Energy Musings - November 15, 2022

Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

Age Of Inflation: More Unseen Challenges For The New Normal

Despite the CPI easing, we still see more inflation and interest rate problems ahead.

New York Times Climate Skeptic Has Change Of Heart

He wonders if the pandemic’s arrival is more reflective of possible climate problems.

COP27 Struggles For Relevance In Energy-Challenged World

In an energy crisis, security of supply is trumping political concern over climate change.

October’s Stock Market Harvest Was Very Good For Energy

Energy has had an outstanding 2022 and October’s performance was a record.

Random Energy Topics And Our Thoughts

Virginia Offshore Wind Project One Step Closer To Construction

Misleading Chart On EVs, But Conclusion Remains The Same

Ominous Challenges For Global Economy, Society, And Energy

Age Of Inflation: More Unseen Challenges For The New Normal

Our last Energy Musings was largely devoted to discussing unseen challenges that will impact the new economic normal. Despite consumer inflation easing recently, there continue to be many forces in today’s economy that created the decades-high inflation rates that will not be reversed or even eliminated anytime soon. These forces will cause interest rates to remain higher.

A recent column by iconoclastic investment commentator Bill Bonner captured the essence of our argument about what is changing in today’s economy and financial markets, and how few people are prepared. Bonner recently wrote:

Three things made the period – 1980 to 2022 – one of the most investment-friendly episodes in history. Energy was cheap. Labor was cheap. Credit (borrowed money) was cheap.

And now? Governments discourage investments in the traditional energy sector. The pool of Chinese peasants that held labor prices down since 1979 has dried up. And the credit cycle turned two years ago; since then, interest rates have been going up, aided and abetted by the Fed.

In short, the situation has profoundly changed. Has anyone mentioned this to investors?

You could ask the same question of businessmen and politicians. While the latter have immense power, they seem oblivious to the changing economic environment. They appear to only want to know if their constituents have noticed the change because then they would be forced to act to clean up the mess unfolding if that is possible. Businessmen have a chance to review history, or, if they are lucky, to seek out advice from some gray-haired advisor who lived and managed in the last period of higher sustained inflation. Today’s Federal Reserve Board is targeting inflation by boosting interest rates substantially above current levels, just has happened the last time.

A recent column in the Financial Times by Gillian Tett, chair of the paper’s editorial board and editor-at-large, U.S., titled “Executives are only now waking up to their collective blind spots,” hit on some factors changing the world ecosystem and adjustments managements must make. She began by noting the recent report of Tesla executives considering taking a stake in Glencore, the global commodities trader, because it provided a potential avenue to better intelligence and connections in the minerals industry whose supplies are becoming critical for the future of renewable energy and electric vehicles.

Tett further noted Tesla CEO Elon Musk’s nervousness about supply chain issues for his companies. Musk is seeking to diversify his supply chain because of its heavy dependence on China for the minerals needed for his Tesla cars. As Tett put it, Musk was “confronting a ‘single point of failure’ problem.” She suggested that historians will consider 2022 as the year when executives became obsessed with Spof.

The counter to Spof is the four-letter acronym Vuca which entered the corporate lexicon some years ago. Standing for “volatility, uncertainty, complexity, and ambiguity,” Vuca was coined by the military to describe an increasingly unstable world in which they must plan for future wars.

While engineers consider Spofs in industrial machines, so too do military leaders who handle logistics, and financial regulators learned about the term during the 2008 financial crisis.In that crisis, the regulators found that so many banks had used the same types of derivative investments to hedge their credit portfolios, and with the same insurance company, AIG Financial Products, that it had become a new concentration of Spof risk for the entire financial system.

Tett is surprised, in retrospect, that the non-financial world appears to have learned little from the 2008 experience. She points to how few German industrial companies worried about their dependence on cheap Russian natural gas, or American tech companies becoming so dependent on Taiwan for their supply of advanced computer chips. Blind spot after blind spot.

You could add to the blind spots the dependence of western healthcare systems on Chinese manufacturers for key medical supplies, as well as the world’s shipping industry’s reliance on passage through the Suez Canal until a ship became stuck. A more recent episode – the bombing of the Nord Stream pipelines – highlights the exposure of energy and communications infrastructures to disruption by acts of nature or malicious acts.

As Tett wrote, “A belated rethink is now under way in corporate boardrooms, since it has become clear that the trifecta of protectionism, war and climate change can threaten supply chains.” “Diversification” has become a watchword among corporate executives and risk managers for how to deal with this threat. Another risk management tool is to create “redundancies” in supply chains. Some managers are looking into “fragmentation” of their operating systems such that their systems can be broken into separate parts if a disaster hits, thus continuing to function, although maybe not quite as efficiently as before.

The implication of these blind spots is profound for our future and consistent with our thinking. As Tett summed it up:

But this shift has one obvious big downside: executives’ desire to embrace redundancy, fragmentation and diversification will invariably create new costs. In other words, anyone who thinks the current wave of global inflation can just be blamed on central banks needs to think hard about Vuca and Spof. And then plug them into their valuation models – and not just for electric cars.

Another example of how financial considerations change with higher inflation and interest rates appeared in a Wall Street Journal Q&A column on retirement investing. The question was what return would be needed for a couple willing to tap their principal in retirement versus a couple who want to preserve it? For a $1 million portfolio being drawn down at a 4%-per-year rate with no inflation and a portfolio with a zero balance at the end, the couple’s money could last for 25 years. To extend the withdrawal period to 30 years, the portfolio needs to earn 1.5% per year, assuming no inflation. If there is inflation, then the earnings need to be 1.5% above the rate of inflation if the portfolio is to last 30 years.

When asked about a couple wanting to leave a legacy, the return target increases to about 3% - 3.5% above inflation with inflation at 2% - 4%. The issue becomes the personal inflation rate of the couple. If it is 2%, then the portfolio’s return needs to be 5% - 5.5%. This is where the challenging aspect of long-term investing clashes with risk and return. The article noted:

If you assume a 3% bond return and 6% stock return, you would need a little over 80% of your money in stocks to hit a 5.5% portfolio return. But to hit a 3.5% return, you’d need only about 30% in stocks. Thus, the desire to maintain principal makes a big difference in how much risk you might take.

