March 28, 2024

Things I Learned This Week on Spring Break

Spring Break. Getting snowed on while taking a Pink Jeep tour of the Grand Canyon after hiking the South Rim the other morning was great. The biggest surprise was the weather. We hiked Sedona on a beautiful morning and, by dinner, it had snowed, sleeted, with thunder and lightning. Four layers in the morning. And it’s Arizona. I was in southern Arizona in January and cold wasn’t an issue. I also forget that we are at 7,000 feet. It was my first time to see the Grand Canyon. It is grand. My son is a sophomore at Colorado and this is his Spring Break trip. And then we came to Vegas! He doesn’t hit 21 till next month so there are no stories that need to stay in Vegas. I never want to grow up!

Can’t Call the Bet. We have written extensively about the issues with Venezuela. Last year, in an effort to lower U.S. gasoline prices for election purposes, the administration lifted sanctions on Venezuelan oil sales, boosting the Venezuelan economy by billions. The condition was that President Maduro would hold fair and honest elections. We got the oil and the shaft. First, Maduro, realizing the economic might related to oil, immediately questioned the 1899 treaty and claimed that his country actually owns part of Guyana, home of the most prolific oil discoveries in a decade and moved troops to the border to back up his claim. He since then has barred his primary rival from running in the upcoming elections and barred his substitute as well. So much for fair and open elections. And the U.S. response? Zero. There is not much we can do. Reinstitute the sanctions? Not likely, and we have no more cards up our sleeve. Maduro gets billions in additional oil revenues, squashes his rivals and thumbs his nose at Washington. No response. The power of oil and politics.

CERA Week. CERAWeek was last week in Houston, bringing together energy executives and government employees across the spectrum of energy. Oil and gas won, with the continuing realization by all that demand is moving sharply even as renewables and others are discussed and contribute but “surety of reliable supply” as it refers to electricity is paramount with nuclear and natural gas being cleaner than coal and not subject to weather as are renewables. One interesting article wrote of three big questions that came out of the conference:

Will the election affect energy investments?

How is AI changing the energy sector?

Will minerals production keep pace with the energy transition?

The election will have little effect at all since there isn’t anything either candidate can do about the weather or the Chinese economy which are affecting natural gas prices. Approving more pipelines is a long term positive but could be a near-term headwind to prices. In oil, our production growth is based now on economics not the need to grow, even though we have grown out production so much that the rest of the world has had to cut back to accommodate us.

AI will change the industry in several very big ways. From a geoscience perspective, our ability to find oil and produce the maximum amount will be first. Second will be the energy needed for all the AI chips that will come on the market like a tsunami. AI chips use 4x-5x the power of regular chips and this is one demand point that many seem to be missing. It is already being used in the mechanical aspects of the industry with great results and that will continue to improve.

Minerals production will continue to be a global issue but the pushback on new mines, child mining, and the fact that the Chinese have cornered both the ownership and long-term processing rights will all come into play but that all means the transition will not be as quick or easy as some expect.

The Weekly EIA Report.

Crude Implications: Bearish – build vs expected draw. WTI 1M-12M backwardation at $7/bbl, flat w/w. Money managers increased ICE Brent and NYMEX WTI net long positions by 26% w/w, with net positioning only 9% below the recent peak in last September.

U.S. Crude Production: Indicated at 13.1mm BOPD, unchanged w/w, and up 0.9mm BOPD y/y.

Refinery Runs: 15.9mm BOPD, up 0.1mm BOPD w/w and up 0.1mm BOPD y/y. Utilization at 88.7%.

Crude Imports (net): 2.5mm BOPD, up 1.1mm BOPD w/w and up 1.8mm BOPD y/y. Brent-WTI spread at $4.5/bbl, flat w/w.

Gasoline: Bearish – build vs expected draw. Demand down 1.1% w/w and down 4.7% y/y.

Distillate: Bullish – draw vs expected build. Demand up 6.4% w/w and up 8.5% y/y.

Other U.S. Energy Market Updates (From PPHB).

Onshore Drilling Rig Count: 601 drilling rigs operating in the U.S. (a decrease of 4 rigs week-over-week).

Frac Spread Count: 265 frac spreads operating in the U.S. (a decrease of 4 spreads week-over-week).

Hot Chocolate. Cocoa is now more expensive than copper. The price for cocoa has been sky-rocketing, up more than $700 a ton in a single day and now selling at $9,000 per ton. A supply crunch is to blame. Ghana is the world’s second largest producer and has had funding issues but the cost of your Hershey bar or hot chocolate just went up.

Houston on a Busy Day.

Politics. In Boston, black churches are demanding reparations from white churches and one member of the Reparations Committee says that Boston needs to spend $16 billion to get the process started.

