Energy Musings - January 4, 2022

Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

Thoughts On What 2022 Holds In Store For Energy

Forces that drove the oil and gas industry’s fortunes in 2021 should continue in 2022. The surprise of 2022 will likely be something we are not even aware of or appreciate its impact.

Is It Green Or Is It Not? Status Of Nuclear Power In Europe

The European Union membership is split over whether to classify nuclear and natural gas power as green. We look at the global nuclear power industry as a solution to climate change.

The Great Coal Revival That Was Missed By The IEA

Coal use is up sharply in 2021, but the latest IEA forecast calls for use to continue rising to a new record in 2024. In 2020, the IEA saw coal plateauing. They got the 2020 outlook wrong. 2021?

Study Says EVs More Costly To Operate Than ICE Vehicles

A detailed study concludes that when all issues EV owners must deal with are considered, EVs are more expensive to operate than ICE vehicles. We recently found a cost issue not publicized.

Thoughts On What 2022 Holds In Store For Energy

In planning how to navigate the likely landscape for energy in 2022, we are reminded of Mike Tyson’s admonition that “everyone has a plan until they get punched in the mouth.” That is true. It means we must be ready to change when events happen. This reality was best summed up by World War 11 Supreme Allied Commander, General Dwight Eisenhower, who offered sound advice about planning. “In preparing for battle I have always found that plans are useless, but planning is indispensable.” Given the volatile nature of energy markets, expecting the unexpected is a smart strategy. We should always be thinking about the what ifs for every scenario we consider.

Last year, energy markets surprised observers, and even participants. As the pandemic’s severity eased, economic activity rebounded faster and was stronger than many expected. This created tight energy markets, which resulted in higher fossil fuel prices than anticipated. Few would have thought we would end 2021 with global oil prices on the threshold of $80 per barrel. Moreover, natural gas, a commodity that had been left for dead for years because of too much supply, suddenly found itself in demand last year, sending prices globally higher.

While oil and gas prices received most of the media’s attention – especially when gasoline prices soared – other commodity prices were also skyrocketing. The most highlighted price move was for lumber, which impacted home building and remodeling work, sending home prices soaring. Across the commodity complex prices rose in response to the recovering economy and a lack of adequate supply hampered by supply chain, labor, and capital shortages.

Supply chain disruptions were often due to the lack of labor. There were not enough people creating the supply, as well as insufficient ability to move it to markets in a timely fashion. We were suddenly forced to revert to an economy from the past – one that lacked an instant response quality. Everything about our lives was changing. For energy, these changes were merely an extension of the recent era of industry volatility that had been kicked off at the start of this century.

Think about how the energy industry has progressed over the past 20 years. Initially it had to deal with a demand boom driven by the massive consumption of energy and commodities by China as it modernized and grew its economy, only to be followed by a massive economic collapse in concert with a global financial crisis. Financial uncertainty and the absence of liquidity caused economic activity to come to a screeching halt. The world’s economy was locked up. Immediately after that episode, we found ourselves back amid another economic/energy boom. By 2010, the world collapse of 2008 was a distant memory.

Oil prices in the $100-a-barrel-range drove global output up as demand was constrained. Guess what? Oil prices slumped. They slumped months before Saudi Arabia pulled the plug on the OPEC price bogey sending the petroleum industry into a recession. A recession that ultimately rivaled the great industry depression of the 1980s, sending the industry into another major restructuring.

In early 2015, the petroleum industry was reeling from the OPEC body blow. “Lower for longer” was the mantra characterizing the industry’s planning response. Recessions necessitate significant resets by companies. Eliminating capacity and jobs was necessary. The industry was forced to resize – much like people who need new clothes after losing lots of weight. We saw the industry’s downsizing pain play out in the bankruptcy courts as we headed toward 2020.

A new decade offered hope for better times for energy. A smaller oil and gas industry was beginning to find its footing. Company balance sheets were being restructured, with prospects for profitability on the horizon. Last March, the industry’s optimism was blown away as global economies shutdown to “bend the curve” of the novel coronavirus. The industry could not shut down production as fast as demand collapsed. The result was a negative price for U.S. crude oil, a never-before seen event. The unimaginable was happening! How could the industry possibly recover?

That future was further hampered by the external threat from climate change. Defining the shape of the future fossil fuel industry became a front-and-center issue for energy executives. Environmental, social, and governance (ESG) issues became a rallying point for climate activists and investors to attack the industry. Shutting down the fossil fuel business was necessary to save the planet’s environment from the ravages of carbon emissions was the message from powerful government and political leaders. From “keep it in the ground” to banning internal combustion engines totally, various strategies for crippling the petroleum industry were rolled out by activists, investors, and politicians. Net Zero by 2050 became the new mantra for energy!

Embracing 2050 to end fossil fuel use allowed activists to pressure governments and companies to establish interim milestones along the path to that date for zero carbon emissions. The highpoint for these efforts was COP26, the U.N. climate conference held in Glasgow last November. Unfortunately, the conference exposed the political and economic divide within the world community over climate change solutions. The masses of poor people in the developing world told the rich elites of the developed nations that until they enjoyed the same economic rewards from using fossil fuels as the rich had experienced, the poor were not about to bear the burdens of fighting climate change.

This ideological battle was unleashed just as an energy crisis exploded across the European continent. Renewables – wind and solar – were suddenly exposed for their fundamental weakness of intermittency. For utilities to meet their social obligation to always ensure adequate power for their customers, they were forced to turn to dirty fossil fuels, because those were the only sources of guaranteed dispatchable power. Instead of oil and gas companies failing, it was electricity companies counting on cheap renewable energy that were lining up at the bankruptcy courts. Customers are being slammed with escalating power bills, as high commodity prices and exploding carbon fees combined to send electricity prices sky-high. The grumbling grew louder.

As we peer into 2022, high oil and gas prices are likely to continue. The latest Dallas Federal Reserve survey of oil and gas executives found the most popular prediction is for WTI to be between $70 and $75 a year from now. The second most popular response was a prediction of prices between $75 and $80, with an $80 to $85 price the third most popular answer. The lowest price predicted was $50 and the highest $125. Optimism for improving industry fortunes is growing.