In a world with higher inflation, to be able to sustain a 4% annual withdrawal rate and leave some principal for heirs, the retired couple must construct a portfolio that takes on much greater financial risk (a higher equity portion). This is one of those unseen challenges of the new normal environment we foresee.

The recent rise in global oil prices and the potential for significant chaos in the global oil market when the European Union ban on Russian oil and refined product sales goes into effect starting in less than four weeks will become a new challenge. While the oil ban comes first, the refined products ban does not start until February, no one can safely predict what will happen to oil supplies. These market disruptions will occur within an emerging “commodity super-cycle” outlined recently by Goldman Sachs commodity strategist Jeff Currie in the Financial Times.

His thesis begins with recognizing that the energy and material shortages being experienced are not the result of supply chain and Covid-19 issues but from a “decade of falling returns and chronic under-investment in the oil economy.” It all began with the economic stagflation following the 2008 financial crisis. Policymakers addressed that crisis with monetary policies that provided significant sums of money to support markets. Currie wrote: “Lower-income households faced sluggish real wage growth, economic insecurity, tighter credit limits and increasingly unaffordable assets. Higher-income households, on the other hand, benefitted from the financial asset inflation caused by QE [loose monetary policies].” As he pointed out, higher-income households may control the money, but lower-income households control the volume of commodity demand because they tend to buy more physical goods rather than services.

Exhibit 1. Disproportionate Impact Of Incomes On Commodity Demand SOURCE: Financial Times

As the lower-income households were financially stressed, their consumption of commodities declined, taking down the returns earned by companies producing the commodities. The problem becomes that the lower returns reduce capital investment in the long-cycle projects to sustain and grow the supply of commodities. We saw this shift from long-cycle exploration in offshore oil and gas in favor of short-cycle shale oil drilling. Currie points to the decline in commodity investments compared to investing in the technology industry. The shrinking investments in commodity companies were also driven by their poor returns and growing pressure from investors for these commodity providers to demonstrate improved sustainable financial performance that further limited capital flows. These trends are amply demonstrated by the comparison of global equity returns from 2002 by the old economy versus the new economy stocks shown in the chart below.

Exhibit 2. Old Economy Vs. New Economy Stock Performance Is Changing SOURCE: Financial Times

When the pandemic hit in 2020, the demand collapse exacerbated the problems for commodity investments, such that when economies rebounded the old economy was stretched. Those demand pressures were further inflated by policymakers’ focus on helping constituents’ financial conditions during the pandemic that boosted demand for goods that accentuated the stretched old economy.

In the energy system, as the limitations of one fuel emerged, consumers were forced to shift to other fuels that eventually showcased their supply limitations. As Currie puts it: “Periods of commodity price pressure will reoccur as broad-based demand meets inadequate infrastructure.” This pressure will cause commodity prices to “significantly overshoot to the upside to provide the incentive for investment.” Correcting these supply/demand imbalances will require years of healthy commodity investment, which underlays his “super-cycle” expectation. What further strengthens his argument is government pressures to accelerate the shift to clean energy that will stress commodity supplies as they have never been stressed before.

The commodity super-cycle is merely a manifestation of the changing world we are facing, as outlined by Bonner above. The end of cheap energy, cheap labor, and cheap money means higher embedded inflation in economies that will drive interest rates higher and economic growth lower. The balance of this decade will challenge politicians, executives, and investors to produce positive results and returns. We may be on the cusp of a repeat of the lost decade of the 1970s. That will create incredible angst and pain that few are prepared for.

New York Times Climate Skeptic Has Change Of

On the Sunday the United Nations Climate Change Conference opened in Egypt’s Sharm el-Shiekh, The New York Times published a 6,000-word climate opinion article by Bret Stephens, one of the paper’s opinion columnists. Stephens has had a long-standing interest in climate change, but more as a questioner rather than a denier, which is the label climate activists assigned him after an earlier climate-questioning column. When Stephens was hired away from the editorial board of The Wall Street Journal in April 2017 to be the conservative voice on the opinion page of The New York Times, Stephens penned his first offering on the climate change debate - “Climate of Complete Certainty.”

Stephens was immediately attacked by readers and other left-leaning opinion writers. One such column was authored by Susan Matthews of Slate, a liberal publication. She titled her column “Bret Stephens’ First Column for the New York Times Is Classic Climate Change Denialism: It doesn’t outright reject the facts—which makes it all the more insidious.” She wrote the following about the column.

His debut column, “Climate of Complete Certainty,” published on Friday, supports my theory. The thesis of the column is that we would do well to remember that there are fair reasons why people might be skeptical of climate change, and that claiming certainty on the matter will only backfire. He casts himself as a translator between the skeptics and the believers, offering a lesson “for anyone who wants to advance the cause of good climate policy.” Technically, he doesn’t get any facts wrong. Painting himself as a moderate, he says it is “indisputable” that warming is happening and is caused by humans. From one angle, his point is quite familiar—it’s actually one that has been made somewhat frequently lately, and by liberal-leaning outlets, too: Shoving the certainty of fact down people’s throats is not the way to get them to change their minds, and it’s high time we try something else.

So, Stephens did not get any facts wrong – technically. But he sure got the morality of climate change wrong, for which he has never been forgiven by the populist left. That made his recent column that much more interesting because Stephens needed to do a mea culpa on climate change to satisfy his readers – those who signed petitions demanding his firing – and the climate scientists who issued open letters condemning his views.

Visiting Greenland – ground-zero of climate change - provided him the opportunity to atone for his 2017 transgression. The problem is that Stephens still has a difficult time accepting the “throw the switch and change the world to renewable power” mentality of climate activists. While this article was designed to set the stage for The New York Times’ coverage of the U.N. climate conference, Stephens kept raising doubts while also offering observations that seemed not to fully embrace the climate change movement, despite his acknowledging the fact of climate change and the role of humans in speeding it up. Stephens seemed to be in pursuit of an easy solution, which we would contend does not exist.

We found Stephens’ article to present a balanced discussion of the issues and possible solutions and their shortfalls. We were intrigued, however, when we reviewed the online version of the article, which featured many more spectacular landscape photos than in the print edition but kept acknowledging the difficult challenges in addressing climate change – challenges climate activists dismiss as minor inconveniences or ignore entirely.

