28 developed economies and 60 emerging and developing countries. As the chart below shows, inflation currently is above 9%. The last time inflation was high was during the 2008-2009 financial crisis, but its peak was less than half the current rate. The IMF made the point that “The average global cost of living has risen more in the 18 months since the start of 2021 than it did during the preceding five years combined.” A sobering thought about the financial pain for families across the world.

Exhibit 10. What Is Behind The Surging Inflation Across The World? SOURCE: IMF

What the IMF chart demonstrates is that global inflation was moderating when the Covid-19 pandemic emerged. Once the worst of the pandemic economic shutdowns ended and economies began recovering, prices began surging. Food and energy are inflation’s main drivers. The IMF calculates that since the start of 2021, the average contribution just from food exceeded the overall average rate of inflation experienced during 2016-2020. It suggests that “food inflation alone has eroded global living standards at the same rate as inflation of all consumption did in the five years immediately before the pandemic.” This is not surprising, but it is troubling because high energy costs are a significant contributor to food inflation via farm operations, fertilizer, food processing, and transportation throughout the supply chain. The current $93 a barrel Brent oil price is 41% above the average for 2001-2021 and 60% above the 2016-2021 average. Unless oil prices crash dramatically soon and remain down for several years, the world is looking at energy inflation as a continuing driving force.

While the IMF chart reflects the global inflation breakdown, we wondered how the U.S. experience was progressing. For a quick and rough assessment, we compared the average annual U.S. inflation rate reflected by the monthly Consumer Price Index (CPI), which we then compared to the CPI minus food and energy, otherwise known as the core inflation rate. The chart below shows that comparison for the same period the IMF chart was measuring.

Exhibit 11. A Look At Recent Inflation Drivers In The U.S. SOURCE: St. Louis Federal Reserve

Our measure is not as detailed as the global one calculated by the IMF, however, it reflects a similar pattern. In our chart above, the blue in the bars reflects the difference between the CPI and the core inflation rate. This gives us a rough measure of the impact on inflation from high energy and food costs that is reflected in the overall CPI.

Exhibit 12. A View Of Energy And Food Inflation In The 1970s And 1980s SOURCE: St. Louis Federal Reserve

Utilizing the two CPI measures, which extend back to 1957, enabled us to examine the inflation of the 1970s and 1980s, the last time the U.S. experienced as high an inflation rate as today. Once again, the blue areas visible in 1973-1974, and again in 1976-1981, highlight how skyrocketing oil prices from the Arab Oil Embargo in the earlier period and the Iranian Revolution in the latter one drove overall inflation rates up.

It is instructive to note that once inflation peaked and countries and families cut their energy use, inflation pressures eased rapidly. That is the expectation now, as all signs point to a moderating CPI as gasoline prices have declined by over 25% in recent months. What we also noted in the above chart is that once the oil crisis of the 1970s passed and the oil price crash of the early 1980s occurred, overall inflation returned to levels that existed before inflation took off due to the 1973 Arab Oil Embargo.

The unanswered question is whether inflation rates will return to levels they were before the pandemic. The most recent New York Federal Reserve Bank’s Survey of Consumer Expectations showed the mean one-year and three-year inflation expectations had declined sharply. Consumers, before the latest CPI release, expected inflation one year out to be only 5.7%, down from the prior month’s expectation of 6.2%. For three years out, consumers expect a 2.8% inflation rate, down from the prior 3.2% estimate. Media commentary was that the three-year inflation expectation was close to the Federal Reserve’s 2% annual target, although that target has been loosened to become an average over an unknown period. With the possibility of a cold winter ahead and the end of the U.S. Strategic Petroleum Reserve oil withdrawal on the horizon, one wonders whether oil prices will begin climbing after months of declining, which could restimulate inflation fears.