Oil prices are elevated because the industry has woefully underinvested for half a decade. That point was driven home by energy consulting firm Rystad’s analysis showing that 2021 is likely to witness the lowest volume of oil and gas discoveries in 75 years. Based on data through November, and with new major new discoveries in early December, the industry is projected to find 4.7 billion barrels of oil equivalent crude oil. Approximately two-thirds of the discoveries have been oil. Importantly, the monthly average discovery volumes in 2021 are less than half the average of 2020 and a third of 2019’s volume.

The lack of discoveries is partly explained by the low level of industry spending, but also by the shrinking supply of attractive exploration prospects. These two trends are not surprising, as many of the major prospective petroleum basins around the world have been actively explored. Since many of these basins are offshore, which is much more expensive to explore compared to onshore, they offer fewer drilling prospects. Traditionally, when oil and gas prices are low, the industry reduces exploration activity and directs its investment toward recovering more oil and gas from existing producing fields. That generally is more profitable oil and gas, especially against the speculative and longer-term profits from new exploration.

Exhibit 1. Low Commodity Prices Have Driven Less Drilling And Discoveries SOURCE: MarketWatch.com

What the Rystad analysis suggests, however, is that oil and gas markets will continue to tighten over the next several years, as demand growth must be met from existing idle productive capacity and increased output from existing fields. While oil price volatility will continue due to seasonal factors, weather, and demand fluctuations, the upward trend in oil prices evident for the past two years is likely to continue. Is it the start of a commodity super-cycle? Probably. What will be absent, however, is the dramatic year-over-year increases seen during the first half of 2021, because we will not be comparing against drastically depressed prices like in 2020.

Another major industry trend we expect to continue is the embrace of financial discipline by energy company executives. Deleveraging balance sheets, limiting reinvestment into the business, and boosting payouts to shareholders will continue to guide executive cash flow allocations. With higher prices and marginally higher outputs, companies will see larger cash flows from operations. Reduction of debt balances further adds to the amount of free cash flow oil and gas companies will have available in 2022, enabling them to boost shareholder returns and grow their businesses. Increased profits, more drilling and production, more employment and higher dividends and more share buybacks will characterize the oil and gas industry in 2022.

That scenario should be good for oil and gas company stock prices even after the industry’s incredibly strong performance in 2021.

The anti-fossil fuel agendas of large institutional investors, financial lenders and government entities ensures that the energy sector, excluding renewables, will struggle to access capital. This will have the perverse impact of driving up returns from oil and gas projects, which already are well above the returns available in the renewable energy sector. How will these investors and financiers look at future energy returns as collectively they sink due to low-return renewables? Their shareholders and clients may not take kindly to seeing their returns sacrificed on the altar of climate change! Being forced to rely on internally generated capital helps assure that any oil and gas boom will be well in the future, if ever seen again.

We have no idea what specific events will materialize that will boost or challenge the oil and gas industry in 2022. As the virus was not on anyone’s radar screen at the start of 2020, or inflation in 2021, we know there will be a surprise in 2022. It may be geopolitical, economic, or financial. Based on history, it must be an event we cannot fathom at the present time. Our best guess is an explosion in interest rates, much like the Volker era rates in 1981 when the prime rate hit $20%. That produced a serious recession, which helped lead to the great oil industry depression later in that decade. It also led to a major restructuring of the global economy.

A similar spike in interest rates will undo the stock market, which has become the money machine for many. High interest rates will boost pension obligations and the nation’s debt-carrying cost, resulting in significant tax increases. At the same time, the physical realities of our various energy fuels are becoming more evident. The idea that we can or will abandon oil, gas, coal, and nuclear anytime soon is a dream in the minds of climate activists. That does not mean fossil fuels will be welcomed with open arms. But, in a recession, the world will turn to its abundant and low-cost energy, which today means fossil fuels.

We thought the comments by Professor Emeritus Vaclav Smil at last fall’s Credit Suisse ESG conference that stunned the audience summed up the realities of the today’s energy transition. Policymakers trying to overcome the physical realities of energy will do nothing but create a bigger mess, much like they have with renewable energy mandates.

Smil pointed out that the world gets 83% of its energy from fossil fuels, with the range from 99% for the Middle East, to 91% for Australia, 87% for China, and 83% for the United States. Germany has spent the last 20 years turning itself “green,” yet it still relies on fossil fuels for 78% of its energy. Smil further noted that since the first global climate meeting in 1992, the world’s dependence on fossil fuels has only fallen from 87% to 83%. In absolute terms, we are using more fossil fuels today. All the investment in renewable energy has resulted in only meeting some of the incremental demand growth of recent years.

Smil told his audience, “Now I am told in the next 30 years by 2050, we are going to go from 83% to zero. That strains one’s imagination. We are burning more than 10 billion tons of fossil fuels and we are dependent, in every facet of existence.” He pointed to nitrogen fertilizer, which is made from natural gas. Without it, we can probably only feed half the world’s population. Think about the implications of that reality! The world’s civilization is dependent on four pillars: steel, ammonia, cement, and plastics. All of them use fossil fuels and there are no easy replacements.

On the issue of climate change, Smil has no problem. He says it was acknowledged in 1860. In his view, the problem is the energy transition and the push by organizations such as the International Energy Agency, whose policy prescriptions he believes to be cuckoo.

“We are in the very early stages of transition from fossil fuels to something else,” he says. “It took us 100 years to go from wood to 50% coal, 100 years to go from zero oil to about 40% oil. It has taken us so far about 70 years to go from zero gas to about 25% gas. These transitions are always unfolding, always at their own sweet pace. This could be accelerated, but within reason. You can’t say ‘by 2030 or by 2035’ – it doesn’t work that way.”

Technology is pointed to as the vehicle to speed up the transition, but Smil is skeptical. He pointed to the Norwegian experience with electrifying container shipping. “The Norwegians put into operation the first electric container ship just this year with 120 containers. It goes about 30 nautical miles. The biggest container ships in the world carry 24,000 containers, can go easily 13,000 nautical miles.” Shipping is under the gun to go “clean” but with no technical or economic solution.