As Stephens chronicled his visit to a Greenland glacier and his discussions with various climate scientists researching the speed and severity of climate change, we sensed he is becoming a “believer.” But then he throws in commentary by theoretical physicist Steven Koonin, a former under-secretary for science in the Obama administration’s Energy Department, and the chief scientist for oil giant BP, suggesting that much of global warming is caused by natural cycles in North Atlantic currents and temperatures as opposed to human-induced warming. Moreover, Koonin believes that over time these natural cycles will regress to the mean.

He also talked with Roger Pielke Jr., a professor of environmental studies at the University of Colorado Boulder, who Stephens labels a “non-alarmist rather than a skeptic because he readily acknowledges that the challenges associated with climate change, including sea-level rise, are real, serious and probably unstoppable, at least for many decades.” As Pielke told Stephens, “If we have to have a problem, we probably want one with a slow onset that we can see coming. It’s not like an asteroid coming from space.” Pielke endorses the idea of spending time and money on mitigation and adaptation steps, rather than wholesale economic restructurings.

But Stephens then wrote, “A few years ago, I would have found voices like Koonin’s and Pielke’s persuasive. Now I’m less sure. What intervened was a pandemic.” He went on to write: “Just as I had once scoffed at the idea of climate doom, I had also, for almost identical reasons, dismissed predictions of another catastrophic pandemic on a par with the 1918-20 influenza outbreak.” Ah, the pandemic changed the world! Or was it because we panicked, with leaders who believed only draconian actions would protect people? Stephens never answers that question.

Dealing with the pandemic mentality, Stephens went on to raise questions worthy of discussion, but which are seldom open to free debate. He wrote:

Here were some questions that gnawed at me: What if the past does nothing to predict the future? What if climate risks do not evolve gradually and relatively predictably but instead suddenly soar uncontrollably? How much lead time is required to deal with something like sea-level rise? How do we weigh the risks of underreacting to climate change against the risks of overreacting to it?

We were surprised by Stephens’ treatment of the renewable energy solution for climate change. Maybe we are too close to the challenges faced by renewable energy, so we assume everyone understands the issues. But we were shocked that Stephens was surprised because we would have thought his research on climate change and solutions would have unearthed what he learned from his dinner companion, Bo Møller Stensgaard, a geologist and CEO of Bluejay Mining, who plans to mine for copper, nickel, cobalt, zinc, and ilmenite in Greenland. Stephens wrote:

When I had dinner with Stensgaard, the mining executive, he mentioned a statistic that stunned me. For the world to achieve the net-zero goal for carbon dioxide emissions by 2050, according to the International Energy Agency, we will have to mine, by 2040, six times the current amounts of critical minerals — nickel, cobalt, copper, lithium, manganese, graphite, chromium, rare earths and other minerals and elements — needed for electric vehicles, wind turbines and solar panels. And we will almost certainly have to do it from sources other than Russia, China, the Democratic Republic of Congo and other places that pose unacceptable strategic, environmental or humanitarian risks.

The following two charts highlight the challenge Stensgaard brought to Stephens’ attention. The first chart shows the mineral needs in 2040 to reach net zero emissions as reported by the International Energy Agency.

Exhibit 3. World Waking Up To Mineral Challenge In Net Zero World SOURCE: New York Times

The second chart shows the challenge of the current global mineral processing industry. For countries in Europe and North America to develop their renewable energy supply chains, there will be significant investment needed in mineral processing capacity. What upsets many environmentalists is that mining and mineral processing are not only energy intensive, but they are also water intensive. These are not “clean” industries by any imagination, which fits with a key conclusion of Stephens’ article.

Exhibit 4. China’s Minerals Processing Dominance Is A Real Challenge SOURCE: IEA, DOE, Bloomberg, RBC Capital Markets

As Stephens noted following his dinner discussion:

A world committed to net zero will need many more Disko Islands to supply its “clean” energy needs. I put the word “clean” in quotation marks because the term is a misnomer. As in everything else in life, so too with the environment: There is no such thing as a free lunch. Whether it’s nuclear, biofuels, natural gas, hydroelectric or, yes, wind and solar, there will always be serious environmental downsides to any form of energy when used on a massive scale. A single industrial-size wind turbine, for instance, typically requires about a ton of rare earth metals as well as three metric tons of copper, which is notoriously destructive and dirty to mine.

He also commented on points about our energy usage made by Vaclav Smil, the Canadian polymath whose most recent book, How the World Really Works, should be required reading for policymakers and anyone else interested in a serious discussion about potential climate solutions. Smil demonstrates how much more dependent our society and economy are on fossil fuels, and that the transition to a cleaner fuel will take decades not years. We agree with Stephens’ endorsement of Smil’s book for those charged with guiding our energy transition.

As we mentioned earlier, the online version of Stephens’ article offered an interesting mosaic contrasting the environmental conditions he had observed with important observations. There were seven mosaics, each beginning with a Greenland landscape photo carrying the caption: “Yes, Greenland’s Ice Is Melting.” The following are the observations that followed each landscape photo and were superimposed on an appropriate photo.

But we need to recognize clean energy’s limitations.

But we’ve gotten better at mitigating climate disasters.

But we need to accept economic growth as a benefit.

But we need solutions that align with human nature.

But we need to avoid alarmist activism.

But the market, not the state, will solve the problem.

The conservative movement needs to set an example for its children and prepare for the future.

Stephens’ conclusion about how we need to deal with climate change is summed up in the following:

In the long run, we are likelier to make progress when we adopt partial solutions that work with the grain of human nature, not big ones that work against it. Sometimes those solutions will be legislative — at least when they nudge, rather than force, the private sector to move in the right direction. But more often they will come from the bottom up, in the form of innovations and practices tested in markets, adopted by consumers and continually refined by use. They may not be directly related to climate change but can nonetheless have a positive impact on it. And they probably won’t come in the form of One Big Idea but in thousands of little ones whose cumulative impacts add up.

We suspect the climate change community will continue to be dissatisfied with Stephens’s climate position. They want the state to force, not nudge the private sector to embrace and commit to clean energy while ignoring the physical challenges and the time and cost required to make such a transition. Unfortunately, the social and political climate is very different from 1962 when President John F. Kennedy gave his famous “We Go to the Moon” speech at Rice University. Kennedy stated:

We choose to go to the moon. We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win, and the others, too.