Coal. India coal production passed 1 billion tons for the first time. As long as India and China continue to increase their burning of coal, little the rest of the world does will matter. And the cheapest form of energy is what is first being demanded and used. Clean forms of energy take a back seat to the cheapest in developing countries.

Nice Deal. Enbridge, Whitewater/I Squared Capital and MPLX are joining forces in a JV to transport associated gas from the Permian directly to LNG export facilities. The deal strategically knits together the assets of three Permian infrastructure companies to transport natural gas. Concerns about future infrastructure to move the increased amounts of associated gas has been an issue for a while. They are contributing existing assets and building more. Consolidation takes all forms.

Determined. Short sellers are still betting billions of dollars that the rally of cryptocurrency-linked stocks, fueled by a surge in Bitcoin, will end. Total short interest has increased to almost $11 billion this year, and more than 80% of it is bets against MicroStrategy and Coinbase Global. Paper losses for the shorts meanwhile have mounted to almost $6 billion. Still, they are doubling down, betting on a crypto collapse.

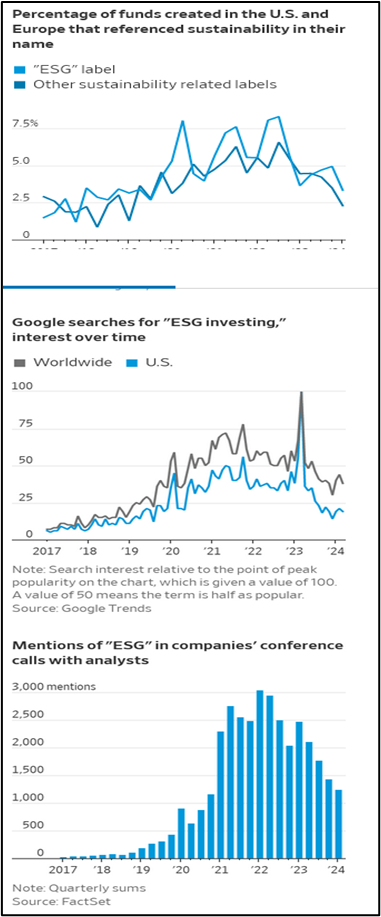

ESG. Three years ago, it seemed to be all that mattered. Every conference, every conference call, every mention included some comment about ESG. Environmentally friendly funds were started where people could invest in clean energy ideas. Since then, the fervor has waned and the ESG funds have under-performed. It seems that people want to make money with their money, not save the planet, when there is no visibility whatsoever that the efforts would have any impact. Concrete investing and back to what matters. See the three charts below. Thanks to Jon Sindreu and James Halloran.

Trying to Lead. Exxon has a plan for the world’s largest low-carbon hydrogen project. You know, hydrogen, that was going to replace gasoline by 2002? Well, of course, now, it is back in vogue. Kinda. The problem is that the cheapest source of hydrogen is natural gas. That makes it THE most economical way to produce hydrogen. The project would produce 1 billion cubic feet per day of hydrogen and capture 98% of associated carbon, reducing the emissions from a refinery by at least one third. Exxon is spending billions to produce hydrogen and reduce refinery emissions. Wow. Leading the way. Except for the fact that, without the IRA bill tax incentives, it is not economic. So, imagine the economics of projects that derive hydrogen from other sources, ones that don’t reduce refinery emissions along the way. From Exxon’s CEO - "The narrative and a lot of the activists in this space have made it a one-dimensional issue which is just get rid of oil and gas, fossil fuels and coal. You can't give up the benefits that quickly. Society can't tolerate that, the hardships that come with the lack of those benefits." The biggest and best are trying and it’s not enough, for the economics, the activists and everyone else associated with the idea that ending oil and gas use tomorrow would result in good things. Geez.

Different Perspective. An article recently was talking about how much emissions are going to be generated from the burning of fossil fuels of fields yet to be brought online. It was a very critical piece, not knowing the difference in impact and use of oil and gas versus coal. In many parts, it was just a screed. But I liked some of the comments and view them as positive, even if the article didn’t. “At least 20 billion barrels of oil equivalent of new oil and gas has been discovered for future drilling since this point, according to the new report by Global Energy Monitor, a San Francisco-based NGO. Last year, at least 20 oil and gas fields were readied and approved for extraction following discovery, sanctioning the removal of 8 billion barrels of oil equivalent. By the end of this decade, the report found, the fossil-fuel industry aims to sanction nearly four times this amount – 31 billion barrels of oil equivalent – across 64 additional new oil and gas fields. The U.S., which has produced more crude oil than any country has ever done in history for the past six years in a row, led the way in new oil and gas projects in 2022 and 2023, the report found. Guyana was second, with countries in the Americas accounting for 40% of all new oil sanctioned in the past two years.” While the article views all those statistics as a negative, I feel exactly the opposite. Well done, guys.