Furthermore, we have been developing electric vehicles for about 20 years, and now we have seven million on the road, competing with 1.2 billion internal combustion engine vehicles. Getting to the 2050 net zero target also involves capturing and storing massive amounts of carbon, a challenge of scale that looks bleak according to Smil.

“We are not powerless, we are always changing – just not at the pace people would imagine it should be now. We have raised expectations too much.” Smil pointed out that “We’ve got into this habit that anyone can forecast. No, anything beyond about six weeks, it’s not even guessing. A fairytale. Thirty years ago in 1991, there was still the USSR, and China was a minor economy. China’s economy has multiplied 14 times. Would someone in 1991 have forecast there would be no USSR by now and China would expand and that global warming would be the No.1 international issue? It certainly wasn’t in 1991.” At that time, the climate crisis was acid rain, which we solved and have moved on.

Smil is a voice of reason, recognizing the realities of energy and how interdependent our economic and social systems are in their dependence on fossil fuels. Change will happen, just as it has in the past. Old fuels will continue to play a role in our global energy mix, just as wood and coal have for decades. But the important point is that the energy transition has always involved a shift to new fuels possessing greater energy content per unit and requiring less land and fewer workers to produce. Wind and solar have opposite qualities. Our energy future will also need more nuclear power, and eventually a new energy source that is even more efficient. Possibly it will be fusion, but we will need significant technological breakthroughs first.

In the meantime, the surprise for 2022 maybe that for all the potential turmoil and volatility that can disrupt the environment, energy might turn out to be very stable sector. Thus, we believe oil and gas will have another good year, as we continue along the positive phase of this energy cycle.

Is It Green Or Is It Not? Status Of Nuclear Power In Europe

Europe is amidst an energy crisis driven by a combination of weather and power events over the past 12 months. Electricity and fossil fuel prices have soared in recent months as a result. In the past two weeks, in response to news that more liquefied natural gas (LNG) cargos are heading from the United States to Europe to help alleviate the supply shortage, natural gas prices have dropped sharply. In the U.K., gas prices were 50 pence per therm (p/thm) ($0.67) last April. The price soared to a high of 470p/thm ($6.30) in early December, before recently falling to 270p/thm ($3.62). There are enough cargos heading to Europe to meet 2.5 days-worth of use. A warming trend in Germany is also helping cool natural gas prices on the continent, but the immediate impact elsewhere around Christmas was rolling power blackouts due to electricity supply shortages, heavy demand, and expensive power. Energy intensive industries throughout Europe have been squeezed by high electricity prices and, in many cases, are reducing operations or closing outright.

Two days before Christmas, Kosovo Energy Distribution Services (KEDS) announced rolling two-hour power blackouts for two million residents due to a surge in demand that “overloaded” its electrical grid. KEDS asked customers to cut their power use due to “insufficient internal generation to cover consumption and the global energy crisis.” Kosovo is Europe’s poorest nation and the need to import expensive power created a financial crisis that rolling-blackouts help mitigate. A technical issue at the country’s largest coal-fired power plant had forced it to shut down in November, which forced the government to import expensive electricity. The result of the rolling-blackouts was a sharp reduction in imported electricity. As reported by OilPrice.com, “Grid data from Entso-E shows electricity imports from Albania, Serbia, Montenegro, and North Macedonia plunged from 750 megawatts on Wednesday [Dec. 22] to about 469 megawatts on Thursday [Dec. 23].”

Exhibit 2. Where Europe’s Rolling Power Blackouts Have Started SOURCE: OilPro.com

As Kosovo was experiencing its power supply problems, Serbia also was forced to cut electricity to customers. This happened at the same time the United Kingdom’s grid operator issued a power supply warning and France experienced a nuclear power plant outage. The net result was a European power grid that was highly stressed, which resulted in soaring electricity prices as a rationing mechanism.

The high price of natural gas in Europe, which spiked in December when the continent experienced some colder than normal weather, collapsed with the news of the LNG cargos and new weather forecasts calling for above normal temperatures for Germany. Both events are captured in the following two charts.

Exhibit 3. Natural Gas Prices In Europe Drop On News Of LNG Cargos Coming SOURCE: OilPro.com

Exhibit 4. Projections Call For Above Normal Temperatures In Germany In Early January SOURCE: OilPro.com

While the European energy crisis eases somewhat, the battle amongst the members of the European Union (EU) over the role of natural gas and nuclear power in the continent’s future electricity fuel mix is simmering. The United Nation’s 26th Conference of the Parties meeting (COP26) in November highlighted the divide amongst the EU members, especially with regards to nuclear power. At the time of COP26, five EU member countries – Germany, Luxembourg, Portugal, Denmark, and Austria – issued a statement against the inclusion of nuclear power in the “green energy” category.

The battle over nuclear power was renewed at an EU meeting in mid-December, in which no policy decisions were reached due to the inability of the respective camps to convince the other to change its position. The tone of the discussions was impacted by the explosion in fuel and electricity costs, partly the result of soaring carbon prices. The EU’s carbon pricing recently reached a peak of €89 ($101) per ton of CO2 on December 8, 2021, a level not forecasted to be reached before 2030. In fact, the carbon price had climbed from slightly below €33 ($37) at the start of 2021 – a 172% increase! From the beginning of December to Christmas Eve, the price declined nearly €13 ($18), as the speculative fever cooled, and warmer weather was predicted.

Exhibit 5. A Key Driver For High Electricity Prices Is High Carbon Credit Prices SOURCE: EMBER, PPHB

The spike in carbon prices created a backlash from many of the poorer members of the EU who called for the organization to help alleviate the financial pain their citizens were experiencing and to control the market’s pricing more aggressively. Several countries called on the EU governing body to better control and eliminate the speculation in the carbon credits market to bring down the continent’s electricity prices.