Stephens’ article with its seven observations should be a starting point for deciding how best to address the climate change issue. Developing pathways forward rather than merely embracing goals is critical. We fear, however, this challenge may be a “bridge too far” for many people.

COP27 Struggles For Relevance In Energy-Challenged World

As you read this issue of Energy Musings, we will be early in week two of the Conference of the Parties of the UNFCCC, or COP27. This marks the 27th United Nations Climate Change Conference that brings climate activists, world leaders, government bureaucrats, and the media together to discuss the state of the world’s environment and what to do about limiting carbon emissions, climbing temperatures, rising sea levels, melting glaciers, and subsidizing developing countries for the cost of not developing domestic fossil fuel-powered energy systems.

COP27 can already claim several notable achievements. First, its past shows have convinced climate activist Greta Thunberg to skip COP27 having decided that attacking capitalism is a more lucrative gig than attacking governments over carbon emissions. Secondly, regarding cutting emissions, COP27’s most significant win was getting U.S. Special Presidential Envoy for Climate John Kerry to fly commercial airlines to the Sharm el-Sheikh conference center in the Southern Sinai province of Egypt, rather than his private jet. Fewer emissions. Not many followed Kerry’s lead.

President Joe Biden was there seeking recognition as the “climate president.” We are sure he welcomed former Vice President Al Gore calling him a “genuine climate hero.”He put the U.S. back into the Paris climate accord, secured billions in green energy funding, killed fossil fuel projects, and bailed out Europe with U.S. LNG.Will Biden work climate miracles on China President Xi Jinping when they meet next week?Gasoline prices no longer matter.

Exhibit 5. Strategically Located Sharm el-Shiekh And COP27 SOURCE: wikipedia.com

Sharm el-Shiekh’s location and historical importance likely played a role in its selection to host COP27. The city is on a promontory overlooking the Straits of Tiran at the mouth of the Gulf of Aqaba. Given its location, it has been transformed from a fishing village into a major port and naval base for the Egyptian Navy. The city and holiday resort is a significant center for tourism in Egypt, while also attracting many international conferences and diplomatic meetings, many of which involved International Peace Conferences.

The name Sharm el-Shiekh, “bay of the wise,” seems an appropriate designation, until you know it is also known as the “City of Peace,” referring to its history of hosting peace conferences. This moniker may be very appropriate for COP27, given that following two days of preliminary negotiations, the topic of reparations for developing economies was put on the program. Forget “Where’s the beef?” Although beef may be a target, this is about “Where’s the money!”

A week ago, The New York Times article on the start of COP27 was titled: “Poorer Nations Pressing Rich Polluters to Pay Up.” That is referencing the 2008 agreement for developed economies to provide $100 billion in aid per year to developing economies to help offset the cost of developing a renewables-based energy system. But it encompassed more. There have been numerous commitments by rich nations to help poorer countries deal with climate change. But the sums received have consistently fallen below the commitments.

Exhibit 6. Recent Shortfalls In Developed Economies’ Climate Payments SOURCE: New York Times

Getting the debate over “loss and damage” on the agenda was the work of Egypt and Pakistan, who are leading a group of 77 developing nations. Simon Stiel, the U.N, climate chief was quoted in the article saying that getting this debate on the agenda “bodes well” for a compromise by the end of the summit. There is Biden’s opening – somebody needs money and the U.S., and the western countries have the printing presses.

Sharm el-Sheikh has an interesting history. It was conquered by Israel during the Suez Crisis of 1956 and returned to Egypt in 1957. A United Nations peacekeeping force was stationed there until the 1967 Six-Day War when Israel reoccupied it and kept control until the Sinai Peninsula was returned to Egypt in 1982 after the Egypt-Israel peace treaty of 1979.

Last year in Glasgow at COP26, the wealthy nations agreed to provide $40 billion per year by 2025 to help poorer countries with climate adoption measures. That is less than one-fifth of what the United Nations estimates is needed. That estimate was what fueled the push for the loss and damage debate being added to the agenda, which Kerry agreed to, although that does not ensure a fund will be created. Politicians from various European countries look at the state of the U.S. midterm election projections and worry about agreeing to a climate fund and being left holding the bag if the next U.S. president repudiates the idea.

The New York Times article highlighted the challenge. The article stated:

Perhaps the biggest challenge is that each side is dug in: Developing countries and activists view loss and damage as a matter of justice while wealthy nations blanch at the idea of accepting blame.

Mr. Kerry acknowledged the United States, which has burned coal for electricity since the 1880s and is the biggest historical emitter, bears responsibility for climate change. But he also argued that by the 1980s, when governments widely agreed that carbon dioxide emissions from oil, gas and coal were warming the planet, emerging nations were burning fossil fuels, too.

“If you want to measure from there, at the rate we’re going, a couple of countries have the ability to eclipse our historical emissions,” Mr. Kerry said. “So yeah, we burned coal and we did this. But guess who else burned coal? Every single one of those other countries. Are they absolved?”

The accompanying chart showed the historical emissions of countries since 1850. The ranking of a country’s vulnerability to the negative effects of climate change comes from the vulnerability index developed by the University of Notre Dame.

Exhibit 7. Countries Ranked By Emissions and Climate Vulnerability SOURCE: New York Times

We have no idea where this debate will land, but we are certain that the developing countries who successfully got the loss and damages topic on the agenda will not settle for ephemeral commitments. This is highly likely given the geopolitical developments of the last year and the probability that energy turmoil will last for several more years, at least, causing inflation and higher interest rates to pressure government budgets. As The Wall Street Journal described the COP27 challenges at the conference’s start, given geopolitical events and concerns: “Last year’s United Nations climate conference in Glasgow was full of disagreements, but it may be a high-water mark for international cooperation on the issue.”

The writer went on to explain that the energy crunch has created challenges for the transition from fossil fuels to renewables, exacerbated by the Russian invasion of Ukraine. This has highlighted energy shortages, which may be about to worsen with the European ban on purchases of Russian oil and refined products, as well as the ban’s restrictions against financing, shipping, and ensuring the Russian cargos seeking to reach other regional buyers. This ban could disrupt the global oil and gas markets causing a spike in prices as buyers compete for supplies.