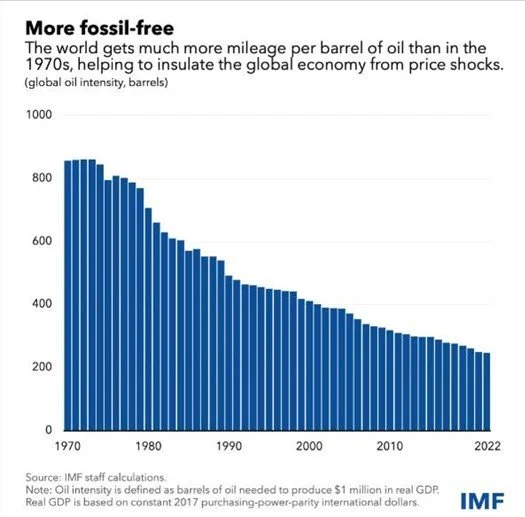

Increased Oil Efficiency In Today’s Economy

The International Monetary Fund (IMF) created the chart below showing how much more efficiently the world’s economy is using its supply of crude oil. The chart, prepared by the IMF’s economists, presents the annual amount of oil needed to produce $1 million in real 2017 Gross Domestic Product (GDP). Since 1970, the trend has been consistently lower, although the slope of the decline was much faster in the twenty years of the 1970s through the 1990s. Thence the rate of decline slowed, albeit it still worked lower. The chart sparked interest in understanding why the decline. What many people looking at the chart may not appreciate is that before the Arab Oil Embargo in 1973, oil was used significantly in generating electricity. So, when the oil price jumped, it was an easy candidate for replacement with a cheaper fuel, primarily coal.

Exhibit 13. Remarkable Increase In Oil Efficiency In Creating GDP SOURCE: IMF

Further to the point about fuel substitution in electricity generation, a 1989 paper by two scientists at the Lawrence Berkeley National Laboratory and published by the U.S. Department of Energy Office of Scientific and Technical Information examined the issue. The abstract for the paper, “The role of oil in electricity generation in five European countries: Past, present, and potential,” stated:

The annual primary oil demand of five European countries --- France, Germany, Italy, England Wales, and Sweden --- declined by approximately 25% between 1973 and 1986. Nearly one-third of this decline is the result of the phasing-out of oil for use in electricity generation. In 1973, oil was the first- or second-most important energy source for electricity generation in all of these countries --- generating between 14% and 59% of electricity produced. By 1986, oil's share of electricity generation had declined to between 1.5% and 5.6% in all countries except Italy (39.4%), where oil is still being used for base-load generation.

The abstract later stated:

In England Wales and Sweden, oil-based generation may soon increase above 1986 levels. In Sweden, oil-based generation will be used to bridge a supply gap that will result from the decommissioning of nuclear power plants in the absence of new generation capacity to replace them. Although oil-fired electricity generation may increase above 1986 levels in the near future in some countries, the maximum potential levels of oil-based generation calculated in this report will not be attained in any of the countries unless a major electricity-generation resource or technology suffers a severe, unforeseen disruption. In the absence of such a disruption, institutional barriers against dependence on oil will preclude the realization of the existing potential. Nonetheless, the hidden potential for oil use in the power sector, represented by the existing oil-fired capacity, must not be forgotten. As institutions and political agendas evolve, so too might attitudes regarding oil use.

To further understand the decline in oil use in world power generation, we tapped the BP statistics to produce the chart below. Unfortunately, BP’s data on fuel use in generating electricity only begins in 1985. What we show, is the number of terawatt-hours of global electricity generated by oil divided between the developed economies (OECD) and the developing ones (non-OECD). Combined, we see the world’s use of oil to generate power. As the chart shows, the decline in the use of oil for electricity generation has primarily come in developed economies. These economies have more power generation options than the typical developing economy.