The debate over the impact of carbon credits and the stress on the continent’s grid overwhelmed the discussion about the role of natural gas and nuclear power in helping the EU meet its green energy mandate. The battle ensued over the push by certain members to get the European Commission to propose before year-end its “sustainable finance taxonomy” rules, which would determine whether natural gas and nuclear power would be included in the definition of green energy. The talks ended when the leaders of the respective governments could not agree on a final text. EU summit chair Charles Michel stated: “We have realized that there were divergent opinions around the table, and we were unable to reach agreement on the conclusions presented.” The can was kicked down the road to a future meeting.

What this debate, as well as the one during the two-week COP26 gabfest, highlighted was the divergent opinions on the roles for natural gas and nuclear power in helping EU members meet the world’s carbon emissions goal. While political leaders debated, many governments have already decided that nuclear power will play a role in their future energy plans. Many of those countries pushing for building nuclear power plants are already members of the atomic energy club.

Currently, worldwide, there are 445 operable nuclear power plants in 33 countries. Combined, these plants represent about 400 gigawatts of electricity (GWe) generation capacity. In 2020, they produced 2,553 terrawatt-hours (TWh) of electricity, or about 10% of the world’s power consumption. The United States leads the world with 93 operating nuclear plants, as of October 2021, with France (56 plants), China (51), Russia (38), and Japan (33) rounding out the top five operators. Germany, with six operating nuclear plants, is tied for 13th place in the table below. It is scheduled to shut down half its plants at the end of 2021 and the remainder by year-end 2022. A nuclear-free electricity grid was a decision by former Germany Chancellor Angela Merkle, who, after the Fukushima nuclear plant accident in Japan in 2011, vowed to eliminate all nuclear power from Germany’s grid by 2022. She was accelerating a push that had broad public support, but with a much longer phase-out timetable. The accelerated phase-out may prove to have been a serious miscalculation, as the performance of renewable energy to power the Germany economy in a low-cost manner is falling short of that goal.

Exhibit 6. Operable Nuclear Power Plants By Country, October 2021 SOURCE: Statista Research

The battle between France and Germany over the greenness of nuclear power is creating a serious political split within the EU. At the time of the COP26 meeting in November, Germany, with its four supporting EU member countries, issued the following statement:

"The current decade will be crucial for our common path toward climate neutrality and an economic system that respects the limits of our planet. Therefore, it is crucial to have an EU taxonomy that considers the sustainability of a form of energy ‘throughout its life cycle.’”

The life cycle comment was intended to reference the issue of the disposal of radioactive waste generated by nuclear power plants.

The signing nations also warned that the classification of nuclear power as green could risk diverting EU funds from renewable energies such as wind and solar power. "Nuclear power cannot be a solution in the climate crisis,'' said German Environment Minister Svenja Schulze. "It is too risky, too slow and too expensive for the crucial decade in the fight against climate change," she added.

This position drew an interesting response from Rafael Mariano Grossi, the Director-General of the International Atomic Energy Agency (IAEA), in an interview at the time of the statement.

"Debates about energy and in particular nuclear energy must be based on facts. And the fact of the matter is that nuclear energy is a green energy. It is an energy that has almost no CO2 emissions. It's an energy that is already now as we speak, preventing millions of gigatons of CO2 going up in the atmosphere. It's an energy that provides already now more than half of the clean energy that exists in Europe as we speak today."

Grossi went on to say, "Sometimes I have the impression that facts are not being looked at as often as they should be. Of course, we respect, in open societies, democratic choices. But when it comes to facts and affirmations, one has to stick to science."

When asked about the nuclear waste argument, Grossi dismissed it as a serious issue. He pointed out that "Nuclear waste is a reality. But nuclear waste, of course, is dealt with in an adequate manner, and there has never been an accident involving nuclear waste. When you talk about the volumes of nuclear waste, they are ridiculously small."

"Did you know, for example, that the whole nuclear waste of the entire fleet of American reactors --talking about around 100 nuclear reactors that have been powering this country for almost 60 years -- would fit within a football stadium?" Grossi stated. "How does that compare with the damage that is being caused to the atmosphere, to the environment by other sources of energy that are causing global warming? Nuclear waste is at a place where you can see it, where you can control it and where you can check it."

Grossi welcomed the ongoing debate among EU members. He said, "I think there is a growing convergence around the fact that Europe needs nuclear energy. It doesn't mean that every country is going to have nuclear energy again, [it's] a matter of political choice. [W]e see that the winds are turning and that people are recognizing that, in fact, it is science and good choices, not ideology, that should prevail when you come to decisions about what energy sources you are going to [use]. So, I don't see a clash."

While some would dismiss Grossi’s comments are being self-serving since he heads the IAEA, his reliance on the science of nuclear power and its non-existent CO2 emissions makes his case stronger. Moreover, French President Emmanuel Macron stated at the time he announced that his government would start building its first nuclear reactors in decades to meet its carbon emissions reduction target, "If we want to pay for our energy at reasonable rates and not depend on foreign countries, we must both continue to save energy and invest in the production of carbon-free energy on our soil." France, the number two country operating nuclear power plants, is also the most dependent on these plants, relying on them for 70% of its power needs.

Exhibit 7. Nuclear Power Plants Under Construction In May 2021 By Country SOURCE: Statista Research

As the table above shows, there were 52 new nuclear power plants being built as of May 2021. France, with one new plant under construction, is among a handful of countries with only one new unit coming on-line soon. Macron’s action will lead to more plants being built in France in the future. The leading builders of nuclear plants are China and India, as they work to meet growing power needs from their large populations and to reach their carbon emissions reduction targets. Interestingly, both countries are also actively building coal-fired power plants, much to the dismay of climate activists, who have been loudly criticizing the countries for their actions and the implication for carbon emissions.

The International Energy Agency (IEA) released its World Energy Outlook 2021 shortly before the COP26 conference. The agency utilizes several scenarios to highlight how various governmental policies will impact the future of energy markets. For this report, the IEA used not only its Stated Policies Scenario (STEPS) to show how the current carbon emissions plans of countries would impact future energy demand and supply, and by what fuels, but it also created an Announced Pledges Scenario (APS) to capture the benefits of the newly updated country plans to reduce their carbon emissions. Compared to these two scenarios, the IEA also sets out what is needed by the electricity market to meet a Net Zero Emissions (NZE) by 2050 goal.

