Energy Musings - June 14, 2022

Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

Energy Stocks: Confounding Yet Still Rewarding

May continued Energy’s run as the sector with the top returns in the overall market. June seems to be continuing the trend, as Energy remains cheap on many investment metrics.

Is ESG A Religion, A Helpful Guide, Or Just A Scam?

The ESG movement ran into a wall at a recent FT conference. A questioning presentation cost the presenter his job. Without clear standards and metrics, ESG investing has underwhelmed.

Changing The Climate Debate – Epstein’s Fossil Future

After his Moral Case bestseller, Epstein’s new volume challenges in depth the anti-impact experts’ narrative that CO2 only creates bad outcomes. He reorients the framework discussion.

Random Energy Topics And Our Thoughts

Rhode Island’s Electricity Fuel Sources

Energy And Food Markets Need To Worry About Hurricane Season

Chronicling Another Frustrating EV Long-Distance Trip

Connecticut Considers Hiking Diesel Fuel Tax?

Amazing Rise In Oil Prices And Its Impact On Oil Demand

Energy Stocks: Confounding Yet Still Rewarding

The super-strong price performance of energy stocks since global economies began reopening last year continues to reward investors who climbed aboard the movement early. The rebound has been a welcomed respite for long-term energy investors who rode the industry’s cyclicality to poor financial returns. Those investors who distained energy’s value proposition remain confounded by share performances, just as their favorite green energy investments have crashed. For many of these anti-fossil fuel investors, stomaching investing in an industry under relentless attack and predicted to have a short future is difficult. The duration of the energy industry’s rebound is open to debate, but the physical realities of the world’s economy suggest oil’s future will last longer than environmental activists and anti-fossil fuel politicians wish.

May marked the third month in 2022 where energy was the top performing sector within the Standard & Poor’s 500 Stock Index. The other two months, energy was the second-best performing sector. One of those two months is the only one of 2022 in which energy declined – minus 1.5% ‒ but that was in a month when the entire S&P index fell 8.7%. In fact, only one sector that month – consumer staples – generated a positive return (+2.6%). Year to date through May 31, 2022, energy has posted a 58.5% gain, topping the second-place utilities sector with its 4.6% return. That is better than a 12.5-times outperformance.

For those heavily invested in energy shares, they are enjoying 2022. Of course, many suffered with years of woeful returns, as managements destroyed shareholder value with decisions to over-invest in drilling wells that built large surplus productive capacity and drove oil and gas prices to low levels. For oilfield service companies, their managers threw money at new equipment to be able to service the surge in oilfield activity, only to suffer from poor pricing and negative returns on investment when activity contracted. We can see the outcome of this history clearly when we examine the annual S&P 500 sector performance over the past 19 years. (See chart below.) To the record of annual sector performance, we have added the 1Q2022 sector performance, along with the five-month returns through May 2022.

While there is a high likelihood of energy being the top performing sector for all of 2022, that would mark only the second time energy would experience back-to-back years of top-performance. Such a positive performance would be some solace for the horrific losses energy investors experienced during those five of seven years (2014-2020) when energy was the worst performing sector. As energy demand was destroyed in 2020 with pandemic-induced economic shutdowns, the idea that energy shares could rise from the dead, let alone experience a massive revival on Wall Street was beyond expectations.

Stock price performance often rises on ‘walls of worry’ about the health of an industry’s fundamentals. Energy is no stranger to such walls, but its performance this time was driven by sharply rising crude oil and natural gas prices that were responding to long-term fundamental trends that most stock market professionals misunderstood. It was more than just a temporary imbalance between oil supply and demand. It was the growing realization of the impact of a long period of underinvestment in the energy industry. New production was not growing. At the same time, investment in sustaining output was struggling. Adding to the mix was needed increased infrastructure investment, especially in a world increasingly dominated by geopolitical tensions that was forcing a revamping of historical energy trade patterns. The reality of energy being a long-cycle industry was driven home to investors when energy share prices soared as earnings prospects brightened and the longevity of the cycle was assured. But what is next for energy?

Exhibit 1. Energy Has been The Top Performing Sector Since 2021 SOURCE: Standard & Poor’s, PPHB

Let us start with a perspective about where energy stands in today’s investment world. During the 2014-2020 span of woeful energy stock market performance, energy’s weighting within the S&P 500 Stock Index fell to its lowest level ever. It happened at the end of 2020’s third quarter when energy’s weighting sank to 2.2% of the S&P 500, almost half a percent below the real estate sector’s weighting, to become the smallest index sector. That slump was not surprising given the global oil glut, which OPEC+ was trying to manage while the domestic energy industry was experiencing a wave of company bankruptcies not seen since the last industry bust in the 1980s. Energy’s 2020 weighting slump came at the same time technology’s weighting was rising to nearly 28%. Although energy soon recovered some of its lost market weighting, it did so as technology’s share slid. However, five quarters later, energy was fighting to hold on to its half a percentage point weighting gain while technology was climbing to a new peak of over 29%.

This year’s market and sector performance has brought a dramatic change in the weightings of energy and technology. Since the start of 2022, energy’s weighting has increased by two percentage points, just as technology’s weighting has dropped by an equal amount. The chart below shows the history of the energy sector weighing at the end of each quarter since 1979. We have noted the dates when that weighting experienced a spike, only to fall back quickly. According to Bespoke Investment Group, the energy sector weighting is now over 5%. The question for many energy investors is whether this marks just another spike or is the first step on a path to a much higher share?

When energy reached its record low sector weighting in September 2020, crude oil prices were recovering from their first ever negative price in April. Oil was selling for $40 a barrel in September and by the end of this May the price was $114, an increase of 186%, helping explain why energy stocks have done so well and the sector’s S&P weighting has increased so much. From the 2020 low to the end of May, energy’s weighting has gone from 2.2% to 4.8% of the S&P 500.

Although history does not repeat, it often rhymes. If so, maybe we are about to experience a repeat of the 2005-2008 years when oil demand growth clashed with inadequate supply driving prices to $147 a barrel and sending energy equity prices soaring. Energy’s weighting more than doubled, rising from 7.1% at the end of 2004 to 16.2% by mid-2008.