Exhibit 14. World Decline In Oil Use For Electricity Was In Developed Economies SOURCE: BP, PPHB

To further confirm the point about the decline in oil use in power generation, we used the U.S. Energy Information Administration (EIA) annual data on the fuel used in generating electricity. What we see in the chart below is how cheap oil and the growth in electricity generation from shortly after World War II combined for a rapid increase in oil use. That growth ran into the explosion in oil prices from the 1973 oil embargo and then at the time of the Iranian Revolution in 1979. The high oil prices and fear that it reflected a global peak in oil supply caused economies to shift as rapidly as possible away from oil’s use to cheaper and abundant coal. When natural gas prices began rising due to market problems created by regulatory mistakes in the 1980s and 1990s, oil use rose further. It wasn’t until the shale revolution spurred drilling for shale gas that proved highly successful and drove gas prices down sharply, that the final nail was hammered in the coffin of oil used for generating electricity.

Exhibit 15. How Oil Use In Generating U.S. Electricity Has Changed SOURCE: EIA, PPHB

Most of the oil used in generating electricity reflects legacy power plants, although there are likely dual-fuel plants that switch based on fuel costs. There is also oil used in the Northeast region during the winter because of natural gas supply issues. Unfortunately, that use is not likely to decline anytime soon. High natural gas prices may force dual-fuel plants to consider using more oil depending on relative fuel costs. The big question is how rapidly oil’s use in generating power will decline in developing economies or are they prisoners because they lack power alternatives?

Worrisome Outlook For The Upcoming Winter In U.S. Northeast

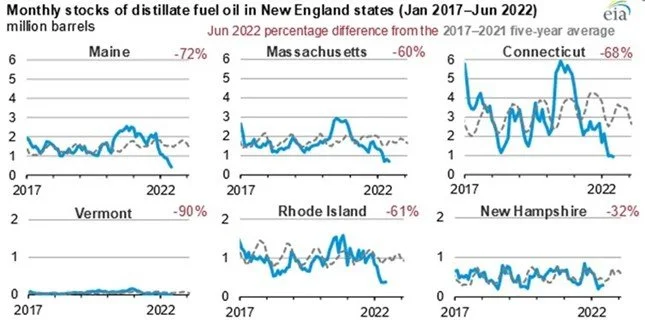

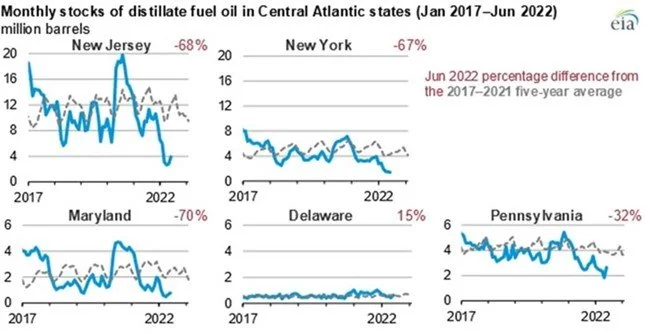

The Energy Information Administration (EIA) recently posted an article on its website containing two charts showing distillate inventories in the New England and Central Atlantic states as of June 2022. The charts showed inventory levels in the individual states from 2017 to June 2022, the latest monthly data available. Distillate fuel is primarily used for transportation, which is critically important for keeping our economy running, but it is also consumed as home heating oil, particularly important in the New England states during winter months. Equally important in New England is that distillate is used to power electricity generating plants during the winter months when natural gas supplies are diverted to home heating, so are in short supply at generating plants, or supplies come from expensive imported liquefied natural gas (LNG).

In New England, except for New Hampshire's June inventory being down only 32% from its 2017-2021 five-year average, every other state’s June inventory level was below the average by at least 60% with Vermont down 90%.

Exhibit 16. New England States At Risk Of Heating Oil Shortage This Winter SOURCE: EIA

In the Central Atlantic states, Delaware (-15%) and Pennsylvania (-32%) were in much better supply shape than the other states and those in New England. New Jersey, New York, and Maryland showed June inventory levels below the 5-year average by -67% to -70%. It is important to note that distillate inventories may vary between states because each state had different needs and methods of supply.