In the IEA’s discussion of the electricity sector, it projects a near doubling of electricity demand under STEPS and an even greater increase under APS. The NZE scenario would see electricity demand nearly triple 2020’s consumption, as more of the power needs from economic activity would be met by electrification. The chart below from the IEA’s report shows these demand scenarios along with projections of which fuel sources will generate the electricity needed. The yellow portion of the generation bars represents the share from nuclear.

Exhibit 8. Global Electricity Demand And Generation Mix By Scenario SOURCE: IEA

The following chart shows the changes in fuel generation for the three scenarios by individual fuels, measured in thousands of TWh, over the next decade. While the nuclear contribution increases in each scenario, it is clear the role of fossil fuels declines sharply, while solar and wind are the primary drivers of the energy revolution. This is not surprising, as the IEA has been a huge booster of renewable power for meeting its NZE scenario.

Exhibit 9. Electricity Generation Change By Source And Scenario, 2020-2030 SOURCE: IEA

The most telling chart is below. It shows the trajectory for nuclear power capacity from existing plants between 2020 and 2050 for the advanced economies and emerging market and developing economies. But the chart also shows the new generation capacity needing to be added over the forecast period for the two respective market segments. While there needs to be an incremental amount of new generating capacity added for the advanced economies, the increase among the three scenarios shows a modest increase as we move from STEPS to APS and ultimately to NZE. However, the relative increases are much greater for the emerging market and developing economies. Of course, countries such as China and India fall in this latter category.

Exhibit 10. Nuclear Power Capacity By Scenario, 2020-2050 SOURCE: IEA

Given the cost and time to construct new nuclear power plants, significant efforts have been undertaken to extend existing plant operating lives. This is one way the electricity industry is dealing with the aging of its nuclear plants and the need to replace their generating capacity. Currently, over 200 operating plants are 30 years or older, suggesting there may be more retirements in the offing. During 1999-2020, according to the World Nuclear Association, 103 reactors were retired, while 104 new ones began operating. In its The Nuclear Fuel Report for 2021, the association projects 123 reactor closures by 2040 in its reference case, however, it also sees 308 reactors coming online.

Plant life extensions and upgrades are a key part of the electricity industry’s response to the need for more clean energy. In the United States, the Nuclear Regulatory Commission has granted 85 operating license renewals since 1977 with plants having their operating lives extended to 40-60 years. These extensions are usually granted at the 30-year life point of operating plants. In France, the government conducts rolling 10-year reviews of plants. In a significant review, it granted an extension for 40 years for one nuclear plant design that impacted 34 of the nation’s operating units. Russia is also extending its nuclear plant lives. They have added 15 or 30 years to the life of operating plants, with the longer extensions offered to the newer VVER-1000 design plants.

The chart below offers a summary of the operating and under construction plant totals by country, along with their combined capacity and electricity generated for 2020. There is also a calculation of the amount of electricity provided by nuclear plants. One can see the handful of countries – many of which are small – where nuclear power provides a significant share of total electricity generated.

Exhibit 11. The Status And Significance Of Nuclear Power SOURCE: Wikipedia

The chart below shows the number of new nuclear power plants and the combined generating capacity scheduled to come online during 2022-2027. The next two years show many plants and generating capacity being added, with a meaningful drop off in the subsequent two years. Given the length of time it takes to construct these new plants, the only issue will be whether their scheduled start-up dates slip. With roughly 14-16 GW of new capacity coming on stream during the next two years, this represents a significant capacity expansion, although offset by early retirements of plants such as the six plants in Germany with a combined 4 GW of generating capacity. Researchers modeling the impact of Germany’s early closure of its nuclear plants find that fossil fuel use and carbon emissions will increase in the near term but then should be offset once additional solar and wind capacity come online. For German electricity customers, the closure of the nation’s remaining nuclear plants will expose them to the loss of electricity generating capacity that operates at 93% utilization, compared to the replacement power of renewables with only 15-25% utilization. What this means is that German utilities will need to build 4-6 times the capacity planned just to match the lost electricity generated from the nuclear plants. That necessity comes at a cost and a risk to grid stability, such as experienced during 2021 when wind stillness and bad weather curtailed renewable power output. Germany already has the highest residential electricity prices in Europe!

Exhibit 12. New Nuclear Power Plants Concentrated in China, India, And Russia SOURCE: World Nuclear Organization

Based on the status of the European energy crisis and this year’s renewables performance, there is growing pressure to ensure that nuclear retains a role in the energy mix to help meet the net zero emissions goal. People are beginning to recognize the value of nuclear generation’s high utilization for grid stability, while also not creating carbon emissions. The stillness that hurt wind energy in Europe was part of a natural weather cycle, something that may last for several more years. Such a weather pattern diminishes the amount of wind power produced, and often at the worst times for electricity demand. That argues for keeping and eventually expanding nuclear capacity.

The question of whether nuclear power is green is clear cut – it does not emit any carbon when it generates electricity, just like solar and wind. That makes it green. That does not make it popular with climate activists because they have an agenda that is myopic. They can only see wind and solar, but now are beginning to accept hydrogen fuel as acceptable, although it is nowhere near being cost-competitive. Nuclear has a role to play in the world’s future power supply – and that role should be expanding rather than contracting. The EU decision to push forward in recognizing nuclear and natural gas as green is a recognition of that future.

The Great Coal Revival That Was Missed By The IEA

The International Energy Agency (IEA) recently published its Coal 2021 report that discusses the global coal market and forecasts it out to 2024. The abstract for the report begins by stating: “Coal 2021 is the world’s most comprehensive forecast of coal demand, supply and trade…” It goes on to discuss how the report relies on the broad knowledge of the agency and its study of multiple fossil fuel and renewable energy markets, including the assumptions that drive all its forecasts.

The abstract highlights the significance of coal for the world’s economy and its energy system. The abstract concludes with the following statement:

Given that coal is the largest source of electricity generation, the second-largest source of primary energy and the largest source of energy-related CO2 emissions, Coal 2021 is a must read for anyone with an interest in energy or climate.