Exhibit 2. Energy’s S&P 500 Sector Weighting Has Been In A Long-Term Decline SOURCE: Standard & Poor’s, PPHB

Could we see energy’s weighting more than doubling again? It depends both on how industry fundamentals unfold along with investor sentiment about energy’s future. Given the long-cycle dynamics of energy, until investment ramps substantially higher than its current trajectory, oil and gas supply will not grow significantly, keeping the market supply/demand balance tight, which means commodity prices will remain elevated. The market tightness is further amplified by Europe’s move to eliminate its dependency on Russian fossil fuels, a rush driven by the ongoing war between Ukraine and Russia. A tight oil and gas market translates into a healthy revenue flow for energy producers. How they manage their cash flows will dictate the level of oilfield activity. Most producers are signaling they plan to increase investment modestly to sustain and slowly grow output. The balance of cash flow will be directed to debt repayment and increased returns to shareholders. As balance sheets strengthen, the capital allocation decision will become much more about how much to reinvest in the business, including new energy technologies, versus returning more funds to shareholders.

Energy’s large weighting increase this year reflects its outstanding share price performance. The move confirms rising investor interest in energy shares. With investor funds flowing into energy equities, and professional money managers under pressure to invest in traditional energy to remain competitive with those money managers who bet on energy earlier, the sector is likely to experience solid performance for quite a while. The relative performance of energy versus clean energy investments was highlighted by New York Times financial columnist Jeff Sommer who recently pointed out how avoiding traditional energy shares worsened investor returns. He wrote:

One simple way of seeing this cost is by comparing two S&P 500 index funds — the SPDR S&P 500 ETF Trust, a plain vanilla fund that tracks the S&P 500, and the SPDR S&P 500 Fossil Fuel Reserves Free ETF. The second fund excludes the high-performing but climate-warming fossil-fuel companies.

The difference shows up in their returns this year. The plain vanilla S&P fund fell 13.5 percent, while the fossil-fuel-free fund fell 15.1 percent. Ouch!

Sommer’s column was focused on the frustration of environmentalists who see ending fossil fuel use (partially accomplished by stopping investment in energy) as their most important objective, even at the risk of suffering poor investment returns. Their green energy investments have been devastated this year while traditional energy shares have produced outstanding returns. ARC Energy Research Institute’s Peter Tertzakian commented on the poor performance of green energy investments. “The broad-based Invesco WilderHill Clean Energy ETF is off 60% from its peak last year.” He further pointed out that this decline was average for clean energy investments. The shares of companies focused on hydrogen, a popular future green energy market, are down 80% or more. Tertzakian wrote about how these new clean energy companies will need to operate to survive the industry downturn, but in doing so, they may provide attractive investment opportunities for savvy investors. He wrote:

Bottom line, the next generation of technology-driven energy companies will enter a phase where they learn to conserve their cash and spend their investment dollars more prudently on the best projects. As these dynamics progress, rational valuations for high-graded companies will start to attract investment from long-term investors rather than short-term traders.

In fact, for the last couple of years, many institutional investors have wisely sat on the sidelines avoiding the market mess. For them, financing the pursuit of clean energy just got a lot cheaper.

Traditional energy’s outlook will also be influenced by the sector’s comparative standing in traditional market metrics that drive investment flows. According to the latest S&P sector metrics, energy has the highest dividend yield of any sector at 3.2%. In terms of relative valuation, energy has the second-lowest price/earnings ratio, the third-lowest price-to-book ratio, and the lowest price-to-sales ratio, while also having the fourth lowest Beta measure. These metrics substantiate that energy is clearly a “value” sector, which attracts a significant segment of investment funds. Energy’s high dividend yield, even in a world of rising interest rates, will attract investors seeking income. That will be especially true as the outlook for energy suggests more dividend hikes and increased share buybacks – putting more money in the hands of shareholders. Historically, when energy industry fundamentals are solid and market metrics attractive, energy equities are in for an extended up-cycle – at least for a couple of more years – confounding anti-fossil fuel investors. So far, June’s market performance is confirming this trend.

Is ESG A Religion, A Helpful Guide, Or Just A Scam?

One of the hottest topics in today’s investment world is the issue of company sustainability – or how companies identify the risks from environmental change, social issues, and governance matters (ESG) and explain the steps executives are taking to mitigate the impact on their businesses. These are not one-time events. They are part of continuums. The environment is always changing, and social trends are often shifting. How corporations handle these matters must evolve, which is what governance is all about. The challenge for corporate executives is to identify and measure potential ESG risks in an uncertain world, while not falling prey to under- or -overstating the potential impact.

ESG is seen as an emerging force in the corporate world. It is driven by growing investor concerns that ESG forces could destroy businesses or at least significantly damage the value of corporate franchises if the issues are ignored. However, ESG has been around for decades, although this specific name was only created in 2004 by Paul Cummings-Hunt while he was heading the United Nations Environment Programme Finance Initiative (UNEP FI) that was targeting the financial industry’s response to the issue, as part of an effort to weaponize investors.

What is relatively new about ESG is the idea that investing in companies that are ranked highly on measures of disclosure and adoption of policies to deal with the risks will produce superior investment returns. This belief has been matched with a strong focus on ESG values among the world’s youth, children who are beginning to invest and who are soon destined to inherit the wealth of their baby boomer parents. That reality was grasped by investment firms, especially BlackRock Inc. who has created a huge ESG investment business. BlackRock’s founder, chairman and CEO Larry Fink has used his annual letter to the CEOs of the companies the firm is invested in to lecture them about how to better manage their businesses from an ESG perspective, which he says will lead to increased support from the investment community and higher share prices. What CEO does not want a higher stock price?

In recent years, Fink’s letter has begun attacking companies for continuing to invest in fossil fuels, when renewable energy and electric vehicles (EV) are seen as the world’s clean energy future. Prior to 2021, this stance was not only popular, but it created solid investment returns for ESG funds while fossil fuel companies slumped (see our discussion of energy stocks elsewhere). Two charts show how powerful the ESG investment movement has become. The first chart shows the increased use of ESG terminology during corporate earnings calls with investors.