Exhibit 17. Central Atlantic States Are Also At Risk For Distillate Shortage SOURCE: EIA

The EIA commented in its article that its Weekly Petroleum Status Report (WPSR) showed total distillate stocks in New England of 3.2 million barrels as of September 9 compared to 3.4 million barrels in June. Central Atlantic stocks were 13.2 million barrels versus 11.8 million barrels in June. The EIA stated: “Our latest WPSR indicates commercial distillate stocks have increased in recent months, but they still remain below average.” While noting the positive of increasing inventories early in September, the following chart shows how dangerously low distillate inventories remain based on national data.

Exhibit 18. Current U.S. Distillate Inventories Are At Decade Low SOURCE: EIA, PPHB

The chart above shows weekly distillate inventories from the WPSR from January 2000 through September 9, 2022. The red line on the chart marks the most recent level compared to other weeks throughout the history plotted. Each of the lows in the 2000s that were below current inventory levels occurred during April or the first week of May. Those inventory lows came at the end of the heating season and when distillate inventories are beginning to be rebuilt for the next winter. One problem is that the seasonal build in inventories has been the slowest in 30 years according to Reuters energy writer John Kemp.

The low September inventory, while up from the June low, comes ahead of the winter heating season when distillate demand climbs. Heating demand in northern states typically starts in November, so there remains another seven weeks or so to further build inventory. However, we are still looking at potential shortages besides high prices. Those conditions will create human suffering, yet we don’t see or hear of actions being taken to prepare for the worst, other than hoping the oil industry will be able to increase supply.

A recent report from RBC Capital Markets noted the following about refining margins and their impact on distillate production:

Since the beginning of August, the spot gasoline crack gave up $7.10/bbl, while the distillate crack rallied by $13.78/bbl. Both moves were massive, and indicative that risk simply rotated from one to the other. We are oversimplifying, but for illustrative purposes, a refiner producing 50% gasoline and 50% distillate, is largely flat from a margin perspective. The risk in diesel is simply an economic signal suggesting that refiners shift yields to maximize diesel production. Finally, given the current crack setup, refiners remain financially incentivized to run their refiners as hard as possible. The simple math of the sum of the gasoline and distillate crack totals $79/bbl, above the YTD average of $67.30/bbl. More importantly, strong cracks so far this year have spurred US refiners to 91% utilization so far this year, which compares to the historical five-year average of 88%, YTD. Despite volatile crack spreads, refiners remain economically incentivized to continue to run hard (which is a fancy way of saying that crude demand will remain firm). We’ve seen a similar story in Europe. Despite the gasoline crack sitting in low single digits (and briefly turning negative earlier this month) after reaching nearly $50/bbl this year, aggregate spreads are still just under $50/bbl, only $8/bbl off the YTD average.

The risk of low distillate inventories in the U.S. Northeast is complicated by the reality that the world is confronting low distillate inventories that may worsen by year-end due to energy policy actions in Europe. Before we look at the upcoming winter for global distillates, the chart below shows U.S. annual average distillate inventory since 1990 through the average weekly figures for 2022 through September 9. The red line in the chart shows the lowest average posted in 2000, which is roughly 4% ahead of 2022’s average year-to-date figure. Even with strong refining incentives for producing more distillate, one should be concerned about the potential for refining being disrupted by a fall hurricane landing on the wrong part of the Gulf Coast.

Exhibit 19. Record Low Distillate Inventories Need To Be Rebuilt SOURCE: EIA, PPHB

Recently, energy writer Irina Slav wrote about “Dark diesel days” in describing the upcoming winter in Europe, but also possibly for the world, depending on how commodity markets, government policies, and petroleum logistics work out. She began her column with the following:

Gas shortage. Electricity shortage. Fertilizer shortage. Metals shortage. Everywhere you look in Europe, it’s shortage after shortage. Now, another is looming large: a diesel shortage. And it won’t be an easy shortage to resolve.