We agree with the importance of understanding the global coal market. What was interesting was rereading Coal 2020, last year’s report, after reading Coal 2021. The conclusions and forecasts from that earlier report totally missed the factors that have driven the global coal market this year. It was also interesting to see that the IEA was comfortable in 2020 issuing a coal market forecast to 2025, but in the latest report, it stops its projections in 2024. Maybe the IEA’s caution in forecasting the global coal market is because it is unsure of the trajectory and power of the trends that have driven coal this year.

In Coal 2020, the headline about demand was “Coal use plateaus through to 2025 on the heels of the drop in 2020 and a rebound in 2021.” The authors of the report cite three reasons why they reached their conclusion. Those reasons were: 1) “coal-fired power plant retirements in developed countries accelerate;” 2) “low-carbon generation technologies, e.g., wind and solar, gain momentum as costs continue to fall and policy support is sustained;” and 3) “the perception that coal is the cheapest source of dispatchable electricity has been shaken by low gas prices.”

With respect to the third reason, the IEA cites various countries that downgraded their plans for coal “reflecting lower cost renewables and cheaper natural gas, amid increasing concerns about CO2 emissions and building anti-coal pressure on many fronts.” That assumption was blown-up when renewable power proved unable to deliver the power anticipated and electricity blackouts and high prices were the alternatives.

In Coal 2021, the IEA states: “Coal-fired power generation is set to reach an all-time high in 2021.”That statement reflects how wrong the coal market forecasts of late 2020 were.Moreover, the new coal forecast suggests interesting challenges for the world’s economy and carbon emissions. The IEA headlines their forecast with “A strong rebound in 2021 and slow growth thereafter lead to highest ever global coal demand by 2024.”Weren’t we told by United Nations Secretary-General António Guterres that burning coal needed to stop immediately if the planet was to be spared from global temperatures increasing by more than 1.5º C (3.7º F)?

In the most recent report, the IEA did address somewhat its forecast from the 2020 report. The IEA wrote:

While Coal 2020 did forecast that coal demand would bounce back robustly in 2021, the rebound is turning out to be much stronger for three reasons: first, the global economy recovered more quickly than expected, with global GDP growth of ~5.8%, the highest in almost half a century. Second, a cold winter and hot summer boosted power demand while low rainfall and weak winds in some regions decreased electricity supplies. Third, weather conditions and some supply issues pushed gas prices to all-time highs, raising demand for coal for power generation.

The increase in coal consumption in 2021 came from three countries – China, India, and the United States. The increases were due to significant increases in coal use for generating power. While increased coal use in China and India is not a surprise, many people are probably shocked to see the revival in coal-fired power generation in the United States. In preparing its forecast, the IEA sees U.S. coal consumption falling between now and 2024 but the major coal use decline will be experienced in Europe.

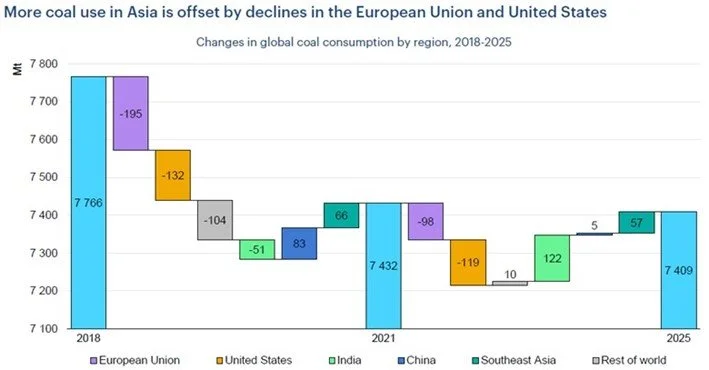

The Coal 2020 forecast for coal use in 2025 (chart below) showed that increases in consumption by India, China, and Southeast Asian countries would be offset by declines in use by the European Union and the United States. What was interesting in this forecast was the minimal demand increase predicted for China between 2021 and 2025 - only 5 Mt. The Rest of the World’s increase was predicted to be double China’s growth.

Exhibit 13. Coal 2020 Forecast Called For Coal Demand Plateau SOURCE: IEA

In contrast, the Coal 2021 forecast shows a dramatically different picture. The European Union’s coal consumption is projected to fall by more than in the prior year’s projection. However, the United States’ decline is one-third less than previously forecast. The regional increases are greater everywhere – India, China, and Other Asia – but for the Rest of the World, which is 1 Mt less than the 2020 projection.

Exhibit 14. Coal 2021 Forecast Is Radically Different From 2020 Prediction SOURCE: IEA

As with any forecast, it is only as good as the quality of the assumptions that underlay it. As we saw in Coal 2020, the key assumptions for the forecast were that recent regional use trends would continue. Less coal used in developed economies (more concerned with carbon emissions) and more consumed by developing economies (growing populations and economies) were the key assumptions. Natural gas, which has been a killer for coal’s use in power generation due to its cleaner burning qualities and its cheaper relative price, was assumed to remain cheap. That assumption was based on the view that the world appeared to be awash in natural gas supply. However, when colder than expected temperatures arrived, gas use rose sharply and suddenly the surplus disappeared, leaving a tight gas market and sharply higher prices. As these dynamics played out this year, the prior forecast proved way off, especially as other knock-on effects were felt.

Should we assume the 2021 forecast will prove more accurate? What happens if renewable energy continues to underdeliver? How about the geopolitical tensions between Europe and Russia? Will Russia use its gas supply as leverage to achieve political ends that would otherwise require military action? Are there sufficient gas supplies in the U.S. to help Europe meet its energy needs if Russia fails to deliver additional supply and Asian demand increases?

At local levels, the question will be how aggressive politicians are in pushing their anti-fossil fuel agendas, which require substantial government subsides for renewable energy and mandates that drive economies to become totally electrified. Will the public accept higher energy costs and power intermittency? These are just some of the questions forecasters need to be asking as they reassess the underlying assumptions that drive their forecasting models.