Exhibit 3. Confirming That ESG Is A Hot Investment Topic SOURCE: FT.com

According to Morningstar Direct, global ESG fund assets under management (AUM) increased to $2.74 trillion in December 2021, up from $1.65 trillion at the end of 2020 and $1.28 trillion at the end of 2019. (See chart below.) However, in 2022, so far, alternative energy stocks have fallen drastically – some down 60% to 80% - and investors have withdrawn money from ESG-focused funds. The combined effect of those declines is shown by the fall in AUM in 1Q2022.

Exhibit 4. Funds Flows Explain Why Investment Groups Target ESG SOURCE: FT.com

Bloomberg Intelligence reported that May saw $2 billion of outflows from ESG funds – the biggest monthly cash withdrawal ever. The firm’s analyst James Sayffart said, “There’s no way to know for certain why the outflows were so extreme.” That withdrawal flow may have been helped by how much the ESG funds’ asset base has grown. Sayffart also mentioned that “ESG ETFs may be finding that people care a lot more about them in bull markets.” If true, that is a telling point, since it says a lot about ESG investing being a fad.

This year started with ESG investors expecting a continuation of the surge in assets that saw $68 billion invested over the prior two years. The war in Ukraine and the spike in fossil fuel prices and energy share prices drove the S&P 500 Energy Index up 59% through May, at the same time the overall market fell 14%. As Australia’s Straits Times commented, ESG investment flows and performance this year “has made do-good investing more of a sacrifice.” That sentiment did not dissuaded investors from putting $3.2 billion into 20 new U.S. ESG funds this year.

RBC Wealth Management recently surveyed over 900 U.S.-based clients and found 49% saying that performance and returns were a higher priority than ESG impact. That was a seven-percentage point increase over the prior year’s survey results.

"The story has been told that you don't have to give up returns in order to do ESG, but everyone assumed that you would get the same exact return profile as a traditional benchmark, which is absolutely not true because traditional benchmarks are not looking at ESG factors," said Kent McClanahan, vice-president of responsible investing at RBC Wealth Management. He went on to say that social and environmental policies can take time to implement, so investors should focus on longer-term returns. Such a view has become the center of a recent storm among ESG investors and advisors.

Nearly two-thirds of RBC Wealth Management clients say socially responsible investing is the way of the future, but 74% of those surveyed said many companies provide misleading information about their ESG initiatives, which is amplifying the issue of “greenwashing” by

corporations and asset managers. This is behind the U.S. Securities and Exchange Commission’s proposal for new restrictions to ensure ESG funds accurately describe their investments that may be critical for ESG investing’s long-term success.

So, is ESG investing a scam, a guideline, or a religion? Scam may be too strong a description, but there is little doubt, as we have covered in prior articles, the high fees earned by dedicated ESG funds and ESG ETFs sponsored by various investment managers have been drivers of the ESG investment business.

Over the past decade or more, investors have shifted much of their investable assets into index funds that mirror the overall or portions of the stock market. Asset managers have competed for these investor funds by cutting their index-related fees to absolutely the lowest levels possible. Investment firms have gone after volume to make up for reduced fees. Specialty, actively managed funds, such as ESG targeted funds, can charge much higher fees based on the greater expense for providing oversight and active investing.

The largest investment fund organizations, such as BlackRock, have actively promoted their ESG funds not merely because they are what the investing public has been convinced it needs and wants, but also because they are hugely profitable. The leaders of these investment fund organizations have been actively campaigning for corporate CEOs to embrace ESG. That effort has extended to advocating ending investing in fossil fuel companies and that these companies need to rapidly transition to renewable energy.

This push ran into a wall earlier this year, when several states whose economies are supported by the fossil fuel industry, reacted to the anti-fossil fuel investment campaigns of money managers. Texas enacted a law requiring the state’s comptroller to compile a list of financial firms that boycott investing in and financing fossil fuels. Those firms could be barred from managing some of the state’s pension funds like the $197 billion Teacher Retirement System of Texas, which has about $2.5 billion invested with BlackRock. To head off such a move, BlackRock executives wrote a letter to officials, trade groups and others in energy-rich Texas to the effect that it has been a large and long-term investor in fossil fuel companies and “we want to see these companies succeed and prosper.” The memo, signed by BlackRock’s head of external affairs and copied to BlackRock’s chief client office, stated: "We will continue to invest in and support fossil fuel companies, including Texas fossil fuel companies."

Although BlackRock’s message is consistent with its other statements, the emphasis in supporting fossil fuel companies is new after years of BlackRock stressing its efforts to take climate change and ESG issues into account in its investment and proxy voting decisions. BlackRock will be walking a tightrope as it manages its ESG-heavy focus on investing and proxy voting, while also supporting fossil fuel companies who will need more capital to meet the world’s future energy needs.

This balancing act was highlighted by the recent German government raid of Deutsche Bank’s asset management’s offices (DWS Group) in Frankfurt over potentially greenwashing investments in its ESG funds. DWS is facing regulatory probes in both the U.S. and Germany after its former chief sustainability officer alleged last year that the company inflated its ESG credentials. She said that DWS’s claims that hundreds of billions of its AUM were “ESG integrated” were misleading because the label did not translate into meaningful action by relevant fund managers. DWS has since stopped using that label.

Across the pond, the U.S. Securities and Exchange Commission fined the investment management arm of Bank of New York Mellon Corp, $1.5 million for misleading claims it made

about funds that use ESG criteria to pick stocks. The regulators found that some U.S. mutual funds BNY Mellon managed did not go through a quality review of ESG factors from July 2018 to September 2021. In settling the claim, the bank neither admitted nor denied the claims. It has also updated its investor communications materials to be more precise and complete.

The SEC’s enforcement division created a Climate and ESG Task Force in March 2021, which is obviously now very active. A news report last week said it is looking into Goldman Sachs asset management division over greenwashing. With few standards for what constitutes an ESG stock or bond, some analysts allege that large banks and asset managers are “greenwashing” by using new investment products to boost their bottom lines in the name of “doing good for the world” while essentially not accomplishing anything positive.

The lack of consistent standards for defining an ESG stock or bond was the center of attention when Tesla, Inc. CEO Elon Musk raged recently over the removal of his company’s stock by S&P Dow Jones from its ESG index. Musk called the move an “outrageous scam,” as one would think the world’s leading EV company would be an ESG favorite. S&P Dow Jones cited Tesla’s emissions strategy with its new plants, its record of complaints over working conditions at its California plant, and how it has handled regulatory investigations. So, the social and environmental good from eliminating tailpipe emissions is overwhelmed by poor internal management issues.