In early December, the EU crude oil embargo against Russia will kick in. Two months later, it will be time for the fossil fuels embargo. Guess what Europe is doing right now? Stocking up on Russian oil and fuels. Guess what Europe will be doing in two months? Looking for oil and fuels elsewhere.

Slav’s question is: Where might Europe find additional distillate supplies once Russian crude oil and then its refined products are banned from purchase by continental countries? The answer is that there are three potential suppliers – Middle Eastern OPEC, cargo diversion, and China – that could come to the rescue. But, on the other hand, there is a major current supplier – the U.S. – who may soon begin limiting its contribution.

At the heart of the issue for Europe is that it imports 1.41 million barrels per day (mmb/d) of diesel fuel, of which 825,000 barrels per day (b/d) come from Russia, representing over half the continent’s supply. The most logical place to find more supply is in the Middle East, especially Saudi Arabia which has spare oil productive capacity. Saudi Arabia also has increased its refining capacity by 400,000 b/d this year with the start-up of a facility at Jizan. The country with 3.3 mmb/d of refining output remains in sixth place in the world, but it is less than 200,000 b/d behind fifth-place South Korea.

In 2021, Saudi Arabia exported 1.34 mmb/d of diesel and fuel oil, with 682,000 b/d being diesel. Last year, a significant portion of the kingdom’s diesel output went to Europe, but not all. About 400,000 b/d of the diesel imports to Europe came from the Middle East, but only a portion was from Saudi Arabia. With increased refining capacity in the region, Middle East OPEC could supply more to Europe. However, the business plans that supported the region’s refinery expansions were based on targeting the rapidly growing Asia market. Europe, however, could do with diesel what it did most recently with LNG – outbid Asian buyers for the cargos.

According to Slav, “Bloomberg reported in mid-August that diesel shipments to Europe were on the rise from both Asia and the Middle East.” With China’s economy slowed significantly by its Covid-19 lockdown policies, its oil demand is down. At the same time, China is taking advantage of purchasing highly discounted Russian oil and is likely to continue buying the cheap oil once the European ban on purchasing Russian oil goes into effect on December 5. China could process that cheap oil and export refined products including diesel to Europe, which would become the ultimate irony of a flawed European Union (EU) energy policy. The EU ban on Russian petroleum products goes into effect in February 2023, so the continental countries can still purchase these products through most of the winter, which may be a good thing.

One reason why U.S. distillate inventories are so low is that diesel exports have been running at record high levels, according to Reuter’s Kemp. That was partially motivated by efforts to help Europe during the Russia-Ukraine conflict, but also because U.S. distillate demand has been fairly flat most of 2022. Kemp pointed out the global problem of diesel inventories that are at their lowest level in over a decade. With the U.S. being forced to dial back diesel exports to help rebuild domestic distillate inventories, the help provided to Europe this summer is about to disappear. In Kemp’s view, “Only a global slowdown in manufacturing and freight transportation will rebuild stocks to more comfortable levels and abate the upward pressure on refinery margins and oil prices.” Of course, that means another form of punishment – a global recession. A recession means people lose their jobs and governments are forced to step up social welfare payments. As much as policymakers believe their central banks can raise interest rates to squeeze down inflation yet not create massive unemployment when consumer demand falters, such a scenario is a pipe dream. Poor energy policies, compounded by even worse geopolitical policies intended to punish the adversary of a friend, are boomeranging on Europe’s citizens in the form of spiraling cost of living increases and the prospect of dim lights, cool homes, and cold showers for the winter and beyond. Watch out because public outrage is a tinderbox primed to ignite.

Green Energy Impact On Families And Homes

All energy systems have impacts on residents with homes nearby. Pollution from fossil fuel plants is the primary risk, but there is also the risk of possible fires caused by accidents. This is true of renewables, too. For wind, risks come from turbine fires, as well as blades spinning off and damaging nearby structures or humans. People living close to wind turbines also have noted noise pollution and in some cases flicker shadow patterns. Both issues have been known to create health problems for wind turbine neighbors, especially for sleeping, although there is no universal experience.