The near-term outcome of European government responses to the loss of Russian natural gas supplies has been sky-high natural gas and electricity prices, which have only recently dropped as the continent’s gas storage capacity has reached capacity and moderate temperatures have limited heating demand. Switching to oil and coal has also reduced Europe’s gas needs. The high energy prices, however, have taken a toll on various countries’ manufacturing sectors as plant products become non-competitive pricewise, costing employment at a time when inflation is pressuring family budgets. To offset high energy costs, inflationary pressures, and weakening economies, governments are forced to step up cash subsidies to homeowners and employers.

As The Wall Street Journal writer put it, “Few believed the transition away from fossil fuels would be easy, smooth or cheap.” The problem is that many political leaders (lacking any understanding of energy markets) and climate activists did believe the transition would be easy, smooth, and cheap. In many cases, these believers are doubling down on the push for renewables, seeing the current problems as “transitory,” the infamous phrase used by many central bankers to describe the rise in inflation that began in 2021 and accelerated earlier this year.

Speaking at a New York Times event at COP27, former U.K. prime minister Boris Johnson declared climate action as “one of the most important collateral victims” of Russia’s invasion of Ukraine. “Per capita, people in the UK put a lot of carbon in the atmosphere,” said Johnson. “But what we cannot do I’m afraid is make up for that with some sort of reparations, we simply do not have the financial resources.” He urged world leaders to not yield to “energy blackmail.” He believes net zero carbon emissions will need to be achieved through investment from the private sector in partnership with the international community rather than by taxpayers in western countries.

Johnson seemed to be teeing up the reported plan being promoted by Kerry to develop a new framework for carbon credits to be sold to businesses. The proceeds from the sale of these carbon credits would fund new clean energy projects. The design of the plan was spelled out in a Financial Times article. Regional governments or state bodies would earn carbon credits by reducing their power sector’s emissions (shutting coal-fired plants and increasing renewable energy capacity).The credits would be “certified” by an independent, as-yet-unspecified, accreditation body. Companies would then be able to buy these credits to offset their carbon emissions. Kerry said the scheme would be voluntary, but he hoped the private sector could be “enticed” to the table because it would offer the most-polluting companies a way to address their emissions. According to the article, many of the details have not yet been worked out, which makes getting support a challenge. If we must guess, COP27 will end with a lot of “feel good” statements but little substantive progress. It will end much like COP26 did just as the energy crunch was emerging. Countries are facing even greater economic and social pressures from current energy and inflation forces than they did in December 2021. Energy security trumps climate change.

October’s Stock Market Harvest Was Very Good For Energy

As we head towards the Thanksgiving holiday, we note that October is usually the month that fall crop harvesting begins. Based on the stock market’s October performance, it was a very good harvest for investors. Of course, 2022’s prior nine-month returns were dismal for equity investors. However, if you were fortunate enough to be invested in energy stocks since January 1st, and continued to hold them through October, you have enjoyed very positive returns.

The month of October was the 10th highest monthly stock market performance for the Dow Jones Industrial Index (DJIA) since the beginning of 1928. The chart below from Bespoke Investment Group lists the top 29 monthly performances for the DJIA beginning the year before the Wall Street Crash on Black Tuesday, October 29, 1929. Also known as the Great Crash, the loss of which signaled the start of the Great Depression, Black Tuesday saw 16 million shares, a record, trade hands that day, causing the ticker tape which reported stock trades to run hours late, meaning people had no idea of current stock prices as trading was underway. At the end of the day, the market had lost nearly 12% of its value. When combined with the losses from Black Monday, the prior day, the DJIA lost 23% of its value from the market’s close the prior Friday to Black Tuesday’s close.

Exhibit 8. Best Monthly DJIA Gains Since 1928 SOURCE: Bespoke Investment Group

The strong performance of the DJIA in October was not reflected in the performance of the Standard & Poor’s 500 Index because of the difference in the composition of the respective indices. For example, the S&P 500 Index increased by 8.1% in October compared to the nearly 14% gain posted by the DJIA. With only 30 stocks versus 500, the importance of each stock changes significantly. For example, in July, the S&P 500 Index rose 9.2%, but the DJIA was only up 6.7%. The S&P 500 Index lost 9.2% in September, after losing 4.2% in August, however, the DJIA fell only 4.1%, but was off by 8.8%, respectively.

Exhibit 9. Monthly S&P 500 Index Sector Performance For 2022 SOURCE: S&P, PPHB

As we see in the S&P 500 Index monthly sector performance matrix for 2022 (above), the energy sector has been among the top-performing sectors all year. It was only in June when energy was the worst performing sector, and in September when it was in the middle that energy did not outperform. Energy was among the top three sectors for the other eight months of 2022 with only one month landing in third place.

The following two charts (below) from Yardeni Research, Inc. show the relative performances of sectors for October and 2022, so far this year. The aqua line in the October 2022 chart shows just how significant energy’s outperformance was. Although energy began the month outperforming all other sectors, its outperformance emerged in the first few days and then continued through the balance of the month. From about the middle of October, the overall stock market began to rally, as reflected by the increases posted by almost every sector. However, energy’s performance also improved and for a while was greater than for the other sectors.

Exhibit 10. October Was A Very Good Month For Energy Stocks SOURCE: Yardeni Research

The next chart shows the performance of the S&P 500 Index sectors for 2022 through October. No sector other than energy has posted a positive return in 2022, which makes the huge outperformance of energy that much more dramatic. This chart, especially energy’s performance in the red dotted line, highlights how certain months marked substantial corrections. However, even after the June drop, energy continued its outperformance and then soared beginning in late September and continued through October. It is always important to note that past performance says nothing about what future performance might be.

Exhibit 11. Energy Has Massively Outperformed Other S&P Sectors This Year SOURCE: Yardeni Research

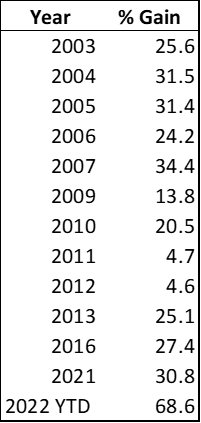

As we showed above, with the positive 25% return achieved in October, the energy sector had its best monthly performance in 2022 so far, beating May’s strong 16% gain. Year-to-date 2022 has energy as the only S&P 500 Index sector of its 11 sectors posting positive performance. Its 68.6% return for the first 10 months of 2022 stands out relative to the history of the sector’s performance. The table below shows the years when the energy sector posted a positive return during the 19 years 2003-2021. The huge gain so far this year stands out. It is more than twice any prior annual gain.