ESG metrics are still unclear. Many of them are being defined by consultants, environmental activists, and shareholders. Proxy advisory firms who recommend how shareholders should vote on these questions implicitly are also defining ESG metrics. But it should be noted that companies have had committees of its boards of directors that deal with these issues for decades. Those committees have evolved under tightened regulations for publicly owned companies and given the increased ESG focus are embracing that effort today.

American history since our founding has been marked by financial booms and busts. The industrial economy grew, but its growth accelerated with the aid of monopolies enabled by laws that allowed the creation of trusts that thwarted greater regulation. Muckraking and trust busting dominated the late 1890s. Early in the 1900s, states began enacting Blue Sky Laws that mandated a level of financial disclosure about the businesses that were issuing new securities. These laws were weak, so it was only after the stock market crash of 1929, leading to the Great Depression, that people began demanding a more active federal government. In 1933, the Securities Act was passed, followed the next year by the Securities Exchange Act of 1934 that created the Securities and Exchange Commission. These two laws established many rules and regulations on companies and brokers. Companies were directed to disclose significantly more financial and business information to their shareholders, especially when issuing new securities. Disclosure of risks to the health of the public companies led to them create independently staffed audit, governance, and compensation committees to oversee the companies.

Over the years, the scope of work required of these committees expanded, and many companies established health, safety, and environment (HSE) committees to help oversee management’s operations. Although companies dealt with ESG concerns for years, it does not mean there were no environmental disasters or that important social issues were not ignored. Both happened. But systems existed to deal with them, albeit the issues may not have received the level of attention or speed of action in dealing with the issues that activists desired.

Now we have financial regulators and securities regulators who have targeted ESG issues as the most important considerations for corporate and financial managers. The problem is that the standards for determining ESG issues are unclear, and regulators are spending significant time hunting for violators, many of whom do not know they are in violation. Expect to see many more announcements such as the BNY Mellon case where the fines are paid, no admission of guilt is made, and new policies are implemented, even without any understanding of what the new standards are or how they are determined.

Last year, BlackRock’s former head of sustainable investing said ESG "creates a giant societal placebo where we think that we’re making progress even though we’re not." Tariq Fancy was recruited by BlackRock in 2017, but after four years he concluded that private enterprise could not deal with climate change, only systemic government oversight would produce scalable climate solutions. He concluded that some of the tools and standards of the ESG movement are not currently being used correctly. He found that even if ESG products are marketed correctly, they have little demonstrable impact.

Tariq considered CEO tenure, which is the shortest it has been in decades, while their pay is the highest in decades. The system is incentivizing CEO actions for the next five years, not the 20-30 years that ESG issues are supposedly addressing. Therefore, in his mind, CEOs would not act quickly enough or aggressively enough to address the long-term challenges being demanded by ESG issues.

ESG as a measurement standard has value but using vague information as the mechanism for change in Tariq’s view is disastrous. It creates the impression we are making progress when we really are not. The data needs to be managed in a way that changes the underlying incentives of the system, which for him means government leadership.

Frustration with the pace of progress with Tariq’s solution is part of what led to the latest furor over the ESG movement. At its core, the belief that only highly restrictive government controls over the economy and society can address ESG challenges has evolved into a religion. People who challenge this religion must be silenced. In this case, the speaker, even though talking from a company-sanctioned presentation, was suspended, and we expect will be out of a job.

Stuart Kirk, HSBC asset management’s head of responsible investing was suspended within days of speaking. Although his firm was a sponsor of the FT Moral Money conference in London, and his slides and presentation were approved by management, what likely got him in trouble with his bosses were a few off-the-cuff comments, mostly in response to an earlier doomster presentation.

The outrage to Kirk’s presentation was swift and brutal, although others found many of his observations on the mark. What was missing from some of his observations was the lack of time to adequately detail the data and reasons behind his conclusions. Interestingly, Kirk and Tariq landed on the same point of how to shock the current system and achieve the most change – enact a carbon tax. Readers can find Kirk’s presentation on YouTube. We urge you to watch it, as we cannot do justice to it and the emotions it stirs in the remainder of this article.

The first warning that Kirk’s presentation was going to be an intellectual challenge was its title: “Why Investors Need Not Worry About Climate Risk.” The presentation title was known for two months during the FT’s promotion for the conference, so for HSBC officials to be outraged at Kirk’s presentation was interesting. It was probably more about them responding to the public reactions coupled with the pressure they are under from prior “greenwashing” issues.

We will begin with a few of his off-the-cuff comments that probably should have been more tempered.

“There’s always some nutjob telling me about the end of the world. What bothers me about this one is the amount of work these people make me do, the amount of regulation coming down the line.”

The “nutjob” comment was highlighted by many in the media critical of Kirk’s presentation. But Kirk’s point was that there are many influential people making end of the world predictions. Kirk listed a handful of the statements predicting the climate catastrophe by prominent officials and organizations. What apparently got him really going was a statement from an earlier presentation by Sharon Thorne, Chair, Global Board of Deloitte, in which she warned that there would be “no jobs on a dead planet.” Kirk commented:

“Sharon said: we are not going to survive [but] no-one ran from the room. In fact, most of you barely looked up from your mobile phones at the prospect of non-survival.”

Of course, there is no scenario from the UN Intergovernmental Panel on Climate Change (IPCC) that fits Thorne’s description. As one columnist wondered, is this taking poetic license to drive climate action? But for Kirk, the lack of a response from the audience to Thorne’s comment was a sign that people are not as concerned as those authoring the catastrophe predictions.

“Who cares if Miami is six meters underwater in 100 years? Amsterdam has been six meters underwater for ages and that’s a really nice place.”

This led into a discussion of mitigation versus adaptation ‒ a topic worthy of extensive discussions but which is ignored by many. Lack of time probably prevented Kirk from explaining how Amsterdam was created and protected from its location below sea level, something Miami may need to undertake, and which is feasible. Kirk did show the following chart during that discussion. It shows that the average of deaths per million population from climate disasters has declined steadily over the past century.