The chart below from wind turbine manufacturer General Electric shows the level of noise experienced over varying distances from the turbine. This is why there are generally local distance standards for wind turbines established when new wind farms are approved.

Exhibit 20. The Noise From Wind Turbines Over Neighboring Distances SOURCE: General Electric

We have written about the issue of the price impact neighboring wind farms have on home values. It is no surprise that the closer a home is to a wind turbine, the greater the price impact. But recently The Wall Street Journal had an article about the value of solar panels on home values. This is becoming an important consideration given the Inflation Reduction Act that extended the 30% federal tax credit for installing solar panels to 2034. The Biden administration is claiming this tax credit extension will result in an additional 7.5 million homes installing solar panels, joining the existing three million homes already equipped. Since our summer home is one of those three million, we were interested in the article’s observations.

The article was based on a new study from scientists at the Lawrence Berkeley National Laboratory who were also sponsored by mortgage guarantor Fannie Mae. The paper concluded that homeowners who owned their solar systems were likely to see an increase in value while those who leased them would see no statistically significant impact on their home’s value. A chart accompanying the article showed the results of a survey contained in the National Association of Realtors Research Group’s 2022 Realtors and Sustainability Report - Residential.

Exhibit 21. Value And Interest In Solar Systems SOURCE: The Wall Street Journal

The chart shows that there may not be much impact on the value of homes and, also, that solar systems are not an important issue for home buyers. How much that attitude may change as more homes are equipped with solar systems remains to be seen. But points made in the article may help determine the impact. The key issue is whether the system is owned or leased. In one case, it becomes an asset that can be valued and transferred in the home sale, but for leased systems, they belong to the lease owner who may have a lease lien on the property that can become a hurdle buyers need to overcome in the purchase. Thus, ownership may impact the home appraisal value, and how a mortgage lender may view the system.

A major shift in solar system use is driven by state clean energy policies for electric utilities. If you install a solar system to self-power your home hoping to “go off the grid,” it will have a value that can be measured by how much future power prices you will avoid paying. However, not that many people are doing that because the cost is high for a large solar system and a battery to store the power for when the sun does not shine. Most solar systems are operated under either net metering or now net billing systems. The former is when you sell your power back to the electric utility and it credits that sale against your monthly power bill, and in some cases pays you if you generate more electricity than you use. Under net billing, the power company eliminates the homeowner’s monthly electricity bill. Under net billing, the value of the solar power generated is generally lower than under a net metering plan, depending on a state’s regulatory plan.

When sold, the considerations about these respective plans can be extensive. They range from the warranty on the solar system, the ability to transfer it to the buyer, what the nature of the contract with the utility is, how it is transferred or whether a new contract must be executed.

In our case, our system has a 25-year warranty on the panels and the installation work, and it can be freely transferred to a new owner. We have a 15-year net metering contract with our utility, which is transferable and guaranteed renewable, although the rate the utility will pay for the power is determined at the time of the renewal. We are currently in our 60th month of operating the system. Between the federal tax credit that we received at the time the system was installed, the installation discount negotiated by our town with our installer, the credits on our bill from the power we sell our utility, and the cash payments they send us for producing more power than we use each month, we are about to reach a 100% repayment of our net system cost on a pre-tax basis. Because we receive cash from the utility, we must pay tax on those payments. Measured on an after-tax basis, we are likely 12-14 months away from recouping 100% of our net system cost. We are looking forward to years of our solar system not only cutting our monthly electricity bill, something that will increase in the future because of rising electricity costs in Rhode Island, but months of free cash flow. We think that makes our solar system an asset that should increase the value of our home.