Exhibit 12. Position Energy Years SOURCE: S&P, PPHB

What is impressive is the five consecutive years of positive performance during 2003-2007. Over that period, energy’s cumulative gain was 147.1%. If we add the 2022 year-to-date performance to that of 2021, energy has posted a 99.4% gain, so only two-thirds of the earlier period’s performance, but this is after only 22 months.

The recent performance is not only impressive but fits with the investment thesis of Goldman Sachs’ commodity strategist Jeff Currie, who calls today’s environment a “Commodity Super-Cycle.” He refers to what is happening in the stock market as “The Revenge of the Old Economy.” By that, he means, the historical pattern of periodic over- and under-investment in commodity businesses leads to subsequent periods of supply surpluses and shortages relative to global demand. Thus, you wind up with commodity prices that are noticeably higher or lower than their long-term average price. The relative performance of commodity prices drives the earnings of those companies involved in those commodity markets.

Currie, in a recent interview on CNBC’s Squawk Box show, made the point that when the under-investment era leads to a super-cycle, it tends to last 10-12 years. Concerning crude oil prices, he cited the 1970s cycle, which started in 1968 and ended in 1980, and the 2000s cycle which began in 2002 and ended in 2014.He believes the current super-cycle began in 2020 following the collapse in oil demand due to the economic lockdowns for Covid-19. In his view, this cycle could last until the end of this decade.

It is important to understand that Currie does not believe a cycle produces a straight-line increase in commodity prices, but rather an extended period of elevated prices that may spike as well as suffer sharp declines. However, over the cycle’s life, the companies in the industry will generate substantial profits that will lead to outstanding stock market performance for their shareholders. On that point, Currie pointed out that currently ExxonMobil and Microsoft are earning about the same 9% cash returns on investment. However, ExxonMobil trades for 25% of the valuation of Microsoft. Currie noted that in 2000 when technology stocks were soaring, “Microsoft was on top, and ExxonMobil was nowhere to be found.” In 2010, as energy was booming, “ExxonMobil was on top, and Microsoft was nowhere to be found.” Today’s relative valuations of the two companies point to Microsoft being on top and ExxonMobil being nowhere. Currie asks: where will ExxonMobil be relative to Microsoft in 5-10 years?

Exhibit 13. How The Weighting Of Energy Stocks In S&P 500 Index Have Changed SOURCE: S&P, PPHB

One last point about how the changing environment for traditional energy is impacting the stock market. How a sector is viewed – earnings results and industry outlook – is usually reflected in the performance of stocks and how their market capitalizations expand or contract. The chart above shows the weighting of energy in the S&P 500 Index since 1979. As Currie noted, 1980 marked the end of the 1970s super-cycle for oil and appropriately, energy stocks were at their peak weighting. Energy’s weighting continued to decline, albeit leveling out for a while in the latter 1980s and early 1990s before finally bottoming in 2003. Remarkably, that was the second year of the next super-cycle. As that cycle unfolded, energy’s weighting rose, only to be hit by the fallout from the 2009 Great Recession following the financial crisis. The weighting continued to erode, although it remained elevated compared to the early slump during the 1990s. What we see after 2014 is a sharp decline in weighting that only bottomed in 2020. It has since recovered and at the end of October had climbed back above 5%. This market weighting increase is in keeping with energy’s growing importance to S&P 500 Index earnings at around 9%. Will we see another doubling of energy’s weighting within the index as happened between 2003 (6.1%) and 2011 (12.4%)? If so, possibly energy’s weighting increases from 3% to 7-8%. That will further signal strong stock market performance for energy, as reflected in the following chart matching annual energy stock performance and weighting along with notations about macro events.

Exhibit 14. Stock Performance Drives Energy Weightings SOURCE: S&P, PPHB

As we noted above, there was the 2003-2007 period when energy’s market performance was outstanding and drove the sector’s weighting up. Energy investors would certainly like to see a repeat of that period. But it will come with constant attacks from the current president and his administration and his fellow Democrat politicians. Maybe their attacks and regulatory and taxation threats against the oil industry will provide the proverbial “wall of worry” associated with stock market performance. Through November 10th, energy and materials continue to lead.

Random Energy Topics And Our Thoughts

Virginia Offshore Wind Project One Step Closer To Construction

A week ago, Dominion Energy Virginia, a subsidiary of the multi-state power company Dominion Energy, which proposes to build the nation’s largest offshore wind farm off the coast of Virginia, announced a settlement agreement with objectors to the project. The Coastal Virginia Offshore Wind (CVOW) project is planned to have 176 turbines, each rated at 14.7 megawatts (MW) of generating capacity, creating a wind farm with a nameplate generating capacity of 2.6 gigawatts (GW). The turbines, standing 800 feet tall will be positioned on a federal lease the company holds located 27 miles off the coast of Virginia Beach, Virginia, but sufficiently far away from the coast that they will not be seen from local beaches.

CVOW is scheduled to begin construction in 2024 and be operational in late 2026 at a cost of $9.8 billion. The project’s cost estimate had jumped last fall by $2 billion from the initial projection. Many observers were shocked at the magnitude of the increase, and Virginia customers feared the magnitude of the cost increase might signal further cost issues that would drive electricity bills higher than presently projected under the latest application for approval of CVOW.As a result of these financial concerns, the parties who recently agreed to the settlement agreement had been intervenors during the hearings held by the Virginia State Corporation Commission (SCC) earlier this year. The settlement agreement was between Virginia Electric and Power Company, the operating arm of Dominion Energy Virginia (Dominion), the Commonwealth of Virginia Office of the Attorney General representing the customers in Virginia, Walmart, Inc., the Sierra Club, and Appalachian Voices.

Following the SCC hearings, the commission issued its Final Order on August 5, 2022. That order included the imposition of an “operating performance guarantee.” That guarantee required Dominion to calculate the CVOW utilization rate on a rolling three-year average and if the rate fell below 42% of the nameplate generating capacity, the cost of the incremental power necessary to meet that average would be entirely borne by the company.

At the time of the SCC approval, Dominion Energy’s Chairman, President, and Chief Executive Officer Robert Blue told analysts on the company’s second-quarter earnings call that the performance guarantee was “untenable.” He raised the possibility Dominion might not go forward with CVOW under the terms of the project’s approval.