Exhibit 5. Why Don’t We Debate The Value Of Mitigation And Adaptation? SOURCE: FT.com

He also claimed the markets “more or less” backed his view. “The more people say the world is going to end…the higher and higher risk assets go; the higher prices go.” The following chart shows in black the number of global articles mentioning “climate catastrophe” compared with the performance in red of the MSCI World stock index for the past decade. As shown, in the most recent years, the focus on the climate crisis has increased markedly while the stock market has gone up. Why?

Exhibit 6. Equity Markets Appear To Reflect Low ESG Concerns SOURCE: FT.com

Kirk suggested that there are three possible answers to the question of what explains the performance of the stock market given the heightened risk of climate change. He listed them in the following chart. To settle on the answer with the red emoji that “All investors are wrong” requires a huge leap of faith, one Kirk and many others are not prepared to accept.

Exhibit 7. Is Climate Risk A Real Investor Concern SOURCE: FT.com

Kirk also presented the chart below (sorry for the screen shot quality) that shows the S&P 500 Index in red, plotted on a log scale, against the number of days without a three-month return being negative in black. Kirk’s point was that in his view climate change is not a long-term risk, just as the impact of wars, energy crises, pandemics, and financial crises that appear apocalyptical at the time prove not to be. Critics challenged that view saying climate change is a different category. It is a systemic risk, which society will find impossible to reverse if climate change goes past a certain tipping point. The problem with that argument is that no one knows where that tipping point is since the latest IPCC Assessment Report 6 shows less climate sensitivity and future CO2 emissions projections. That is why its central range for temperature projections raised the lower end but significantly cut the high end. Doomster experts conveniently ignore these important points.

Exhibit 8. What Does The Stock Market Worry About If Not ESG? SOURCE: FT.com

While reading the commentary about Kirk’s presentation, and the vitriol leveled at him, we began thinking about another aspect of the ESG debate. It came from a presentation by American pollster Frank Luntz that we watched a month ago. Besides political polling, Luntz’s polling expertise is in language and message creation. In a series of focus groups involving people of all ages, he tested the word “sustainability.” Based on the outcomes, especially from the younger people in the focus groups, this word has a problem. Youth equate “sustainability” with “stays the same.” For them, it is not a sign of progress. Luntz’s advice to his corporate clients, and the investment audience he was speaking to, is to ditch “sustainability” ‒ the sooner the better. Unfortunately, this is the foundation on which ESG is built. Is there any wonder why ESG is becoming a battleground?

The answer to our question about ESG is: We do not know. We can make a case for each of scam, guideline, and religion – some cases stronger than others. The uncertainty of what ESG is, especially as governments and regulators charge people over their failures to appropriately account for it, has weaponized an important subject. The rush to do something about ESG is wrong – at least until we have clearly defined terms, accurate measurements, and tools to address the issue. That involves opening discussions about many of the points raised in Kirk’s presentation, even the inartful framing of certain topics, and in Tariq’s critique of ESG in its present form. Such a discussion is needed to diffuse the political war over ESG. Pressuring people to address ESG issues is not wrong. Imposing unrealistic compliance timetables is wrong and counterproductive. We can and should do better, for everyone’s sake. While the simplest action may be a phased in carbon tax that allows market forces and CEOs the freedom to address the “E” of ESG. It, too, needs a full and fair debate, something few people embrace. The tax has good and bad points, just as every other proposed solution.

Changing The Climate Debate – Epstein’s Fossil Future

After his successful 2014 book, The Moral Case For Fossil Fuels, philosopher Alex Epstein spent the next several years traveling the country, speaking at seminars, corporate meetings, and in webinars, to help people understand why the apocalyptical view of our climate future and the role of fossil fuels is wrong. Epstein’s success in reframing the energy and climate discussion encouraged him to dig into the topic even more so than he had done up to then. The result is his 430-page tome Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas – Not Less, which examines the conventional view of the destructive nature of fossil fuels because of their carbon emissions that is espoused by “experts,” who ignore humanity’s huge gains from their use.

Exhibit 9. Alex Epstein’s Latest Climate Book SOURCE: PenguinRandomHouse.com

Besides dismantling the apocalyptical narrative that fossil fuels are making the world “a worse and worse place to live,” Epstein focuses on the “big picture” facts of how fossil fuels are helping the world’s populations to live longer, live better, live safer, while managing the side-effects of increasing carbon emissions. By framing the climate discussion around the big picture facts of human improvements since fossil fuel use began, Epstein takes on the mainstream’s “knowledge system” driven by the climate experts and shows how their framework for viewing climate change

is anti-human, anti-energy, and anti-impact, which requires ignoring human progress to date, but importantly the projected gains the growing world population needs and will experience.

Epstein frames his climate discussion on “the livability of the planet,” which continues to improve despite rising CO2 levels. In fact, more carbon in the atmosphere has contributed to dramatic increases in crop yields, further aided by man’s ability to use fossil fuels to create fertilizers that boost food output and the fuel to power farm machinery that eases the human effort needed in agriculture.

The height of the folly about climate policy and the restriction and ultimate elimination of fossil fuels from human use, in the name of avoiding a planetary disaster, came during a 2016 U.S. Senate hearing in which Epstein was testifying as an energy expert based on his writings. The Moral Case had become a Wall Street Journal and New York Times bestseller at that point. The exchange between Epstein and liberal California Senator Barbara Boxer has become a classic.

SENATOR BARBARA BOXER: Mr. Epstein, are you a scientist?

ALEX EPSTEIN: No, philosopher.

SENATOR BARBARA BOXER: You’re a philosopher?

ALEX EPSTEIN: Yes.

SENATOR BARBARA BOXER: Okay. Well, this is the Senate Environment and Public Works Committee. I think it’s interesting we have a philosopher here talking about an issue…

ALEX EPSTEIN: It’s to teach you how to think more clearly.

Thinking clearly and critically about energy and climate change is important, especially when considering policies being promoted that would radically restructure the world and the U.S. economies and societies in the name of limiting carbon emissions that otherwise are projected to cook the planet. Those scientists and policymakers who are thinking critically about this subject are attacked not over the accuracy of their data and facts, the interpretations of them, or their resulting policy recommendations, but rather because they dare to counter the existing climate narrative. That narrative is often divorced from the data, but the terminology is used to hype fear of carbon emissions and climate change. Critics are not welcome.