The Growing Interest In Hybrid Vehicles

Electric vehicles (EVs) are the preferred choice of environmentalists, but the dominant regional market for them is China, a country not known to care much about the climate, especially if it disrupts the building of its economy and implementation of its global business strategy. Just as China came to dominate the solar panel business, it is quickly moving to capture a large market share in the global offshore wind industry and is moving to make its EVs global models. While many see the struggle in the automobile industry as between internal combustion engine (ICE) vehicles and EVs, there is another automobile technology – hybrids - experiencing a growing acceptance and represents a compromise between the other choices. The primary promotor of hybrids has been and continues to be Japan’s Toyota Motor Corporation.

EV purists often elect to not only dismiss electric hybrid vehicles but also dismiss plug-in hybrid vehicles (PHEV). They believe only battery electric vehicles (BEV) should be considered when analyzing the EV industry. Therefore, we were intrigued when the Department of Energy (DOE) published the following chart in one of its weekly data point releases. In its release, the DOE noted that model year (MY) 2021 saw a sharp increase in the light-duty hybrid electric vehicle production share as it reached nearly 9%.

Exhibit 22. How Hybrid Vehicle Market Share Has Grown SOURCE: DOE

Key to that improvement was the growth in the share of hybrid-electric SUVs that nearly doubled between 2020 to 2021 reaching a 4.7% share. It is interesting that because of the improved fuel economy that comes with hybrid-electric vehicles, the manufacturers have been expanding their model offerings. Hybrid-electric technology was introduced in MY2000 in the sedan/wagon class. Hybrid pickup trucks were introduced in MY2018 and have grown their market share dramatically from 0.1% to 1.2% in MY2021. The first minivan/van class hybrids arrived in MY2021.

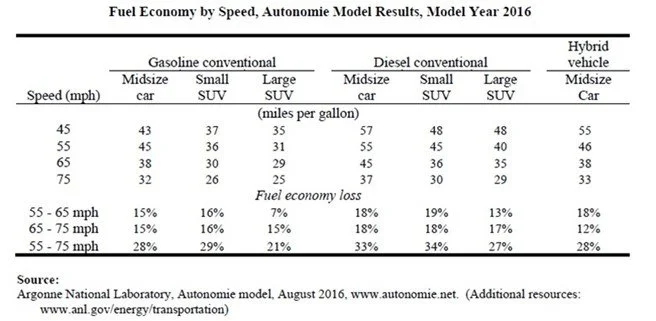

We found an interesting chart and table in the Department of Energy’s Transportation Energy Data Book: Edition 39 published in the spring of 2021. The table below shows fuel economy by speed for MY2016 ICE, diesel, and hybrid-electric vehicles. The hybrid delivered better fuel economy than a similar ICE vehicle at all speeds other than 65 miles per hour where they were even. However, diesel vehicles outperformed both ICE and hybrids.

The bottom portion of the table showed how the various models were compared based on fuel efficiency loss at highway speeds. The hybrid-electric did well in competition with the other two models. Since hybrids can operate at lower speeds off their battery, these vehicles are good for carbon emissions in stop-and-go city traffic, which is a plus for the technology.

Exhibit 23. Hybrid Vehicles Perform Well On Fuel Economy SOURCE: DOE

The chart below from the DOE transportation data report highlights how fuel economy has improved over nearly 40 years from 1973 to 2016. The difference between 1973 and the later years shows why fuel consumption in the U.S. has not grown in lockstep with the increase in the vehicle fleet. The performance of the three 2016 models demonstrate further progress by the American automobile industry in improving vehicle fuel economy.

Exhibit 24. Improvement In Vehicle Fuel Economy Over Time SOURCE: DOE

Despite all the market share gains of EVs, American car buyers are still hesitant to purchase them because of range anxiety. Growth in the public EV charging infrastructure may help ease the minds of buyers, but many of them are turning to hybrids as their answer to concerns about climate change caused by automobiles. Hybrid technology is seen as a reasonable compromise, and if the battery range is 50 miles, it covers many people’s daily driving distance. Since these hybrids do not need to be plugged in to recharge their batteries (done through regenerative braking of the vehicle) and they offer an internal combustion engine with a gasoline tank attached, they eliminate fear of running out of battery charge before finding a plug-in station.

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.