Dominion filed a petition requesting a reconsideration of the SCC’s operating performance guarantee, which was granted. The Office of the Attorney General and other intervenors filed responses to Dominion’s petition, to which the company subsequently responded. This led to private negotiations among the various intervening parties.

In Dominion’s petition, it cited that “the Commission lacks authority to impose a performance guarantee on this Project of the nature directed and it is unreasonably broad in scope and unreasonable and improper in application.” Blue had warned that “Effectively, such a guarantee would require [Dominion] to financially guarantee the weather, among other factors beyond its control, for the life of the project.” He further said, “There are obviously factors that can affect the output of any generation facility, notwithstanding the reasonable and prudent actions of the operator, including natural disasters, acts of war or terrorism, changes in law or policy, regional transmission constraints or a host of other uncontrollable circumstances.” In his view, the performance guarantee creates a financial one-way risk for the utility and is “inconsistent with the utility risk profile” expected by investors. These points were included in the petition asking for a reconsideration of the SCC’s approval.

The settlement agreement, the terms of which were filed by the Office of the Attorney General with the SCC, addressed allocations for project cost overruns and elimination of the performance guarantee, which is replaced with a requirement to report and explain the failure to reach the 42% average output threshold.

Concerning the cost overruns, the parties agreed to the following sharing structure. Initially, customers bear 100% of the cost increase, then to be shared 50/50, and for the third tier, the company assumes the full cost. The schedule is shown below.

Exhibit 15. New Plan For Sharing Potential VCOW Cost Overruns SOURCE: Office of the Attorney General

Initially, there was a $500 million contingency fund in addition to the $9.8 billion cost of the wind farm. Dipping into the contingency fund would be reported to the SCC and was anticipated to be fully borne by customers. Therefore, the need to justify the cost increase to the SCC will be automatically resolved by this agreement. Equally sharing the next $1 billion in cost overruns between customers and the company becomes a win for Dominion since it doesn’t need to seek approval from the SCC. For Dominion to assume the next $2.4 billion in cost overruns suggests that it does not believe the project’s cost will exceed $11.3 billion, $1.5 billion over the estimated cost of CVOW. If the project costs $11.3 billion, Dominion has only been exposed to a third of the increase when it might be subject to two-thirds or more. In an inflationary environment, costs have suddenly become a serious issue for these early offshore wind projects.

Regarding the operation performance guarantee, the parties agreed to a meaningful modification. The following comes from the filing with the SCC by the Office of the Attorney General:

2. Operating Performance Provisions: Beginning with the commercial operation of the Project’s final wind turbine and extending throughout the thirty-year expected service life of the Project, the Company will report average net capacity factors for the Project on an annual basis in its Rider OSW update proceeding. To the extent the Project’s net capacity factor, as measured at the aggregate turbine level, is less than 42% on a three-year rolling average basis, the Company will provide a detailed explanation of the factors contributing to any deficiency.

To the extent the Commission determines that any deficiency has resulted from the unreasonable or imprudent actions of the Company, the Commission may determine a remedy at that time to address any incremental energy or other costs resulting from such actions.

Because of the seasonal nature of offshore wind, we were somewhat surprised by Dominion’s pushback to the 42% utilization factor guarantee. It appears Dominion’s management has little confidence in the performance of CVOW sustaining that output. One would think that over 12 months the average utilization factor could be attained. Moreover, the SCC plan gives Dominion a three-year averaging period. However, as we have shown, the only functioning U.S. offshore wind farm, Block Island Wind, has yet to achieve its target output during any of the wind farm’s five years of operation. So, what will the SCC commissioners say to Dominion executives when they come in to explain why CVOW did not meet its output target and say, “the wind didn’t blow.”

Maybe we are missing something, but the above scenario is exactly why the SCC designed the performance guarantee to protect Virginia customers. That is an important role for the SCC. Who can project what the purchased power required to make up for CVOW’s shortfall will cost? This new agreement seems to ensure that the cost burden will fall on customers.

The CVOW has been put forward to meet Virginia’s Clean Energy Act’s target of a state energy system powered 100% with clean energy by 2050. The act was signed into law in 2020. The key terms of the plan are listed below.

Dominion and Appalachian Power, two large investor-owned utility companies in the state, need to retire their carbon-emitting electrical generation facilities. The dates by which they need to do so depend on the type of plant (i.e., whether they burn coal, natural gas, or oil) and the size of the facility.

The net metering cap for residential customers will be bumped from 20 kilowatts (kW) to 25 kW; residential Dominion customers can also size their system to meet up to 150% of their annual electricity demand.

The bill establishes specific MW targets for offshore wind, solar, and energy storage.

There are new energy efficiency standards for utilities, including programs to support low-income populations.

The RPS includes a solar carve-out for Dominion, mandating that at least one percent of its renewable energy generation must come from distributed solar panel systems less than 1 MW large.

To appreciate the pressure Dominion is under, one only needs to look at the state’s electricity market. The following chart shows the 2021 data for electric generating capacity and output by fuel source for electric utilities and the Virginia electricity industry in total. Like many other states, natural gas is the primary fuel source for generating electricity. Nuclear also hits way above its weight in power production given its share of generating capacity. Renewables represent a small component of the totals.

Exhibit 16. Natural Gas And Nuclear Provide Most Power In Virginia SOURCE: EIA, PPHB

In our view, solving the possible cost overrun sharing issue is fine. It reflects the unknown cost world Dominion has entered, which it previously assured the SCC it had covered with fixed-price contracts with suppliers and hedges for currency risk on foreign equipment purchases. Letting Dominion off the hook the SCC installed to protect Virginia customers against long-term performance issues of offshore wind power seems a dereliction of responsibility by the SCC.

Based on our contacts with the SCC, the commissioners will be holding a hearing on the proposed agreement, but no date has been established. A paragraph in the agreement specifies that it must be adopted in full, or it is void, although the signers of the agreement can agree to amend it to address concerns raised by the SCC. The August surprise of the performance guarantee was the first attempt by a utility regulator to level the playing field between renewable energy developers and electricity customers. Maybe the SCC will surprise Dominion again.