The public’s ignorance of the data and climate change is not surprising in a world focused on 30-second sound bites from the mainstream media who embraces the “if it bleeds, it leads” approach to reporting news. In the Moral Case book, Epstein argued that the world would use more fossil fuels in the future to improve lives despite the embrace of renewable energy by the anti-impact experts. The use of fossil fuels worldwide, which currently accounts for 80% of the world’s energy, has grown and continues to grow despite the recent surge in investment in new renewable energy generating capacity. Solar and wind renewables account for only 3% of world energy use after decades of investment, which has occurred in response to mandates and subsidies. Lost on the renewables promoters is that their success has been due to the existence of reliable fossil fuel backup power supplies. As we see with the growing number of grid blackouts, the loss of this 24/7 fossil fuel backup power means grids become more fragile due to the intermittency of wind and solar power and subject to brownouts and blackouts.

According to Epstein, the world has become a better place to live. For him, “human flourishing” has been critically important for the poorest people on the planet who have benefited from a reduced rate of extreme poverty. Epstein cites a college survey in the U.K. about world poverty, which is defined as living on less than $2 a day. The survey’s question was: “In the last 30 years, the proportion of the world population living in extreme poverty has…?” Respondents were offered three choices: “decreased,” “remained more-or-less the same,” and “increased.” The

responses showed: 55% of respondents said increased, 33% said the same, and just 12% said decreased. According to World Bank data, the percentage of people living in extreme poverty in 1980 was 42%, which has fallen to under 10% today. That is hundreds of millions of people who are living better today due to the use of fossil fuels. Anti-impact climate experts ignore this reality, but it is a critical measure of human progress.

Global warming is an issue that Epstein acknowledges, and in fact devotes three chapters. He points out that the planet has warmed by 1ºC over the past 170 years. However, climate-related disaster deaths continue to fall to all-time lows. In fact, there has been a 98% decline in disaster deaths over the last century. This is due to “climate mastery” by society that is accomplished with the aid of fossil fuel-powered machines and equipment. From irrigation to heating and cooling equipment, as well as our ability to construct sturdy buildings and create early warning systems are how the climate has been mastered. However, mastering the climate does not absolve us from ignoring the negative side-effects attributable to fossil fuel use – heat waves, droughts, floods, storms, and wildfires - but it is equally wrong for our “knowledge system” to ignore the economic and human benefits that come from using fossil fuels.

Fossil Future’s 11 chapters are organized into four parts: Framework, Benefits, Climate Side-Effects, and A Flourishing Fossil Future. In Framework, Epstein dismisses the anti-impact framework of the climate alarmists, and focuses on “human flourishing,” which he demonstrates with hockey-stick charts that show how world life expectancy, world population growth, and world GDP per capita have soared despite constant increases in CO2.

The Benefits from fossil fuel use have led to reduced air pollution, sharp declines in world death rates from floods, and especially for flood deaths in G7 developed countries, among other benefits. The world’s population has gained from more plant growth and greater crop yields due to the natural fertilization effect from the increased CO2 emissions. More food coupled with improved medicines and health care have led to significant increases in human longevity and improved living standards. In addition, these benefits contribute to our mastery of the climate that has helped address the Climate Side-Effects from fossil fuel use.

As part of his examination of fossil fuel side-effects, Epstein asks about the risks from rising CO2 emissions on the human flourishing framework? Risings CO2 levels could have implications for temperatures, precipitation patterns, and sea levels around the world. Rising CO2 levels might impact plant life and oceans, and maybe even lead to mass species extinctions. As Epstein says, these are all possible impacts, but given the level of climate data and computer models, the impacts cannot be predicted with any degree of precision. However, the answers fall into two categories: the “CO2 benefit denial” and the “deliberate over-statement.” The climate experts focus only on those negative side-effects and deny any positive benefits. CO2 is both a warming gas and a fertilizing gas, but the experts will only talk about the warming aspect. Not only is this short-sighted, but it also becomes a disservice to mankind.

Although Epstein did not point this out, American journalist, essayist, satirist, cultural critic, and scholar of American English H.L. Mencken did. “A demagogue is one who knowingly tells untruths to those he believes to be morons.” This is where Epstein’s latest book is important for people wanting to understand the full scope of climate change and its impact on the planet and society. Not only is Fossil Future a guidebook for why fossil fuels are critical for human flourishing, but Epstein also helps readers learn how to talk with anti-fossil fuel activists. He is particularly hard on energy industry executives for failing to actively engage those who want to eliminate fossil fuels and reorient the discussion framework. Contrary to arguing to 100 as their opponents due, energy executives seem to only argue to zero, which Epstein shows helps the opposition in making its case against fossil fuels. Epstein has shown over the past seven years how the climate and fossil fuel dialogue can be reoriented, and now he delivers both the data and the mechanism to change the dialogue. A more balanced approach will produce a less scary and more promising outlook that is justified by the full spectrum of data and is desperately needed in today’s polarized world.

Random Energy Topics And Our Thoughts

Rhode Island’s Electricity Fuel Sources

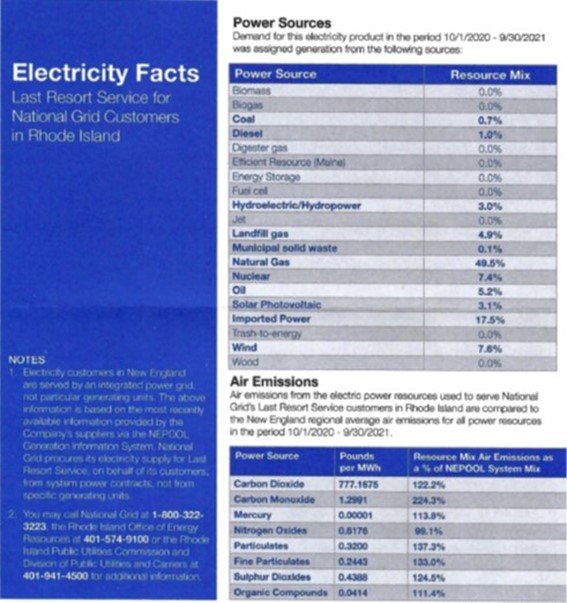

The following flyer was inserted into our summer home’s most recent electric bill from National Grid, Rhode Island’s largest power supplier. We always find it an interesting read, because we always learn more about the Northeast power market.