In looking at a couple of other interesting sections from Coal 2021, we see how policy actions can significantly alter forecast outcomes. For example, if governments decide to aggressively push to shut down the coal industry, there will be significant financial pain felt, especially in the Asian and Indian subcontinent regions. The chart below highlights the average age of existing coal power plants in 2020 by region. The plants are very young in Asia, but much older in Europe, Russia, and the United States. Countries in Asia are still building coal-fired power plants, so they will be reluctant to shut down modern existing plants. However, if the anti-coal movement is successful in stifling new coal mines, is it possible that these coal-dependent countries will be forced to shut power plants for lack of fuel? What are the repercussions of such a scenario? What happens if citizens reject the shutting of coal-fired power plants if it translates into higher electricity bills? Has anyone asked them?

Exhibit 15. Will Asia And India Be Willing To Close Young Plants At Large Losses? SOURCE: IEA

The Coal 2021 report showed predictions for the average annual coal-fired plant retirements under the APS and NZE scenarios. Under both scenarios, there should be sharply lower coal consumption, based on the capacities estimated to be shuttered each year. Are these estimates realistic, or are they based on an anti-coal agenda that might be rejected by major coal-consuming countries? Has the IEA considered the experience of 2021 when previously retired coal-fired power plants were restarted to keep the lights on in places like Germany, Hungary, Poland, and the U.K.? If the coal plant shutdowns are rejected, is it possible the IEA’s coal consumption forecast to 2024 is understated? In which case, coal use projections for the second half of this decade may turn out to be too conservative.

Exhibit 16. How Realistic Are These Coal-fired Plant Closure Predictions? SOURCE: IEA

Another issue we always find interesting is the impact of the green energy/anti-fossil fuel development on employment. The chart below shows the impact of employment growth in clean energy out to 2030. With the APS and NZE scenarios, employment shrinks for oil, gas, and coal, as well as for automobiles and power generation. However, employment grows sharply in green energy sectors. That is one of the big selling points for subsidizing renewable energy projects.

Exhibit 17. Green Energy Employment Gains Look Impressive SOURCE: IEA

The more telling employment chart is below. It shows that the fossil fuel and energy industries will lose more jobs than will be generated by the clean energy sector. Supposedly the job skills in the two sectors are overlapping, but, as the IEA points out, there are insufficient clean energy jobs created in Asia to absorb all the displaced coal workers in that region. This may be an honest assessment of the employment picture in the energy sector, broadly defined, but we have always been skeptical of the estimates of the number of green jobs to be created by clean energy projects, which is the justification for them being subsidized and promoted.

Exhibit 18. Green Energy Fails To Create Sufficient Jobs To Offset Fossil Fuel Job Losses SOURCE: IEA

Coal is one of the most interesting energy markets. Its death has been pronounced several times in recent years, but each time some event gives it new life. Reading Coal 2020 and Coal 2021 reinforces the important role coal plays in the world’s energy system, a role not likely to be displaced quite as easily as climate activists would like. That is good news for those people who depend on the power generated by their coal-fired power plants. We are certain the Coal 2021 forecast will be revised when Coal 2022 is published next fall – we just are not sure whether it will be up or down. Based on current trends in energy markets, we would not be surprised if the coal demand estimate is increased in the 2022 report. However, we are confident that coal’s longer-term future, as posited by the IEA, will reflect either a continued demand “plateau” or that that a peak is at hand and demand will then begin falling. Coal may be the proverbial cat with nine lives, which will frustrate environmentalists to no end.

Study Says EVs More Costly To Operate Than ICE Vehicles

Electric vehicles (EV) are presented to be not only good for the environment but also cheaper to operate than internal combustion engine (ICE) vehicles. Yes, EVs are more costly to buy than their ICE counterpart, which is why they are being subsidized, but their total lifetime costs are cheaper. The cost premium of EVs over comparable ICE vehicle was estimated at $11,000 last September. Current buyers may also benefit from state subsidies. Current federal subsidies are limited to EVs produced by auto manufacturers who have not yet sold 200,000 EVs cumulatively.

Once that threshold is reached, the amount of annual tax credit is reduced quarterly in a stairstep manner eventually reaching zero in a year after exceeding the 200,000-unit number.

EV buyers have an additional challenge, in that the subsidy comes in the form of a tax credit, which must be claimed when filing one’s annual tax return for the year the EV was purchased. Should an EV-buyer not have a tax liability equal to or greater than the subsidy the remainder of the credit is lost. That is why the Biden administration’s Build Back Better legislation includes a revamped EV credit system. First, the credit is increased to $12,500 depending on the model be produced by an American car manufacturer in a unionized plant. Secondly, the credit is to be an adjustment to the vehicle’s purchase price, rather than as an income tax credit. The belief it that by cutting EV prices, more Americans will find them affordable, compared to buyers who can only use the credit on their tax returns.

If the EV’s purchase price premium can be largely eliminated, more EVs will be sold, even though buyers may face challenges in charging them. The small remaining EV purchase premium is thought to be rapidly erased as owners drive these low-cost vehicles since gasoline no longer needs to be purchased. Moreover, owners will enjoy the sportier, more responsive, pollution-free driving experience. The unknown is how much driving the EV buyer needs to do to offset that remaining purchase-price premium.

In 2020, the Department of Energy (DOE) released a study attempting to answer the driving cost question. The report was quite detailed, as it used state-level assessments of EV charging costs, however, there was a national average figure calculated. The study found that the national average to charge an EV was $0.15 per kilowatt-hour (kWh), which DOE determined translated into savings of potentially $14,500 over 15 years of use based on fuel cost differentials alone. To that savings, one should add the savings from a cheaper-to-maintain EV. That translates into about $0.04 per mile according to DOE, or another $8,000 in savings for EV drivers over the course of 200,000 miles.

On October 2, 2021, the Anderson Economic Group, a well-known economic consulting firm with decades of auto industry experience, released the results of its own study, which required six months to complete. The study concluded that “Electric vehicles can be more expensive to fuel than their internal combustion engine counterparts.” What?

The study’s methodology involved examining EV charging costs in more finite detail, going beyond state-by-state details to also examine rural/urban charging considerations. The study also separated vehicles by segment, use, and cost.