Misleading Chart On EVs, But Conclusion Remains The Same

The chart below was included in one of our friend Jim Wicklund’s recent weekly emails. He wrote about the chart:

Ratchet Down. Is there enough cobalt and lithium? Why is the average cost so high? What is the rate of adoption? As the chart below shows, concern about hitting targets is justified. It has been happening for years.

His commentary related to the chart was spurred by observing the lower projections for 2050 in the 2021 and 2022 forecasts compared to the earlier ones of 2017, 2018, and 2019. This was certainly a valid conclusion, and much is being made about electric vehicle (EV) costs and questions about future supplies of the critical minerals needed for the batteries to power the projected surge in EVs as some states have mandated their use.

Something struck us as odd about the chart. It is labeled “% Electric Vehicle Sales in U.S. (& EIA Revisions).” But as we looked at the percentage figures for the earlier projections, we wondered about them. It turns out that the forecasts are for “Light-Duty Vehicle Sales: Percent Total Alternative/Electric Sales.” These graphs represent the forecasts for alternative-fueled vehicle sales by year in each of the Energy Information Administration’s (EIA) Annual Energy Outlook (AEO) for the years 2010-2022. So, we went to the EIA website to find the data.

Exhibit 17. Misleading Chart Title But Correct Conclusion About Forecasts SOURCE: Jim Wicklund

For many people, a discussion about alternative-fuel vehicles is all about EVs. That is a mistake, as there are numerous alternative-fuel vehicles on the roads. The AEO forecasts project the number of new vehicle sales for the following categories of cars and a similar list of light-duty trucks.

Exhibit 18. Vehicle Sale Categories SOURCE: EIA, PPHB

While there are several categories of EVs, there are also hybrid vehicles that involve electric (battery) with conventional fuels, as well as ethanol flex-fuel, natural gas, propane, and fuel cell-powered vehicles. When we think of alternative-fuel vehicles, we seldom think of this wide range of choices.

As the chart seemed to confuse the concept of alternative fuel with electric vehicles, we decided to plot the history of AEO projections for both categories. As the two charts below show, both categories showed similar trends of lower long-term forecasts in 2021 and 2022 compared to the earlier 2017-2019 projections. The red dotted line shows where we are timewise in the forecasts, while we have also made the most recent projection (2022) a dashed line to make it easier to identify.

Exhibit 19. Recent Projections Of Alternative Vehicle Sales Have Fallen SOURCE: EIA, PPHB

Exhibit 20. Is Trend Of Lower EV Sales Projections Soon To Be Reversed? SOUCE: EIA, PPHB

In the case of alternative-fuel vehicle projections, we see how more recent forecasts are well below the very early projections of 2010 and 2011. Was that due to the enthusiasm people expressed about alternative-fuel vehicles? Those were the days when ethanol was being promoted, as well as compressed natural gas. In both cases, the hype behind each of these fuels was that they were cleaner than conventional gasoline and diesel. The enthusiasm for both fuels has waned at the same time demand for battery electric vehicles (BEV) has grown. We have been optimistic about the future of electric-hybrid vehicles, such as those promoted by Toyota Motor Corporation, which remains the primary thrust for the company today.

It is important for people viewing these charts to pay attention to the fact that they are showing the trend in the percentage of new vehicle sales. That is especially important in assessing the projections in 2050, given the policies being adopted by various states to ban the sale of conventional internal combustion engine (ICE) vehicles after 2035. When we consider the 2022 projection for BEVs, their share of new vehicle sales in 2050 will be slightly under 10%. However, when we consider the share represented by alternative fuel vehicles, it is closer to 25%, but a substantial portion of that share is made up of fossil fuel-dependent vehicles.

At the same time as the mix of new vehicles sold is shifting, we also must consider the expectations that consumer attitudes toward vehicle use and vehicle ownership are shifting. Therefore, we thought it would be interesting to look at the AEO2022 forecast for vehicles in 2050 compared to the baseline data from 2021. That data is contained in the next chart.

Exhibit 21. How Vehicle Mix Is Projected To Change Over Time SOURCE: EIA, PPHB

Note that nearly 30 years in the future, the EIA expects new vehicle sales (cars and light-duty trucks) to be roughly 400,000 vehicles greater than those sold in 2021. Analysts would say that 2021 vehicle sales were constrained by the recovery from the Covid pandemic, and the shortage of semiconductor chips needed for controlling and powering vehicles. Importantly, the EIA does project a major shift in consumer attitudes toward ICE versus EV ownership, but how much of that shift is related to mandates rather than customer decisions?

As the chart shows, the share of conventional gasoline-powered vehicles declines from 87% to 74.5%, which equates to approximately 1.6 million fewer ICE vehicles. That means a significant increase in the share of alternative-fuel vehicles. Total BEVs sales will more than quadruple from 335,500 to 1.5 million vehicles. Equally significant is the 50% increase in the sales of electric hybrids and plug-in electric hybrids. The total of those hybrids exceeds projected BEV sales, although the relative hybrid market size advantage over BEVs shrinks noticeably between 2021 and 2050 (from nearly 3-1 to only about 15% greater). That trend should not be surprising given the push by states and the federal government to subsidize and promote BEVs, along with the investment and business strategy shifts of the automobile manufacturing companies.

While forecasting is hard and often frustrating (missing a market trend shift), the sobering conclusion of this analysis of the history of the EIA vehicle sales by fuel type forecasts is that we are not projected to wildly change our vehicle purchasing habits. People might question what vehicle buyers will do when only BEVs are in the showrooms of auto dealerships as Presidential Envoy for the Environment John Kerry recently pointed out will happen in 2035. Maybe the EIA forecasters take that statement with a large grain of salt.

Ominous Challenges For Global Economy, Society, And Energy

Two charts reflect energy trends with ominous implications for the global economy and European societies. The chart below shows how LNG flows to Europe have changed this year, leaving previous customers seeking other supplies or switching to other fuels. This will be costly for countries as well as potentially damaging to the climate if countries choose coal over gas.

Exhibit 22. LNG Flow Changes Have Costly Implications For Some SOURCE: Bloomberg

The next chart shows energy poverty in European countries in 2021. We have a hard time imagining how this chart will look after 2022’s data is collected, given the history of natural gas and electricity prices this year due to the Russia/Ukraine war. A sad view of the future.

Exhibit 23. Energy Poverty In Europe Will Be Much Worse In 2022 SOURCE: Statista.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.