Exhibit 10. Rhode Island’s Fuel Sources For Electricity Generation SOURCE: National Grid

We thought it was interesting that natural gas generated almost half the electricity National Grid sold. We were not surprised at wind (7.6%) and solar (3.1%) shares since these are highly subsidized and aggressively promoted by the state. We were surprised with nuclear (7.4%) accounting for almost as much power as wind. Oil (5.2%), diesel (1.0%), and coal (0.7%) share, totaling almost a 7%, was not a surprise since the reporting period included two winters when natural gas is diverted to home heating and coal and oil play a more prominent role in generating electricity, something we have written about previously. We should not lose sight of the 17.5% of electricity that was imported, and we suspect was largely generated from natural gas and other fossil fuels.

The following information comes from the latest Rhode Island State Profile and Energy Estimates sector on the website maintained by the Energy Information Administration (EIA).

In 2020, Rhode Island generated a larger share of its electricity from natural gas than any other state, about 89%. Most of the rest of the state's net generation came from solar, wind, and biomass resources. A small amount of the state's electricity was also generated from petroleum and hydropower. Rhode Island is a member of the Regional Greenhouse Gas Initiative (RGGI), a market-based program to reduce carbon emissions from electricity generation in 11 of the northeastern and Mid-Atlantic states. Rhode Island is the nation's second-lowest energy-related carbon dioxide emitter, after Vermont, due in part to its low energy use and because of the state's small size.

Rhode Island's total per capita electricity sales are lower than in all other states except for California and Hawaii, and its per capita electricity sales to the residential sector are lower than in all but five states. With fewer than 10 days of temperatures above 90°F in a typical summer, air conditioning use in Rhode Island is limited, and only about 1 in 10 households use electricity as their primary energy source for home heating.

We suspect the natural gas share of electricity generation is lower now, given the major push by National Grid and other electricity suppliers to comply with Rhode Island’s renewable energy standard requiring retail electricity providers obtain 22% of the power they sell from renewable resources by the end of 2024 and 38.5% at the end of 2035. To help bolster those targets, the state has adopted a plan to get 100% of the electricity used by the state government by 2030. The Rhode Island legislature is considering a stricter and earlier date for 100% clean energy.

Energy And Food Markets Need To Worry About Hurricane Season

The National Oceanic and Atmospheric Administration (NOAA) is the last of the weather forecasters to weigh in with its prediction for this year’s hurricane season, already underway. They put the odds at 65% that 2022 will see an above-average Atlantic hurricane season. NOAA’s odds are slightly above the odds it predicted for 2020 and 2021. Their current forecast calls for 6-10 hurricanes with 3-6 being major hurricanes, Category 3 and above.

The key driver for the above-average storm outlook is the continuation of La Niña meteorological conditions in the eastern equatorial Pacific Ocean, which began in mid-2020 and is projected to persist through at least early 2023. La Niña means the ocean waters become cooler than normal, opposite of the El Niño warm phase. The differences in water temperatures means La Niña tends to reduce wind shear over the tropical Atlantic Ocean where hurricanes form. Wind shear characterizes how wind speed and direction change with height. When it is strong, wind shear can hinder tropical storm development and even weaken existing storms.

La Niña conditions could worsen U.S. commodities markets. While La Niña-induced droughts have boosted global grain prices along with the impact from the war on Ukraine and Russia that has limited wheat exports. The droughts also hurt soybean and corn crops in South America over the past two years, as well as limiting this year’s U.S. hard red winter wheat crop to a 59-year low.

The importance of the Gulf of Mexico for hurricane season and commodity markets cannot be understated. The Gulf is the prime target for many of the season’s hurricanes. Louisiana ports are the busiest for U.S. grain exports. Additionally, about half the U.S. petroleum refining capacity, currently in short supply, is located along the Gulf Coast, as well as a significant amount of the nation’s oil and gas production. This is also the center of the U.S. LNG industry that has become critical to the world’s natural gas market.

In 2017, Hurricane Harvey knocked out up to 23% of U.S. refining capacity at one point. Hurricane Ida’s landfall in 2021 damaged or destroyed several Louisiana grain export terminals, limiting corn and soybean exports to half the typical export volume. Hurricanes in the early 2000s damaged offshore oil and gas producing facilities and pipelines bringing the output to shore.

The chart below shows the number of hurricanes in years with La Niña and El Niño conditions. The more active La Niña years are clearly shown, as are the less active El Niño years.

Exhibit 11. What Drives The Above-Average 2022 Hurricane Forecasts SOURCE: Reuters

We need to be crossing our fingers and praying a lot that we do not have a major hurricane that disrupts either the petroleum or grain exporting industries. Tropical Storm Alex that recently crossed Florida, surprisingly had strengthening limited by cooler Gulf waters but also, importantly, strong wind shear. Since we cannot count on wind shear helping us much this summer, a major hurricane landing on the Guld Coast could be the Black Swan event that sends the U.S. into a serious recession, while also sending global grain and petroleum product prices to unimaginable heights.

Chronicling Another Frustrating EV Long-Distance Trip

Wall Street Journal reporter Rachel Wolfe, who covers topics for the newspaper’s Life & Work section, chronicled a four-day trip with her friend Mack, driving from New Orleans to Chicago and back. The illustration below shows her route and the various charging spots utilized during the trip. Wolfe convinced her friend that the trip, which saw the two ladies spending more time charging the rented Kia EV6 than they did sleeping, would be “fun.” She also assured her friend she would be back in time for her next shift as a server at a local restaurant. That almost did not happen.

Wolfe planned the 2,000-mile trip by dividing it into four parts – each of roughly 7½-hours duration. She understood the Kia EV6 had a battery range of up to 310 miles, which she later learned was wrong. The trip plan involved charging once or twice each day, while plugging in near their hotel for an overnight charge.

Exhibit 12. A 2,000-Mile EV Trip With Challenges SOURCE: WSJ.com

This is not the first long-distance road trip documented by EV owners that we have read. As we began Wolfe’s article, we fully expected to learn of her frustration with the status of the charging network, the lack of performance of the EV, and importantly, how much planning is necessary for such a trip, in contrast to the rigors of taking a trip with an internal combustion engine (ICE) vehicle. We were not disappointed.