Automobiles. While gasoline or diesel would encompass my normal commentary concerning automobiles, today is a bit different. It makes you realize that all industries are at the mercy of political stupidity. It seems that car thefts in Chicago have sky-rocketed and it turns out to be the car maker’s fault! The mayor of Chicago is suing Kia and Hyundai because they didn’t install engine immobilizers between 2011 and 2022. It seems that videos on social media went viral, showing how to start those models in those years without a key. It’s alleged that they advertised “advanced” safety features of these cars but not quite “advanced” enough. “The impact of car theft on Chicago residents can be deeply destabilizing, particularly for low- to middle-income workers who have fewer options for getting to work and taking care of their families,” said the mayor. “The failure of Kia and Hyundai to install basic auto-theft prevention technology in these models is sheer negligence, and as a result, a citywide and nationwide crime spree around automobile theft has been unfolding right before our eyes.” That’s right. The crime spree is the result of a Kia’s missing piece? Wow. A federal judge declined to approve a class action settlement, reclaiming all the costs of responding to car thefts, and giving money to people whose cars are more prone to theft.

Reality. We have written about this many times in the past. Four years ago, Germany got the lesson that the wind doesn’t blow every day, just like it’s not sunny every day. This is a great representation. It has happened a few times since and was the cause of concern going into winter last year why natural gas storage depleted from having to supplant wind. They got bailed out, this year and last, by surprisingly warm winters.

Coming Hot Spot. Uruguay’s offshore blocks went from zero to fully licensed in under three years, committing material work programs estimated at ~$233 million. That from TGS, one of the largest geophysical companies with a strong effort in exploration. In the view of Pangea, the recent discoveries in Africa, in Namibia, led geoscientists to believe that it has similar geology to Uruguay. Santiago Ferro of ANCAP suggests that this development has doubled the probability of finding oil and/or gas off Uruguay's coast to 5-25%.

Great Expectations... Over the past five months, the MSCI Al Country World Index is up ~25% while many other asset prices are up double digits or more. We think this rally has been mostly about looser financial conditions and falling cost of capital as a result of the Fed’s 4Q dovish shift. Further multiple expansion in the U.S. is likely dependent on an upward inflection in earnings expectations for 2024 and 2025, which have been flat at the S&P level since last October.

Reflation Trades Back into Focus. With the Fed appearing to be less concerned about inflation or looser financial conditions, reflation trades are coming back into vogue. The internals of the market appear to be onto this with some of the strongest breadth coming from the commodity cyclicals. Large capital Energy stocks are the classic late cycle winner in the reflation trade and the sector has under-performed until very recently.

As a Result… Morgan Stanley upgraded Energy to Overweight. “The sector's relative performance versus the S&P 500 has lagged the price of crude YTD, and Morgan Stanley's Global Commodities Strategist, MarLijn Rals, recently raised his Brent forecast to $90/bbl by 3Q given incrementally tighter supply/demand balances.” “Free cash flow margin for the space remains well above its historical average, net debt to EBITDA remains below its long-term run rate and the sector remains under-owned based on hedge fund net exposure. On a single stock basis, our North American Energy Research team led by Devin McDermott recommends COP, DVN (I own DVN), and OXY.” I love it when analysts get bullish after the move has begun but I do agree with the idea that it has a long way to go. As the realization grows that we won’t quit using oil in the next five or so years, the DCF valuations will change dramatically and, as long as the sector continues to demonstrate discipline and earn high rates of return, investors are very likely to come back. In fact, they already are. In recent conversations with OFS execs, their marketing road trips to Boston, New York and elsewhere are starting to draw portfolio managers again.

The Solution? Al Dhafra, a small settlement in Abu Dhabi, is building a solar farm that contains almost 4 million solar panels. It's expected to power 160,000 homes and eliminate more than 2.4 million tons of CO2 per year. It takes up about 5,000 acres or 20 square kilometers. The solar panels cannot be recycled. They have the room. Al Dhafra is characterized by a large geographic spread and low population density. There are seven main settlements in the region, each providing a range of services and opportunities to residents. These are Madinat Zayed, Mirfa, Ghayathi, Liwa, Ruwais, Sila'a and Delma Island. But 5,000 acres versus a couple of wellheads???

Will It Ever End? Nine states are planning to ban new gasoline-powered vehicle sales by 2035 as part of an initiative to cut climate-warming emissions. California has started to phase out the sale of new gas vehicles beginning with the 2026 model year, scaling back over time until 2035 when a total ban on the sales will go into effect. Now, eight other states have joined California. The other states, who don’t seem to understand economics or physics, planned to completely ban new gas-powered vehicles by 2035 include Washington, Oregon, New York, New Jersey, Rhode Island, Massachusetts, Delaware and Maryland. You don’t have to own an EV and you can still drive your ICE for now, you just can’t buy an ICE after 2035. The jury is out.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.