The DOE study said that the average cost of electricity for an EV is $0.04 per mile, meaning it costs $9 to fully charge a battery with a 200-mile range. According to the American Automobile Association (AAA), it costs between $0.07 and $0.10 per mile to fuel a comparable gasoline-powered car.

The Anderson study concluded that there are four hidden costs in operating an EV that were not considered in the DOE study. First is the cost to purchase and install a home charger. Second is the inflated cost of using commercial charging stations. Third is the amount of “deadhead miles” spent driving to find far-flung charging stations, especially in rural areas. Finally, there was the registration taxes being imposed on EVs to help offset the fact they do not pay gasoline taxes that fund the maintenance of roads. The study also factored in the cost of time spent searching for reliable charging stations, as well as the time spent recharging the EV. The times were measured with stop watches.

The DOE study presumed that most EV owners would rely on cheap, at-home charging instead of expensive commercial charging. This was a point hammered on by critics of the Anderson study. They believed Anderson allocated too much charging to commercial charging stations. The critics also suggested that the cost of installing chargers was overdone because many utility companies provide subsidies since they hope to sell a lot more electricity. Lastly, critics raised issues with the cost estimates of the time spent seeking commercial charging stations, as well as the time spent in recharging the vehicle. The critics argued that most charging is done at home and the EV owner can do other things during the time the vehicle is charging. Some critics acknowledged that for certain EV owners – those without garages or living in apartments – may have to rely on commercial charging stations for most of their recharging, which will add to the cost of operating their EV.

An article by GoBankingRates.com dissecting the Anderson study summed up its key conclusions.

Commercial charging rates are two to four times higher than residential rates.

Level 1 chargers cost an average of $600 to install and can take 20 hours to fully charge an EV.

Level 2 chargers are much faster but cost $1,600.

“Full charge” is a misleading term because charging past 90% is slow, difficult, and unadvised, which means you get far fewer miles than the advertised ranges would have you believe. Gas vehicles, on the other hand, are good for 300-400 miles per tank.

Considering all those factors, and presuming a greater reliance on commercial charging, it would cost $8.58 to fuel a mid-priced gas car that gets 33 mpg for 100 miles at $2.81 a gallon. Comparatively, a mid-priced EV — Tesla Model 3, Nissan Leaf or Chevy Bolt — would cost $12.95 per 100 miles.

Annually, presuming 12,000 miles driven, it would cost $1,030 to drive a gas car versus $1,554 for an EV.

This study was the first installment from Anderson, so we should learn even more in the future about the EV cost issue. But we were recently made aware of another cost for EVs that has not received much attention, which is the rapid wear of EV tires. There are considerations about EV tires that most of us do not consider, and those issues are contributing to owners often needing to replace tires after 12-20,000 miles, rather than the 30-50,000-mile range for ICE vehicles.

An article by Ars Technica examined the challenges of designing tires for EVs. The article was captioned “EVs have more mass and lots of torque, but the tires need to be efficient and quiet.” It was based on an interview with Ian Coke, director of quality at tire company Pirelli, and his company’s experience working with Tesla.

EVs are generally heavier than ICE vehicles. As a result, "We had to introduce a new load index to be able to support the weights of these vehicles,” commented Coke. That is done by beefing up the sidewall construction and using certain synthetic textiles like aramid fibers. At the same time, an important consideration in EV-buying is vehicle range, so the tire needs to have a low rolling resistance. A 20% increase in rolling resistance can reduce EV range by 5-8%, which is a meaningful compromise. According to Coke, "Clearly, one of the major constraints is you've really got to use a lot of technology in terms of construction, in terms of compounds—especially high-content silica compounds—to really work on that rolling resistance. "While there was no mention of the cost impact of these requirements, we must believe it leads to EV tires being more expensive.

The tire also needs to have plenty of traction because of the torque of the EVs’ electric motors that drive the wheels. That requirement has become necessary because EV drivers like to mash the accelerator when leaving traffic lights. Coke suggested this challenge in reducing rolling resistance and boosting tire performance is necessary because most of the EVs operating today are actually “performance” vehicles rather than standard commuter vehicles.

The final challenge for tires is that EV powertrains are almost silent, so tire noise that would be unnoticeable in an ICE vehicle becomes significant at the same speed in an EV. Coke suggested that "Now there's a variety of technologies out there. [Tread] pattern is one aspect. There has been a big uptake in noise-cancellation systems, which [involves] an open cell structured foam [being] placed inside the tire; the sponge absorbs the noise, and [the noise cancellation] stops it from being carried through."

Coke commented that while Pirelli has been able to make tires that meet most of those attributes, the result has been the need to compromise on other characteristics. "The thing that we've seen the most is the wear. If you have owned an EV for a couple of years, you've certainly changed your tires twice," Coke said. This point was confirmed by several other EV owner reports about tires we have read. Many EV owners report tires wearing out after as few as 12,000 miles or possibly upwards of 25-30,000 miles. If people are replacing tires after such little driving, their vehicle cost increases by as much as $0.07 per mile. One of our vehicles – 2010 Lexus 450h – required new tires after 60,000 miles. Based on the same tire cost estimate, our vehicle incurred an operating cost of $0.01 per mile.

As more research is conducted into the cost of EVs, we are finding that they may not be as low-cost as touted. We also know that their legacy carbon emissions requires that they be driven for years to breakeven against ICE vehicles. This research suggests to us that rather than becoming ubiquitous, EVs may remain a niche market unless mandated by governments. Not surprisingly, that is the road the EV industry is heading down. That policy is being administered in a stealth manner under the guise of revised government mileage standards currently being implemented. The revised standards effectively mandate that 17% of vehicles sold in 2026 be EVs versus 3% now. We see this revised government policy leading to auto manufacturers restricting the availability of ICE vehicles, forcing people to buy EVs. A clever but coercive policy. It is likely to force people to rush to buy ICE vehicles early in the year before manufacturers reach their quotas. Later in the year, car buyers will find auto dealer showrooms resembling grocery store shelves of the past two years!

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.