Wolfe noted that the PlugShare app on her phone showed “thousands of charging options between New Orleans and Chicago.” The problem was that most were Level 2 chargers, requiring about eight hours for a full charge. That would be ok for the overnight charges, but not satisfactory for rapid charging during the day. She commented that ChargePoint Holdings Inc., which manufactures and maintains many fast-charging stations, promised 20-30 minutes for an 80% charge. This was an acceptable time span, albeit longer than an ICE vehicle fill-up. But with the comfort of knowing about the fast-charging times, the ladies drove off.

Surprisingly, New Orleans has no fast chargers. Wolfe and her friend decided to top up the battery in Slidell, Louisiana. Their first shock was seeing 15% of their battery charge disappear in their 35-mile drive that lasted 40 minutes. Their calculation was that their “quick charge” would take five minutes. The vehicle’s dashboard, however, said it would take an hour! Following breakfast at McDonald’s, they disconnected from the charger to begin traveling, only to learn they had gotten just a 13% charge after 40 minutes.

There were some bright spots when charging was quick, but on balance, the ladies spent more time charging and suffering from “range anxiety” than they did sleeping. The scariest episode was on the third day heading home when bad weather prevented them from using the cruise control (the car’s systems would not allow it), which meant they were only making about 200 miles on a full charge. They learned from talking to a Kia spokesman that when driving on the highway you are not using the regenerative brakes that help charge the battery. This helps EV range in city driving. Therefore, weather, load, speed, and car system use will cut into the battery’s range, especially in highway driving.

As Wolfe wrote: “To save power, we turn off the car’s cooling system and the radio, unplug our phones and lower the windshield wipers to the lowest possible setting while still being able to see. Three miles away from the station, we have one mile of estimated range.” They made it.

Exhibit 13. EV Dashboard As Battery Charge About To Reach Zero SOURCE: WSJ.com

During their charging episodes, Wolfe talked with others charging their vehicles and found both EV critics and supporters. There will likely be more EV road trips documented. What we know is that planning and making our annual trips to and from Rhode Island would require an unknown number of hours of planning and charging. We were amused on our recent trip seeing a car parked under the portico of our hotel with an extension cord running to a plug in the hotel lobby. We did see some hotels with charging stations, but only one or two, and usually not used. Our EV charging system is years away from being ubiquitous, thus making travel challenging and frustrating for EV owners. For the time being, we will stick with our “gas guzzler.”

Connecticut Considers Hiking Diesel Fuel Tax?

Rising gasoline and diesel fuel prices continue to bedevil state politicians trying to demonstrate empathy with their constituents over the financial pain they are experiencing every time they fill up their vehicles. In March, Connecticut became the third state to enact a gasoline tax holiday. The $0.25 a gallon charge for gasoline was waived from April 1 to June 30. The legislature has since extended the gas tax holiday to December 1. Unfortunately, drivers of diesel-powered vehicles not only have yet to be granted similar relief, but they now look at a possible 50% hike in the diesel fuel tax!

Connecticut taxes diesel at $0.40 a gallon. Under its law, the tax rate is adjusted each July based on a formula that considers the daily wholesale price at two terminals in the state over the prior 365 days. This year’s increase is to be announced June 15th. Speculation is that the tax will rise by a minimum of $0.10 to possibly as much as $0.20 a gallon. Republicans in the legislature are pushing for a tax holiday, but Democrats are fighting it because “most of the truckers buying diesel are from out of state.” Take that you heroes of the pandemic!

Amazing Rise In Oil Prices And Its Impact On Oil Demand

Global oil demand has remained remarkably strong in the face of China’s Covid lockdowns and the sharp rise in oil prices. The price rise has been surprising given how the value of the U.S. dollar has soared, which normally would depress the price. Historically, oil prices and the dollar’s value move in an inverse relationship because global oil demand is boosted when the price of oil in local currency is low and vice versa. A recent column by Javier Blas of Bloomberg highlighted this relationship and the possibility that the relationship has been broken.

The chart below shows the value of the U.S. dollar against major currencies. When global oil prices (Brent) reached an all-time high of $147.50 a barrel in 2008, the collapse in the U.S. dollar’s value helped ease the pain for foreign buyers. Since then, the dollar’s value has climbed from roughly 70 to 105, while oil prices currently are $120. In the past 12 months, the value of the dollar has risen by 10%, yet oil prices have risen.

Exhibit 14. Dollar’s Value In 2008 And 2022 Had Impact On Oil’s Price Abroad SURCE: Bloomberg

Blas showed that while the Brent price is lower than it was in 2008, when denominated in other currencies, it is much more expensive. The chart below shows the perverse impact of the dollar’s strength. In terms of the Chinese yuan, the oil price is nearly 22% below 2008’s level, while for countries buying oil in euros, the price is over 20% higher. With oil nearly 47% more expensive than in 2008 for India, a country with a rapidly growing population and economy, we can understand why the government is willing to buy sharply discounted Russian crude oil in defiance of many world leaders seeking to isolate Russia. The oil price further explains why India is relying more on indigenous coal resources for electricity generation to save money.

Exhibit 15. Change In 2008 Oil Price Due To Change In U.S. Dollar Value SOURCE: Bloomberg

The final chart shows the price of Brent oil in U.S. dollars, euros and British pounds. In the latter two currencies, the current oil price exceeds the 2008 peak. The fact that demand has yet to be crippled by these high prices speaks to both the new dynamics of energy markets, but also points out the risk that the world may be on the cusp of serious demand destruction.

Exhibit 16. Oil Price In Euros And Pounds Now More Expensive Than 2008 Price SOURCE: Bloomberg

Barring a serious economic recession, and we know the World Bank and others have cut their global economic growth projections sharply in recent days, oil prices are at risk of climbing higher due to the lack of additional supply capacity and refining capacity, along with the disruption in the market from the boycott of Russian oil. The next several months will be a test of the market reaching a price level that causes oil demand destruction. Given the underlying supply situation and the anti-fossil fuel sentiment that holds the oil industry back from aggressively adding new supply, even with demand destruction, we doubt oil prices will fall dramatically.

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.